U.S. Craniomaxillofacial Devices Market Size and Growth

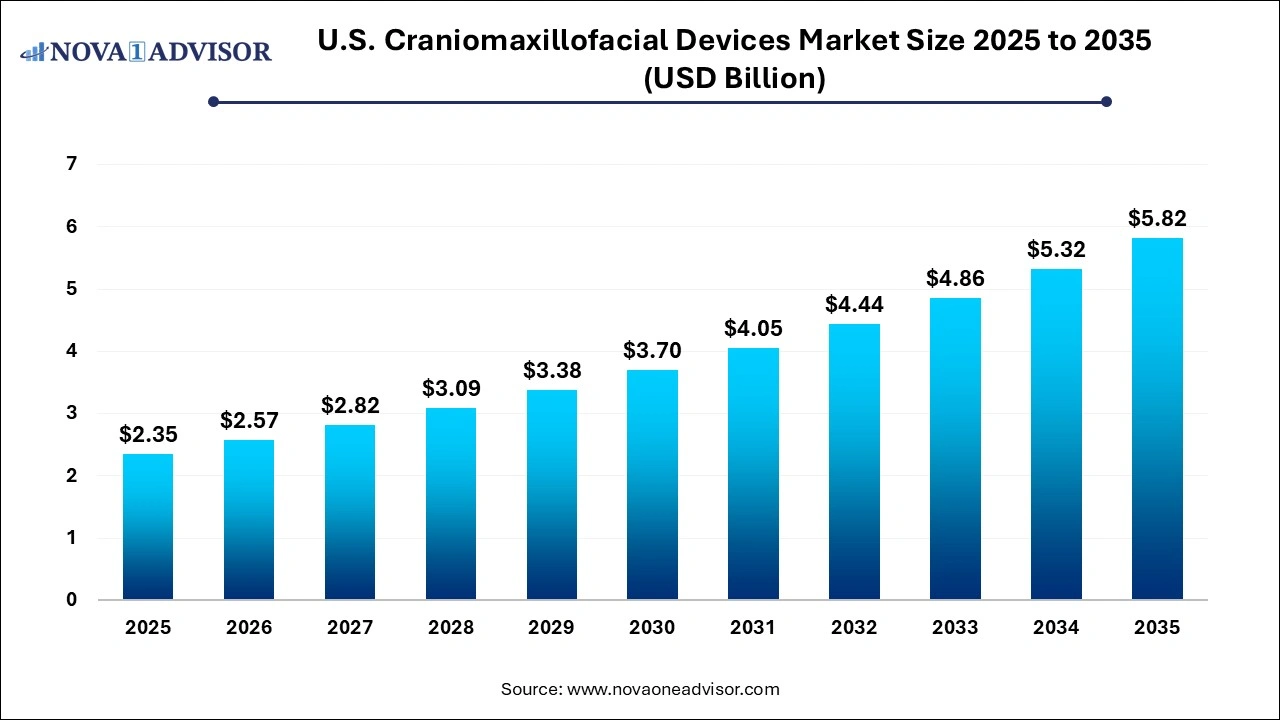

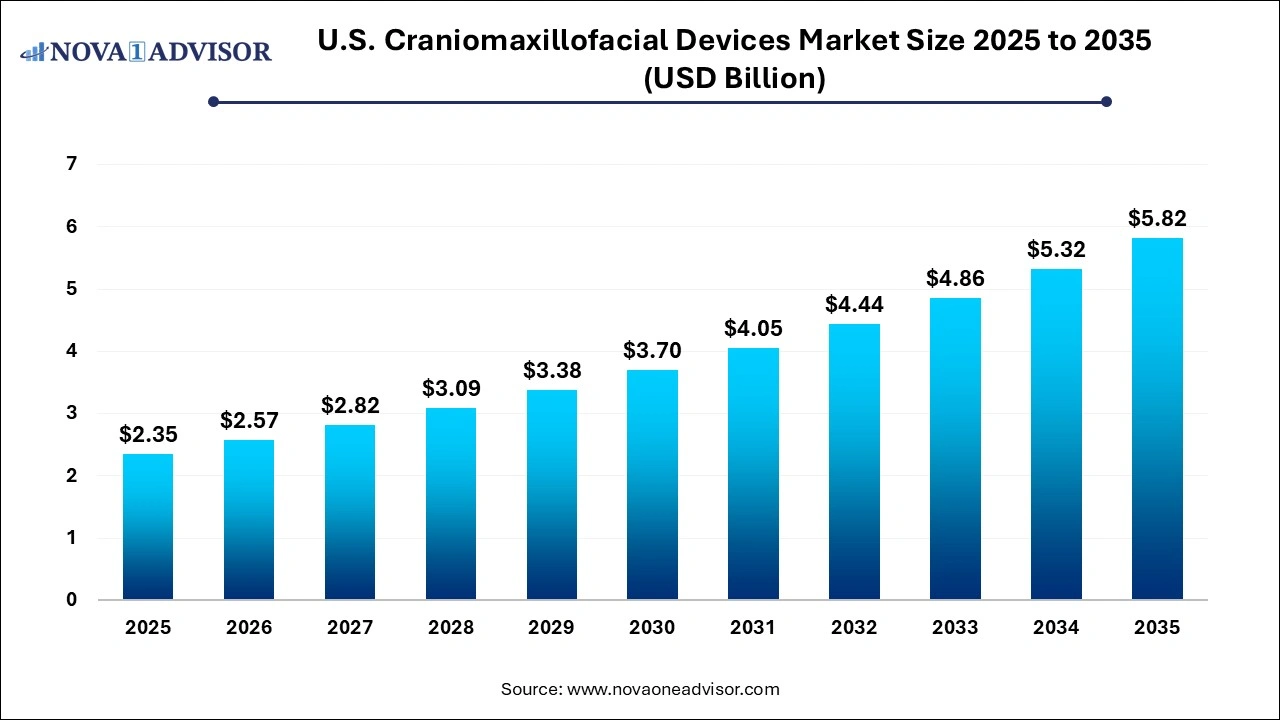

The U.S. craniomaxillofacial devices market size was exhibited at USD 2.35 billion in 2025 and is projected to hit around USD 5.82 billion by 2035, growing at a CAGR of 9.5% during the forecast period 2026 to 2035.

U.S. Craniomaxillofacial Devices Market Key Takeaways:

- The orthognathic and dental surgery segment dominated the U.S. craniomaxillofacial devices market with the highest revenue share of 51.0% in 2025.

- The neurosurgery segment is expected to grow at the fastest CAGR over the forecast period from 2025 to 2035.

- The CMF plate and screw fixation segment held the largest revenue share of over 70% in 2025.

- On the other hand, the temporomandibular joint replacement segment is expected to grow at the fastest CAGR over the forecast period

- Metallic CMF implants held the largest revenue share of around 70% in 2025.

- On the other hand, the bioabsorbable materials segment is expected to grow at the fastest CAGR over the forecast period.

Market Overview

The U.S. Craniomaxillofacial (CMF) Devices Market is experiencing significant growth, driven by a confluence of clinical advancements, rising surgical procedures, and increasing awareness about facial trauma reconstruction. Craniomaxillofacial devices are instrumental in the surgical management of trauma, congenital deformities, and diseases affecting the skull and facial bones. They include a variety of products, from fixation plates and screws to distraction systems and joint replacements. These devices are particularly critical in neurosurgery, plastic surgery, orthognathic surgery, and dental reconstructions.

The U.S. healthcare infrastructure, known for its technological prowess and specialized care facilities, has significantly boosted the adoption of CMF devices. The country reports one of the highest numbers of facial trauma cases annually, primarily due to road accidents, sports injuries, and physical violence, necessitating surgical interventions. Moreover, the increasing prevalence of congenital facial disorders, combined with rising demand for minimally invasive and aesthetically focused procedures, continues to stimulate market growth.

Additionally, the aging population in the U.S. presents a demographic shift that benefits this market. Elderly patients frequently require craniofacial reconstructions due to trauma or degenerative disorders such as temporomandibular joint dysfunction. Coupled with growing cosmetic awareness and elective facial surgeries, the market is poised for sustained growth.

Major Trends in the Market

-

Adoption of 3D Printing for Customized Implants: The integration of 3D printing in CMF surgeries is revolutionizing patient-specific implants. This technology allows surgeons to create anatomically accurate reconstructions, reducing surgery time and improving outcomes.

-

Growing Shift Toward Bioabsorbable Materials: Increasing preference for bioabsorbable implants is reducing the need for secondary surgeries, as these materials naturally dissolve within the body after fulfilling their purpose.

