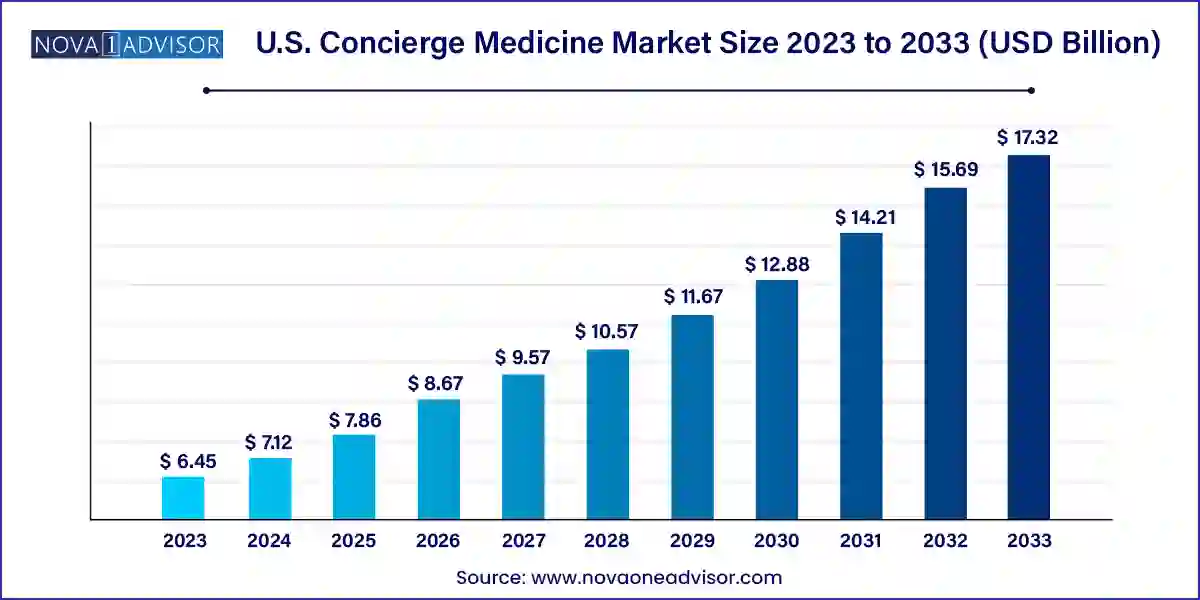

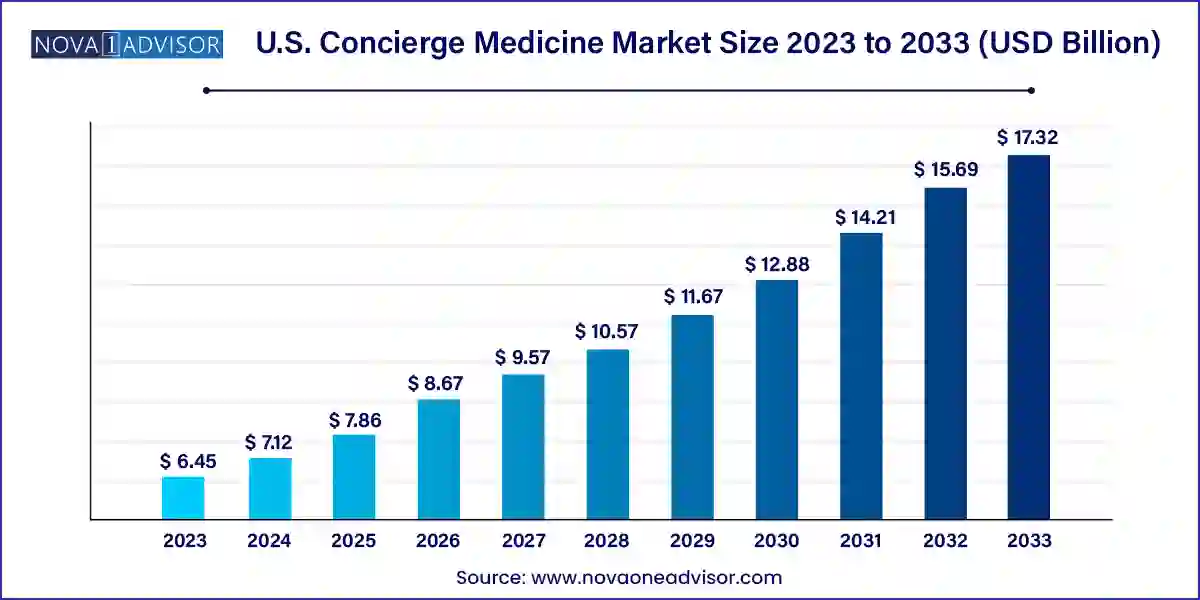

U.S. Concierge Medicine Market Size and Growth

The U.S. concierge medicine market size was exhibited at USD 6.45 billion in 2023 and is projected to hit around USD 17.32 billion by 2033, growing at a CAGR of 10.38% during the forecast period 2024 to 2033.

