U.S. Companion Animal Osteoarthritis Market Size, Share, Growth, Report 2025 to 2034

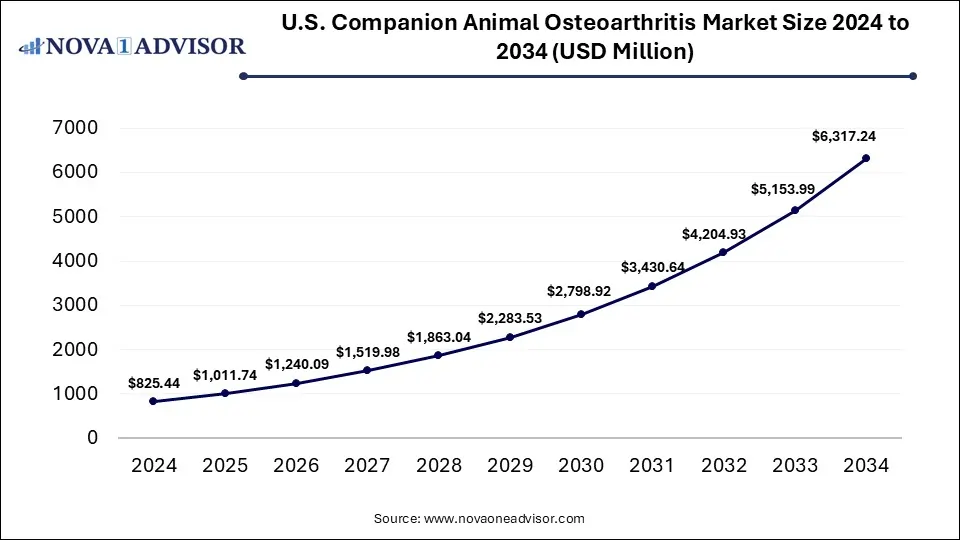

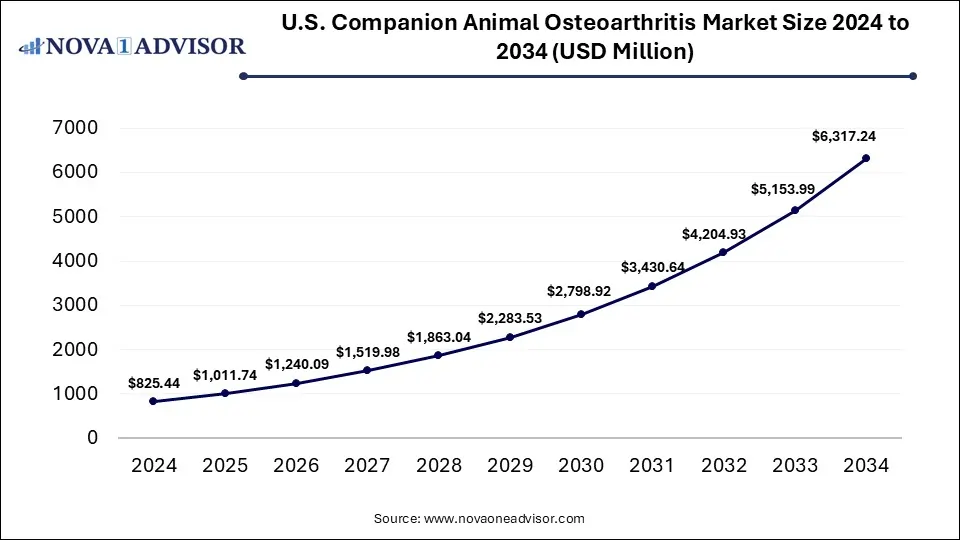

The U.S. companion animal osteoarthritis market size is calculated at USD 825.44 million in 2024, grows to USD 1,011.74 million in 2025, and is projected to hit around USD 6,317.24 million by 2034, growing at a CAGR of 22.57% from 2025 to 2034. The market is growing due to rising pet ownership and increasing awareness about joint aging in pets. Additionally, advancements in veterinary care and availability of novel treatments are fueling market expansion.

U.S. Companion Animal Osteoarthritis Market Key Takeaways

- By product, the biologics segment dominated the market with a revenue share in 2024.

- By product, the pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the studied years.

- By animal, the canine segment held the largest market share in 2024.

- By animal, the equine segment is expected to grow at the fastest CAGR in the market during the studied years.

- By route of administration, the injectable segment led the market with the largest revenue share in 2024.

- By route of administration, the topical segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end user, the veterinary hospitals/clinics segment held the highest market share in 2024.

- By end user, the e-commerce segment is expected to grow at the fastest CAGR in the market during the studied years.

How is Innovation Impacting the U.S. Companion Animal Osteoarthritis Market?

Companion animal osteoarthritis is a degenerative joint disease in pets like dogs and cats, causing pain, inflammation, and reduced mobility due to the breakdown of joint cartilage. Innovation is driving growth in the U.S. companion animal osteoarthritis market through advanced diagnostics, personalized treatment plans, and improved drug delivery systems. Wearable devices now help track pet mobility and response to therapy, aiding in early intervention. Additionally, innovation in nutritional supplements and non-invasive therapies like laser and shockwave treatments is enhancing long-term joint health and pain management, offering pet owner more effective and convenient care options for their animals.