-

Technological Integration in Surgery: Navigation systems and robotic-assisted surgeries are gaining traction, enabling precise placement of CMF devices, reducing complications, and improving postoperative recovery.

-

Rising Incidence of Sports and Vehicular Trauma: With more Americans participating in high-impact sports and a persistently high rate of road accidents, there is a growing demand for trauma-related CMF procedures.

-

Focus on Pediatric and Congenital Corrections: Specialized CMF solutions tailored for pediatric use are on the rise, as awareness and early diagnosis of congenital conditions such as craniosynostosis increase.

Report Scope of U.S. Craniomaxillofacial Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.57 Billion |

| Market Size by 2035 |

USD 5.82 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Material, Application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Stryker Corporation; Medtronic Plc; KLS Martin L.P; Medartis AG; Johnson & Johnson; W. L. Gore & Associates, Inc; TMJ Concepts; Integra LifeSciences; OsteoMed L.P.; Aesculap Implant Systems, Inc; Zimmer-Biomet Inc. |

Key Market Driver: High Incidence of Facial Trauma

One of the principal drivers of the U.S. CMF devices market is the high and consistent incidence of facial trauma cases resulting from vehicular accidents, sports injuries, occupational hazards, and interpersonal violence. According to the American Association of Oral and Maxillofacial Surgeons (AAOMS), facial injuries are among the most common types of trauma treated in emergency departments. The U.S. Department of Transportation reports over 6 million vehicle crashes annually, many involving facial impact injuries. These require immediate and precise surgical intervention, often involving CMF devices like plates, screws, or bone grafts.

Moreover, with the proliferation of extreme sports and an active youth population, sports-related facial injuries are also on the rise. From professional athletes to college-level participants, the demand for rapid and efficient reconstructive procedures is high. This growing need for trauma management is driving hospitals and trauma centers to stock advanced CMF devices and train specialists, fueling market growth further.

Key Market Restraint: High Cost of Procedures and Implants

Despite the technological advancements and growing demand, the high cost of craniomaxillofacial procedures and implants acts as a significant market restraint. CMF surgeries often require expensive, specialized devices that are not always covered by insurance—especially in elective or cosmetic procedures. A single CMF surgical intervention, including hospitalization and implant costs, can range from $10,000 to $50,000 or more, depending on the complexity of the case.

For many uninsured or underinsured patients, these costs present a barrier to accessing necessary care. Additionally, hospitals and surgical centers must invest in high-end tools, 3D printing systems, and robotic assistance for advanced surgeries, which increases operational costs. While insurance coverage has improved for trauma and reconstructive surgeries, the cosmetic segment remains largely out-of-pocket, limiting the addressable patient base and slowing overall market penetration.

Key Market Opportunity: Personalized Implants through Digital and 3D Technologies

An emerging and promising opportunity in the U.S. CMF devices market lies in the personalization of implants through digital imaging and 3D printing. These technologies allow for the creation of custom implants that match a patient’s anatomical structure with unparalleled precision. Pre-operative imaging using CT scans or MRIs can be converted into 3D models, guiding surgeons in both planning and execution.

This innovation has revolutionized complex cranial reconstructions and congenital defect repairs. Companies such as Stryker and Zimmer Biomet are investing heavily in in-house 3D manufacturing capabilities and partnering with healthcare providers to deliver faster turnaround times for patient-specific solutions. This not only improves surgical outcomes but also reduces operating room time and revision surgery rates. As hospitals look to offer personalized, value-based care, the adoption of these advanced tools is expected to surge.

U.S. Craniomaxillofacial Devices Market By Application Insights

Neurosurgery dominated the application segment of the CMF devices market. The increasing prevalence of traumatic brain injuries, aneurysms, and cranial tumors requiring decompressive surgeries has led to higher adoption of CMF devices in neurosurgical procedures. Cranial flap fixation systems are essential in post-craniotomy reconstructions, enabling rapid healing and structural stability. Given the aging population and the rise in neurodegenerative disorders, neurosurgery is likely to maintain its lead in demand for CMF devices.

Plastic surgery is anticipated to be the fastest-growing application segment, fueled by rising aesthetic consciousness, increased disposable incomes, and the expansion of cosmetic surgical centers across the U.S. Procedures such as facial contouring, chin augmentation, and reconstructive surgeries post-cancer treatment rely heavily on CMF implants. The availability of customized and minimally invasive solutions has broadened the appeal of plastic surgery beyond corrective cases to elective enhancements, driving segment growth.

