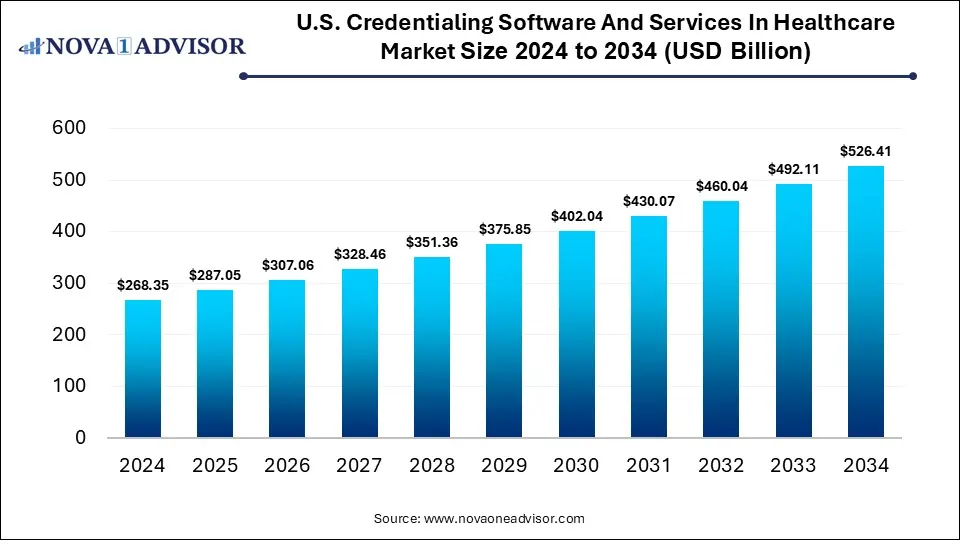

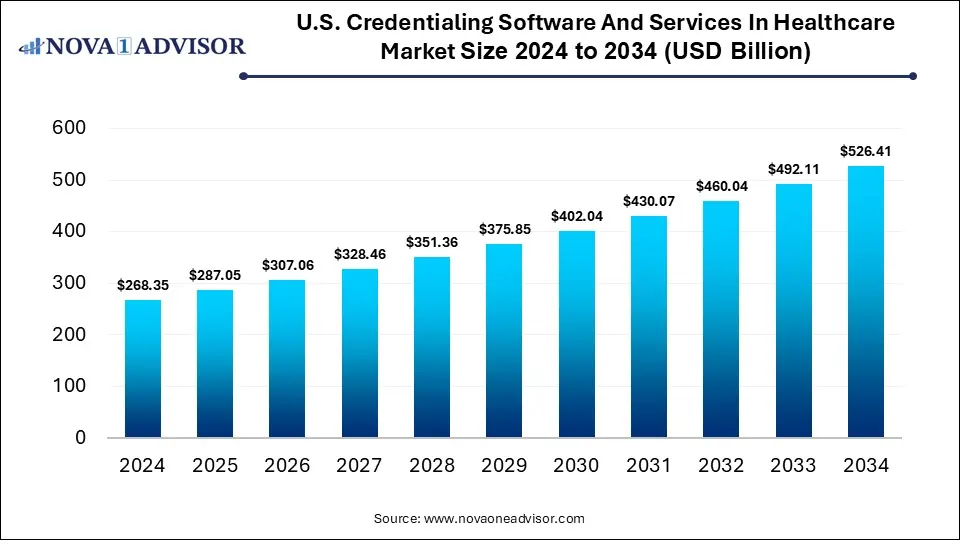

U.S. Credentialing Software And Services In Healthcare Market Size and Forecast 2025 to 2034

The U.S. credentialing software and services in healthcare market was valued at USD 268.35 billion in 2024 and is projected to hit around USD 526.41 billion by 2034, growing at a CAGR of 6.97% during the forecast period 2025 to 2034. The growth of the market is driven by regulatory compliance requirements, telemedicine expansion, and data security concerns.

Key Takeaways

- By component, the software segment led the market with the largest share in 2024.

- By component, the services segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By functionality, the credentialing and enrollment segment dominated the market in 2024.

- By functionality, the provider information management segment is expected to grow at the highest CAGR over the projection period.

