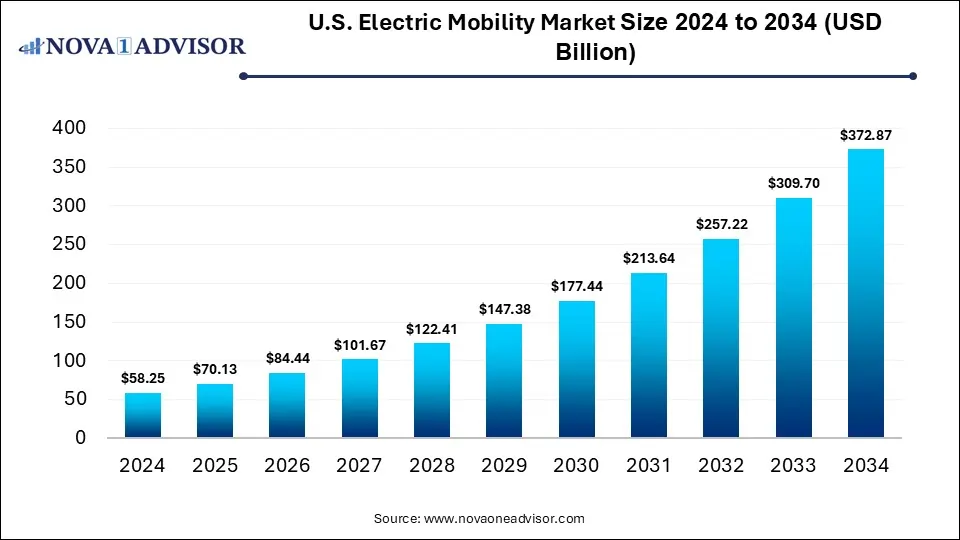

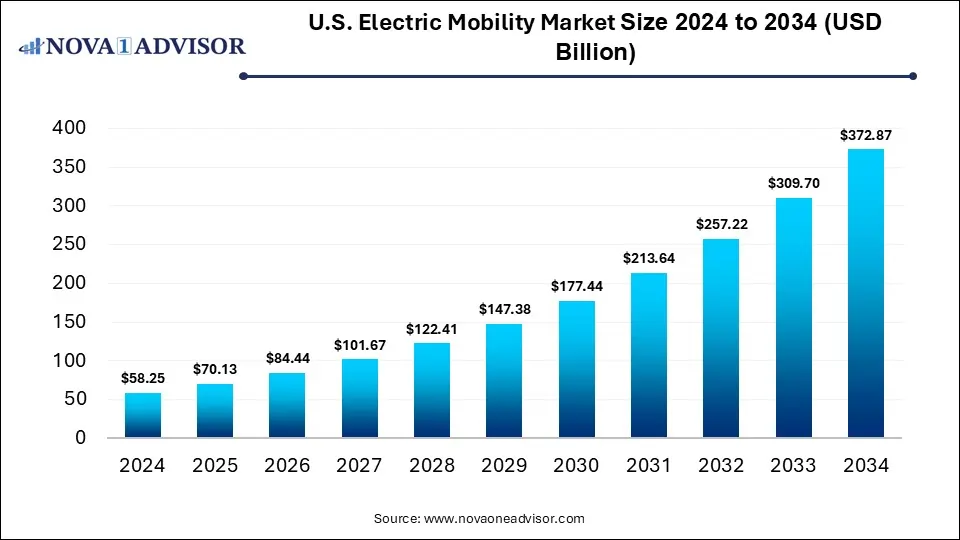

U.S. Electric Mobility Market Size and Forecast 2025 to 2034

The U.S. electric mobility market size was exhibited at USD 58.25 billion in 2024 and is projected to hit around USD 372.87 billion by 2034, growing at a CAGR of 20.4% during the forecast period of 2025 to 2034.

Key Takeaways:

- The electric car segment dominated the market in 2024 and accounted for an overall market share of 80.8%.