Key Takeaways:

- Based on ownership, group segment dominated the market with a revenue share of 64.15% in 2023.

- Based on specialty, primary care segment held the largest market share of 26.6% in 2023.

Market Overview

The U.S. concierge medicine market is undergoing a significant transformation, reshaping how healthcare is delivered, experienced, and valued by patients and physicians alike. Concierge medicine also known as boutique, retainer, or membership medicine offers patients direct access to physicians in exchange for an annual or monthly fee. In return, patients benefit from highly personalized care, minimal wait times, extended consultations, and enhanced access to healthcare providers.

The dissatisfaction with conventional healthcare models marked by long wait times, rushed appointments, overburdened physicians, and fragmented care has driven both patients and doctors toward this alternative model. Concierge medicine strips away many of the administrative and insurance-related barriers that slow down traditional care, instead creating a relationship-centered framework focused on prevention, wellness, and convenience.

Initially viewed as a niche service for the wealthy, concierge medicine has since expanded to serve a broader socioeconomic demographic. Hybrid models have emerged, blending insurance billing with concierge services, allowing middle-income patients access to premium care without exorbitant fees. Moreover, digital platforms and telehealth integrations are making concierge services more accessible across geographies, including in rural and suburban communities where personalized healthcare was once a luxury.

As healthcare costs rise and patient expectations evolve, concierge medicine is uniquely positioned to meet modern demands—emphasizing proactive health management, doctor-patient trust, and long-term well-being over episodic, reactive care. The U.S. market has witnessed increasing investments, new practice launches, and provider consolidations, all pointing toward sustained market expansion over the next decade.

Major Trends in the Market

-

Rise of hybrid concierge models combining traditional insurance billing with membership services for broader patient accessibility.

-

Increasing physician migration from insurance-driven practices to concierge models for better work-life balance and professional autonomy.

-

Integration of telemedicine platforms into concierge offerings, enhancing access and continuity of care.

-

Growth of employer-sponsored concierge programs for high-performing professionals and executives.

-

Expansion of concierge services into mental health and psychiatry, reflecting increased demand for personalized behavioral health support.

-

Technology-enabled concierge platforms offering on-demand services like health coaching, virtual visits, and real-time biomarker monitoring.

-

Emergence of pediatric concierge care as parents seek dedicated, uninterrupted access to child specialists.

-

Strategic partnerships with health tech and wellness firms to offer holistic packages combining diagnostics, fitness, nutrition, and primary care.

Report Scope of U.S. Concierge Medicine Market

Market Driver: Growing Dissatisfaction with Traditional Healthcare Delivery

A major driving force behind the rise of concierge medicine is the widespread frustration with conventional healthcare systems in the U.S. For both patients and physicians, fee-for-service models managed through private insurers or Medicare are often characterized by excessive bureaucracy, limited appointment times, and overworked providers. According to a 2023 survey by the American Academy of Family Physicians, the average physician spends less than 15 minutes with each patient and dedicates almost half of their workweek to non-clinical administrative tasks.

In contrast, concierge medicine enables providers to manage smaller patient panels—often 80% less than in traditional practices thereby allowing deeper patient engagement, longer consultation times, and proactive health management. Patients, in turn, appreciate 24/7 physician access, unhurried appointments, and comprehensive annual exams that are often neglected in rushed environments. As demand for patient-centric models grows and dissatisfaction with systemic inefficiencies intensifies, concierge medicine is becoming a preferred alternative for health-conscious individuals seeking a more humane, responsive care experience.

Market Restraint: Limited Affordability and Perception of Exclusivity

Despite its many benefits, concierge medicine faces the challenge of being perceived as a premium, exclusive service inaccessible to the average American. Annual membership fees for concierge practices typically range from $1,500 to over $10,000 per person, depending on the provider's reputation, specialization, and geographic location. While hybrid models and group practices are attempting to democratize access, a significant portion of the population still views concierge care as a luxury reserved for the wealthy.

Additionally, as concierge physicians limit their patient loads, this transition may contribute to physician shortages in traditional care settings, especially in rural or underserved communities. Critics argue that widespread adoption without supportive public policy could further fragment the U.S. healthcare landscape. Thus, while the market is growing, affordability and inclusivity remain significant concerns limiting its universal appeal.

One of the most promising opportunities in the U.S. concierge medicine market is the integration of concierge healthcare services into corporate wellness and employee benefit programs. With workplace productivity closely linked to health outcomes, companies are investing in tailored healthcare services to reduce absenteeism, increase employee satisfaction, and control long-term health costs.

Employers, particularly in competitive industries like tech, finance, and consulting, are increasingly offering concierge memberships as part of executive compensation packages. Moreover, smaller companies are beginning to adopt group-rate concierge services through partnerships with third-party providers. These programs often include virtual consultations, health screenings, lifestyle coaching, and preventive care, contributing to employee retention and organizational well-being. As the focus on workforce wellness intensifies, employer-sponsored concierge care could become a mainstream solution across corporate America.

