U.S. Dental 3D Printing Market Size and Growth

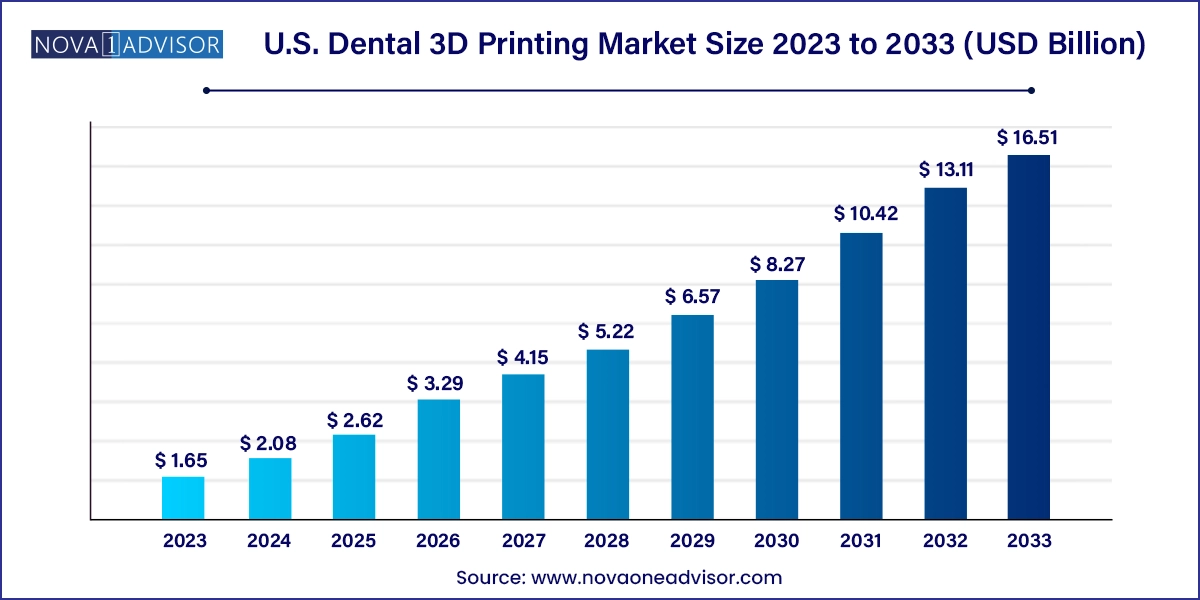

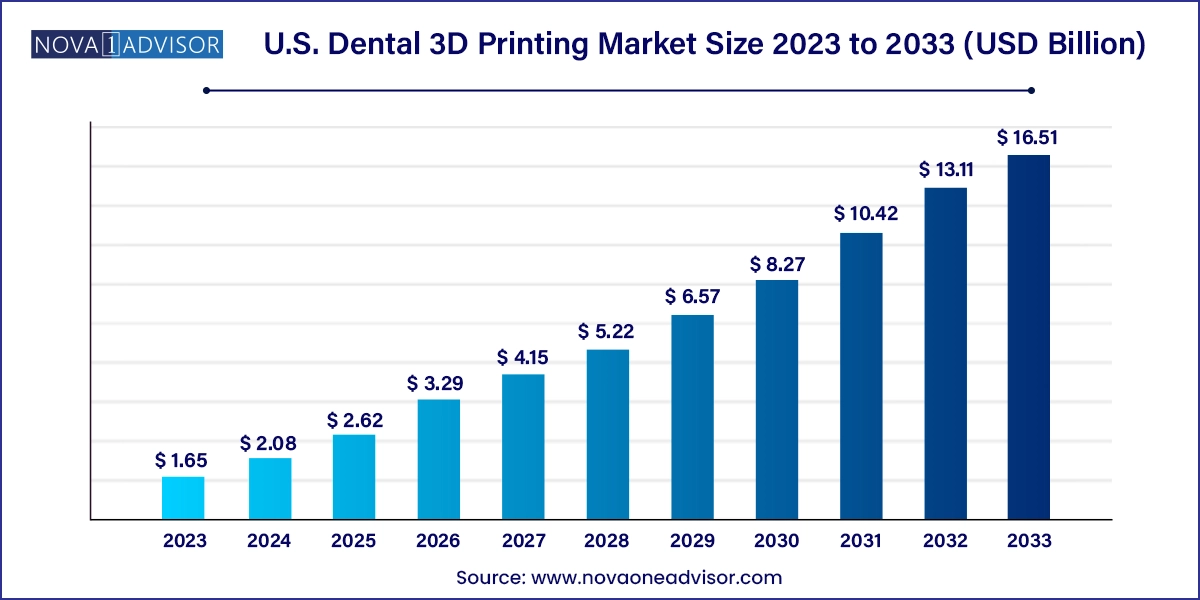

The U.S. dental 3D printing market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 16.51 billion by 2033, growing at a CAGR of 25.9% during the forecast period 2024 to 2033.