- The Li-Ion battery segment dominated the market in 2024 and accounted for 57.0% of the market share.

- The 24V segment accounted for 37.9% of the overall revenue in 2024.

Market Overview

The U.S. electric mobility market is experiencing a paradigm shift driven by rising environmental awareness, technological innovations, changing consumer behavior, and progressive government policies. Electric mobility, which refers to transportation powered fully or partially by electricity, has expanded significantly in the U.S. across various vehicle types—ranging from electric cars and bicycles to scooters, skateboards, motorcycles, and even wheelchairs.

Once viewed as niche or futuristic, electric mobility is rapidly becoming mainstream, catalyzed by the federal government's aggressive targets for net-zero emissions, increasing EV incentives, and a broader shift toward sustainable urban mobility. In cities like Los Angeles, New York, San Francisco, and Portland, infrastructure for electric vehicles—including public charging stations, designated bike lanes, and last-mile connectivity options—is expanding at an unprecedented pace.

Further, a new wave of micromobility startups is making electric scooters and bikes accessible through app-based rentals and shared-use models. Simultaneously, automotive giants and startups alike are investing billions into electric cars and two-wheelers, leading to a competitive and rapidly evolving ecosystem. Consumers now demand not just greener transportation but also greater efficiency, cost-effectiveness, and seamless integration with digital lifestyles.

As of 2024, the U.S. electric mobility market is marked by strong regulatory backing, rapid product diversification, evolving battery technologies, and a convergence of automotive, tech, and infrastructure industries. These dynamics are creating fertile ground for growth, innovation, and sustainable urban transformation.

Major Trends in the Market

-

Shift from Ownership to Shared Electric Mobility

Ride-sharing and micromobility platforms are reshaping urban commuting, especially with electric scooters and bikes.

-

Rise of Electrified Last-Mile Delivery

Electric bicycles and scooters are increasingly being adopted by delivery and logistics companies like UPS, Amazon, and FedEx.

-

Widespread Adoption of Li-ion Battery Technology

Lightweight, high-efficiency lithium-ion batteries are replacing lead-acid batteries across all electric mobility products.

-

Expansion of Public EV Infrastructure

Investments in charging stations, especially fast-charging networks, are enabling greater adoption of electric cars and motorcycles.

-

Federal and State-Level Incentives for E-Mobility

Programs like tax rebates, HOV lane access, and infrastructure grants are fueling growth in electric vehicle purchases.

-

Integration of Smart Technologies and IoT

From app-based diagnostics to GPS tracking, U.S. electric mobility solutions increasingly feature connected capabilities.

-

Youth and College-Centric Adoption of Electric Scooters and Boards

University campuses and youth-heavy urban centers are key markets for standing/self-balancing scooters and electric skateboards.

U.S. Electric Mobility Market Report Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 70.13 Billion |

| Market Size by 2034 |

USD 372.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 20.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Battery, Voltage |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Accell Group; Airwheel Holding Limited; Derby Cycle; HARLEY-DAVIDSON; Honda Motor Co. Ltd.; Invacare Corporation; Lohia Auto Industries; and Ninebot Ltd. |

U.S. Electric Mobility Market Dynamics

- Environmental Concerns and Regulatory Policies:

The U.S. electric mobility market dynamics are heavily influenced by growing environmental concerns and evolving regulatory policies aimed at curbing greenhouse gas emissions.With increasing awareness of climate change and air pollution, governments at various levels are implementing stringent regulations to promote the adoption of electric vehicles (EVs) as a cleaner alternative to traditional gasoline-powered vehicles. Incentives such as tax credits, rebates, and subsidies for EV buyers, along with mandates for automakers to produce a certain percentage of zero-emission vehicles, are driving market growth.

