The U.S. ECG equipment market size was estimated at USD 2.23 billion in 2023 and is expected to surpass around USD 4.22 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 6.6% during the forecast period 2024 to 2033.

.jpg)

Key Takeaways:

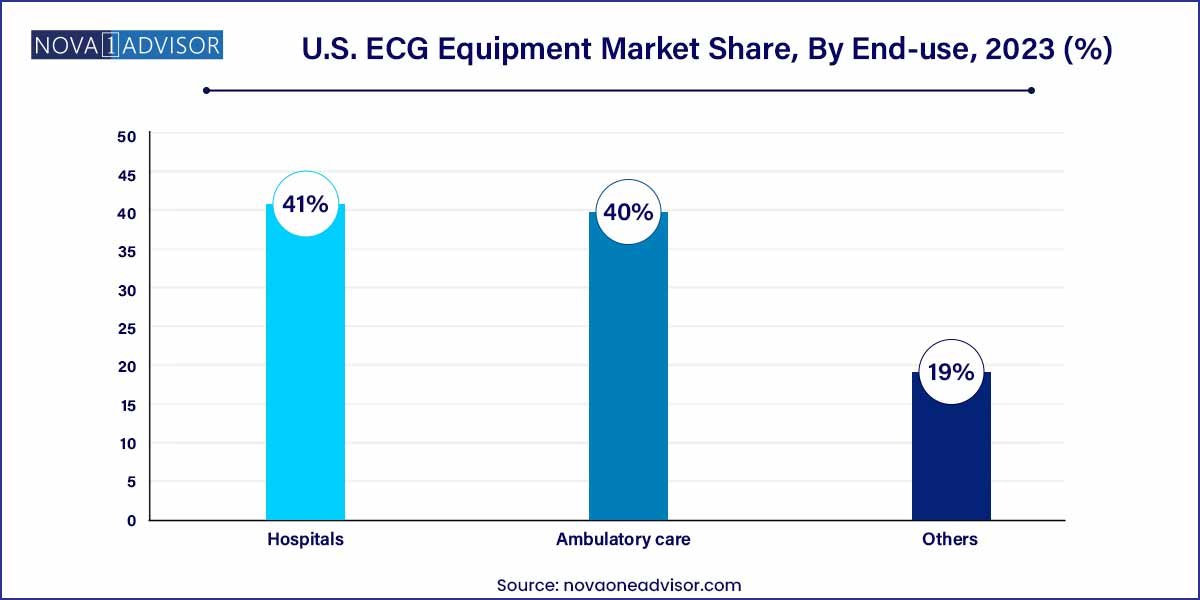

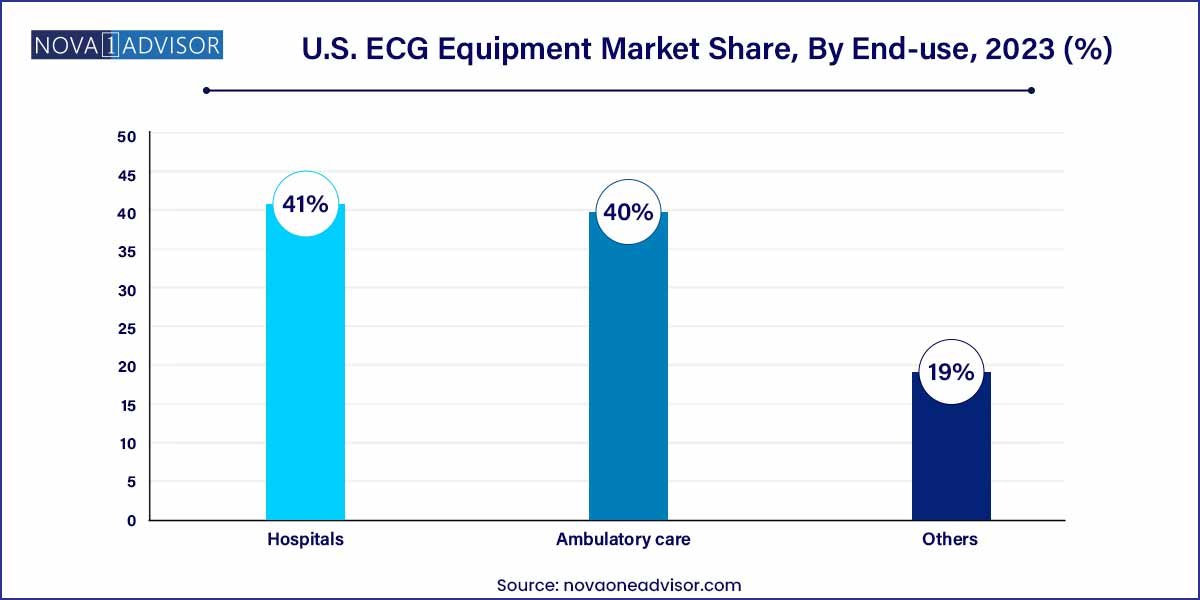

- Hospitals held the highest market share of around 41% in 2023

- The other end-uses segment is expected to register significant CAGR over the forecast period from 2024 to 2033.

