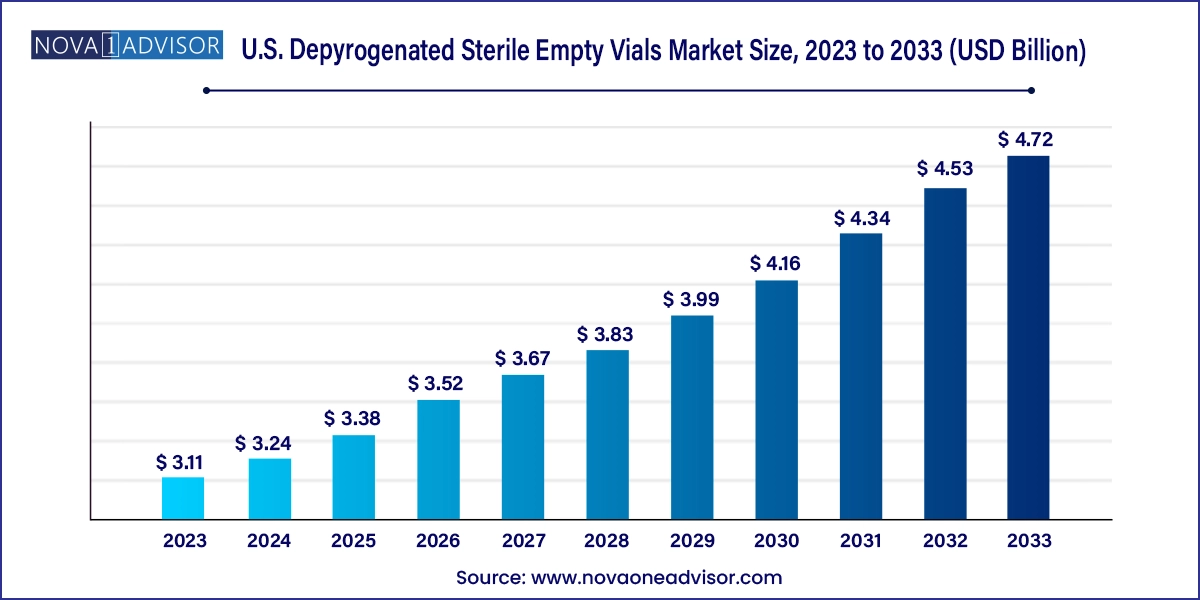

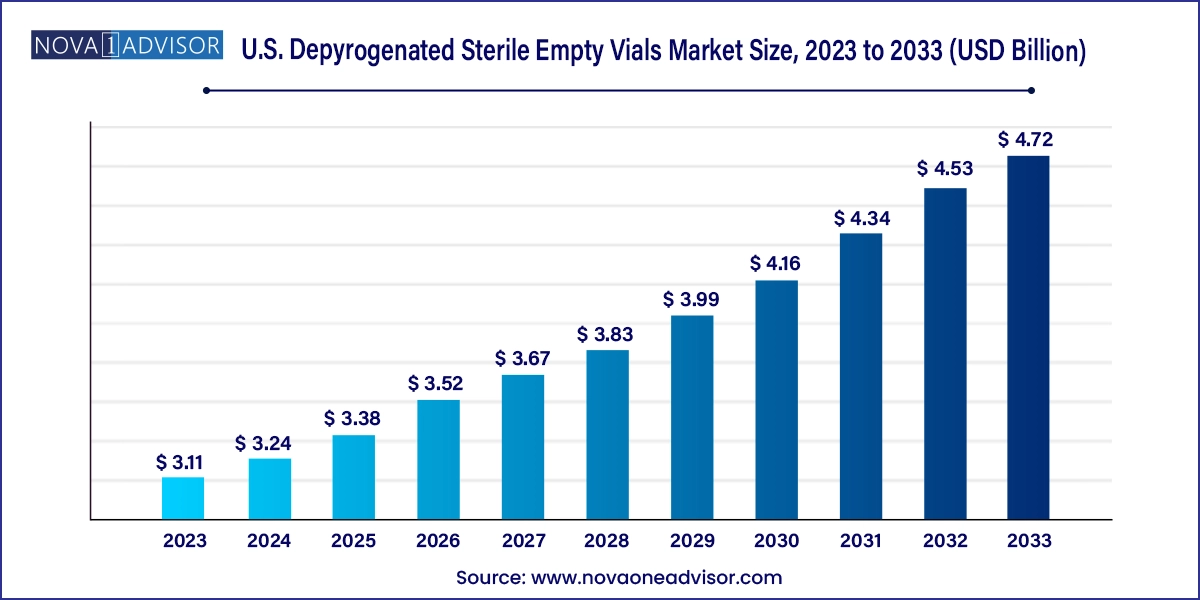

U.S. Depyrogenated Sterile Empty Vials Market Size and Growth

The U.S. depyrogenated sterile empty vials market size was exhibited at USD 3.11 billion in 2023 and is projected to hit around USD 4.72 billion by 2033, growing at a CAGR of 4.27% during the forecast period 2024 to 2033.