For Instance, In October 2023, Zoetis’s Basepaws introduced an advanced DNA testing service for dogs, utilizing Next-Generation Sequencing (NGS) technology to deliver detailed information on breed traits and potential health risks, helping pet owners better understand their dog’s genetic profile.

What are the Key Trends in the U.S. Companion Animal Osteoarthritis Market in 2024?

- In March 2025, ELIAS Animal Health received approval from the USDA Center for Veterinary Biologics for its ELIAS Cancer Immunotherapy (ECI), the first autologous prescription treatment for canine osteosarcoma. The pivotal ECI-OSA-04 study demonstrated promising safety and potential effectiveness.

- In March 2025, Privo Technologies, Inc. launched BeneVet Oncology, a veterinary initiative aimed at enhancing the health of companion animals. The platform uses advanced drug delivery systems to tackle gaps in veterinary care, emphasizing safe, effective, and easy-to-administer treatments.

How Can AI Affect the U.S. Companion Animal Osteoarthritis Market?

AI is poised to transform the U.S. companion animal osteoarthritis market by enhancing diagnostic precision and enabling truly personalized care. AI-powered imaging tools can detect early signs of osteoarthritis, such as subtle bone and soft tissue changes, far earlier and more accurately than traditional methods. Coupled with predictive analytics and treatment optimization based on individual patient history, genetics, and response data, AI enables tailored therapeutic plans and continuous monitoring via wearable sensors, boosting efficacy and long-term outcomes while improving clinical workflow and client compliance.

Report Scope of U.S. Companion Animal Osteoarthritis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,011.74 Million |

| Market Size by 2034 |

USD 6,317.24 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 22.57% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Animal, Route of Administration, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Zoetis Inc., Boehringer Ingelheim, Elanco Animal Health, American Regent, Inc., Merck Animal Health (Merck & Co. Inc.), Vetoquinol S.A., Ceva Sante Animale, Virbac, Biogenesis Bago, Ardent Animal Health, LLC,PetVivo Holdings, Inc. (Spryng), VetStem, Inc., Enso Discoveries, Contura Vet US, T-Cyte Therapeutics, MEDREGO LLC |

Market Dynamics

Driver

Rising Pet Ownership

A growing number of U.S. households now have pets, a record 94 million in 2024, up from 82 million in 2023, which fuels increased demand for veterinary care, including services for chronic conditions like osteoarthritis. This rise is reflected in higher spending on pet health, veterinary services, and product sales reached nearly $40 billion in 2024, making pet owners more willing to invest in diagnostics, joint treatments, and long-term care to ensure their pets' quality of life.

Restraint

Safety Concerns and Potential Side Effects

Safety concerns and side effects limit the adoption of osteoarthritis treatments in pets, as some therapies may interfere with other health conditions or require frequent vet visits for monitoring. Oeners often worry about how their pets will tolerate injections, long-term medications, or new biologics, especially in older or sensitive animals. This hesitation leads to delayed treatment or preference for natural remedies, ultimately slowing the acceptance of advanced medical interventions in the market.

For instance, For example, prolonged use of NSAIDs in dogs has been linked to side effects like diarrhea, vomiting, and even stomach ulcers. Due to these potential risks, especially in pets with existing health problems or sensitivities, both veterinarians and pet owners may hesitate to use such medications, opting for safer alternatives when possible.

Opportunity

The rise of advanced point-of-care diagnostics offers a strong growth opportunity by simplifying the diagnostics process for osteoarthritis in pets. These tools help veterinary assess joint health quickly during routine visits without needing specialized equipment. This convenience encourages more frequent screenings, even in early or mild cases, leading to protective care. As pet owners seek faster answers and less invasive methods, such technologies can improve client satisfaction and promote broader adoption of osteoarthritis treatment.

Segmental Insights

How will the Biologics Segment Dominate the U.S. Companion Animal Osteoarthritis Market in 2024?

The biologics segment led the market in 2024 due to its advanced, targeted approach in managing joint 2024 due to its advanced targeted approach in managing joint pain and inflammation. Treatment like monoclonal antibodies and regenerative therapies offers longer-lasting relief with fewer side effects compared to traditional medications. Their ease of administration and improved outcomes have made them a preferred choice among veterinarians and pet owners, especially for aging pets or those with chronic joint conditions requiring ongoing, effective care.

The pharmaceutical segment is projected to grow rapidly in the U.S. companion animal osteoarthritis market due to the increasing use of combination therapies and supportive medications that manage both pain and inflammation. Growing awareness among pet owners about early interventions, along with improved veterinary prescribing practices, is boosting demand. Additionally, rising availability of over-the-counter supplements and joint-support drugs is encouraging regular use, making pharmaceuticals a convenient and cost-effective option for long-term osteoarthritis management.

