U.S. Dental Splint Market Size and Trends

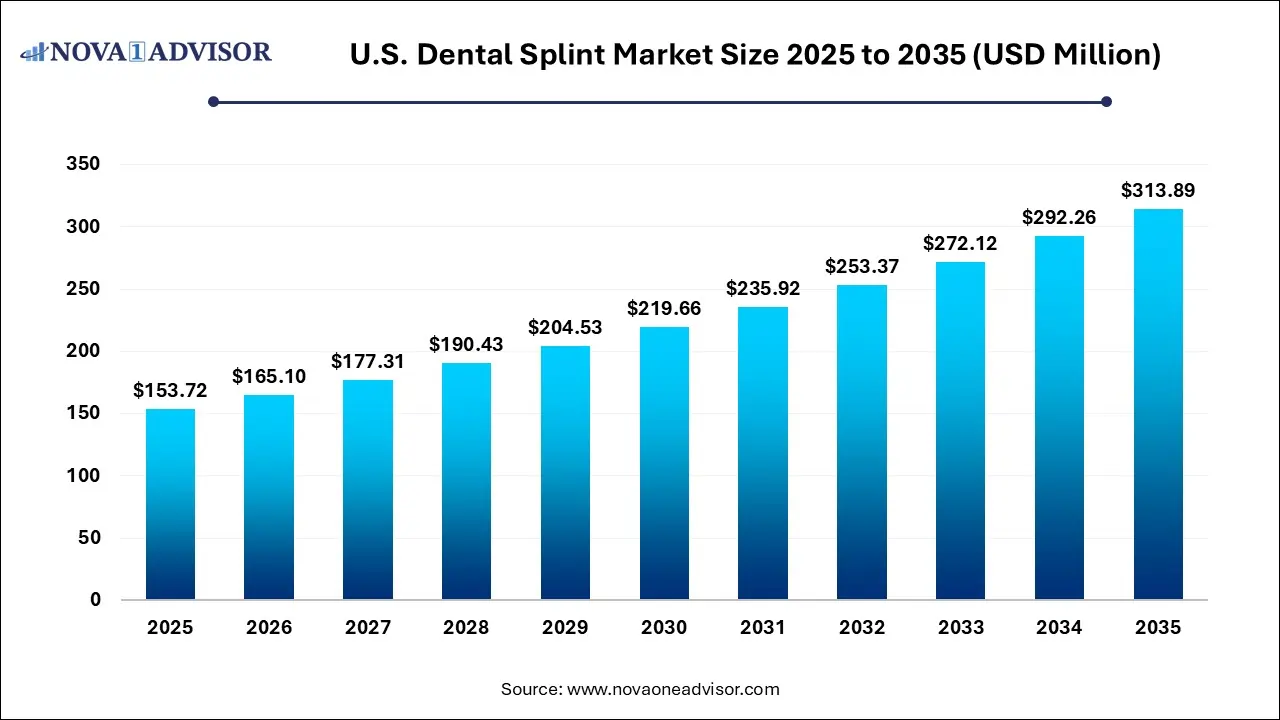

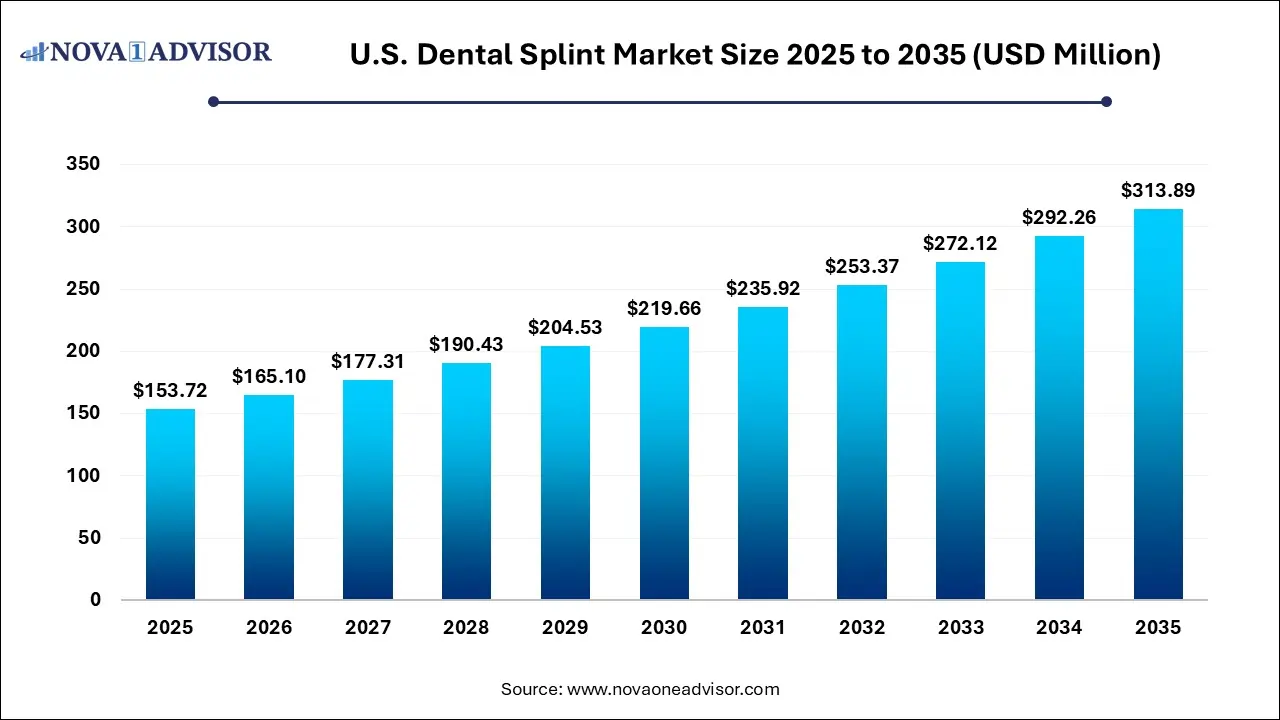

The U.S. dental splint market size was exhibited at USD 153.72 million in 2025 and is projected to hit around USD 313.89 million by 2035, growing at a CAGR of 7.4% during the forecast period 2026 to 2035.

Key Takeaways:

- Based on product, the rigid segment had the highest revenue share at 47.6% in 2025.

- The semi-rigid segment is anticipated to witness a sizable CAGR is anticipated during the forecast period.

