U.S. & Europe Extractable And Leachable Testing Services Market Size and Trends

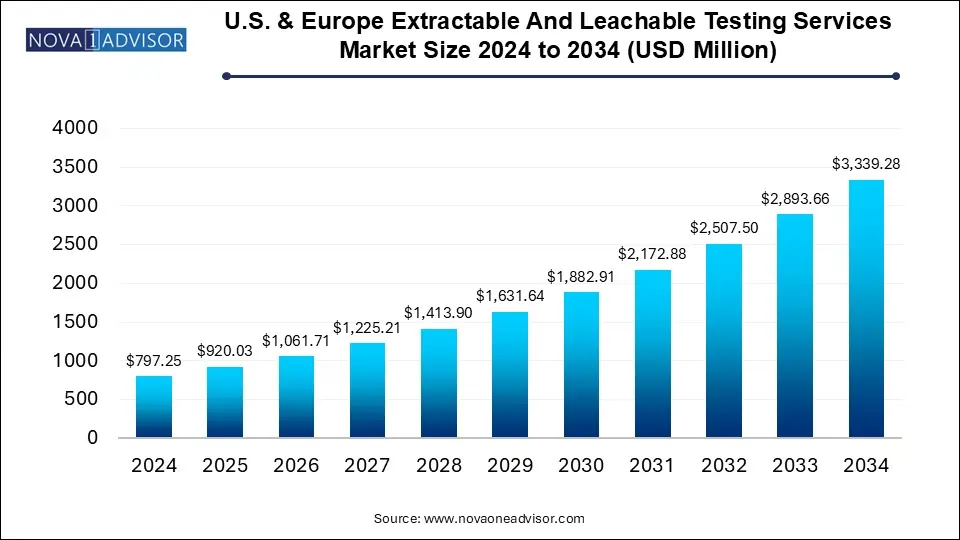

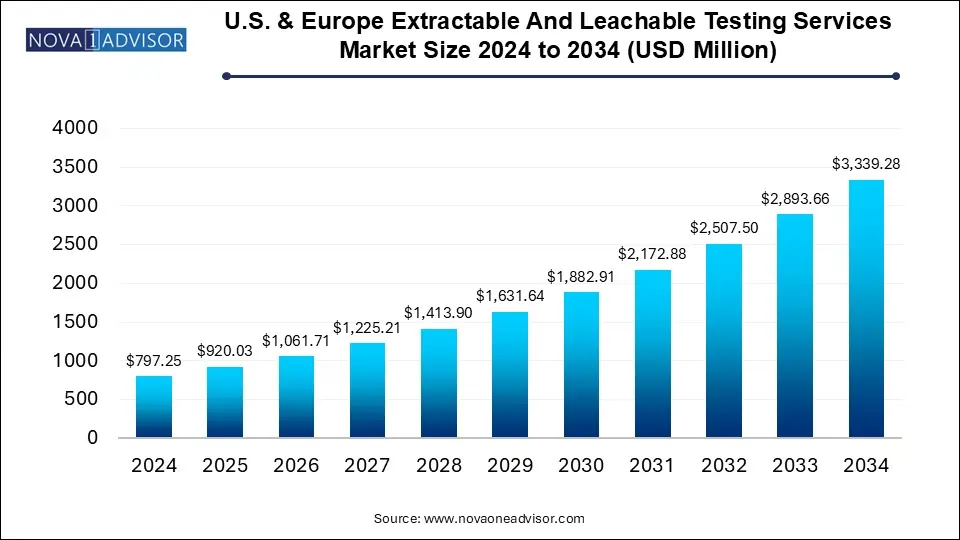

The U.S. & Europe extractable and leachable testing services market size was exhibited at USD 797.25 million in 2024 and is projected to hit around USD 3339.28 million by 2034, growing at a CAGR of 15.4% during the forecast period 2025 to 2034.

U.S. & Europe Extractable And Leachable Testing Services Market Key Takeaways:

- The container closure systems segment held the largest revenue share of 30.4% of the market.

- The single-use systems segments are expected to grow at a significant growth rate of 17.5% during 2025-2034.

- Orally inhaled and nasal drug products segment held the largest share in 2024, with a revenue share of 42.0%.

- The parenteral drug products segment is projected to witness the fastest growth rate of 17.5% over the forecast period.

- The U.S. held the largest market share of 57.5% in 2024.