U.S. Concierge Medicine Market By Ownership Insights

Group practices dominated the U.S. concierge medicine market in 2023, owing to scalability, shared administrative infrastructure, and multispecialty care delivery. Group-based concierge services offer multiple providers under one roof, enabling patients to access a range of services such as internal medicine, cardiology, and psychiatry within a coordinated ecosystem. These practices often operate under sophisticated business models, with centralized marketing, data analytics, and back-office support. Moreover, patients benefit from expanded service availability and peer referrals within the group network.

Conversely, standalone concierge practices are gaining traction as the fastest-growing ownership model, especially among younger physicians seeking autonomy and lifestyle flexibility. These solo or micro-practices offer hyper-personalized experiences, often rooted in strong community engagement or niche specializations. With telemedicine reducing overhead costs, it has become easier for individual physicians to establish private concierge clinics serving select patient populations. Additionally, platforms like MDVIP and SignatureMD offer turnkey concierge conversion services that support independent practitioners in transitioning to membership-based care. As burnout from traditional systems persists, more providers are expected to pursue the standalone path.

U.S. Concierge Medicine Market By Specialty Insights

Primary care dominated the U.S. concierge medicine market in 2024 and continues to be the foundation of most concierge practices. This segment benefits from the broad applicability of preventive services, chronic disease management, and wellness coaching. Patients of all ages require regular primary care, making it a logical starting point for concierge conversion. With time-consuming tasks and administrative burdens often deterring physicians in traditional settings, primary care providers are increasingly adopting the concierge model for sustainable practice and patient satisfaction. Direct access, same-day appointments, and comprehensive physicals form the core offerings in this segment.

However, psychiatry is the fastest-growing specialty in concierge medicine, reflecting a seismic shift in how Americans approach mental health. With mental health conditions on the rise—particularly anxiety, depression, and burnout—there is an increased demand for continuity, discretion, and personalized therapy that insurance-based systems often fail to provide. Concierge psychiatrists limit their patient panels, allowing deeper therapeutic relationships and faster responsiveness in crises. Some practices integrate telepsychiatry, lifestyle coaching, and pharmacogenomic testing, offering an advanced, holistic approach to mental wellness. As mental health takes center stage in national health discourse, concierge psychiatry is poised for rapid expansion.

Country-level Analysis

The concierge medicine movement in the United States is gaining ground across both urban centers and affluent suburban communities. Metropolitan areas like New York City, Los Angeles, Chicago, San Francisco, and Boston are home to many established concierge practices, catering to high-income populations and executives. These markets are saturated with premium offerings that span from luxury clinics with spa-like amenities to personalized health optimization programs involving genomics and wearables.

At the same time, concierge care is expanding into secondary markets and rural regions, fueled by digital platforms that facilitate remote consultations, home visits, and virtual health assessments. With healthcare access a persistent issue in rural America, some providers are using concierge models to serve smaller communities with limited infrastructure. In states like Texas, Florida, and North Carolina, group-based concierge services are increasingly linked with employer health programs or retirement community wellness initiatives.

Additionally, policy developments around direct primary care (DPC) a related model that overlaps with concierge care—are influencing broader acceptance and legal frameworks that support non-insurance-based practices. While adoption is uneven across states, the trajectory is clearly upward, supported by changing consumer expectations and physician interest in reclaiming clinical autonomy.

Recent Developments

-

February 2025 – Castle Connolly Private Health Partners (CCPHP) announced a strategic expansion into the Midwest, onboarding 15 new physicians in a concierge transition partnership to cater to growing demand in Ohio, Michigan, and Illinois.

-

January 2025 – MDVIP, a national leader in personalized primary care, surpassed 1,300 affiliated physicians and launched a mental wellness initiative that integrates behavioral health into its core services.

-

December 2024 – SignatureMD unveiled a new hybrid concierge program designed for rural practices, offering flexible conversion models to adapt to smaller patient volumes and local economics.

-

November 2024 – Specialdocs Consultants launched a female-focused concierge healthcare service in partnership with women's health specialists, combining gynecology, hormonal health, and preventive screening.

-

October 2024 – Forward Health, a tech-driven concierge provider, raised $100 million in Series D funding to expand AI-powered medical services and virtual clinics across new U.S. markets.

Some of the prominent players in the U.S. concierge medicine market include:

- MDVIP

- Signature MD

- Crossover Health

- Specialdocs Consultants, LLC

- PartnerMD

- Concierge Consultants & Cardiology

- Castle Connolly Private Health Partners

- Peninsula Doctor

- Campbell Family Medicine

- Destination HealthMDI

- Priority Physicians, Inc.

- U.S. San Diego Health

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. concierge medicine market

Specialty

- Primary Care

- Pediatrics

- Osteopathy

- Internal Medicine

- Cardiology

- Psychiatry

- Others

Ownership