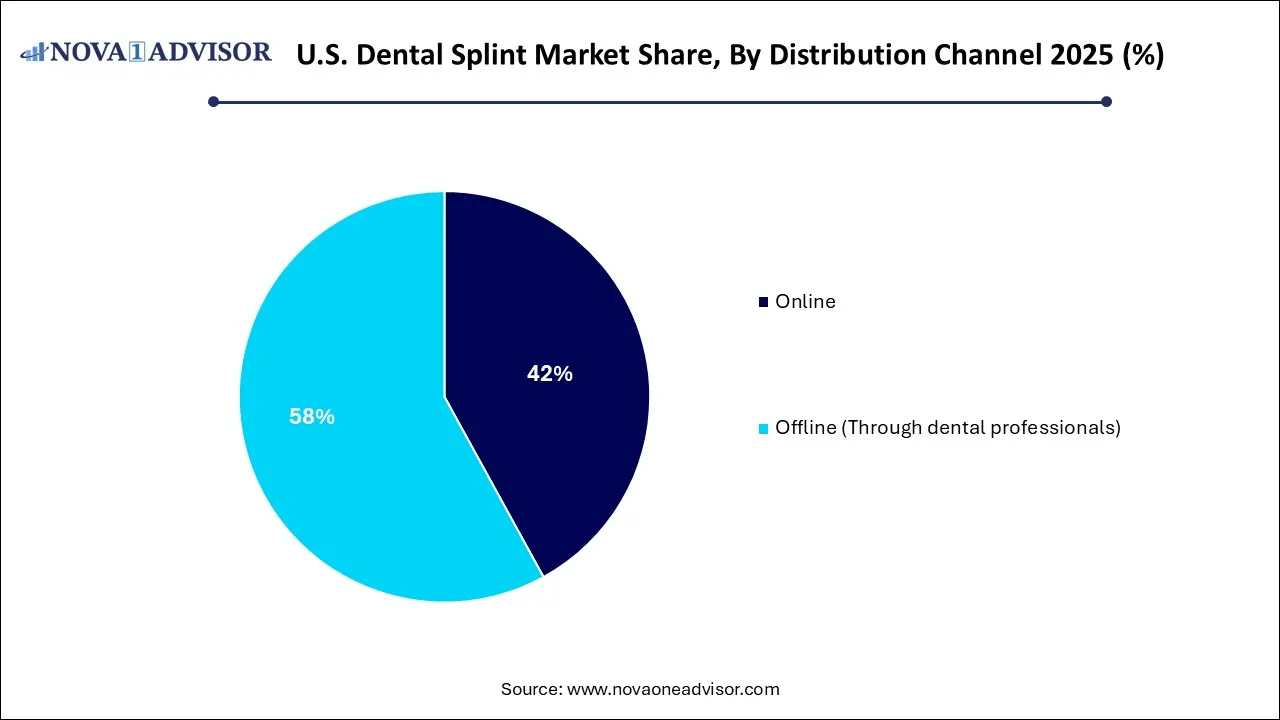

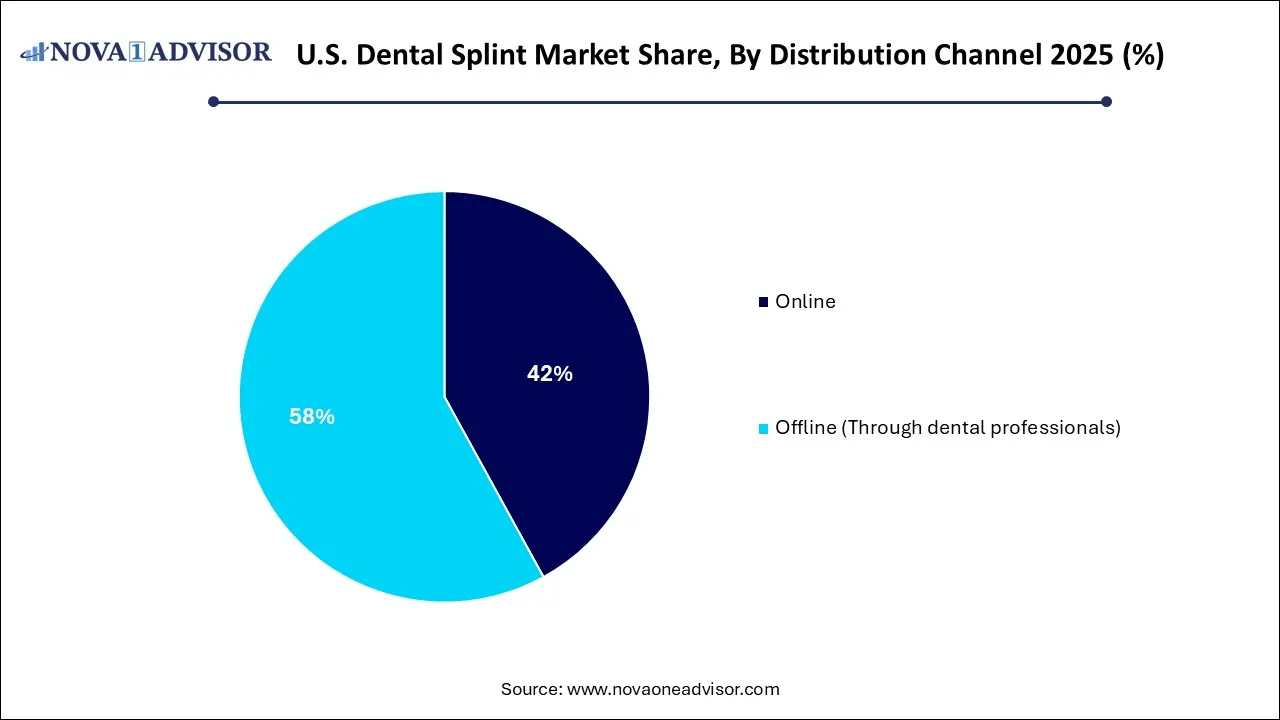

- Based on distribution channel, the offline segment accounted for the largest revenue share of 58.0% in 2025.

- The online segment is expected to witness the highest CAGR during the forecast period.

Market Overview

The U.S. Dental Splint Market is a vital component of the country’s broader dental and orthodontic industry, encompassing a diverse array of devices designed to stabilize, protect, and align the teeth and jaw. Dental splints also referred to as occlusal splints, bite guards, or night guards are used in the management of temporomandibular joint disorders (TMD), bruxism (teeth grinding), dental trauma, periodontal conditions, and orthodontic stabilization. They can be fabricated from a variety of materials and are customized for each patient based on diagnosis and clinical need.

The demand for dental splints in the United States is closely linked to the country’s robust dental care infrastructure, rising awareness around dental health, and an increasing prevalence of conditions such as sleep bruxism and TMD. According to estimates, over 10 million people in the U.S. suffer from TMD symptoms, and many more are affected by stress-induced bruxism an issue that gained further traction during the COVID-19 pandemic, as anxiety levels and remote work contributed to deteriorating oral habits.

Another key factor fueling market expansion is the growing availability of over-the-counter (OTC) dental splints via online platforms. Although professionally made custom splints remain the gold standard for treating complex cases, mass-market products cater to price-sensitive or early-stage users. Additionally, dental insurance coverage in the U.S. is gradually evolving to include TMD-related therapies in select plans, which may accelerate the adoption of dentist-prescribed splints.