Market Overview

The Extractable and Leachable (E&L) Testing Services Market in the U.S. and Europe is experiencing significant momentum, driven by tightening regulatory expectations, innovation in pharmaceutical packaging, and rising demand for biologics and complex drug formulations. Extractables are chemical compounds that can be released from container closure systems, drug delivery devices, or processing equipment under exaggerated conditions. Leachables are the subset of these compounds that migrate into the drug product under normal usage conditions, potentially compromising product safety, efficacy, and stability.

The U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regulatory bodies have issued stringent guidelines mandating E&L testing as part of product development and pre-market approval processes. These services are vital in ensuring that pharmaceutical packaging, medical devices, and delivery systems do not introduce harmful contaminants into drug formulations. As the pharmaceutical industry shifts toward parenteral, inhalable, and ophthalmic drug products—where direct patient exposure to packaging materials is higher—the importance of E&L studies has intensified.

In both the U.S. and Europe, pharmaceutical and biopharmaceutical companies are increasingly outsourcing E&L testing to specialized service providers equipped with high-resolution analytical instrumentation, regulatory expertise, and advanced simulation models. The market is also seeing a surge in testing demand for single-use systems used in biomanufacturing and personalized therapies. With increasing complexity in drug-device combinations, coupled with regulatory pressures for thorough safety assessments, the E&L testing services sector is poised for steady, long-term growth.

Major Trends in the Market

-

Regulatory Intensification: FDA and EMA guidelines are evolving to demand more extensive E&L testing for combination products and novel packaging materials.

-

Outsourcing Surge: Pharma and biotech firms are increasingly outsourcing E&L testing to third-party laboratories with specialized expertise and analytical capabilities.

-

Biologics Driving E&L Demand: The rise in monoclonal antibodies, gene therapies, and biosimilars has accelerated E&L requirements due to their sensitivity to packaging and delivery systems.

-

Growth of Single-Use Systems (SUS): Increased adoption of disposable bioprocessing equipment in biologics manufacturing is creating a robust market for SUS-related E&L testing.

-

Digitalization of Testing Platforms: Integration of AI, automation, and data analytics is improving the accuracy, traceability, and efficiency of E&L studies.

-

Customized Protocol Development: Service providers are offering client-specific testing strategies tailored to product type, packaging materials, and intended use conditions.

-

Cross-continental Harmonization Efforts: Collaborative initiatives between U.S. and European agencies aim to standardize testing methodologies and approval processes for global scalability.

Report Scope of U.S. & Europe Extractable And Leachable Testing Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 920.03 Million |

| Market Size by 2034 |

USD 3339.28 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 15.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

U.S., Europe |

| Key Companies Profiled |

Eurofins Scientific; Intertek Group plc; SGS Société Générale de Surveillance SA; WuXi AppTec; Merck KGaA; West Pharmaceutical Services, Inc; Wickham Micro Limited (Medical Engineering Technologies Ltd.); Pacific Biolabs; Boston Analytical; Sotera Health (Nelson Laboratories, LLC). |

Key Market Driver: Stringent Regulatory Mandates for Drug Safety and Compliance

One of the principal drivers of the E&L testing services market in the U.S. and Europe is the rising stringency of regulatory mandates governing pharmaceutical product safety. Regulatory agencies now require comprehensive risk assessments for all materials that may come into contact with the drug product throughout its lifecycle including primary packaging, processing equipment, and drug delivery systems. The FDA's 2020 guideline on combination products and the EMA’s standards for OINDPs (Orally Inhaled and Nasal Drug Products) both underscore the necessity for rigorous E&L evaluations.

Moreover, the increasing number of warning letters and product recalls linked to unidentified leachables has made pharmaceutical companies more proactive in risk mitigation. E&L testing is now integral to early-stage product development, helping companies avoid costly delays, reformulations, or regulatory rejections. These pressures have led to heightened demand for specialized E&L testing services that offer not only chemical characterization but also toxicological risk assessment and regulatory documentation support. As regulators continue to tighten scrutiny particularly for parenterals, biologics, and pediatric formulations this driver is expected to remain central to market expansion.