- By deployment mode, the cloud-based segment held the largest market share in 2024.

- By deployment mode, the on-premises segment is likely to grow at a significant rate in the upcoming period.

- By end use, the hospitals and clinics segment contributed the largest market share in 2024.

- By end use, the healthcare payers segment is expected to grow at the fastest CAGR during the forecast period.

AI’s Impact on the U.S. Credentialing Software And Services in Healthcare Market

AI is significantly transforming the U.S. credentialing software and services in healthcare market by automating complex, time-consuming tasks such as data verification, document management, and provider background checks. With AI-powered tools, healthcare organizations can reduce manual errors, accelerate provider onboarding, and ensure real-time compliance with regulatory standards. Natural language processing (NLP) and machine learning algorithms are also enhancing data accuracy and enabling predictive analytics for proactive credentialing management. Furthermore, AI-driven chatbots and virtual assistants are improving user experience by guiding administrators through credentialing workflows. As healthcare systems seek greater efficiency and scalability, AI is becoming a critical driver of innovation and growth in this market.

- In August 2024, Simplify Healthcare launched Provider1.Credentialing, an AI-powered solution integrated into its Provider1 platform that automates and streamlines provider credentialing for payers. It offers fast, validated applications, AI-driven primary source verification, and configurable workflows to ensure compliance. The platform provides continuous monitoring, automated notifications for expiring credentials, and analytics via PowerBI, all seamlessly integrated for efficient, accurate, and consistent credentialing management.

Market Overview

The U.S. credentialing software and services in healthcare market involves solutions that automate and streamline the verification, enrollment, and management of healthcare providers’ credentials to ensure compliance with regulatory standards. These software and services improve accuracy, reduce administrative burden, accelerate provider onboarding, and enhance operational efficiency across hospitals, clinics, and payer organizations. Benefits of this software include real-time data updates, secure storage of sensitive information, and seamless integration with existing healthcare IT systems, supporting applications like provider management, compliance monitoring, and network optimization. The growth of the market is driven by increasing regulatory requirements, expansion of telehealth, rising demand for operational efficiency, and the adoption of advanced technologies such as AI and cloud computing.

Major Market Trends

- Cloud-Based Solutions Adoption: The shift toward cloud deployment is enabling healthcare organizations to access credentialing data in real-time from multiple locations, improve collaboration, and reduce IT infrastructure costs.

- Focus on Data Security and Compliance: With rising cyber threats and stringent regulatory requirements, there is a growing emphasis on implementing credentialing systems with robust security features to protect sensitive provider and patient information.

- Expansion of Telehealth and Virtual Care: The rapid growth of telemedicine has increased the demand for efficient credentialing solutions that can quickly verify and enroll virtual providers across different states and networks, ensuring seamless care delivery.

- Need to Improve Operational Efficiency: There is rising need to improve operational efficiency, as healthcare organizations seek to reduce the time and resources spent on manual credentialing tasks. By improving workflow efficiency, credentialing solutions help organizations lower administrative costs and free up staff to focus on patient-centric activities. Additionally, integrated credentialing systems enhance data accuracy and consistency across departments, further boosting productivity.

Report Scope of U.S. Credentialing Software And Services In Healthcare Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 287.05 Billion |

| Market Size by 2034 |

USD 526.41 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.97% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Component, Functionality, Deployment Type, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Regulatory Compliance Requirements

Regulatory compliance requirements are driving the growth of the U.S. credentialing software and services in healthcare market, as healthcare organizations must adhere to strict standards set by agencies like CMS, HIPAA, and The Joint Commission. These regulations mandate thorough verification and ongoing monitoring of healthcare providers’ credentials to ensure patient safety and reduce fraud. Credentialing software automates compliance processes, minimizes human error, and provides audit-ready documentation, making it easier for organizations to meet evolving regulatory demands. As penalties for non-compliance increase, healthcare providers are investing more in advanced credentialing solutions to mitigate risks and maintain reimbursement eligibility. This heightened focus on regulatory adherence is fueling widespread adoption of credentialing software and services.