As digital dentistry continues to advance, with intraoral scanning, CAD/CAM fabrication, and 3D printing becoming commonplace, the production and customization of dental splints are becoming faster and more precise. This has significantly improved turnaround times and patient comfort, making splints more accessible and effective than ever before.

Major Trends in the Market

-

Rising Incidence of Bruxism Among Working Adults and Teens: Increased stress and anxiety—especially post-pandemic—have triggered higher bruxism rates, particularly among remote workers and students.

-

Growth in Direct-to-Consumer (DTC) Splint Offerings: Several startups and dental tech brands now offer mail-order night guards and splints, disrupting traditional dental channels.

-

Adoption of Digital Workflow and 3D Printing: Dental laboratories and clinics are increasingly using digital impressions and additive manufacturing for faster splint customization.

-

Integration of Splints with Smart Sensors: R&D efforts are exploring smart splints that monitor grinding intensity and frequency, offering real-time feedback to users and clinicians.

-

Increased Use of Splints in Post-Orthodontic and Periodontal Therapy: Splints are being used more frequently for tooth stabilization after orthodontic treatments and surgeries.

-

Customization via AI and Intraoral Scanning: Artificial intelligence is being applied to optimize splint design and fit, based on patient-specific digital data.

-

Emergence of Hybrid Materials: New polymer composites with improved durability, transparency, and comfort are being adopted in clinical-grade and consumer splints.