U.S. Dental 3D Printing Market Key Takeaways:

- The orthodontics segment held the largest revenue share of 39.6% in 2023 and is expected to grow at a significant rate of 25.9% during the forecast period.

- The prosthodontics segment is estimated to witness the fastest growth from 2024 to 2033

- The selective laser sintering segment dominated the market with the largest share in 2023.

- The other technological segment is expected to register a significant CAGR from 2024 to 2033.

- The photopolymer segment held the largest revenue share in 2023.

- The ceramic segment is estimated to grow at the fastest CAGR from 2024 to 2033.

- The dental clinics segment is estimated to witness significant growth from 2024 to 2033.

Market Overview

The U.S. dental 3D printing market has rapidly emerged as one of the most innovative and transformative segments of the broader digital dentistry landscape. With the growing need for personalized, high-precision dental solutions and the drive for more efficient clinical workflows, 3D printing has found an indispensable place in U.S. dental practices, laboratories, and research institutes. This technology enables dental professionals to fabricate crowns, bridges, dentures, orthodontic aligners, surgical guides, and models with exceptional speed, accuracy, and cost-efficiency.

Over the past decade, the transition from conventional subtractive methods to additive manufacturing (3D printing) has significantly changed how dental care is delivered. Traditionally, crafting dental prosthetics required time-intensive manual labor, impression molds, and external lab processing. Today, chairside 3D printers allow same-day restorations, dramatically reducing turnaround time and enhancing patient satisfaction. For dental labs, 3D printing optimizes the production of complex prosthodontic and implantology components at scale, offering economies of speed and precision.

The U.S. dental industry, characterized by a strong base of private practices, advanced research centers, and high patient awareness, is uniquely positioned to lead this revolution. The widespread availability of desktop and professional-grade dental 3D printers, coupled with user-friendly CAD/CAM software, is accelerating adoption across both solo practitioners and multi-specialty clinics. Moreover, the integration of digital scanning and cloud-based treatment planning tools is creating an end-to-end digital dentistry ecosystem in which 3D printing is the core production engine.

The demand for cosmetic dentistry, aging population needs, and the rise in orthodontic treatment among youth and adults are major contributors to the market's growth. Additionally, favorable reimbursement models for certain procedures and the ongoing evolution of biocompatible dental printing materials are creating fertile ground for market expansion. The result is a dynamic, innovation-driven U.S. dental 3D printing market poised for sustained growth and technological advancement.

Major Trends in the Market

-

Chairside 3D Printing Adoption: Dentists are increasingly integrating compact 3D printers into their offices for real-time production of crowns, surgical guides, and splints.

-

Expansion of Biocompatible Materials: New photopolymers, ceramic composites, and hybrid resins are enabling the production of more durable and esthetic dental restorations.

-

AI-Integrated CAD Tools: AI-powered design software is simplifying model generation, auto-suggesting optimal aligner shapes, or simulating occlusal dynamics.

-

Growth of Clear Aligner Manufacturing: Orthodontic practices are investing in 3D printers to produce custom aligners in-house, reducing dependence on external labs.

-

Digital Workflow Integration: Seamless integration of intraoral scanners, design software, and 3D printers is shortening treatment cycles and minimizing manual error.

-

Customization in Implantology: Patient-specific implants and abutments are increasingly produced using 3D printing, improving surgical outcomes and implant longevity.

-

Eco-Friendly Printing Solutions: Manufacturers are focusing on recyclable resins and sustainable production processes to address environmental concerns.

Report Scope of U.S. Dental 3D Printing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.08 Billion |

| Market Size by 2033 |

USD 16.51 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 25.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Technology, Material, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

3D Systems; Stratasys Ltd.; EnvisionTEC; Straumann; DentsPly Sirona; Renishaw plc; Carbon3D; Argen X; Asiga; Formlabs; DWS GmbH; Markforged |

Key Market Driver: Rising Demand for Customized Dental Solutions

One of the most prominent drivers in the U.S. dental 3D printing market is the rising demand for personalized and patient-specific dental restorations. Dentistry is inherently a field that thrives on customization no two mouths are the same, and the need for tailor-made prosthetics, aligners, or surgical guides is universal. 3D printing perfectly aligns with this requirement, allowing practitioners to design and produce individualized solutions with millimeter precision.

