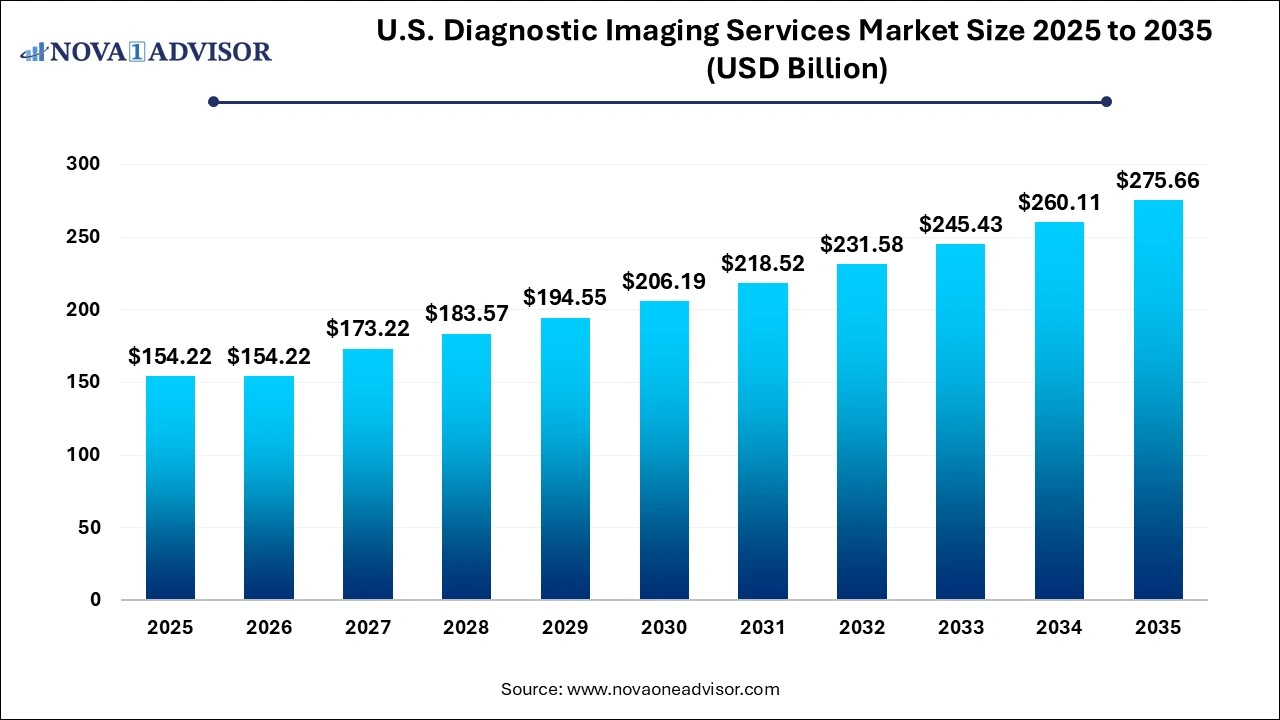

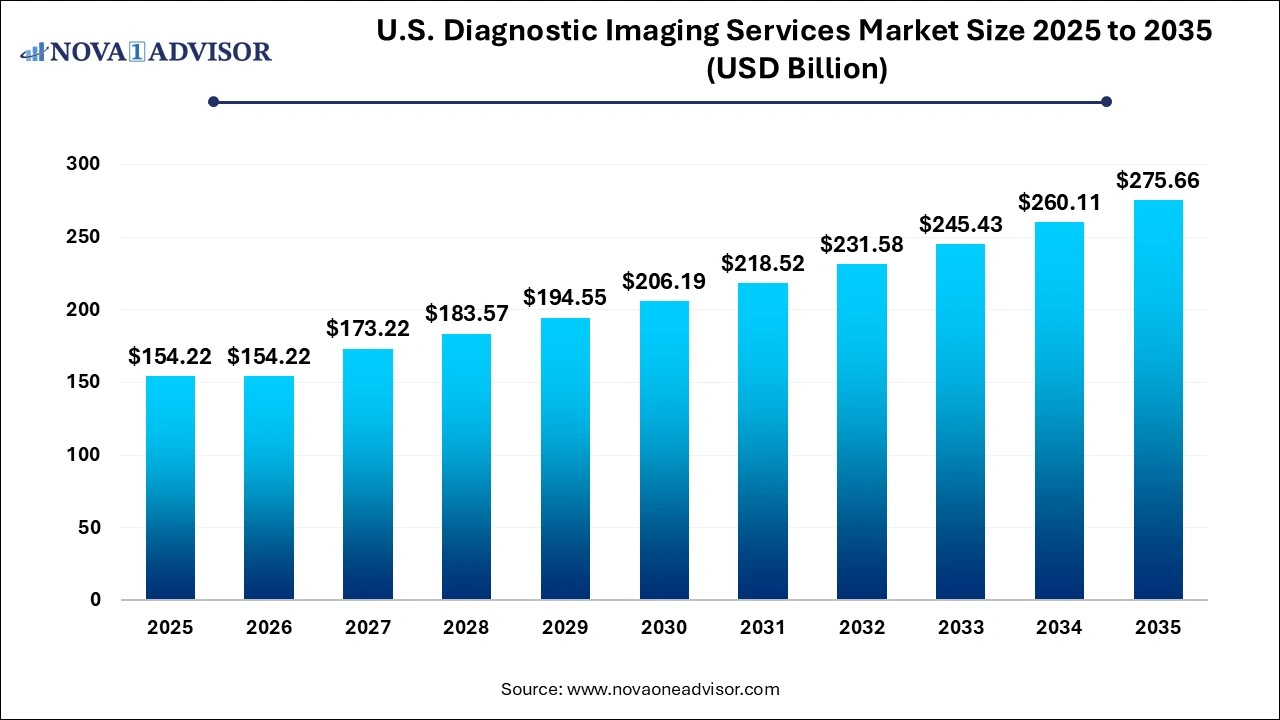

U.S. Diagnostic Imaging Services Market Size and Growth 2026 to 2035

The U.S. diagnostic imaging services market size was exhibited at USD 154.22 billion in 2025 and is projected to hit around USD 275.66 billion by 2035, growing at a CAGR of 5.98% during the forecast period 2026 to 2035.

Key Takeaways:

- The X-ray segment dominates in the U.S. Diagnostic Imaging Services market.

- The CT segment is expected to grow at the fastest CAGR in the U.S diagnostic imaging services market during the forecast period.

- The cardiology segment holds the major revenue share in the U.S. diagnostic imaging services market.

- The neurology segment is expected to hold the fastest-growing U.S. Diagnostic Imaging Services market in the coming years.

- The private health insurance segment dominates in the U.S. diagnostic imaging services market.

- The public health insurance segment grows the fastest in the U.S. diagnostic imaging services market.

- The hospitals segment holds the largest revenue share in the U.S. diagnostic imaging services market.

U.S. Diagnostic Imaging Services Market Outlook

- Market Growth Overview: The U.S. diagnostic imaging services market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of chronic disease, innovation of AI-powered systems and advanced modalities, and rising demand in outpatient settings.

- Sustainability Trends: Sustainability trends involve the focus on energy and waste reduction, reduced low-value imaging, and adoption of green radiology.

- Major Investors: Major investors in the market include RadNet, Akumin, RAYUS Radiology, GE Healthcare, Siemens Healthineers, Philips, and Canon.

Artificial Intelligence: The Next Growth Catalyst in U.S. Diagnostic Imaging Services

AI is profoundly transforming the U.S. diagnostic imaging services industry by increasing efficiency and enhancing diagnostic accuracy, with AI-enabled tools now considered standard in many, if not most, major imaging departments. AI algorithms, particularly deep learning models, act as "second readers" to detect subtle abnormalities and prioritize critical cases, such as strokes or hemorrhages, significantly reducing report turnaround times.