- The resting electrocardiograph segment accounted for the largest revenue share of 47.3% in 2023

- The Holter monitoring system segment is expected to expand at the fastest CAGR of 7.7% from 2024 to 2033.

Market Overview

The U.S. Electrocardiogram (ECG) Equipment Market represents a crucial segment of the nation's cardiovascular diagnostics landscape. ECG equipment, which records the electrical activity of the heart, is widely used in hospitals, ambulatory care centers, emergency rooms, and even home-based monitoring settings. These devices play a pivotal role in detecting heart conditions such as arrhythmias, myocardial infarction, ischemia, and heart failure.

With cardiovascular diseases (CVDs) being the leading cause of death in the United States, early detection and continuous monitoring have become central to both acute and chronic cardiac care. According to the CDC, nearly 1 in 4 deaths in the U.S. are attributed to heart disease, which makes tools like ECG devices indispensable to modern healthcare infrastructure.

The market has evolved significantly, moving beyond traditional single-use diagnostic tools to more sophisticated, wearable, wireless, and AI-integrated systems that offer real-time data and remote monitoring. The convergence of ECG with digital health technologies, EHR integration, and mobile platforms is expanding the use of ECGs beyond the hospital into ambulatory settings, home healthcare, and fitness monitoring.

Strong regulatory oversight by the FDA, supportive reimbursement structures under Medicare, and the rising prevalence of lifestyle-related cardiac risks have positioned the U.S. ECG equipment market as both mature and innovation-driven.

Major Trends in the Market

-

Rising Adoption of Wireless and Wearable ECG Monitoring Devices

-

Integration of AI Algorithms for Arrhythmia Detection and Risk Stratification

-

Shift Toward Ambulatory and Home-based Cardiac Monitoring

-

Demand for Multi-lead Portable ECG Systems in Emergency Medicine

-

Incorporation of Cloud-based Data Management for Remote Cardiology

-

ECG Integration with Electronic Health Records (EHRs) and Telemedicine

-

Increased Use of Patch-based and Smartphone-connected ECG Devices

-

Hospital System Consolidation Driving Bulk Procurement and Platform Standardization

U.S. ECG Equipment Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 4.22 Billion |

| Market Size by 2033 |

USD 2.37 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BioTelemetry, Inc.; CompuMed, Inc.; GE HealthCare; Hill-Rom Services, Inc.; Koninklijke Philips N.V.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Schiller AG; NIHON KOHDEN CORPORATION; CardioComm Solutions, Inc.; McKesson Corporation |

U.S. ECG Equipment Market Dynamics

Drivers

- Increasing Cardiovascular Disease Incidence: The primary driver for the growth of the U.S. Electrocardiography (ECG) equipment market is the rising incidence of cardiovascular diseases. As heart-related conditions become more prevalent in the population, the demand for advanced diagnostic tools like ECG devices rises, driving market expansion.

- Growing Embrace of Telehealth Services: The accelerated adoption of telehealth services, particularly in response to the COVID-19 pandemic, is a key driver. ECG equipment that facilitates remote monitoring aligns with the broader telehealth trend, allowing healthcare providers to monitor and diagnose patients remotely.

Restraints

- High Initial Costs: One significant restraint facing the U.S. Electrocardiography (ECG) equipment market is the high initial costs associated with acquiring and implementing advanced ECG devices. The considerable investment required for purchasing sophisticated technology can pose a financial challenge for healthcare facilities, especially smaller clinics or those with limited budgets.

- Complex Regulatory Compliance: The healthcare industry operates within a complex regulatory landscape, and compliance with evolving standards can be challenging. Strict regulatory requirements for ECG equipment, including adherence to quality and safety standards, may lead to delays in product approvals and market entry, acting as a constraint for manufacturers.

Opportunities

- Rising Demand for Home-Based Healthcare: The increasing trend towards home-based healthcare presents a significant opportunity for the U.S. Electrocardiography (ECG) equipment market. Portable and user-friendly ECG devices that enable remote monitoring can cater to the growing demand for healthcare services delivered in the comfort of patients' homes.