In orthodontics, for example, the ability to produce a sequence of clear aligners customized to a patient’s dental arch movement is revolutionizing treatment planning. Similarly, prosthodontics benefits from accurately printed crowns and bridges that match the patient’s bite and appearance. Traditional methods often involved weeks-long processes and required multiple patient visits. 3D printing allows dental practices to perform same-day treatments in many cases. With the rise in consumer expectations for fast, aesthetically pleasing dental services, the ability to deliver accurate, same-day solutions has become a significant competitive advantage.

Key Market Restraint: High Initial Costs and Training Requirements

Despite its advantages, a major restraint in the U.S. dental 3D printing market is the high cost of equipment and the need for technical expertise. Although entry-level 3D printers are available, professional-grade devices capable of producing implant-grade components or multi-material dental restorations can cost tens of thousands of dollars. This financial barrier is especially daunting for smaller clinics or solo practitioners.

Additionally, successful implementation of 3D printing in dentistry requires comprehensive training in digital design (CAD software), printing workflows, post-processing, and material handling. Even though companies are offering more intuitive software interfaces, the learning curve remains steep for many clinicians accustomed to analog methods. Dental teams must also keep up with continuous material innovations, printer maintenance requirements, and calibration protocols to ensure consistent output. These factors can slow down market adoption despite evident long-term benefits.

Key Market Opportunity: Growth of Chairside and In-House Production Systems

A compelling opportunity in the U.S. dental 3D printing market is the growth of compact chairside and in-house 3D printing systems that empower clinics to reduce turnaround time and enhance treatment capabilities. In recent years, manufacturers have introduced desktop-sized printers with medical-grade accuracy, suitable for use directly in the clinic. These systems allow dentists to create crowns, retainers, splints, and even surgical templates in a matter of hours improving patient experience and maximizing operational efficiency.

Startups and established companies alike are designing plug-and-play printing ecosystems, which integrate intraoral scanners, intuitive design software, and material-specific printer presets. With simplified workflows, practitioners can produce accurate restorations on-site without relying on external labs, thereby saving cost and time. As more dental schools introduce digital dentistry modules and new graduates enter the field with 3D printing proficiency, this opportunity is expected to grow rapidly. Clinics that adopt in-house printing not only reduce operational costs but also unlock revenue from additional services like same-day restorations and emergency dental care.

U.S. Dental 3D Printing Market By Application Insights

Prosthodontics dominated the U.S. dental 3D printing market by application, owing to the high demand for crowns, bridges, dentures, and veneers. With growing interest in cosmetic dentistry and restorative procedures, prosthodontics has become the most frequently adopted 3D printing use case. 3D printers can create wax-ups for casting, direct resin crowns, or complete removable dentures with speed and customization previously unattainable by manual techniques. For example, a dentist can scan, design, print, and place a temporary crown within one visit a dramatic improvement from conventional multi-visit processes. Additionally, material advancements such as printable zirconia and hybrid resins are expanding the range of prosthodontic applications.

However, implantology is the fastest-growing application segment, driven by increasing preference for digital surgical planning and precision-fabricated implant components. Custom surgical guides, printed abutments, and models for bone graft planning are becoming essential for implant procedures. 3D-printed surgical guides enhance implant placement accuracy and reduce operative time. Moreover, practices are increasingly utilizing 3D models to simulate implant procedures, improving patient education and acceptance rates. As implant dentistry becomes more mainstream in general practice, the demand for 3D-printed solutions in this area is expected to accelerate.

U.S. Dental 3D Printing Market By Technology Insights

Vat photopolymerization technology leads the U.S. dental 3D printing market, particularly due to its subtypes stereolithography (SLA) and digital light processing (DLP). These technologies are ideal for high-resolution, detailed dental components such as crowns, aligners, and surgical guides. SLA and DLP printers are capable of producing ultra-smooth surface finishes with micron-level accuracy, making them suitable for intraoral applications. Dentists and labs often prefer SLA and DLP systems for their speed, precision, and growing library of certified dental materials.

