U.S. DNA Manufacturing Market Size and Research 2026 to 2035

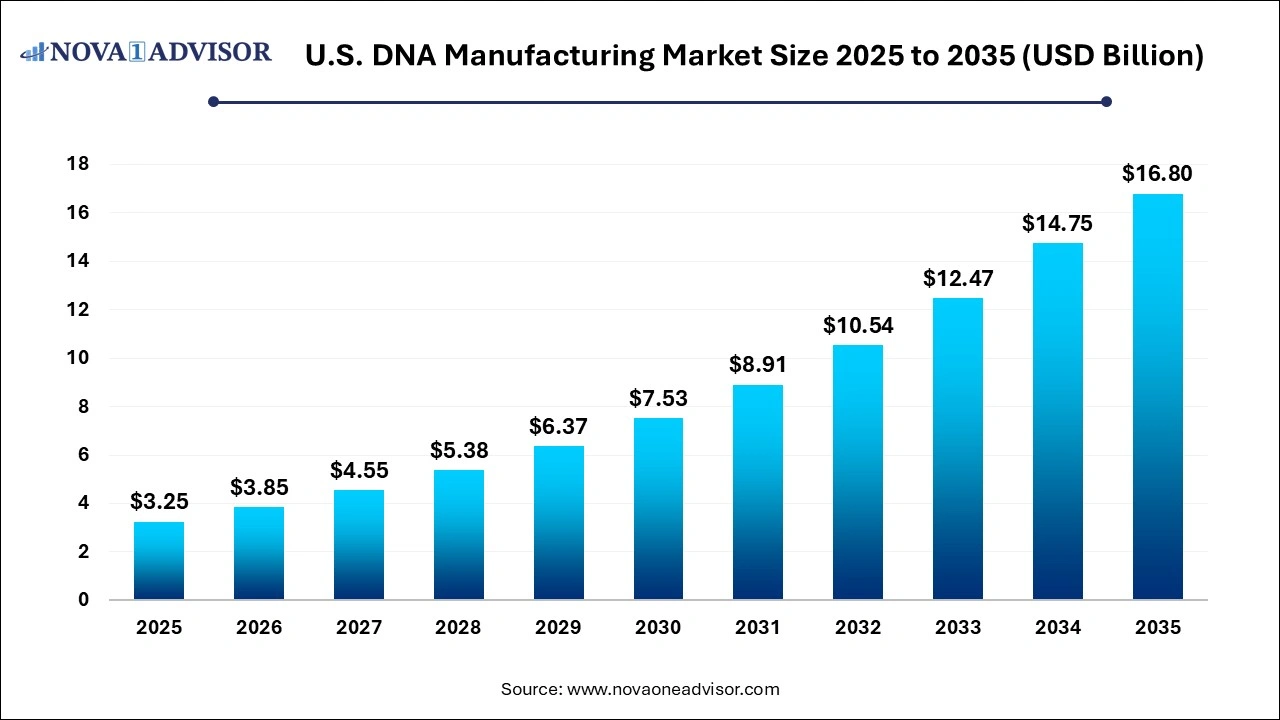

The U.S. DNA manufacturing market size is calculated at USD 3.25 billion in 2025, grows to USD 3.85 billion in 2026, and is projected to reach around USD 16.80 billion by 2035, growing at a CAGR of 17.85% from 2026 to 2035. The U.S. DNA manufacturing market growth can be linked to rising demand for personalized manufacturing, increased emphasis on cell and gene therapies, and surging investments in infection prevention and control (IPC) measures.

U.S. DNA Manufacturing Market Key Takeaways

- By type, the synthetic DNA segment dominated the market with the largest share in 2025.

- By type, the plasmid DNA segment is expected to show the fastest growth over the forecast period.

- By grade, the GMP grade segment held the largest market share in 2025.

- By grade, the R&D grade segment is expected to register fastest growth during the forecast period.

- By application, the cell and gene therapy segment captured the largest market share in 2025.

- By application, the oligonucleotide-based drugs segment is expected to show the fastest growth during the forecast period.