- Integration with Wearable Technology: The integration of ECG technology with wearable devices presents a promising opportunity. Wearables equipped with ECG capabilities offer continuous monitoring and real-time data collection, providing valuable insights into patients' cardiac health and contributing to preventive care.

Challenges

- Regulatory Compliance Complexities: The U.S. Electrocardiography (ECG) equipment market faces challenges related to complex regulatory compliance. Strict adherence to evolving standards and regulations can pose hurdles for manufacturers, leading to delays in product approvals and market entry.

- High Initial Capital Investment: The high initial capital investment required for acquiring advanced ECG equipment is a significant challenge. This poses financial constraints, particularly for smaller healthcare facilities or those with limited budgets, hindering their ability to invest in state-of-the-art technology.

Segments Insights

End-use Insights

Hospitals are the Dominant End-use Segment

Hospitals continue to dominate ECG equipment usage due to the critical need for rapid and accurate cardiac diagnostics in emergency departments, ICUs, operating rooms, and inpatient wards. Resting ECGs, stress tests, and telemetry units are deeply embedded into hospital workflows.

Most hospitals operate networked ECG systems connected to EHRs, enabling real-time cardiology review and integration with clinical decision-making. These settings also support high-acuity cases where multi-lead ECGs, stress monitoring, and post-intervention follow-ups are essential. The purchasing power of hospitals allows them to adopt enterprise-level platforms, often with bundled software, warranty, and service contracts.

Ambulatory Care Settings are the Fastest-Growing End-use Segment

Ambulatory care, including outpatient clinics, urgent care centers, and telehealth-linked services, is the fastest-growing end-use category. These settings increasingly rely on portable and wireless ECG devices that are easy to use, cost-effective, and patient-friendly.

The rise of value-based care models, where providers are incentivized to prevent hospitalizations, has further encouraged the use of ambulatory ECGs for early detection and monitoring. Coupled with the adoption of home-use ECGs for cardiac rehab, post-discharge surveillance, and wellness tracking, this segment is expanding rapidly.

By Type

Resting ECG Systems Dominated the Market

Resting ECG systems have historically dominated the U.S. ECG equipment market due to their wide adoption in routine hospital diagnostics, outpatient care, and preoperative assessments. These systems typically use 12-lead configurations to capture a comprehensive view of heart activity during rest, making them ideal for diagnosing arrhythmias, ischemia, and heart block.

Most primary care clinics and emergency departments are equipped with these devices as a standard of care. Their widespread use, ease of interpretation, and integration into electronic medical records (EMRs) sustain their dominance. Innovations in compact, digital ECG machines with touchscreens, wireless transmission, and cloud backup are ensuring their continued relevance.

Holter Monitor Systems are the Fastest-Growing Segment

Holter monitor systems represent the fastest-growing segment, fueled by the shift from episodic testing to continuous cardiac monitoring. Unlike resting ECGs that capture a brief snapshot, Holter monitors provide 24 to 48 hours or longer of continuous data, allowing the detection of intermittent arrhythmias and symptoms not captured in brief exams.

Advanced Holter monitors now offer patch-based formats, extended wear durations, and real-time data transmission, making them ideal for ambulatory care, outpatient cardiology, and home settings. These devices are gaining popularity for post-stroke patients, AFib diagnosis, and athletes with unexplained syncopal episodes. Combined with AI-powered analytics, they offer actionable insights that drive personalized cardiac care.

Country-Level Analysis

In the United States, the ECG equipment market benefits from a mature regulatory framework, advanced healthcare infrastructure, and widespread physician adoption. The presence of leading manufacturers, research institutions, and health-tech startups ensures a steady stream of innovation.

Federal health programs like Medicare and Medicaid, as well as private insurers, now cover a broad range of ECG services, including remote monitoring and AI-assisted diagnostics. The increasing incidence of heart disease among both aging and younger sedentary populations continues to push demand.

The U.S. is also a hotbed for FDA-cleared wearable ECG devices, such as Apple Watch’s ECG function, AliveCor’s KardiaMobile, and Withings Move ECG, which are reshaping how patients and doctors approach early cardiac screening. Furthermore, hospital systems are rapidly deploying cloud-based ECG management software, enabling multi-location coordination and teleconsultations.

Key U.S. ECG Equipment Companies:

- BioTelemetry, Inc.

- CompuMed, Inc.

- GE HealthCare

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Hill-Rom Services, Inc.

- NIHON KOHDEN CORPORATION

- Koninklijke Philips N.V.

- Schiller AG

- CardioComm Solutions, Inc.

- McKesson Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ECG Equipment market.

By Type

- Resting ECG system

- Holter monitor systems

- Stress ECG monitors

- Event monitoring system

By End-use

- Hospitals

- Ambulatory care

- Others

.jpg)