Rising Demand for Value-Based Care and Integration with Telehealth Platforms

The rising demand for value-based care and the integration of credentialing solutions with telehealth platforms are driving the growth of the market by necessitating more efficient, accurate, and scalable provider verification processes. Value-based care models require seamless coordination and accountability among providers, making comprehensive credentialing critical to ensure quality and compliance. Meanwhile, the expansion of telehealth across multiple states increases the complexity of managing provider credentials remotely, fueling the need for automated, cloud-based credentialing solutions. These technologies enable faster onboarding and real-time updates, supporting both care quality and regulatory adherence. As healthcare shifts toward more connected and outcome-focused models, credentialing solutions become essential for enabling efficient provider network management.

Restraints

High Implementation Costs and Integration Challenges

High implementation costs and integration challenges are significant restraints on the growth of the U.S. credentialing software and services in healthcare market. Many healthcare organizations, especially smaller clinics and practices, struggle with the upfront investment required for software licensing, customization, and staff training. Additionally, integrating new credentialing systems with existing electronic health records (EHRs) or legacy IT infrastructure can be complex and time-consuming, often disrupting workflows during the transition period. These challenges can delay adoption and limit the scalability of credentialing solutions across diverse healthcare settings. As a result, some providers continue to rely on manual or outdated methods, slowing overall market growth.

Resistance to Change and Cybersecurity Threats

Resistance to change and cybersecurity threats are another major factors restraining the growth of the market. Many healthcare organizations, particularly those with long-standing manual processes, are hesitant to adopt new digital solutions due to concerns about disruption, staff training, and adaptation challenges. This resistance can slow down the implementation of more efficient systems. At the same time, growing cybersecurity threats make organizations wary of transitioning sensitive provider and patient data to digital or cloud-based platforms. Fears of data breaches and compliance risks can deter investment in modern credentialing technologies, limiting broader adoption of credentialing systems across the healthcare industry.

Opportunities

Development of Mobile Credentialing Solutions

A major opportunity for the U.S. credentialing software and services in healthcare market lies in the development of mobile credentialing solutions, offering greater flexibility, accessibility, and real-time management capabilities. Mobile platforms allow healthcare administrators and providers to update, track, and verify credentials on the go, streamlining workflows and reducing administrative delays. This is especially valuable for large healthcare systems and mobile or remote care providers who operate across multiple sites. Mobile solutions also enhance communication, improve compliance tracking, and support faster decision-making through instant alerts and document uploads. As the healthcare industry increasingly prioritizes mobility and convenience, mobile credentialing tools are emerging as a vital component of modern healthcare operations.

- In October 2024, Transact Campus, Inc. announced the launch of its Mobile Credential solution at the University of Victoria, marking the first deployment of this technology in British Columbia. This launch strengthens Transact's position as the leading mobile credential provider in Canada, with University of Victoria marking the sixth major Canadian post-secondary institution now utilizing its pioneering technology.

Credentialing-as-a-Service (CaaS)

The rise of Credentialing-as-a-Service (CaaS) is creating immense opportunities in the U.S. credentialing software and services in healthcare market by offering healthcare organizations a flexible, scalable, and cost-effective alternative to managing credentialing in-house. CaaS providers handle the entire credentialing process, from primary source verification to ongoing monitoring, allowing healthcare facilities to reduce administrative burden and ensure compliance without needing dedicated internal resources. This model is especially appealing to small and mid-sized practices that lack the infrastructure or expertise to manage complex credentialing requirements. Additionally, CaaS enables quicker provider onboarding and better adaptability to regulatory changes. As healthcare providers seek streamlined solutions with minimal upfront investment, demand for CaaS is expected to grow rapidly.

Segment Outlook

By Component

What Made Software the Dominant Component in the Market in 2024?

In 2024, software emerged as the dominant component in the U.S. credentialing software and services in healthcare market due to the growing demand for automation, efficiency, and compliance in healthcare operations. Healthcare organizations increasingly turned to credentialing software to streamline provider onboarding, reduce manual errors, and ensure adherence to regulatory standards such as HIPAA and CMS requirements. The flexibility of cloud-based solutions and integration capabilities with existing healthcare IT systems further boosted adoption. Additionally, software solutions offer real-time updates, data analytics, and scalability, making them more cost-effective and adaptable than manual or service-based alternatives. This strong value proposition positioned software as the preferred choice across hospitals, clinics, and health systems nationwide.