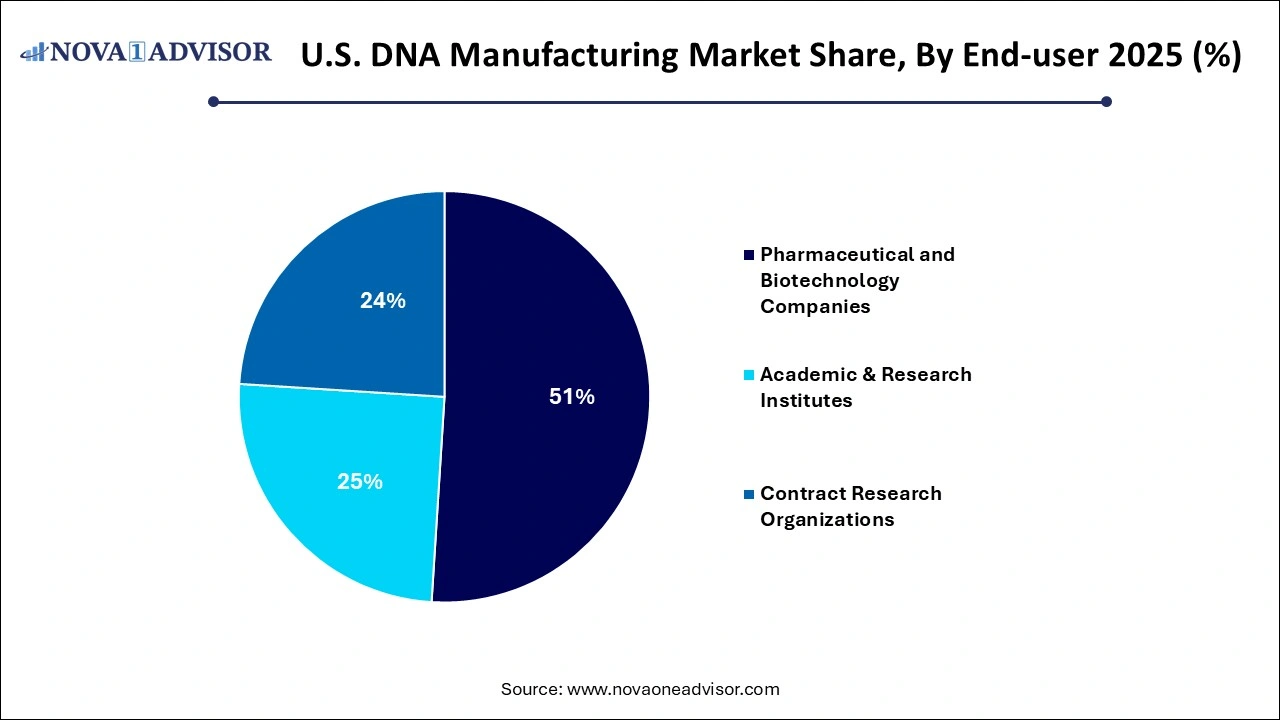

- By end-use, the pharmaceutical and biotechnology segment generated the highest market revenue in 2025.

- By end-use, the Contract Research Organizations (CROs) segment is expected register the fastest CAGR over the forecast period.

How is the U.S. DNA Manufacturing Market Expanding?

DNA manufacturing refers to methods used for synthesis of DNA molecules such as plasmid DNA for biotechnology and research purposes. Manufacturing of DNA is either naturally within living organisms through DNA replication or artificially in laboratories by using recombinant DNA technology. Increased emphasis on controlling infectious disease and development of vaccines, continuous advancements in personalized medicine and synthetic biology, regulatory support and large presence of major companies is fuelling the expansion of the U.S. DNA manufacturing market. Enhanced scalability, accuracy and speed with the deployment of automated and high-throughput technologies in DNA manufacturing, is enabling efficient production of complex DNA sequences.

What Are the Key Trends in the U.S. DNA Manufacturing Market in 2025?

- In May 2025, Thermo Fisher Scientific launched its automated plasmid DNA purification kit, the Applied Biosystems MagMAX Pro HT NoSpin Plasmid MiniPrep Kit.

- In April 2025, ProBio, an internationally recognized CDMO, rolled out a GMP Plasmid DNA manufacturing service at its cutting-edge Hopewell facility in New Jersey. The new service offers guaranteed delivery of ≥ 85% supercoiled, clinical-grade DNA production at fixed-cost from cell bank to batch release in just three months, further accelerating the development of cell and gene therapies.

Integrating artificial intelligence (AI) in DNA manufacturing market in U.S. is enhancing workflows by facilitating the designing and optimization of DNA sequences for multitude of applications. AI algorithms can be applied for analyzing large datasets of gene sequences for predicting gene expressions, further enabling development of stable and efficient genes for researchers engaged in drug development and protein production. Efficiency of genome editing techniques such as CRISPR-Cas9 can be enhanced by using AI for designing guide RNAs specific to their gene targets. AI-powered tools can develop tailored synthetic DNA sequences, leading to optimized DNA synthesis workflows with improved efficiency and at reduced costs. Increased adoption of AI technologies and machine learning methodologies by various DNA manufacturers for gaining precise control over DNA synthesis and gene expression will transform multiple sectors such as agriculture, biotechnology and medicine.