U.S. Craniomaxillofacial Devices Market By Product Insights

CMF Plate and Screw Fixation dominated the U.S. craniomaxillofacial devices market in terms of revenue and usage. These devices are widely used in trauma cases, particularly for the rigid fixation of fractures in the midface and cranial bones. Their ability to provide stable anatomical alignment and facilitate faster healing makes them the preferred choice among surgeons. Given the high rate of facial injuries, CMF plate and screw systems are essential in emergency and elective surgeries alike. Leading manufacturers continue to innovate in terms of size, shape, and material composition, enhancing both efficacy and patient comfort.

CMF Distraction is expected to be the fastest-growing segment, particularly driven by its use in pediatric patients for treating congenital deformities. Distraction osteogenesis allows for gradual bone elongation, which is crucial in cases of craniofacial microsomia or mandibular hypoplasia. Unlike traditional grafting, distraction avoids secondary donor site morbidity and is highly effective for patients with complex craniofacial anomalies. With growing awareness and increasing availability of skilled pediatric surgeons, this segment is poised to expand significantly in the coming years.

U.S. Craniomaxillofacial Devices Market By Material Insights

Metal implants remained the dominant material segment, owing to their durability, strength, and widespread acceptance. Titanium and its alloys are the most commonly used metals in CMF devices due to their superior biocompatibility, corrosion resistance, and ability to integrate with bone. Surgeons continue to rely on metal implants for high-load-bearing areas like the mandible and for trauma-induced fracture repairs. The extensive clinical history and proven outcomes make metal a reliable choice across all applications.

Bioabsorbable materials are the fastest-growing segment, gaining popularity due to their ability to degrade over time, eliminating the need for secondary removal surgeries. These materials are particularly useful in pediatric surgeries, where the skeletal system is still developing, and long-term retention of metal implants may pose risks. Innovations in polymer science have improved the mechanical strength and predictability of degradation, positioning bioabsorbables as the future of CMF surgery—especially in cosmetic, pediatric, and less load-bearing applications.

Country-Level Analysis: United States

In the United States, the craniomaxillofacial devices market benefits from a sophisticated healthcare ecosystem characterized by well-equipped trauma centers, high adoption of cutting-edge surgical tools, and extensive insurance coverage for trauma cases. Government initiatives aimed at reducing road fatalities and enhancing emergency medical response systems indirectly contribute to market expansion.

The U.S. also hosts some of the world’s leading CMF device manufacturers, research institutions, and surgical training centers. This ensures constant innovation and rapid dissemination of best practices. Moreover, the country has seen a consistent increase in outpatient surgical procedures, supported by favorable reimbursement scenarios for facial trauma and congenital defect surgeries.

Another key factor is the ongoing shift toward value-based healthcare. Hospitals and healthcare providers are increasingly focused on reducing surgical complications, minimizing hospital stays, and improving patient-reported outcomes—all of which align with the advantages offered by modern CMF devices, especially personalized and bioabsorbable implants.

Some of the prominent players in the U.S. craniomaxillofacial devices market include:

Recent Developments

-

Stryker Corporation (March 2025) announced the expansion of its CMF product line with the launch of the "TruMatch CMF" portfolio, integrating AI-powered imaging analysis with 3D printing to offer personalized implants with faster surgical readiness.

-

Zimmer Biomet (January 2025) launched a new bioabsorbable plating system specifically designed for pediatric cranial surgeries, citing increased demand from children’s hospitals and trauma centers.

-

Medartis Holding AG (December 2024) opened a new R&D center in Florida focused exclusively on advanced biomaterials for craniofacial implants, aiming to lead innovation in biodegradable technologies.

-

KLS Martin (November 2024) partnered with several U.S. universities to advance CMF implant design through virtual surgical planning (VSP) and anatomical simulation models, aiding surgical education and training.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. craniomaxillofacial devices market

By Product

- Cranial Flap Fixation

- CMF Distraction

- Temporomandibular Joint Replacement

- Thoracic Fixation

- Bone Graft Substitute

- CMF Plate and Screw Fixation

By Material

- Metal

- Bioabsorbable material

- Ceramics

By Application

- Neurosurgery

- Orthognathic and Dental Surgery

- Plastic surgery