- Technological Advancements and Innovation:

Another significant driver of the U.S. electric mobility market dynamics is the continuous technological advancements and innovations in electric vehicle technology. Breakthroughs in battery technology, electric drivetrains, and vehicle connectivity are improving the performance, range, and affordability of EVs, making them increasingly competitive with traditional internal combustion engine vehicles. Innovations such as fast-charging technologies, longer-lasting batteries, and lightweight materials are addressing key challenges associated with EV adoption, such as range anxiety and charging infrastructure limitations. Moreover, advancements in autonomous driving technology and vehicle-to-grid integration are opening up new possibilities for electric mobility, transforming the way people commute and interact with their vehicles.

U.S. Electric Mobility Market Restraint

- Infrastructure Limitations:

One of the primary restraints facing the U.S. electric mobility market is the limited infrastructure for charging electric vehicles (EVs). Despite significant growth in recent years, the availability of charging stations remains uneven across different regions, and charging times can still be perceived as inconvenient compared to refueling gasoline vehicles. This lack of charging infrastructure can lead to range anxiety among consumers, deterring them from purchasing EVs and slowing market adoption. Moreover, the cost of installing charging stations, particularly fast-charging infrastructure, can be prohibitively expensive for businesses and municipalities, further hampering market growth.

- Limited Consumer Awareness and Education:

Another significant restraint impacting the U.S. electric mobility market is the limited consumer awareness and education regarding the benefits and practicalities of electric vehicles (EVs). Despite growing interest in sustainability and environmental concerns, many consumers still lack sufficient knowledge about EVs, including their performance, range, charging options, and cost savings. Misconceptions about EVs, such as concerns about battery life, charging times, and upfront costs, can deter potential buyers from considering electric vehicles as a viable transportation option. Additionally, the absence of comprehensive education and outreach initiatives from automakers, government agencies, and other stakeholders further exacerbates the lack of consumer awareness.

U.S. Electric Mobility Market Opportunity

- Expansion of Electric Vehicle Charging Networks:

An important opportunity within the U.S. electric mobility market lies in the expansion of electric vehicle (EV) charging networks. Despite significant progress, the current charging infrastructure remains insufficient to meet the growing demand for EVs and alleviate range anxiety among consumers. Expanding the network of charging stations, particularly in underserved areas and along key transportation routes, presents a lucrative opportunity for investment and innovation. Companies operating in the electric mobility sector, including utilities, technology firms, and infrastructure developers, can capitalize on this opportunity by investing in the deployment of fast-charging stations, workplace charging solutions, and residential charging infrastructure.

- Diversification of Electric Mobility Solutions:

Another promising opportunity in the U.S. electric mobility market is the diversification of electric mobility solutions beyond passenger cars to include commercial vehicles, public transportation, and last-mile delivery services. As the demand for sustainable transportation solutions continues to rise, there is growing interest and investment in electric buses, trucks, vans, and e-commerce delivery vehicles. Companies specializing in electric mobility solutions for commercial fleets, logistics, and transportation services stand to benefit from this trend by developing innovative products and services tailored to the specific needs of businesses and municipalities. Moreover, government incentives and subsidies for electrification initiatives, coupled with advancements in battery technology and vehicle design, create favorable conditions for the expansion of electric mobility solutions across various sectors.

U.S. Electric Mobility Market Challenges

- Battery Technology and Range Limitations:

One of the significant challenges facing the U.S. electric mobility market is the limitations associated with battery technology and vehicle range. While advancements in battery technology have improved the energy density and performance of electric vehicle (EV) batteries, challenges such as limited driving range, long charging times, and high costs persist. Many consumers experience range anxiety, fearing that their EVs may run out of power before reaching their destination or encountering difficulty finding charging stations along the way. Additionally, the upfront cost of EVs remains relatively high compared to conventional gasoline-powered vehicles, largely due to the expensive battery packs. Overcoming these challenges requires continued investment in research and development to enhance battery efficiency, increase energy storage capacity, and reduce costs.