Report Scope of U.S. DNA Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.85 Billion |

| Market Size by 2035 |

USD 16.80 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.85% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, Grade, Application, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

AGC Biologics, Catalent, Charles River Laboratories, Danaher (Aldevron), Eurofins Genomics, GenScript,Lonza, Thermo Fisher Scientific Inc. , Twist Bioscience, VGXI, Inc. |

Market Dynamics

Drivers

Increasing Demand for High Quality DNA

Rising investments in research and development activities, conduction of clinical trials by pharmaceutical and biotechnology companies for various applications such as in cell and gene therapies nucleic-acid based vaccines, synthetic biology and personalized medicine are driving the demand for high quality DNA manufacturing facilities in the U.S.

Restraints

Complex Manufacturing Processes and Stringent Regulations

Manufacturing of high-quality and GMP-grade plasmid DNA used various applications such as gene therapies and vaccines is an intricate process and involves complex processes like fermentation of cell, DNA purification and quality control. High costs associated with raw materials, sophisticated bioprocessing facilities as well as scaling up of DNA manufacturing from research-grade to clinical and commercial amount can potentially restrict the market growth.

Moreover, stringent regulations such as implementation of Good Manufacturing Practice (GMP) Standards, extensive testing and validation processes imposed by the U.S. Food and Drug Administration (FDA) for ensuring the safety, efficacy and quality of DNA-based products can significantly impact the time to market reach for DNA therapies, further limiting their access and availability to patients.

Opportunities

Advancements in Manufacturing Technology

Development of Enzymatic DNA Synthesis for assembling DNA strands, incorporation of automated technologies and robotics, shift to continuous bioprocessing, use of microfluidic devices and integration of miniaturized systems are enhancing the efficacy, scalability and cost-effectiveness of complex DNA manufacturing processes.

U.S. DNA Manufacturing Market Segmental Insights

What Drives Dominance of the Synthetic DNA Segment in the Market in 2025?

By type, the synthetic DNA segment generated the highest revenue share in the market in 2025. Synthetic DNA molecules are widely used in synthetic biology and next-generation gene editing workflows for making precise genomic modifications through advanced gene-editing tools such as CRISPR-Cas9, TALENs (Transcriptor Activator-Like Effector Nucleases) and Zinc Finger Nucleases. Continuous research on novel vaccine platforms is leveraging synthetic DNA for rapid design and production of mRNA vaccine templates and direct manufacturing of DNA vaccines. Advancements in DNA synthesis technologies such as deployment of automated high-throughput platforms, cell-free DNA manufacturing and enzymatic DNA synthesis (EDS) are expanding synthetic DNA production capabilities, leading to increased access to these technologies for researchers and biotechnology organizations.

- For instance, in January 2025, Aldevron, a globally leading producer of DNA, RNA and protein, made a revolutionary advancement in synthetic DNA manufacturing with the launch of its latest breakthrough, Alchemy cell-free DNA technology. The technology is designed for providing a cell-free, enzymatic process for generation of linear DNA (linDNA) templates required for in vitro transcription (IVT) synthesis of mRNA molecules.

By type, the plasmid DNA segment is expected to register the fastest growth during the forecast period. Multiple applications such as for viral vector production like Adeno-Associated Viruses (AAVs) and lentiviruses, CAR-T cell therapies, non-viral gene delivery and DNA-based vaccines are driving the demand for high quality plasmid DNA. Rise in number of clinical trials, stringent regularity requirements and improvements in manufacturing technologies are creating opportunities for market growth of this segment.

How GMP Grade Segment Dominated the Market in 2025?

By grade, the GMP-grade segment dominated the market with the biggest share in 2025. Good Manufacturing Practice (GMP) grade DNA manufacturing is crucial for ensuring the safety, efficacy, purity and quality of DNA-based products intended for human use as well as for maintaining adherence to stringent GMP guidelines enforced by the Food and Drug Administration (FDA). Rising demand for GMP-grade plasmid DNA, rise in number of cell and gene therapies advancing from preclinical development to late stage clinical trials, accelerated regulatory approvals and increased focus of manufacturers on expanding product portfolios are driving the market dominance of this segment. Furthermore, increased outsourcing activities by pharmaceutical and biotechnology companies to Contract Development and Manufacturing Organizations (CDMOs) for ensuring GMP compliance is fuelling the market expansion.