Selective Laser Sintering (SLS) is the fastest-growing technology, especially in dental labs producing metal frameworks and implant bars. SLS enables the creation of robust, biocompatible metal components that are vital in partial dentures, orthodontic brackets, and implant infrastructure. The increasing adoption of metal 3D printing in dental laboratories, coupled with the shift toward patient-specific metal restorations, is fueling this segment’s rapid growth. As software integration and affordability of metal printers improve, SLS adoption is expected to accelerate further.

U.S. Dental 3D Printing Market By Material Insights

Photopolymer resins dominate the materials segment due to their widespread use in vat photopolymerization printers and their versatility in crafting dental models, surgical guides, and temporary restorations. These materials offer high detail fidelity, are easy to post-process, and are increasingly certified for biocompatibility, making them essential for most in-office and lab-based 3D printing applications. Recent advancements have introduced hybrid photopolymers with improved mechanical properties, wear resistance, and translucency expanding their use in both aesthetic and functional restorations.

Metal materials are the fastest-growing segment, driven by the adoption of metal 3D printing for implant and prosthetic frameworks. Stainless steel, titanium, and cobalt-chromium alloys are being used to print permanent, load-bearing dental components. With increased accessibility of laser-based metal printers and software capable of optimizing print orientation and support structures, the use of metals is extending beyond specialized implantology centers to mainstream dental labs. As demand grows for permanent restorations and precision-fit frameworks, the growth in metal-based printing is expected to surge.