- Supply Chain Constraints and Material Sourcing:

Another significant challenge for the U.S. electric mobility market is the supply chain constraints and material sourcing issues associated with the production of electric vehicles (EVs) and related components. The global supply chain disruptions caused by factors such as trade tensions, geopolitical conflicts, and natural disasters have highlighted vulnerabilities in the EV supply chain, leading to delays in production and increased costs. Moreover, the sourcing of critical materials used in EV batteries, such as lithium, cobalt, and rare earth elements, presents challenges related to environmental sustainability, ethical sourcing practices, and geopolitical dependencies. Ensuring a resilient and sustainable supply chain for EV manufacturing requires diversification of sourcing locations, development of alternative materials, and implementation of transparency and accountability measures throughout the supply chain.

Segments Insights:

Product Insights

Electric cars dominate the U.S. electric mobility market, accounting for the largest market share by value. They benefit from the strongest regulatory support, robust charging infrastructure, and high consumer awareness. Brands like Tesla, Ford, Rivian, Lucid, and Chevrolet have rolled out compelling electric vehicles across price segments, from luxury sedans to affordable compact models. The expansion of long-range EVs and battery leasing models has further accelerated adoption. In 2024, EV sales in the U.S. crossed 1.2 million units, with Tesla’s Model Y and Ford’s F-150 Lightning leading the charts.

Electric bicycles are the fastest-growing segment, particularly among commuters and delivery workers. The combination of portability, low cost, ease of maintenance, and electric assist features makes e-bikes a preferred alternative to cars and traditional bikes. Cities like Austin, Seattle, and Boston are witnessing a surge in daily e-bike commuting, supported by growing bike lane infrastructure and federal rebate initiatives. E-bikes are also popular among gig economy workers for urban food delivery, making them a dynamic and economically vital mobility option.

U.S. Electric Mobility Market Size By Product, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Electric Scooter |

8.74 |

10.52 |

12.67 |

15.25 |

18.36 |

22.11 |

26.62 |

32.05 |

38.58 |

46.45 |

55.93 |

| Electric Bicycle |

14.56 |

17.53 |

21.11 |

25.42 |

30.60 |

36.84 |

44.36 |

53.41 |

64.31 |

77.42 |

93.22 |

| Electric Skateboard |

2.91 |

3.51 |

4.22 |

5.08 |

6.12 |

7.37 |

8.87 |

10.68 |

12.86 |

15.48 |

18.64 |

| Electric Motorcycle |

11.65 |

14.03 |

16.89 |

20.33 |

24.48 |

29.48 |

35.49 |

42.73 |

51.44 |

61.94 |

74.57 |

| Electric Car |

14.56 |

17.53 |

21.11 |

25.42 |

30.60 |

36.84 |

44.36 |

53.41 |

64.31 |

77.42 |

93.22 |

| Electric Wheelchair |

5.83 |

7.01 |

8.44 |

10.17 |

12.24 |

14.74 |

17.74 |

21.36 |

25.72 |

30.97 |

37.29 |

Battery Insights

Li-ion batteries dominate the U.S. electric mobility market, owing to their superior energy density, lighter weight, faster charging capability, and longer life cycles. Most electric cars, bicycles, and high-end scooters in the U.S. use lithium-ion battery packs. Tesla’s innovation in Li-ion technology has set industry standards, with other players following suit. Furthermore, the decline in lithium battery costs due to mass production has enabled affordability across micromobility categories as well.

Sealed lead acid batteries are declining, though still used in certain entry-level scooters and wheelchairs due to their low initial cost. However, their heavier weight, shorter life, and longer charging times limit their appeal in a performance-focused market. Government mandates for recycling and safe disposal of lead-based batteries also add complexity, making them less competitive compared to Li-ion options.

U.S. Electric Mobility Market Size By Battery, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Sealed Lead Acid |

11.7 |

14.0 |

16.9 |

20.3 |

24.5 |

29.5 |

35.5 |

42.7 |

51.4 |

61.9 |

74.6 |

| NiMH |

11.7 |

14.0 |

16.9 |

20.3 |

24.5 |

29.5 |

35.5 |

42.7 |

51.4 |

61.9 |

74.6 |

| Li-ion |

35.0 |

42.1 |

50.7 |

61.0 |

73.4 |

88.4 |

106.5 |

128.2 |

154.3 |

185.8 |

223.7 |

Voltage Insights

Greater than 48V systems dominate in the electric car segment, as higher voltage platforms allow for faster acceleration, higher torque, and extended driving ranges. Vehicles like the Lucid Air (900V) and Porsche Taycan (800V) have set benchmarks for performance EVs. High-voltage systems are also being used in electric motorcycles and high-end scooters to support high-speed, long-distance riding.