U.S. Depyrogenated Sterile Empty Vials Market Key Takeaways:

- Based on product, the market is segmented into 2 ml, 5 ml, 10 ml, 20 ml, and more than 20 ml. In 2023,

- The 2 ml segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

- Based on end-use, the U.S. depyrogenated sterile empty vials market is segmented into clinical labs, compounding pharmacies, and others. In 2023

- The clinical labs segment is expected to grow at the fastest CAGR of 4.8% during the forecast period.

Market Overview

The U.S. depyrogenated sterile empty vials market is a crucial segment within the broader pharmaceutical packaging and lab supply ecosystem. These vials are specifically treated to eliminate pyrogens contaminants that can cause febrile responses in patients making them essential for handling sensitive biologics, vaccines, injectables, and diagnostic reagents.

In the U.S., where quality and regulatory compliance are non-negotiable standards, the demand for sterile, depyrogenated containers has significantly increased. The presence of a robust biopharmaceutical manufacturing base, a thriving research ecosystem, and aggressive investments in personalized medicine, vaccine production, and compounding pharmacy operations have fueled this demand.

These vials undergo specialized processes such as high-temperature dry heat treatment (generally above 250°C), terminal sterilization, and strict particulate control, ensuring endotoxin levels are within the permissible thresholds as defined by USP <85> and <797> guidelines. Key buyers include clinical labs, compounding labs, contract manufacturing organizations (CMOs), biotech companies, and government-supported healthcare facilities.

Driven by stringent FDA regulations and expanding clinical applications, the market is characterized by innovations in vial design, increasing use of automation in vial sterilization and packaging, and rising demand for ready-to-use (RTU) components that streamline aseptic processing.

Major Trends in the Market

-

Surge in demand for RTU sterile packaging in aseptic manufacturing

-

Adoption of modular depyrogenation tunnels to scale production efficiently

-

Increasing integration of robotics and cleanroom automation in vial filling lines

-

Use of Type I borosilicate glass for better chemical resistance and safety

-

Preference for smaller vial volumes (2 ml–10 ml) in personalized medicine and vaccines

-

Outsourcing of sterile packaging to contract development and manufacturing organizations (CDMOs)

-

Rising interest in depyrogenated vials for lyophilized drug applications

-

Regulatory emphasis on low-endotoxin formats for parenteral drug delivery

Report Scope of U.S. Depyrogenated Sterile Empty Vials Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.24 Billion |

| Market Size by 2033 |

USD 4.72 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.27% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; VWR International, LLC; Stevenato Group; SiO2 Medical Products, Inc.; DWK Life Sciences; Merck KGaA; Corning, Inc.; SCHOTT Corporation |

Market Driver: Growth of Injectable Biologics and Vaccines

A key driver of the U.S. depyrogenated sterile empty vials market is the rapid expansion of injectable biologics, monoclonal antibodies, and vaccines, all of which require the highest levels of sterility and safety. In recent years, the U.S. pharmaceutical sector has witnessed an increase in targeted therapies for autoimmune diseases, cancer, and infectious diseases, many of which are administered parenterally.

Biologics and personalized medications, such as gene therapies and mRNA vaccines, demand high-quality primary packaging that ensures zero contamination, as even minimal levels of pyrogens can compromise efficacy or safety. Depyrogenated vials are a gold standard in such scenarios, offering sterile, endotoxin-free storage solutions suitable for storage, freeze-drying (lyophilization), and final formulation.

Moreover, in the wake of the COVID-19 pandemic and future pandemic preparedness plans, the U.S. Biomedical Advanced Research and Development Authority (BARDA) and other federal programs have continued to fund advanced vaccine platforms, which rely heavily on RTU depyrogenated vials.

Market Restraint: High Production Costs and Stringent Compliance

One of the key restraints in this market is the high cost of production and validation involved in manufacturing depyrogenated vials. Producing sterile and pyrogen-free containers requires specialized facilities, automated dry-heat ovens, cleanroom environments, and endotoxin testing procedures that meet USP, FDA, and cGMP standards.

Companies must also invest in quality assurance teams, routine sterility and pyrogen testing, and third-party validation audits, all of which increase the per-unit cost. Additionally, the cost of borosilicate glass, the primary material used for most depyrogenated vials, has risen due to raw material shortages and global supply chain challenges.

This makes these vials less cost-effective for low-margin applications or for smaller labs that lack sufficient funding. Furthermore, the complexity of handling sterile products and the risk of contamination during manual operations require highly trained personnel and strict SOP adherence, limiting scalability for some users.

Market Opportunity: Demand from Compounding Pharmacies and Specialty Clinics

An emerging opportunity in the U.S. market lies in the rising number of compounding pharmacies and specialty clinics that require sterile, depyrogenated packaging for preparing customized IV medications, parenteral nutrition, ophthalmic solutions, and pain management injections.

Compounding pharmacies are under growing pressure from USP <797> revisions and FDA guidelines to demonstrate the integrity of their sterile preparations. The availability of pre-sterilized, depyrogenated vials reduces contamination risks, simplifies operations, and ensures compliance with regulatory audits.