Report Scope of The U.S. Dental Splint Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 165.10 Million |

| Market Size by 2035 |

USD 313.89 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 7.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Mobility Degree, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Aqualizer; Glidewell; Procter & Gamble; Dentek; Brux Night Guard; Sporting Smiles; Smile Brilliant; Chomper Labs; Sentinel Mouth Guards |

Market Driver: Increased Prevalence of Bruxism and Temporomandibular Joint Disorders (TMD)

A major driver of the U.S. dental splint market is the growing incidence of bruxism and temporomandibular joint disorders, conditions that are directly addressed through splint therapy. Bruxism, characterized by involuntary grinding or clenching of teeth, often occurs during sleep and is closely associated with psychological stress, lifestyle factors, and certain neurological or sleep disorders. The American Academy of Sleep Medicine has recognized sleep bruxism as a common parasomnia, affecting nearly 8-10% of the adult population in the U.S.

Temporomandibular disorders, encompassing a range of musculoskeletal and neuromuscular conditions, are frequently accompanied by jaw pain, clicking, and limited range of motion. Occlusal splints are often the first line of conservative therapy recommended by dentists and oral surgeons, intended to offload the joint and reduce muscular tension.

Increased awareness, coupled with a preference for non-invasive interventions, has made dental splints a widely accepted management strategy. As diagnostic accuracy and dental care accessibility improve, the number of patients being prescribed splints for functional, therapeutic, and protective purposes is set to rise, reinforcing this market’s upward trajectory.

Market Restraint: Cost Sensitivity and Limited Insurance Reimbursement

Despite a strong demand base, one of the most significant restraints on the U.S. dental splint market is the cost barrier associated with professionally fabricated splints and limited third-party reimbursement. Custom dental splints provided by dentists can range from $300 to $800 or more, depending on the material, complexity, and geographic location. This price point may deter uninsured or underinsured individuals from seeking professional solutions.

Dental insurance plans in the U.S. often exclude occlusal splints from coverage or impose strict medical necessity documentation, especially when used for bruxism or TMD rather than acute trauma. Many plans categorize splints as elective appliances or limit their frequency of replacement, creating financial hurdles for both patients and providers.

As a result, many consumers opt for cheaper OTC night guards, which may not provide optimal fit or efficacy. The gap between clinical-grade and mass-market solutions has also created confusion regarding efficacy, with some patients delaying professional treatment due to initial trial-and-error experiences with lower-quality alternatives.

An emerging opportunity lies in the fusion of teledentistry and direct-to-consumer business models for custom dental splints. Teledentistry platforms have already revolutionized orthodontics and whitening products, and a similar transformation is underway for occlusal splints. Companies like Smile Brilliant and Remi are offering mail-in impression kits that allow consumers to obtain custom night guards without visiting a dental office.

These platforms combine convenience with cost savings, often delivering custom-fit splints at 40–60% lower prices than traditional providers. While clinical oversight may vary, technological advancements such as AI-driven impression verification, online consultations, and remote fitting support are narrowing the quality gap.

This opportunity is especially compelling in the U.S., where geographic disparities and rising dental costs hinder access to in-person care. A hybrid model offering remote assessment, impression collection, and local fulfillment can unlock new patient segments, particularly among tech-savvy millennials and Gen Z consumers who prioritize affordability, speed, and convenience.

U.S. Dental Splint Market By Mobility Degree Insights

Flexible splints dominated the U.S. market, primarily due to their widespread use in bruxism management and patient comfort. These splints are typically fabricated from soft thermoplastic materials or dual-laminate polymers, offering a cushioned interface that reduces jaw pressure and minimizes wear on teeth. Patients with mild to moderate bruxism, as well as those new to splint use, often prefer flexible options because they are easier to adapt to and less likely to cause initial discomfort. Dentists often prescribe these for nighttime use, particularly in younger patients or those with heightened sensitivity.

Semi-rigid splints are the fastest-growing segment, especially in the management of TMD and post-trauma stabilization. These devices offer a balance between flexibility and structural support, making them ideal for patients with more complex conditions requiring joint realignment or muscle relaxation. Semi-rigid designs are increasingly being produced through digital workflows, enhancing customization and durability. Their growth is also driven by increasing dental referrals for TMD management, which typically favors hybrid materials that can provide both therapeutic and protective benefits without compromising wearability.

U.S. Dental Splint Market By Distribution Channel Insights

Offline distribution channels, particularly those through dental professionals, dominated the market, as clinical evaluation and customization remain the gold standard for efficacy and long-term outcomes. Dentists, prosthodontists, and oral surgeons are able to assess bite alignment, joint function, and oral pathology before fabricating splints tailored to the patient’s unique anatomy. Moreover, the ability to adjust splints during follow-up visits and monitor their effects ensures higher patient satisfaction and compliance. These clinician-led pathways are crucial for managing complex cases, such as TMD-induced migraines or post-orthodontic stabilization.

Online distribution is the fastest-growing segment, largely propelled by direct-to-consumer (DTC) startups and e-commerce adoption. Consumers increasingly seek convenience, lower prices, and access to custom-fit night guards without dental appointments. Online platforms offer impression kits, AI-assisted fitting tools, and remote consultations, making them attractive to younger demographics and price-sensitive users. The pandemic accelerated the normalization of online dental purchases, and this momentum has continued with recurring subscriptions, influencer-driven marketing, and transparent pricing structures. With increasing trust in digital dental care, the online segment is expected to capture a growing share of the total market in the coming years.

Country-Level Analysis – United States

In the United States, the dental splint market is shaped by a mature dental care infrastructure, strong private sector involvement, and a dynamic innovation landscape. Urban and suburban regions report higher demand for occlusal splints due to greater access to dental care, higher awareness levels, and stronger insurance coverage in employer-sponsored plans. Major dental chains such as Aspen Dental and Pacific Dental Services offer in-house splint fabrication or partner with centralized labs to streamline delivery.

Conversely, rural populations often face barriers such as travel distance, dentist shortages, and limited insurance acceptance, making them more likely to seek OTC or online alternatives. Initiatives by state dental associations and teledentistry platforms aim to bridge these gaps by offering mail-in impression kits or virtual consultations.

Furthermore, the integration of digital dentistry across academic institutions and private clinics is transforming the speed and accuracy of splint fabrication. Intraoral scanning, 3D modeling, and cloud-based case management are becoming the norm in advanced practices, enabling faster turnaround and better patient fit. The rise of health-tech investment in the dental sector is also fueling R&D into smart splints and AI-supported diagnostics.

Some of the prominent players in the U.S. dental splint market include:

- Aqualizer

- Glidewell

- Procter & Gamble

- Dentek

- Brux Night Guard

- Sporting Smiles

- Smile Brilliant

- Chomper Labs

- Sentinel Mouth Guards

Recent Developments

-

In March 2025, Remi Night Guard introduced a new subscription model for its custom night guard service, allowing U.S. consumers to receive replacements every six months at discounted rates, enhancing compliance and dental health.

-

In February 2025, 3M Oral Care announced the development of a next-generation polymer composite for semi-rigid splints, designed to improve strength and reduce bulkiness, to be rolled out through licensed dental professionals.

-

In January 2025, Smile Brilliant expanded its product portfolio with a TMD-focused splint line, supported by virtual consultations with licensed dentists across all 50 states.

-

In December 2024, ProSomnus Inc. launched a pilot study in partnership with University of California dental clinics to test smart dental splints embedded with sensors for tracking bruxism frequency.

-

In November 2024, Zenyum, a dental-tech firm, entered the U.S. market offering AI-enhanced scanning for mail-order dental splints, focusing on younger consumers seeking affordable alternatives to in-office appliances.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. dental splint market

Mobility Degree

- Flexible

- Semi-rigid

- Rigid

Distribution Channel

- Online

- Offline (Through dental professionals)