36V and 48V systems are widely used in e-bikes and scooters, offering a balance between power output and battery cost. These voltages are optimal for urban commuting, delivering enough speed and range for daily use. For low-speed personal mobility devices like skateboards and wheelchairs, 24V systems remain in use, though with limited performance potential.

U.S. Electric Mobility Market Size By Voltage, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| 24V |

17.5 |

21.0 |

25.3 |

30.5 |

36.7 |

44.2 |

53.2 |

64.1 |

77.2 |

92.9 |

111.9 |

| 36V |

17.5 |

21.0 |

25.3 |

30.5 |

36.7 |

44.2 |

53.2 |

64.1 |

77.2 |

92.9 |

111.9 |

| 48V |

11.7 |

14.0 |

16.9 |

20.3 |

24.5 |

29.5 |

35.5 |

42.7 |

51.4 |

61.9 |

74.6 |

| Greater than 48V |

11.7 |

14.0 |

16.9 |

20.3 |

24.5 |

29.5 |

35.5 |

42.7 |

51.4 |

61.9 |

74.6 |

U.S. Country-Level Analysis

The U.S. electric mobility landscape is highly regionalized, with distinct adoption patterns across states and cities.

California leads the nation in electric mobility adoption, thanks to strong state policies, high environmental awareness, and innovation clusters in Silicon Valley and Los Angeles. The state mandates zero-emission vehicle (ZEV) sales, offers robust rebates, and has the highest number of EV charging stations. Major cities like San Francisco and San Diego have adopted micromobility solutions at scale, with pilot zones for electric scooter regulation and EV-only road lanes.

Texas and Florida are emerging hotspots, driven by high population density, state-level support for electric vehicle startups, and consumer demand. Austin, for example, has integrated shared scooters into its urban transit strategy. Meanwhile, New York City is expanding its electric bus fleet and mandating EV integration in delivery vehicles.

States like Colorado, Oregon, and Washington are also notable for their progressive EV policies and infrastructure investments. As a whole, the U.S. is building an interconnected ecosystem that supports both long-haul EV usage and urban micromobility innovation.

Some of the prominent players in the U.S. electric mobility market include:

- Accell Group

- Airwheel Holding Limited

- Derby Cycle

- HARLEY-DAVIDSON

- Honda Motor Co. Ltd

- Invacare Corporation

- Lohia Auto Industries

- Ninebot Ltd.

Recent Developments

-

March 2025 – Ford Motor Company announced the launch of a new sub-$30,000 electric crossover, targeting middle-income families with an EPA-estimated range of 275 miles.

-

February 2025 – Bird Global Inc. expanded its shared micromobility fleet to four new U.S. cities, introducing dockless folding scooters with IoT-based anti-theft features.

-

January 2025 – Tesla Inc. began testing wireless charging pads for urban EV parking lots in partnership with a California-based energy startup.

-

November 2024 – Rad Power Bikes introduced its latest cargo e-bike line for B2B logistics, enabling faster urban deliveries with swappable battery packs.

-

October 2024 – Lime partnered with Google Maps, allowing users in the U.S. to reserve and unlock e-scooters directly from the app interface.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global U.S. electric mobility market.

Product

- Electric Scooter

- Electric Bicycle

- Electric Skateboard

- Electric Motorcycle

- Electric Car

- Electric Wheelchair

Electric Scooter by Product

- Retro

- Standing/Self-Balancing

- Folding

Battery

- Sealed Lead Acid

- NiMH

- Li-ion

Voltage

- 24V

- 36V

- 48V

- Greater than 48V