Moreover, specialty clinics—particularly those in oncology, regenerative medicine, and fertility treatments—prefer RTU depyrogenated vials to maintain sterile chain-of-custody, reduce drug waste, and enhance patient safety. Companies that offer tailored volume options (2 ml to 20 ml), lot traceability, and compatible closures can capture this growing demand segment.

U.S. Depyrogenated Sterile Empty Vials Market By Product Insights

10 ml Vials Dominated the Segment

The 10 ml vial segment holds the dominant share in the U.S. market due to its widespread utility in injectable drug preparations, lyophilized compounds, and vaccine reconstitution. This volume strikes a balance between single-use and multi-dose applications, making it highly versatile for clinical and lab settings.

Pharmaceutical manufacturers and compounding pharmacies prefer 10 ml vials as they accommodate a range of active ingredients and solvents while ensuring minimal headspace and lower contamination risk. Additionally, 10 ml formats are commonly used in antibiotic suspensions, biologics, contrast agents, and sterile diluents, reinforcing their demand across medical disciplines.

2 ml and 5 ml Vials are the Fastest-growing Sub-segments

The 2 ml and 5 ml vial segments are growing rapidly, especially in areas like vaccines, ophthalmology, endocrinology (e.g., insulin, hormones), and diagnostics. Smaller volume vials reduce drug wastage, improve dosing precision, and are increasingly used for single-patient regimens, aligning with personalized medicine trends.

Biotech companies producing targeted biologics or gene therapies often work with very small batch sizes, making 2 ml and 5 ml formats ideal for preclinical and early-phase trials. Furthermore, smaller vial sizes are easier to automate in high-throughput filling lines and can be manufactured with tighter dimensional tolerances.

U.S. Depyrogenated Sterile Empty Vials Market By End-use Insights

Clinical Labs Dominate the End-use Segment

Clinical laboratories account for the largest market share due to their continuous need for sterile, depyrogenated vials in diagnostic reagent storage, sample collection, and pre-analytical processing. Labs associated with hospitals, research institutions, and private testing companies utilize thousands of vials daily under highly controlled conditions.

These labs often require bulk packaging options, strict lot certifications, and validated sterilization documentation to maintain accreditation and quality assurance. Additionally, government-funded labs working on infectious disease surveillance and pandemic response often use depyrogenated vials to avoid false positives in sensitive molecular assays.

Compounding Labs Are the Fastest-growing End-users

Compounding labs are emerging as the fastest-growing segment, especially in light of stricter USP <795> and <797> enforcement that governs the handling of sterile drugs. These labs, including 503A and 503B registered outsourcing facilities, are rapidly investing in high-quality sterile packaging to meet FDA inspections and avoid warning letters.

Depyrogenated vials enable these labs to offer customized, patient-specific sterile injectables with minimized contamination risk. Furthermore, with the increasing prevalence of drug shortages, compounding labs are often tasked with filling the supply gap, thus needing scalable, RTU vial inventories.

Country-Level Analysis

The United States dominates the depyrogenated sterile vials market in North America due to its extensive biopharmaceutical manufacturing base, high regulatory standards, and thriving clinical research environment. The U.S. is home to hundreds of GMP-compliant contract development and manufacturing organizations (CDMOs) and 503B outsourcing facilities, all of which rely on depyrogenated primary packaging components.

Demand is particularly high from the Midwest and East Coast regions, where large numbers of pharmaceutical hubs, vaccine manufacturers, and academic research centers are based. Regulatory agencies such as the FDA and USP have introduced and updated guidelines requiring depyrogenated materials for injectable drugs, further cementing this requirement as a compliance necessity.

Growth is also fueled by public health initiatives, such as the Strategic National Stockpile, which requires long-term storage of vaccines and biologics in validated, pyrogen-free containers. Companies supplying to the U.S. government must meet exacting sterilization and validation protocols, offering a stable revenue channel for manufacturers.

Some of the prominent players in the U.S. depyrogenated sterile empty vials market include:

- Thermo Fisher Scientific, Inc.

- VWR International, LLC

- Stevenato Group

- SiO2 Medical Products, Inc.

- DWK Life Sciences

- Merck KGaA

- Corning, Inc.

- SCHOTT Corporation

Recent Developments

-

March 2025 – Gerresheimer AG announced expansion of its sterile vial production facility in Peachtree City, Georgia, to meet U.S. demand for RTU packaging components.

-

February 2025 – Stevanato Group introduced a new line of depyrogenated nested vials compatible with robotic aseptic filling systems, targeting CDMOs and compounding labs.

-

January 2025 – DWK Life Sciences unveiled its next-gen low-endotoxin Type I borosilicate vials for use in biologics and freeze-dried drug applications.

-

December 2024 – West Pharmaceutical Services partnered with a U.S.-based biotech startup to co-develop smart vial stoppers integrated with real-time sterility sensors.

-

November 2024 – SGD Pharma launched a 5 ml RTU vial format in the U.S. with a Type I molded glass body and validated pyrogen removal protocols.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. depyrogenated sterile empty vials market

Product

- 2 ml

- 5 ml

- 10 ml

- 20 ml

- More than 20 ml

End-use

- Clinical Labs

- Compounding Labs

- Others