By grade, the R&D-grade segment is anticipated to show fastest growth over the forecast period. Large number of academic institutes and research organizations in the U.S., devoted to basic and translational research in biochemistry, cell biology, genomics and molecular biology for development of advanced diagnostics and therapies are creating a huge demand for R&D-grade DNA. Researchers are widely using this DNA in gene-editing techniques such as gene knockout studies and gene insertion as well as for designing and building new biological systems like novel genetic circuits, pathways and for engineering organisms. Rising investments by venture capitalists, pharmaceutical organizations and government agencies for advancing research into gene therapies and synthetic biology are driving the market growth of this segment.

Why Did the Cell and Gene Therapy Segment Dominate in 2025?

By application, the cell and gene therapy segment accounted for the largest market share in 2025. Cell and gene therapies (CGTs) are widely being applied for targeting various conditions such as autoimmune disorders, cancer, infectious diseases and rare genetic diseases. DNA molecules are critical in CGT manufacturing for viral vector production, in CRISPR-based therapies and engineering of cell therapies like CAR-T. Furthermore, rising focus on personalized medicine approaches, significant funding and investments for R&D and clinical development, expansion of DNA manufacturing services by CDMOs and CMOs, and accelerated regulatory pathways are boosting the market growth of this segment.

By application, the oligonucleotide-based drugs segment is expected to expand rapidly during the predicted timeframe. Oligonucleotide drugs which are short synthetic strands of DNA and RNA are transforming therapeutic modalities with its ability to target diseases at the genetic level. Antisense oligonucleotides drugs such as Inotersen (Tegsedi) for nerve damage caused by hereditary transthyretin amyloidosis (hATTR) and Nusinersen (Spinraza) for treatment of spinal muscular atrophy (SMA) are well-known due to their established clinical efficiency. Broad spectrum applications of oligonucleotide drugs for various diseases such as neurological conditions, rare genetic disorders, oncology and more as well as efficiency for addressing undruggable targets are driving their adoption for expanding clinical pipelines.

What Made Pharmaceutical and Biotechnology Companies the Dominant Segment in 2025?

By end-use, the pharmaceutical and biotechnology companies segment held the largest market share in 2025. Pharmaceutical and biotechnology companies are applying various strategies such as gaining better comprehension of competitive landscape, studying patient demographics, addressing unmet medical needs, continuously monitoring market trends and defining their product’s unique selling proposition (USP) in comparison to competitor offerings. Increasing investments in gene therapy and vaccine development, focus on biologics production such as monoclonal antibodies, rise in strategic collaborations and acquisition activities, optimization of supply chain networks and stringent regulatory guidelines are driving the market growth of this segment.

By end-use, the Contract Research Organizations (CROs) segment is anticipated to witness the fastest growth over the forecast period. Rise in outsourcing DNA manufacturing processes by research organizations and pharmaceutical companies, further allowing them to focus in core competencies such as research and marketing are driving the market growth. Additionally, numerous benefits through outsourcing manufacturing to CROs such as reduced capital expenditure, optimization of resources, streamlined workflows, accelerated turnaround times, reduced risks, regulatory navigation and supply chain stability are boosting the segment’s market growth.

Country-Level Analysis

The DNA manufacturing industry in the U.S. is experiencing robust growth, due to factors such as significant investments in R&D activities, strong biotechnology ecosystem and presence of major market players. Continuously evolving and stringent regulations set by the U.S. FDA for DNA manufacturing processes and rising approvals of innovative products are bolstering the market growth. High demand for GMP-grade plasmid DNA, custom plasmid development services, and increased outsourcing to CDMOs, especially by emerging biopharma start-ups are contributing to the market growth.

Some of the Prominent Players in the U.S. DNA Manufacturing Market

- AGC Biologics

- Catalent

- Charles River Laboratories

- Danaher (Aldevron)

- Eurofins Genomics

- GenScript

- Lonza

- Thermo Fisher Scientific Inc.

- Twist Bioscience

- VGXI, Inc.

Recent Developments

- In March 2025, Elegen, a leading manufacturer of next-generation cell-free DNA, declared a 25% cost reduction for its both linear and plasmid ENFINIA DNA products applied for standard and complex sequence designs, further making them more accessible for biotech innovators and researchers.

- In January 2025, CD Bioparticles launched an extensive line of Silica Spin Columns which are specifically designed for systematic and reliable isolation of DNA & RNA. These columns provide researchers with high quality DNA and RNA which includes cfDNA, genomic DNA, plasmid DNA and pathogenetic DNA & RNA by leveraging advanced silica membrane technology.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. DNA Manufacturing Market.

By Type

- Plasmid DNA

- Synthetic DNA

-

- Gene Synthesis

- Oligonucleotide Synthesis

By Grade

By Application

- Cell & Gene Therapy

- Vaccines

- Oligonucleotide-based Drugs

- Others

By End-use

- Pharmaceutical and Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations