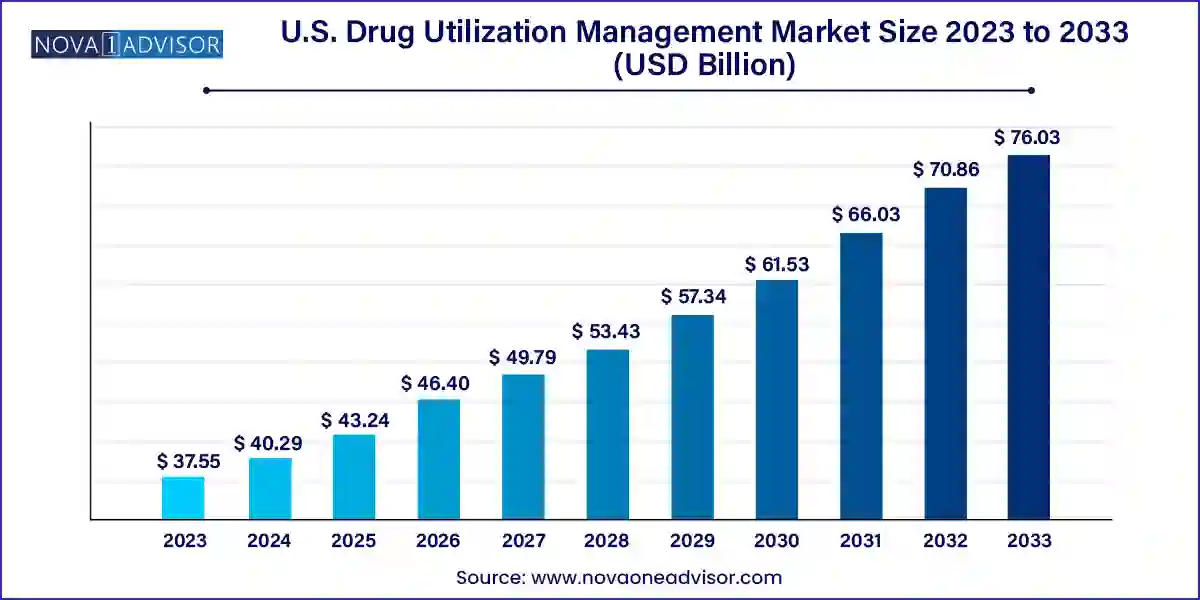

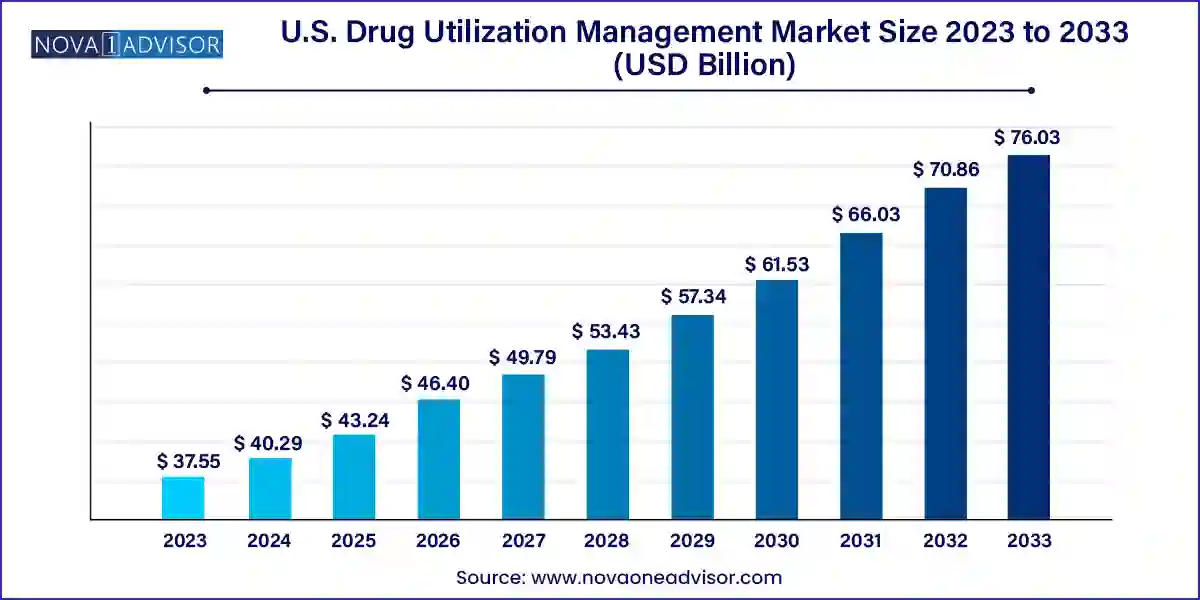

U.S. Drug Utilization Management Market Size and Growth

The U.S. drug utilization management market size was exhibited at USD 37.55 billion in 2023 and is projected to hit around USD 76.03 billion by 2033, growing at a CAGR of 7.31% during the forecast period 2024 to 2033.

Key Takeaways:

- Based on program type, the in-house segment dominated the market with the largest revenue share of 65.15% in 2023.

- However, the outsourced segment is expected to witness the fastest growth over the forecast period.

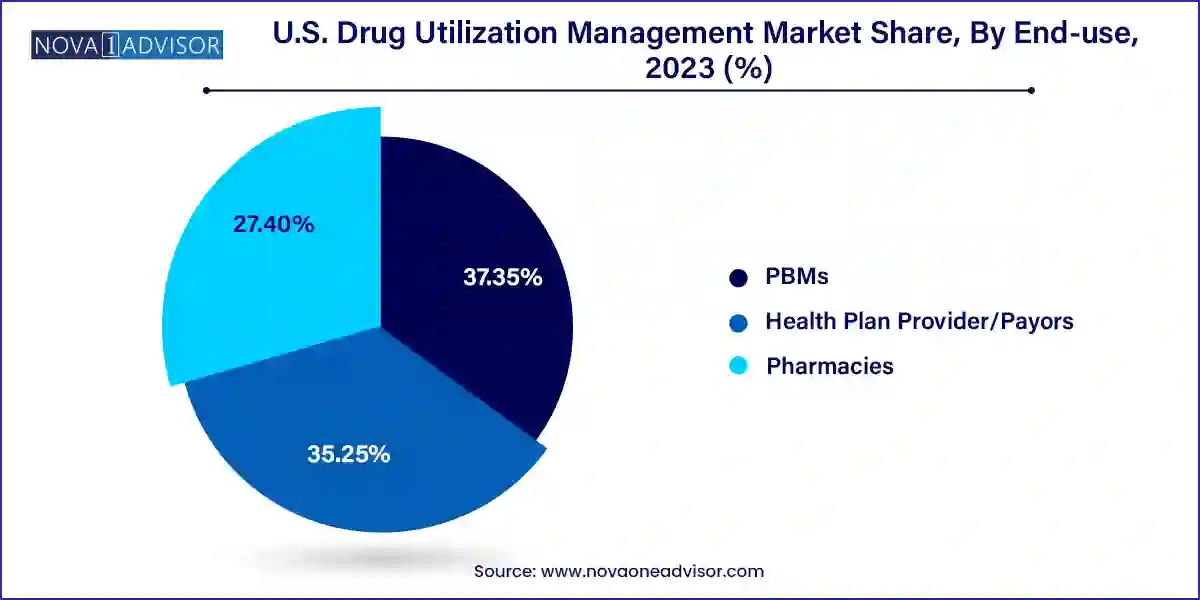

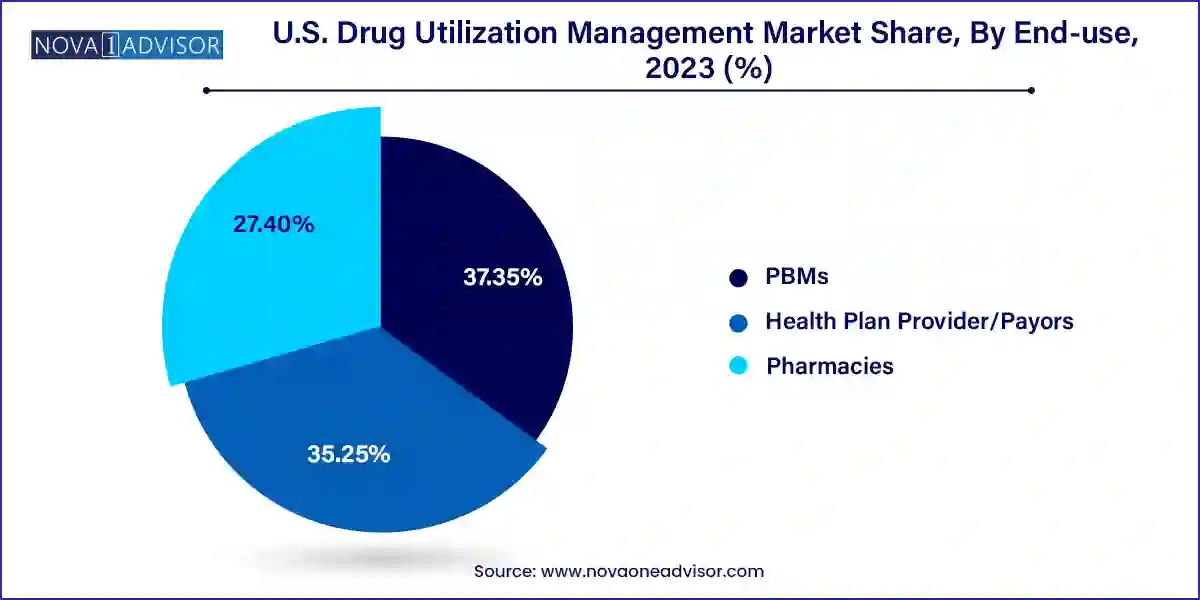

- Based on end-use, the PBMs segment dominated the market in 2023 with a share of 37.35% and is expected to have the fastest growth rate during the forecast period.

- The health plan provider/payors segment is expected to witness substantial growth over the forecast period.

Market Overview

The U.S. Drug Utilization Management (DUM) market is an integral pillar in the country's healthcare cost containment and quality assurance strategies. It encompasses the processes, tools, and systems used by payers, pharmacy benefit managers (PBMs), and healthcare providers to ensure prescribed medications are used appropriately, safely, and cost-effectively. Drug Utilization Management programs scrutinize prescriptions based on clinical necessity, cost-efficiency, and therapeutic value before approval, acting as a checkpoint against excessive, redundant, or inappropriate drug use.

The system plays a crucial role in managing spiraling drug expenditures in the U.S., especially with the rapid increase in specialty drugs, high-cost biologics, and personalized treatments. With prescription drug spending reaching over $400 billion in recent years, healthcare stakeholders are under pressure to optimize therapy decisions without compromising patient outcomes. DUM programs such as prior authorization, step therapy, and quantity limits are therefore widely adopted across health insurance plans, Medicare Part D sponsors, and managed care organizations.

Moreover, as the healthcare landscape becomes more data-driven, there’s a growing emphasis on integrating artificial intelligence and real-time analytics into utilization management workflows. These innovations are making it possible to process high volumes of drug requests efficiently, ensure evidence-based decisions, and reduce manual burden on clinicians and administrative staff. While the benefits of these systems are widely acknowledged, debates around patient access delays and administrative burden continue to challenge the ecosystem. Nevertheless, the U.S. market continues to lead globally in terms of DUM program sophistication, policy maturity, and vendor innovation.

Major Trends in the Market

-

Growing integration of AI and machine learning: Predictive algorithms are being employed to automate prior authorizations and assess appropriateness of prescriptions faster.

-

Rise of outsourced drug utilization management services: Payers and health plans are increasingly outsourcing DUM functions to third-party vendors to improve cost-efficiency and scalability.

-

Increased regulatory scrutiny: Federal and state-level agencies are stepping up oversight of DUM practices to ensure they do not obstruct timely access to medically necessary drugs.

-

Expansion of real-time benefit tools (RTBTs): These digital platforms allow prescribers to view formulary status, cost-sharing information, and alternative medications at the point of care, improving patient adherence and satisfaction.

-

Greater use of step therapy protocols: Designed to encourage the use of less costly therapies before stepping up to expensive drugs, this practice is growing in complexity and application.

-

PBMs consolidating control over utilization management: Leading PBMs are merging or partnering with insurers and healthcare systems to streamline DUM and pharmacy benefit operations.

-

Digital transformation in pharmacies: Retail and specialty pharmacies are increasingly embedding DUM tools into electronic prescribing and medication dispensing workflows to ensure compliance.

Report Scope of U.S. Drug Utilization Management Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 40.29 Billion |

| Market Size by 2033 |

USD 76.03 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.31% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Program Type, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Prime Therapeutics LLC; MedicusRx; EmblemHealth; Optum, Inc.; Point32Health, Inc.; AssureCare LLC; MindRx Group; Agadia Systems, Inc; Elevance Health (CarelonRx); ExlService Holdings, Inc.; MRIoA; S&C Technologies, Inc.; Ultimate Health Plans; Security Health Plan of Wisconsin, Inc.; Blue Cross and Blue Shield Association; Providence; Simply Healthcare Plans, Inc; Health Plan of San Mateo (HPSM); PerformRx; Aetna, Inc. (CVS Health Corp.) |

Key Market Driver: Rising Prescription Drug Costs

The most potent driver fueling the growth of the U.S. drug utilization management market is the dramatic and sustained rise in prescription drug prices, especially for specialty drugs and biologics. According to data from the American Medical Association, drug prices in the U.S. have been increasing at a rate of approximately 5-10% annually over the past decade, significantly outpacing inflation. Specialty drugs, which now represent over 50% of total drug spend despite accounting for less than 2% of prescriptions, are a primary cost concern for payers.

DUM programs serve as a defensive mechanism for both public and private insurers to limit unnecessary spending. Tools such as prior authorization and step therapy are designed to direct patients toward cost-effective alternatives without sacrificing clinical effectiveness. For example, a payer may require a patient to try a generic statin before approving a high-cost branded cholesterol-lowering medication. These programs allow insurers to scrutinize prescribing patterns and only approve costly therapies when clinically justified. Consequently, utilization management has become a non-negotiable part of formulary design and reimbursement strategies across the healthcare spectrum.

Key Market Restraint: Administrative Burden and Patient Delays

One of the major restraints hampering the broader acceptance of drug utilization management programs is the administrative complexity they impose on healthcare providers and the potential delays they create for patients. Physicians frequently report that utilization management requirements especially prior authorizations consume valuable clinical time and delay access to essential medications. A study by the American Medical Association in 2023 found that over 90% of physicians experienced treatment delays due to prior authorization, with nearly one-third reporting that these delays led to adverse clinical outcomes.

Moreover, the time-consuming nature of these processes can increase clinician burnout and diminish the quality of patient-provider interactions. Manual documentation, long wait times for payer approvals, and lack of interoperability among health IT systems exacerbate the problem. From the patient’s perspective, delays in getting medications can lead to decreased adherence, worsened health outcomes, or unnecessary emergency room visits. These limitations have sparked legislative and advocacy efforts aimed at simplifying DUM processes, increasing transparency, and incorporating clinical best practices.

The intersection of artificial intelligence (AI) and drug utilization management presents a significant growth opportunity in the U.S. market. AI technologies, particularly natural language processing (NLP) and machine learning (ML), have shown great potential in streamlining and optimizing DUM processes. For example, AI tools can be trained to evaluate clinical documentation, detect incomplete authorizations, identify patient-specific drug risks, and recommend alternative therapies with greater speed and accuracy than manual reviews.

Several tech-driven startups and established vendors have already begun launching AI-based platforms that integrate directly with electronic health records (EHRs) and pharmacy benefit management systems. These platforms can reduce administrative burden on healthcare providers, minimize errors, and significantly accelerate decision-making processes. Companies that invest in developing scalable, intelligent DUM tools tailored to provider workflows and payer requirements are likely to gain a competitive edge. As AI continues to prove its utility in real-world deployments, it could drastically reshape how utilization management is executed in the coming years.

U.S. Drug Utilization Management Market By Program Type Insights

Outsourced utilization management services dominate the U.S. market, accounting for the majority share due to their operational scalability, lower costs, and broad expertise across drug classes. Many payers, including small to mid-sized health plans, lack the in-house infrastructure or clinical review personnel to efficiently manage complex utilization programs. By outsourcing to third-party administrators or specialty benefit managers, they gain access to ready-made clinical protocols, automated systems, and compliance mechanisms. Additionally, large PBMs like OptumRx and CVS Caremark offer outsourced utilization management as part of broader service portfolios, allowing for integrated benefits and cost savings.

In contrast, in-house DUM programs are witnessing faster growth, particularly among large integrated healthcare delivery systems and health insurers that want tighter control over clinical decisions and cost-containment strategies. These organizations are investing in dedicated utilization management departments equipped with advanced analytics, clinical decision support tools, and AI-enabled review systems. The ability to customize protocols, respond faster to emerging therapies, and align closely with internal quality standards makes in-house programs appealing. Furthermore, organizations with in-house teams can more easily trial novel models like real-time utilization feedback or predictive drug adherence interventions, thereby accelerating innovation.

U.S. Drug Utilization Management Market By End-use Insights

Pharmacy Benefit Managers (PBMs) held the largest share of the U.S. drug utilization management market, owing to their central role in administering drug benefits, negotiating rebates, and designing formulary access rules. PBMs operate at the intersection of payers, manufacturers, and pharmacies, allowing them to enforce utilization management across multiple points of care. Major PBMs such as Express Scripts, OptumRx, and CVS Caremark have expansive networks and data assets, enabling them to execute complex step therapy protocols, clinical edits, and prior authorization reviews at scale. Their ability to consolidate drug spending data and apply evidence-based restrictions helps minimize wasteful prescribing.

However, health plan providers and payors represent the fastest-growing segment, driven by an increasing desire to regain control over pharmacy benefits and reduce over-reliance on third-party PBMs. Many insurers are now building in-house DUM capabilities or selectively partnering with vendors to customize their utilization protocols. These organizations are also integrating utilization management into broader population health strategies, using patient risk profiles and social determinants of health to shape prescribing rules. With greater access to patient-level data through EHRs and health information exchanges (HIEs), payors are now better positioned than ever to fine-tune their DUM models in a personalized and proactive manner.

Country-Level Analysis

The United States remains at the forefront of global drug utilization management due to its unique pharmaceutical pricing structure, complex insurance ecosystem, and high prescription drug consumption. The country’s healthcare model, which includes a mix of public and private payers, has led to a multi-tiered approach to utilization management—each tailored to the needs of commercial insurers, Medicare Advantage plans, and Medicaid managed care organizations. Unlike many countries with centralized drug approval and reimbursement systems, the U.S. landscape allows health plans and PBMs significant autonomy in implementing DUM strategies.

Urban centers such as New York, Chicago, and Los Angeles are home to some of the most advanced DUM implementations, supported by high-volume health systems and payer hubs. Meanwhile, legislative activity at the state level—such as step therapy reform laws—continues to shape local utilization practices. Medicare Advantage plans, which now cover over 30 million seniors, rely heavily on utilization management to control the costs of expensive chronic disease therapies. Furthermore, the federal government’s increasing involvement—e.g., Centers for Medicare and Medicaid Services (CMS) policies mandating electronic prior authorizations—underscores the pivotal role of DUM in shaping future drug coverage pathways.

U.S. Drug Utilization Management Market By Recent Developments

-

March 2025 – OptumRx announced the expansion of its AI-powered real-time benefit tool for utilization management, allowing prescribers to receive immediate feedback on formulary compliance and prior authorization requirements at the point of care.

-

January 2025 – CVS Health unveiled an integration of its pharmacy DUM tools with leading EHR platforms like Epic and Cerner to automate approval workflows for specialty medications.

-

November 2024 – Cigna’s Evernorth launched a partnership with Amazon Web Services (AWS) to develop cloud-native DUM analytics solutions aimed at reducing time-to-decision and enhancing transparency.

-

October 2024 – Magellan Rx Management introduced a new step therapy decision support tool powered by NLP, designed to help clinicians understand therapy alternatives and patient eligibility in real time.

-

August 2024 – Express Scripts published the results of a pilot program using AI to automate high-volume prior authorization requests, reporting a 40% reduction in turnaround time and a 20% increase in approval accuracy.

Some of the prominent players in the U.S. drug utilization management market include:

- Prime Therapeutics LLC

- MedicusRx

- EmblemHealth

- Optum, Inc.

- Point32Health, Inc.

- AssureCare LLC

- MindRx Group

- Agadia Systems, Inc

- Elevance Health (CarelonRx)

- ExlService Holdings, Inc.

- MRIoA

- S&C Technologies, Inc.

In-House Providers:

- Ultimate Health Plans

- Security Health Plan of Wisconsin, Inc.

- Blue Cross and Blue Shield Association

- Providence

- Simply Healthcare Plans, Inc

- Health Plan of San Mateo (HPSM)

- PerformRx

- Aetna, Inc. (CVS Health Corp.)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. drug utilization management market

Program Type

End-use

- PBMs

- Health Plan Provider/Payors

- Pharmacies