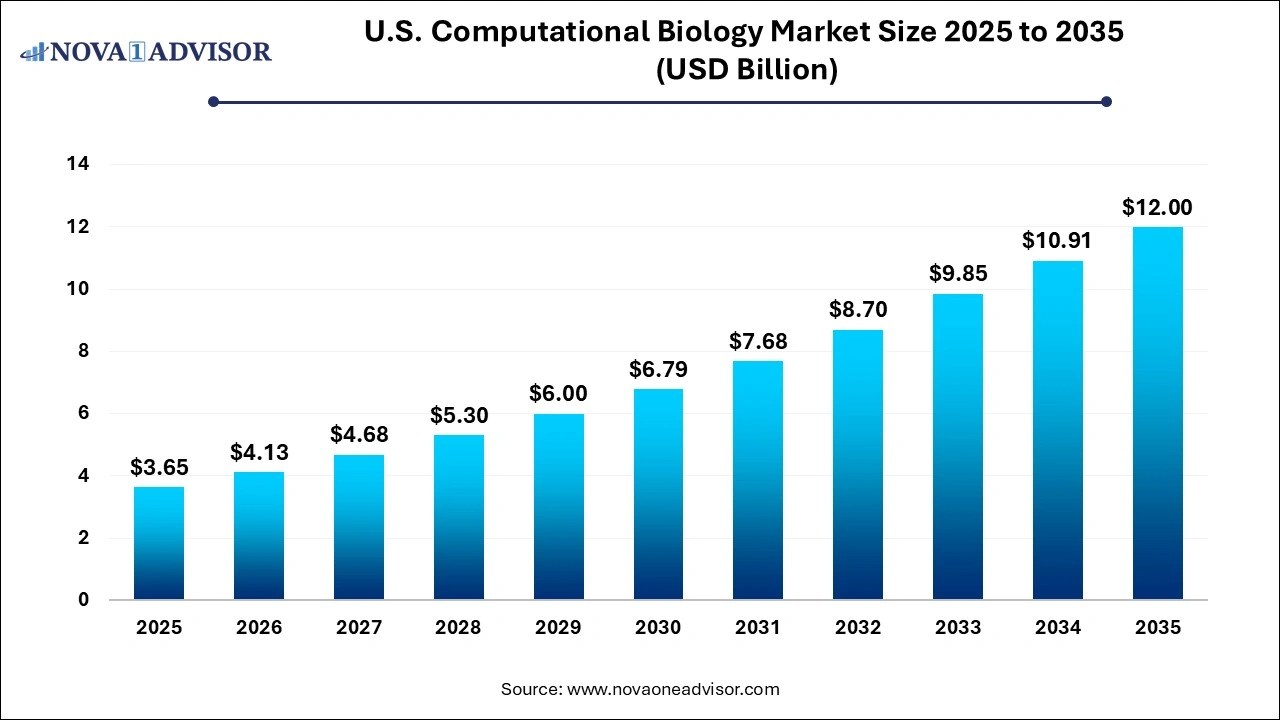

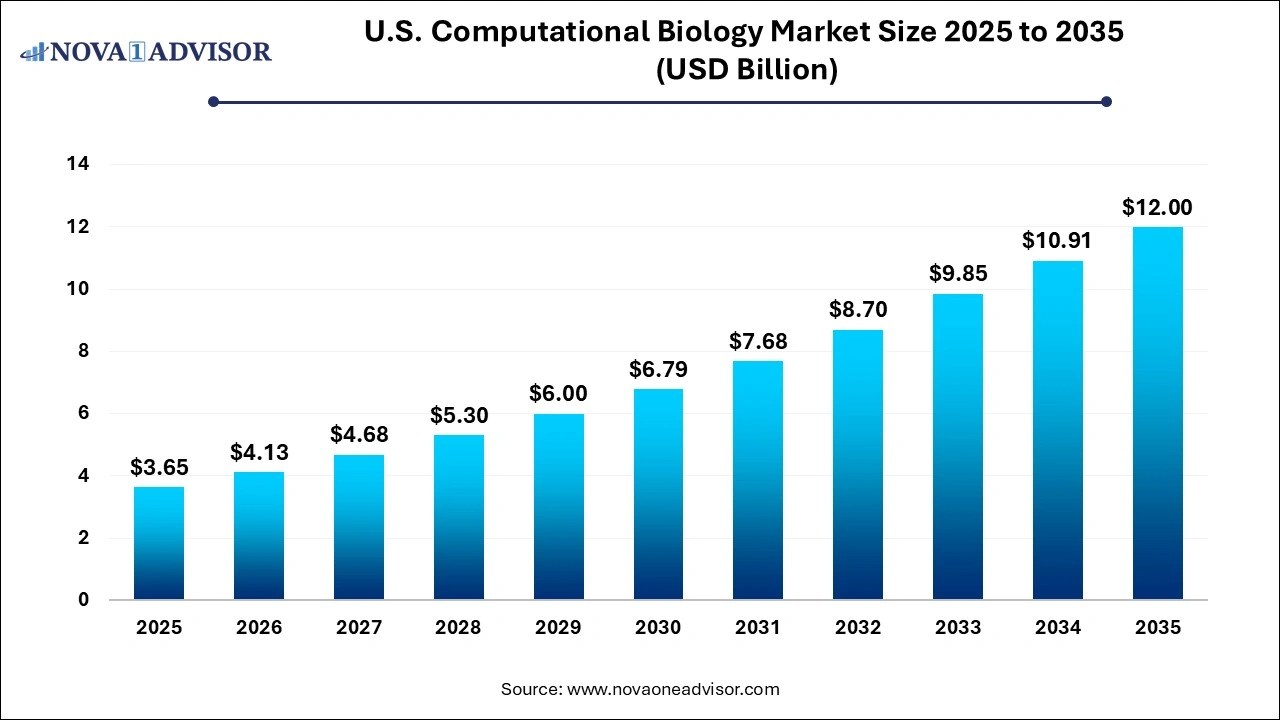

U.S. Computational Biology Market Size and Growth 2026 to 2035

The U.S. computational biology market size was valued at USD 3.65 billion in 2025 and is projected to surpass around USD 12.00 billion by 2035, registering a CAGR of 12.64% over the forecast period of 2026 to 2035.

U.S. Computational Biology Market Key Takeaways:

- The software platforms segment accounted for the largest market share of 39.12% in 2025 and is expected to grow at the fastest CAGR from 2026 to 2035.

- The infrastructure & hardware segment is expected to witness lucrative growth over the forecast period.

- Clinical trials held the highest market share of 26.19% in 2025.

- The computational genomics segment is expected to grow at the fastest CAGR from 2026 to 2035.

- The industrial segment accounted for the largest market share of 67% in 2025.

- Academics & research is expected to exhibit the fastest CAGR during the forecast period.

U.S. Computational Biology Market Overview

The U.S. Computational Biology market is emerging as a cornerstone in the modern biomedical and life sciences research ecosystem. Computational biology, also known as bioinformatics when applied to data analysis, merges the principles of biology, computer science, mathematics, and statistics to simulate biological processes. Its application ranges from genome sequencing and drug discovery to personalized medicine and systems biology. With the increasing volume of biomedical data generated from omics technologies such as genomics, proteomics, and metabolomics the need for robust computational tools is growing rapidly.

One of the key accelerators of the U.S. Computational Biology market is the rapid adoption of high-throughput technologies that generate large datasets, including next-generation sequencing (NGS) and CRISPR gene-editing tools. Organizations, including pharmaceutical companies, biotech firms, research institutions, and academic bodies, are investing heavily in computational tools to interpret this data, understand disease pathways, and streamline the drug development pipeline.

Government initiatives and funding are also critical to market growth. The U.S. National Institutes of Health (NIH) has launched several projects such as the "Big Data to Knowledge (BD2K)" initiative and the "All of Us" precision medicine research program. These have helped create a strong infrastructure for computational biology research, resulting in increased demand for services and software in this space.

Furthermore, the COVID-19 pandemic showcased the power of computational biology, as companies and research groups used computer-aided models to understand the viral structure, simulate the effects of potential drugs, and develop vaccines in record time. This catalyzed investments and fast-tracked innovations in the field. The continuous evolution of machine learning and artificial intelligence is further enhancing capabilities in drug modeling, disease prediction, and simulation, contributing significantly to the long-term potential of the U.S. market.

Major Trends in the U.S. Computational Biology Market

-

Integration of AI and Machine Learning: The infusion of artificial intelligence in computational biology tools is enhancing the accuracy of disease prediction models and drug efficacy simulations.

-

Rise of Cloud-Based Platforms: Cloud computing is increasingly being adopted to manage and process the massive volumes of data generated by genomic and proteomic studies.

-

Growing Demand for Personalized Medicine: Computational biology is playing a pivotal role in tailoring treatments based on individual genetic profiles.

-

Academic-Industry Collaborations: A significant increase in partnerships between academic institutions and biotech/pharmaceutical companies is fueling innovation and commercialization.

-

Focus on Multi-Omics Approaches: Integrating genomics, proteomics, transcriptomics, and metabolomics is becoming the new norm for comprehensive biological analysis.

-

Adoption of Digital Twins in Drug Testing: Digital twin technology is being utilized to simulate human biology, allowing for virtual drug testing and reducing reliance on animal models.

-

Expansion of Direct-to-Consumer Genomics Services: Companies like 23andMe and AncestryDNA are using computational biology to interpret genetic data for health and ancestry insights.

U.S. Computational Biology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 4.13 Billion |

| Market Size by 2035 |

USD 12 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.64% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Service, application, end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

DNAnexus, Inc.; Illumina, Inc.; Thermo Fisher Scientific, Inc.; Schrodinger, Inc.; Compugen, Aganitha AI Inc.; Genedata AG; QIAGEN; Simulations Plus, Inc.; Fios Genomics. |

Key Market Driver: Expansion of Drug Discovery Pipelines

One of the most significant drivers in the U.S. computational biology market is the growing reliance on computational tools in the drug discovery process. Traditional drug discovery is both time-consuming and costly, often requiring over a decade and billions of dollars to bring a drug to market. Computational biology offers a paradigm shift by enabling in-silico drug design, molecular modeling, and simulation, drastically reducing time and cost.

With advancements in structural biology and AI algorithms, researchers can now model protein-ligand interactions, predict off-target effects, and perform virtual screening of compound libraries. Companies such as Schrödinger Inc. and Insilico Medicine have demonstrated the power of computational platforms in discovering new drug candidates, some of which are already in clinical trials. This technology has become indispensable for pharmaceutical companies looking to optimize their pipelines and de-risk the R&D process.

Key Market Restraint: Data Privacy and Standardization Issues

Despite the benefits, data privacy concerns and lack of standardization in biological data present a major restraint for the market. Computational biology relies heavily on the availability and sharing of large datasets, often including sensitive patient health and genetic information. Ensuring compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) while maintaining open-access scientific collaboration is a complex challenge.

Moreover, the absence of standardized data formats across laboratories and institutions leads to compatibility issues and hampers large-scale integration. Different sequencing technologies and platforms generate data in diverse formats, making cross-study comparisons difficult and often requiring time-consuming preprocessing. These issues can delay project timelines and impact the scalability of computational solutions in real-world healthcare environments.

Key Market Opportunity: Personalized and Precision Medicine

One of the most promising opportunities in the U.S. Computational Biology market lies in the advancement of personalized and precision medicine. With increasing accessibility to whole-genome sequencing and transcriptomics, healthcare is gradually moving away from a one-size-fits-all model toward more individualized therapies. Computational biology provides the analytical backbone to interpret complex multi-omic datasets and derive actionable insights tailored to a patient’s unique biological makeup.

This trend is evident in oncology, where tumor genome profiling is enabling the selection of targeted therapies that significantly improve patient outcomes. For instance, platforms such as Foundation Medicine and Guardant Health employ computational tools to match cancer patients with the most effective treatment options based on genetic mutations. As healthcare providers and payers increasingly recognize the value of personalized treatment pathways, demand for computational solutions is expected to surge, opening new avenues for growth.

U.S. Computational Biology Market Segmental Insights

By Service Insights

The software platform segment dominated the U.S. computational biology market due to its central role in data processing, analysis, and simulation. These platforms provide algorithms and visualization tools that enable researchers to model biological systems, simulate drug-target interactions, and conduct evolutionary analyses. Companies such as Schrödinger and Dassault Systèmes have developed comprehensive software platforms that are widely used in academia and industry. The versatility and scalability of software platforms make them indispensable for a wide range of applications, including genomics, proteomics, and drug development.

Meanwhile, the infrastructure & hardware segment is expected to witness the fastest growth over the forecast period. With the proliferation of omics data, there's an increasing demand for high-performance computing systems, GPU clusters, and cloud-based servers capable of processing terabytes of information. The need for advanced hardware has become more evident with the emergence of AI-driven modeling, which requires intensive computing resources. Government and private investments in supercomputing infrastructure are contributing to this segment's expansion.