The services segment is expected to expand at the fastest CAGR during the projection period due to the increasing reliance on third-party expertise for managing complex credentialing processes. As healthcare regulations evolve and compliance becomes more stringent, many providers are outsourcing credentialing tasks to specialized service providers to reduce administrative burden and avoid costly errors. These services offer end-to-end support, including verification, monitoring, and renewal management, allowing healthcare organizations to focus on patient care. The growing adoption of value-based care and the need for faster provider onboarding are also fueling demand for scalable, efficient credentialing services. This trend is particularly strong among smaller practices and organizations lacking in-house credentialing resources.

U.S. Credentialing Software And Services In Healthcare Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Software |

161.0 |

172.8 |

185.5 |

199.0 |

213.6 |

229.3 |

246.1 |

264.1 |

283.4 |

304.1 |

326.4 |

| Services |

107.3 |

114.2 |

121.6 |

129.4 |

137.7 |

146.6 |

156.0 |

166.0 |

176.7 |

188.0 |

200.0 |

By Functionality

How Does the Credentialing and Enrollment Segment Dominate the Market in 2024?

The credentialing and enrollment segment dominated the U.S. credentialing software and services in healthcare market in 2024 due to its central role in verifying provider qualifications and ensuring timely participation in healthcare networks. As regulatory requirements and payer expectations became more complex, healthcare organizations prioritized streamlined credentialing and enrollment processes to avoid delays in reimbursement and maintain compliance. This functionality enables automated verification, primary source validation, and real-time status tracking, significantly reducing manual workload and turnaround time. Additionally, the rise of telehealth and multi-state provider networks increased the need for efficient, scalable credentialing solutions. These factors made credentialing and enrollment the most critical and widely adopted functionality across healthcare systems.

The provider information management segment is expected to grow at the highest CAGR in the coming years. This is mainly due to the increasing need for accurate, centralized, and real-time access to provider data across healthcare systems. As organizations expand and providers work across multiple locations and networks, managing up-to-date credentials, licensure, and affiliations becomes more complex and critical. Advanced provider information management solutions help reduce errors, improve compliance, and enhance operational efficiency by maintaining a single source of truth. The growing demand for data integrity and streamlined workflows is also driving rapid adoption of these solutions.

U.S. Credentialing Software And Services In Healthcare Market Size, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Credentialing and Enrollment |

147.6 |

158.2 |

169.5 |

181.6 |

194.7 |

208.6 |

223.5 |

239.5 |

256.7 |

275.1 |

294.8 |

| Provider Information Management |

120.8 |

128.9 |

137.6 |

146.8 |

156.7 |

167.3 |

178.5 |

190.5 |

203.3 |

217.0 |

231.6 |

By Deployment Mode

Why Did the Cloud-Based Segment Lead the Market in 2024?

The cloud-based segment led the U.S. credentialing software and services in healthcare market with a major share in 2024. This is primarily due to its scalability, cost-effectiveness, and ease of deployment. Healthcare organizations increasingly favored cloud solutions for their ability to provide real-time access to credential data across multiple locations, enabling faster decision-making and improved collaboration. Additionally, cloud-based platforms reduce the need for on-premises infrastructure and IT maintenance, making them especially attractive to small and mid-sized healthcare providers. Enhanced data security, automatic updates, and integration with other cloud-based healthcare systems further boosted adoption. As industry shifted toward more agile and remote-friendly operations, cloud deployment became the preferred model.

The on-premises segment is expected to grow at a significant rate during the forecast period, owing to increasing concerns over data security, control, and compliance with strict healthcare regulations. Many large healthcare institutions prefer on-premises solutions to maintain full ownership of sensitive provider and patient data, reducing reliance on third-party cloud providers. These deployments also allow for greater customization to meet specific organizational workflows and integration with legacy systems. As cybersecurity threats rise, organizations with the resources to manage in-house IT infrastructure are investing in robust, secure on-premises credentialing systems. This focus on control and compliance is driving renewed interest and growth in the segment.