How will the Canine Segment Dominate the U.S. Companion Animal Osteoarthritis Market in 2024?

The canine segment led the U.S. companion animal osteoarthritis market in 2024 largely because dogs are more prone to visible mobility issues, making diagnosis and treatment easier and more frequent. Their active lifestyle increases the risk of joint wear over time, prompting early veterinary intervention. Additionally, the emotional bond between dog owners and their pets drives a stronger commitment to long-term care, leading to higher demand for therapies that support mobility, comfort, and overall quality of life.

The equine segment is forecasted to grow at the fastest CAGR in the U.S. companion animal osteoarthritis market because musculoskeletal and joint injuries are particularly common in performance horses driven by competitive equestrian activities like show jumping and dressage. Regenerative treatments such as stem cells, PRP, and autologous protein solutions are increasingly adopted to speed recovery, reduce re-injury, and extend working life. Owners' willingness to invest in advanced therapies and insurance integration further fuels adoption in the equine sector.

How Does the Injectable Segment Dominate the U.S. Companion Animal Osteoarthritis Market?

The injectable route dominated the U.S. companion animal osteoarthritis market in 2024 due to its rapid onset and long-lasting therapeutic effects. Injectables like monoclonal antibodies, stem cells, and intra-articular therapies directly target affected joints, offering precise, localized treatment with fewer systemic side effects These treatments require less frequent dosing improving pet comfort and owner adherence and have expanded clinical validation, making them the preferred choice for effective, long-term osteoarthritis management in veterinary practice.

The topical segment is projected to grow at the fastest CAGR in the market as pet owners increasingly seek stress-free, at-home care options. Topical treatments are especially useful for pets that resist oral medications or have digestive sensitivities. Innovations in absorption-enhancing formulations have made these products more effective, encouraging broader use. Their ease of application and potential for frequent use without professional assistance make them a practical choice for ongoing joint pain management.

How will the Veterinary hospitals/clinics Segment Dominate the Market in 2024?

The veterinary hospitals/clinics segment le the U.S. companion animal osteoarthritis market in 2024 due to the increasing number of pet visits for regular checkups and chronic pain management of diagnosis for joint issues, allowing early intervention. Additionally, strong trust in veterinary professionals and better access to structured treatment plans, follow-ups, and guidance encourage pet owners to rely on clinics for managing osteoarthritis in their animals.

The e-commerce segment is poised to witness the fastest CAGR in the U.S. companion animal osteoarthritis market due to the increasing preference for digital shopping and contactless services. Pet owners are turning to online platforms for easy access to a wide range of osteoarthritis care products, including supplements, mobility aids, and topical treatments. The availability of auto-refill options, subscription plans, and detailed product reviews also enhances buyer confidence and encourages consistent, long-term care from home.

Regional Insights

How is the U.S. approaching the U.S. Companion Animal Osteoarthritis Market in 2024?

In 2024, the U.S. approach to the companion animal osteoarthritis market focused on accelerating innovation, expanding accessibility, and enhancing diagnostics. The FDA approved groundbreaking biologics like Librela (bedinvetmab) and Solensia, establishing new standards for pain management in dogs and cats. Aging pet demographics, rising pet insurance adoption, and strong investment in regenerative and minimally invasive treatments stimulated broader market development and earlier intervention strategies.

Top Companies in the U.S. Companion Animal Osteoarthritis Market

- Zoetis Inc.

- Boehringer Ingelheim

- Elanco Animal Health

- American Regent, Inc.

- Merck Animal Health (Merck & Co. Inc.)

- Vetoquinol S.A.

- Ceva Sante Animale

- Virbac

- Biogenesis Bago

- Ardent Animal Health, LLC

- PetVivo Holdings, Inc. (Spryng)

- VetStem, Inc.

- Enso Discoveries

- Contura Vet US

- T-Cyte Therapeutics

- MEDREGO LLC

Recent Developments in the U.S. Companion Animal Osteoarthritis Market

- In April 2025, Felixvet introduced Carprofen Soft Chewable Tablets as a generic option for treating pain and inflammation in dogs caused by osteoarthritis or surgery. Designed to match the safety and effectiveness of Rimadyl, these tablets come in 25 mg, 75 mg, and 100 mg doses. Each is scored for precise dosing and flavored with beef to improve taste and ease of administration.

- In February 2025, Zoetis updated the U.S. label for Librela (bedinvetmab injection), its monthly treatment for osteoarthritis pain in dogs. The revision adds new safety details gathered from post-approval use and recommends that veterinarians inform pet owners about possible side effects before starting treatment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. companion animal osteoarthritis market.

By Product

-

- Stem Cells

- Platelet-Rich Plasma (PRP)

- Monoclonal Antibodies (mAb)

- Other Biologics

- Viscosupplements

- Pharmaceuticals

By Animal

By Route of Administration

-

- Intra-muscular

- Intra-articular

- Other Injectable

By End Use

Veterinary Hospitals/Clinics

E-commerce

Others