By Application Insights

Drug discovery and disease modeling emerged as the dominant application segment, driven by the growing need for computational tools to identify potential drug candidates, simulate biological pathways, and understand disease mechanisms. Within this category, lead discovery and optimization are key focus areas, supported by machine learning algorithms that can predict binding affinities, toxicity, and pharmacokinetics. Companies are increasingly using computational biology to reduce preclinical failure rates and accelerate early-stage development. This approach has proven especially beneficial in therapeutic areas like oncology, neurology, and rare genetic disorders.

On the other hand, computational genomics is anticipated to be the fastest-growing application segment. With the explosion of genomic data from initiatives like the Human Genome Project and NIH’s All of Us program, there is an urgent need for computational solutions to manage and interpret this information. Computational genomics is central to applications like SNP analysis, gene expression profiling, and CRISPR editing. It has vast potential in uncovering disease biomarkers, studying population genetics, and guiding gene therapies. The convergence of genomics with big data analytics and AI is accelerating discoveries in this field, attracting both public and private investments.

By End-use Insights

Academic and research institutions remain the primary end-users in the computational biology market, accounting for the largest share due to their active involvement in fundamental research and government-backed initiatives. Universities and federal agencies across the U.S. frequently collaborate with biotech companies, contributing to algorithm development, systems biology modeling, and computational drug discovery. For instance, the Broad Institute and Stanford University have built extensive computational platforms and partnered with industry leaders for drug target discovery and precision medicine.

In contrast, the industrial segment is projected to register the highest growth rate during the forecast period. Pharmaceutical, biotechnology, and contract research organizations are heavily investing in computational biology to streamline their R&D efforts. From preclinical modeling to clinical trial optimization, industrial stakeholders are leveraging computational platforms to reduce costs, shorten development timelines, and increase pipeline success rates. The rise of AI-driven biotech startups and partnerships with tech firms like NVIDIA and Google Cloud are further propelling industrial adoption.

Country-Level Insights

As a global leader in biomedical research, the United States is at the forefront of computational biology innovation. The country boasts a well-established infrastructure of academic institutions, biotechnology firms, pharmaceutical giants, and government bodies like the NIH, FDA, and CDC. This ecosystem facilitates groundbreaking research and the commercial application of computational biology tools.

Federal funding has been pivotal in supporting large-scale genomics projects, including the Cancer Moonshot and the Precision Medicine Initiative. Private sector contributions are also substantial, with major U.S.-based players like Thermo Fisher Scientific, Illumina, and IBM Watson Health pushing the boundaries of bioinformatics and systems biology. The U.S. also maintains strong IP protections, data-sharing frameworks, and cross-disciplinary collaborations, making it a fertile ground for computational biology startups.

The demand for personalized medicine and genomics-based diagnostics continues to grow, leading to increased integration of computational tools in hospital networks and clinical labs. Additionally, public awareness of direct-to-consumer genetic testing and the democratization of health data is encouraging wider adoption across healthcare settings. With a robust foundation of technological innovation, research funding, and market demand, the U.S. computational biology market is poised for sustained long-term growth.

U.S. Computational Biology Market By Recent Developments

-

March 2025: Schrödinger Inc. announced a partnership with the University of California, San Francisco (UCSF) to expand AI-based drug design capabilities, focusing on rare disease targets.

-

January 2025: NVIDIA launched its BioNeMo Cloud Service for drug discovery, enabling biotech firms to access advanced generative AI tools for molecular modeling via the cloud.

-

December 2024: Thermo Fisher Scientific acquired Olink Proteomics, a leader in precision proteomics, enhancing its capabilities in computational proteomics and biomarker discovery.

-

November 2024: Gilead Sciences announced a strategic collaboration with Google Cloud to build AI-driven platforms for real-time patient genomic analysis during clinical trials.

-

October 2024: IBM Watson Health rebranded as Merative following its acquisition by Francisco Partners, introducing new computational tools for healthcare decision-making and clinical insights.

U.S. Computational Biology Market Top Key Companies:

- DNAnexus, Inc.

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Schrodinger, Inc.

- Compugen

- Aganitha AI Inc.

- Genedata AG

- QIAGEN

- Simulations Plus, Inc.

- Fios Genomics

U.S. Computational Biology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Computational Biology market.

By Service

- Databases

- Infrastructure & Hardware

- Software Platform

By Application

- Drug Discovery & Disease Modelling

- Target Identification

- Target Validation

- Lead Discovery

- Lead optimization

- Preclinical Drug Development

- Pharmacokinetics

- Pharmacodynamics

- Clinical Trial

- Phase I

- Phase II

- Phase III

- Phase IV

- Computational Genomics

- Computational Proteomics

- Others

By End-use

- Academic & Research

- Industrial