U.S. Credentialing Software And Services In Healthcare Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cloud Based |

174.4 |

187.2 |

200.8 |

215.5 |

231.2 |

248.1 |

266.2 |

285.6 |

306.4 |

328.7 |

352.7 |

| On-Premise |

93.9 |

99.9 |

106.2 |

113.0 |

120.2 |

127.8 |

135.9 |

144.5 |

153.7 |

163.4 |

173.7 |

By End Use

Why Did Hospitals and Clinics Contribute Major Market Share in 2024?

The hospitals and clinics segment dominated the U.S. credentialing software and services in healthcare market, accounting for the largest share in 2024, as these facilities require continuous credentialing and enrollment management. These institutions face strict regulatory and payer requirements, making efficient credentialing essential for compliance, reimbursement, and operational continuity. Hospitals and clinics also deal with frequent provider onboarding, multi-specialty staff, and expanding telehealth services, all of which demand robust credentialing solutions. The need for streamlined workflows, reduced administrative burden, and minimized delays in service delivery further drove adoption.

The healthcare payers segment is expected to grow at the fastest CAGR in the upcoming period, as insurers increasingly invest in credentialing solutions to ensure the accuracy and compliance of provider networks. With rising regulatory scrutiny and the need to prevent fraud, payers are prioritizing automated credentialing to streamline provider verification, reduce administrative costs, and improve data transparency. Additionally, value-based care models and growing partnerships with diverse provider types require payers to manage more complex and dynamic networks. Advanced credentialing software enables real-time updates, better network oversight, and faster onboarding, enhancing overall efficiency. These factors are driving rapid adoption of credentialing solutions among healthcare payers.

U.S. Credentialing Software And Services In Healthcare Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals and Clinics |

134.2 |

143.0 |

152.3 |

162.3 |

172.9 |

184.2 |

196.2 |

209.0 |

222.7 |

237.2 |

252.7 |

| Healthcare Payers |

93.9 |

101.0 |

108.7 |

116.9 |

125.8 |

135.3 |

145.5 |

156.5 |

168.4 |

181.1 |

194.8 |

| Other End use |

40.3 |

43.1 |

46.1 |

49.3 |

52.7 |

56.4 |

60.3 |

64.5 |

69.0 |

73.8 |

79.0 |

Country Level Analysis

- Regulatory Frameworks: The U.S. has stringent regulatory requirements, such as those from The Joint Commission and NCQA, mandating comprehensive provider credentialing processes.

- Healthcare Infrastructure: The U.S. boasts a vast and complex healthcare system, necessitating efficient credentialing solutions to manage a large network of providers.

- Technological Adoption: High adoption rates of IT solutions in healthcare, including cloud-based credentialing platforms, drive the demand for advanced credentialing services.

- Market Players: The presence of numerous key market players in the U.S. contributes to the development and implementation of innovative credentialing solutions.

U.S. Credentialing Software And Services in Healthcare Market Value Chain Analysis

1. Technology Development & Software Design

This stage involves the development of credentialing software platforms, incorporating automation, cloud computing, AI, and data security features. Companies like Modio Health and VerityStream focus on designing intuitive, compliant, and scalable solutions tailored to healthcare-specific workflows, ensuring robust credentialing and provider lifecycle management.

2. Data Aggregation & Integration

In this stage, verified data from multiple sources, such as licensing boards, medical institutions, and payer networks, is collected, standardized, and integrated into centralized credentialing platforms. Providers like CAQH facilitate data exchange through interoperable systems, enabling real-time credential verification and updates across systems.

3. Credentialing Processing & Verification Services

This stage involves primary source verification, background checks, monitoring of expirables, and enrollment services. Companies like Symplr and MedTrainer offer Credentialing-as-a-Service (CaaS), managing end-to-end processes to ensure that healthcare providers meet payer and regulatory standards efficiently.

4. Deployment & Implementation

Once developed and verified, credentialing solutions are deployed within healthcare organizations, either on-premises or via the cloud. Players like HealthStream and VerityStream provide implementation support, data migration, user training, and system customization to ensure seamless adoption within hospitals and clinics.

5. Support, Compliance, and Continuous Monitoring

This final stage involves ongoing management of credentialing data, alerts for re-credentialing, compliance audits, and support for regulatory changes. Companies such as MedTrainer and IntelliSoft provide dashboards, automated alerts, and reporting tools to help organizations maintain readiness for audits and streamline compliance with evolving standards.