U.S. Dental 3D Printing Market By End-use Insights

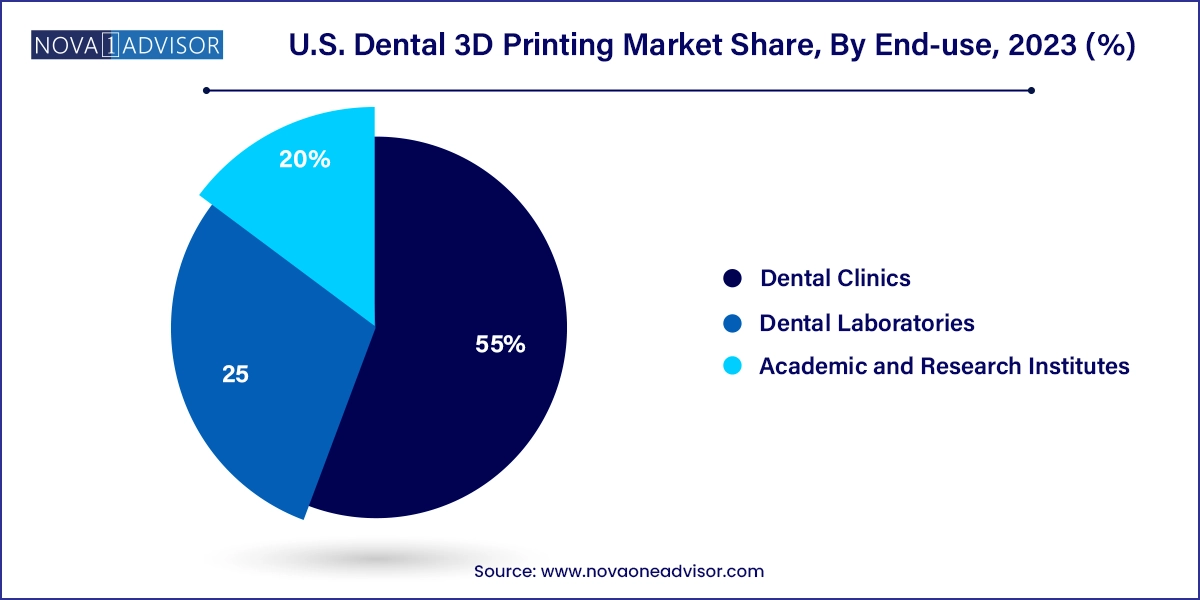

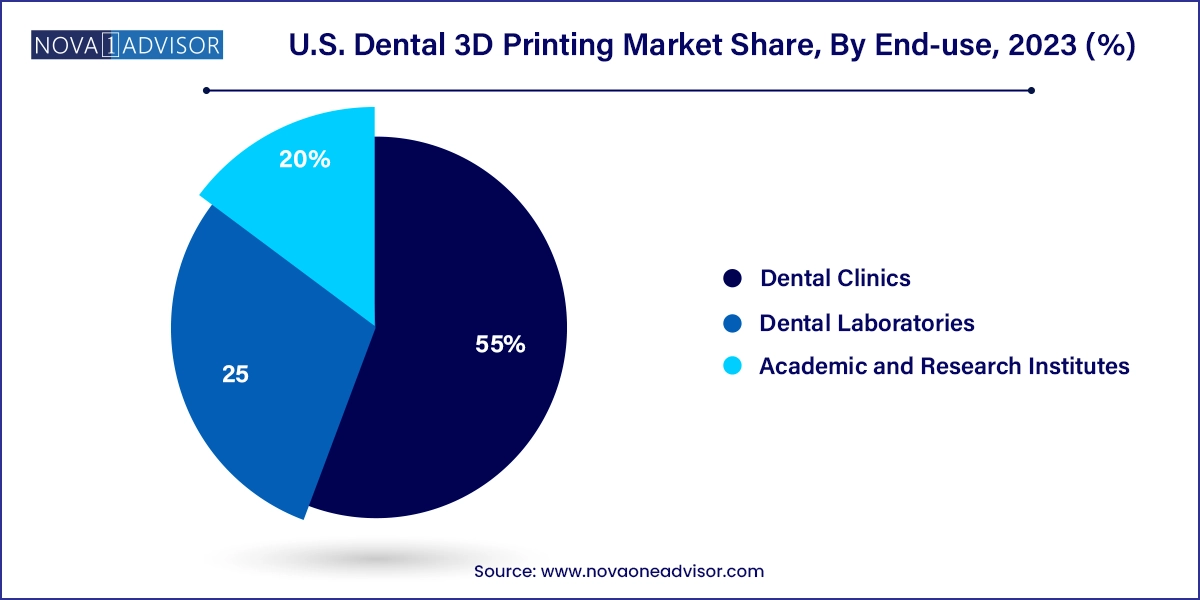

Dental laboratories dominate the U.S. market by end use, as they are equipped with the space, expertise, and capital to invest in industrial-grade printers. Labs play a critical role in producing customized prosthetics, surgical guides, and orthodontic devices at scale. The shift toward digitized workflows has transformed labs into mini-factories capable of handling high-volume orders with precision and consistency. Labs also serve as innovation hubs, experimenting with new materials and testing complex geometries that individual clinics may not attempt.

Dental clinics represent the fastest-growing end-user segment, as more practices integrate chairside 3D printing to enhance treatment efficiency. In-clinic printing empowers dentists to control the design and production process, offer same-day restorations, and reduce lab outsourcing costs. With compact, easy-to-use desktop 3D printers and plug-and-play resin systems entering the market, adoption among small and mid-sized practices is increasing rapidly. Clinics offering cosmetic and orthodontic services, in particular, are turning to 3D printing to create aligners, trays, splints, and temporary crowns in-house.

Country-Level Analysis

The United States stands as the global leader in dental 3D printing adoption, owing to its advanced dental infrastructure, innovation-led manufacturers, and high per capita expenditure on oral healthcare. With over 200,000 practicing dentists and tens of thousands of dental laboratories nationwide, the U.S. has cultivated a fertile ecosystem for the deployment of digital manufacturing technologies in oral care.

Educational institutions such as Harvard School of Dental Medicine, NYU College of Dentistry, and the University of Michigan have integrated 3D printing into their curriculum and clinical programs, fostering a digitally fluent generation of dentists. Additionally, U.S.-based startups and multinational dental companies are spearheading breakthroughs in materials science, AI-assisted design, and integrated workflow solutions. States like California, New York, and Texas have become hotbeds for early adoption, while rural clinics are increasingly benefiting from compact and affordable 3D printing solutions.

The U.S. regulatory environment, led by the FDA, plays a supportive role by approving a growing list of biocompatible dental materials and software tools. Insurance providers are also beginning to recognize the cost-efficiency of digital dentistry, especially in complex restorative procedures. Overall, the U.S. market is characterized by a robust combination of demand, innovation, and infrastructure that continues to push dental 3D printing toward new frontiers.

Some of the prominent players in the U.S. dental 3D printing market include:

- 3D Systems

- Stratasys Ltd.

- EnvisionTEC

- Straumann

- DentsPly Sirona

- Renishaw plc

- Carbon3D

- Argen X

- Asiga

- Formlabs

- DWS GmbH

- Markforged

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. dental 3D printing market

Application

- Orthodontics

- Prosthodontics

- Implantology

Technology

-

- Stereolithography

- Digital Light Processing

- Polyjet Technology

- Fused Deposition Modelling

- Selective Laser Sintering

- Others

Material

- Metals

- Photopolymer

- Ceramic

- Others

End-use

- Dental Clinics

- Dental Laboratories

- Academic and Research Institutes