Report Scope of U.S. Diagnostic Imaging Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 154.22 Billion |

| Market Size by 2035 |

USD 275.66 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.98% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Procedure, By Application. By Payor. By Setting |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

RadNet, Inc., Akumin, Inc., Rayus Radiology, MedQuest, LucidHealth, Inc. |

U.S. Diagnostic Imaging Services Market Segmental Insights

By Procedure Insights

How did the X-ray segment dominate in the U.S. Diagnostic Imaging Services market?

The X-ray segment growth is driven by the integration of AI and portable digital units, which have revolutionized the field by improving image quality and reducing radiation exposure. These versatile advancements ensure X-ray remains a cornerstone of orthopedic and pulmonary care, effectively meeting the rising global demand for efficient, high-volume diagnostic services.

The CT scan segment is driven by the shifts toward cost-effective outpatient care, and diagnostic centers are making these advanced tools more accessible. Ultimately, CT's critical role in oncology staging and 3D visualization ensures its position as the fastest-growing imaging modality in the current medical landscape.

By Application Insights

How did the cardiology segment hold the major revenue share in the U.S. Diagnostic Imaging Services market?

The cardiology segment maintains its market dominance due to the heavy epidemiological burden of heart disease, which necessitates constant, high-volume diagnostic monitoring. The rapid shift toward non-invasive imaging techniques, such as cardiac MRI and echocardiography, has significantly increased the demand for advanced visualization over traditional invasive methods.

The neurology segment is the fastest-growing imaging application, driven by the surging prevalence of Alzheimer's and Parkinson’s, which necessitate frequent, non-invasive screenings. Technological leaps, such as the integration of AI for detecting subtle hemorrhages and the use of ultra-high-field MRI like the SIGNA MAGNUS, are providing unprecedented diagnostic precision.

By Payor Insights

How did the private health insurance segment dominate in the U.S. diagnostic imaging services market?

The private health insurance segment is fueled by an aging workforce requiring frequent screenings for chronic conditions. These private plans facilitate faster access to sophisticated modalities like CT and MRI, avoiding the potential bureaucratic delays often associated with public systems.

The public health insurance is the fastest-growing payor segment as Medicare and Medicaid enrollment surges due to an aging U.S. population and expanded coverage mandates. Strategic shifts by the Centers for Medicare & Medicaid Services (CMS) to equalize reimbursements are driving massive patient volumes toward cost-effective outpatient centers and rural clinics.

By Setting Insights

How did the hospitals segment hold the largest revenue share in the U.S. diagnostic imaging services market?

The hospitals dominate the diagnostic imaging market due to their capacity for high patient volumes and delivery of comprehensive, integrated care, from primary diagnostics to complex therapies. Their superior infrastructure allows them to adopt and upgrade advanced imaging technologies like CT and MRI, positioning them as trusted providers for critical diagnostic needs.

The diagnostic imaging centers segment is driven by the advancements in AI and hybrid modalities like PET/MRI, which are drastically improving accuracy for aging populations. Ultimately, the surging demand for orthopedic and musculoskeletal imaging, driven by sports injuries and arthritis, solidifies independent centers as the primary engine for market growth.

U.S. Diagnostic Imaging Services Market Companies

- RadNet, Inc.: RadNet is the largest operator of freestanding, fixed-site diagnostic imaging centers in the U.S., performing over 10 million imaging procedures annually across a network of more than 400 centers.

- Akumin, Inc.: Akumin serves as a key national provider of outpatient diagnostic imaging and radiation oncology services, operating hundreds of locations and boasting the largest mobile imaging fleet in the U.S.

- Rayus Radiology: RAYUS Radiology acts as a national leader in subspecialty care, with over 130 centers and a strong emphasis on providing high-quality, 3T MRI, PET/CT, and interventional radiology services.

- MedQuest: MedQuest Associates is a prominent operator and manager of outpatient imaging facilities, leveraging partnerships with health systems to provide comprehensive diagnostic solutions such as MRI, CT scans, and mammography.

- LucidHealth, Inc.: LucidHealth is a major, tech-enabled radiology company that partners with community-based radiology practices to enhance their operational, clinical, and administrative capabilities.