U.S. Credentialing Software And Services in Healthcare Market Companies

VerityStream (a HealthStream Company)

VerityStream offers end-to-end credentialing and provider lifecycle management solutions, serving hospitals, health systems, and payer organizations. It contributes significantly by providing scalable, cloud-based platforms that integrate credentialing, enrollment, and privileging to streamline compliance and onboarding processes.

A leading provider of enterprise healthcare operations software, symplr delivers automation across credentialing and provider data management. Its NCQA‑certified Credentials Verification Organization (CVO) processes millions of applications annually, helping health systems and payers streamline workflows, ensure compliance, and reduce manual effort.

Modio Health provides cloud-based credentialing software designed to simplify provider management across multi-location health systems. Known for its user-friendly OneView platform, Modio enables real-time credential tracking and compliance monitoring, contributing to operational efficiency in healthcare settings.

- CAQH (Council for Affordable Quality Healthcare)

CAQH delivers data management and exchange solutions, including the CAQH ProView system, which simplifies provider data collection and sharing across payers. It plays a pivotal role in streamlining credentialing data and reducing redundancy for both providers and health plans.

HealthStream powers credentialing systems like CredentialStream, offering secure, scalable, cloud-based solutions for enrollment, privileging, and onboarding. Widely adopted by healthcare organizations, its platforms are recognized among G2’s top healthcare software, delivering automation, compliance support, and improved provider experience.

CureMD provides comprehensive credentialing services focused on payer enrollment and regulatory compliance, particularly for small practices and specialties. Their solutions enable fast turnaround, multi-state credentialing, and Medicare/Medicaid enrollment with detailed tracking and dedicated support, empowering practices to become revenue-ready quickly.

Kareo (merged with PatientPop to form Tebra) supports small practices with credentialing services, enrollment management, and medical billing. Its solutions help independent providers and clinics quickly credential with payers, improving cash flow and administrative efficiency.

IntelliSoft offers credentialing, privileging, and payer enrollment software with strong customization capabilities. It supports healthcare organizations in maintaining accurate provider data and meeting accreditation requirements, enhancing compliance and audit preparedness.

MedTrainer provides credentialing services and learning management systems for healthcare providers, particularly in small to mid-sized organizations. Its all-in-one platform offers compliance training, credentialing, and documentation, improving regulatory alignment and administrative productivity.

- Credentialing.com (Aperture Health)

Credentialing.com offers Credentialing-as-a-Service (CaaS), handling the complete provider enrollment and verification process. It caters to organizations seeking to outsource credentialing operations for faster onboarding and improved compliance.

Neolytix delivers outsourced credentialing services including provider data maintenance, application filing, contract negotiation, and re-credentialing support, ideal for medical practices seeking efficient, hands-off credentialing operations.

Recent Developments

- In August 2025, Fluent launched its Fluent Credentialing SaaS platform, a next-generation, end-to-end solution designed to modernize and accelerate credentialing across the dental ecosystem. This platform streamlines credentialing for payers, DSOs, and providers. Leveraging AI and intelligent workflow automation, it accelerates and enhances credentialing accuracy. As part of the broader Fluent Credentialing Suite, which includes NCQA-accredited delegated credentialing, payer enrollment, and full-service CVO options, the platform offers scalable, in-house or fully outsourced solutions without compromising speed, compliance, or quality.

- In February 2024, Medallion launched its one-day credentialing solution, dramatically speeding up the credentialing process with seamless integration into its provider data management platform. The solution features instant primary source verifications, automated quality assurance, and built-in NCQA compliance to ensure fast, accurate, and reliable credentialing for healthcare organizations.

- In September 2023, Global Healthcare Exchange (GHX) enhanced the digital credentialing experience by launching GHX Credentialing Service Packages (Gold, Platinum, and Diamond) to reduce administrative burdens and streamline credentialing for healthcare industry representatives. This followed GHX Vendormate’s partnership with 360training, reinforcing GHX’s commitment to simplifying credentialing for healthcare suppliers and providers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. credentialing software and services in healthcare market.

By Component

By Functionality

- Credentialing and Enrollment

- Provider Information Management

By Deployment Type

By End Use

- Hospitals and Clinics

- Healthcare Payers

- Other End use