Key Market Restraint: High Cost and Time-Intensiveness of Testing Protocols

Despite the increasing necessity, the E&L testing process is both capital- and time-intensive, often representing a substantial burden for small-to-mid-sized pharmaceutical firms. Advanced testing protocols require state-of-the-art instruments such as LC-MS/MS, GC-MS, and ICP-MS, along with highly trained analytical chemists and toxicologists. Additionally, the iterative nature of extractables profiling, simulation studies, migration modeling, and leachable identification adds weeks or even months to development timelines.

In Europe, where regulatory expectations vary across countries and between national and EU-level agencies, repeated testing for multiple markets can further inflate costs. The lack of universally accepted testing standards can necessitate customized protocols, increasing both complexity and expense. For startups or generics manufacturers with limited resources, the cost of outsourcing E&L testing can represent a major barrier to market entry. This restraint may also delay innovation in novel drug delivery platforms and packaging formats due to the perceived compliance burden.

Key Market Opportunity: Expanding Role of E&L Testing in Biologic and Cell/Gene Therapy Development

As the pharmaceutical landscape shifts toward biologics and cell/gene therapies, E&L testing services have a significant opportunity to expand their value proposition. These advanced therapies are highly sensitive to environmental contaminants, making them particularly susceptible to quality degradation from leachables. Moreover, the complexity of bioprocessing steps, often involving single-use systems (tubing, bioreactors, bags, connectors), necessitates detailed scrutiny of extractables throughout the production pipeline.

In the U.S., the FDA’s increasing focus on the compatibility of SUS with drug substances has opened a wide field for service providers who can offer end-to-end E&L analysis—starting from preclinical development to commercial manufacturing. In Europe, initiatives like the Innovative Medicines Initiative (IMI) are driving collaboration between academia, regulators, and industry, creating a strong pipeline of biologic candidates with extensive E&L testing needs. As personalized medicine and precision biologics expand, especially in oncology and rare disease treatment, this segment will require even more tailored and predictive E&L assessments, offering sustained growth opportunities for labs and CROs.

U.S. & Europe Extractable And Leachable Testing Services Market By Product Insights

Container closure systems dominated the U.S. and European markets, as they represent the primary point of contact between the drug product and packaging. These systems include vials, syringes, ampoules, seals, and rubber stoppers—all of which must undergo extensive E&L evaluations to ensure that they do not release harmful substances into the product. The parenteral drug product category particularly relies on robust container closure integrity, as the sterile nature of the formulation demands contamination-free environments. In the U.S., several recent FDA reviews have flagged inadequate extractable data in ANDAs, reinforcing the focus on this segment. Additionally, glass alternatives like cyclic olefin polymers (COP) are gaining popularity, prompting new E&L studies due to their novel material profiles.

Single-use systems (SUS) are the fastest-growing product segment, driven by the expansion of biologics manufacturing facilities across the U.S. and Europe. SUS offer cost and contamination control advantages but pose new challenges in extractables characterization due to the diversity of polymers used in tubing, connectors, and bags. As manufacturers adopt flexible production systems and disposable bioreactors, E&L service providers are tasked with developing rapid and reliable testing frameworks. In Europe, countries like Germany and France are leading SUS adoption in their biopharma sectors, and regulatory scrutiny of leachables from these systems is expected to intensify. Service providers who can deliver real-time, batch-specific E&L assessments for these systems are seeing rapid growth in demand.

U.S. & Europe Extractable And Leachable Testing Services Market By Application Insights

Parenteral drug products held the leading share in the application segment, given the sterility and systemic exposure associated with injectable drugs. These formulations are highly sensitive to impurities, necessitating a rigorous E&L testing protocol throughout the drug lifecycle. Syringes, IV bags, vial stoppers, and delivery devices must all be screened for both known and unknown leachables. In the U.S., biologics and biosimilars under development—often in injectable forms—rely heavily on advanced container closure systems and thus generate consistent E&L testing needs. Similarly, Europe’s strong injectable vaccine pipeline, especially post-COVID-19, is driving E&L investments.

Orally inhaled and nasal drug products (OINDPs) are the fastest-growing application, due to their complex formulation-device interactions and heightened regulatory requirements. The FDA and EMA have issued specific guidance demanding in-depth E&L studies for components of inhalers, nebulizers, and nasal sprays. These products are prone to contamination from plastic, elastomeric, or metallic components, and leachables can reach pulmonary or nasal tissues directly—raising toxicity concerns. Inhalation therapies for asthma, COPD, and even targeted gene delivery are growing across both regions, thereby intensifying demand for device-specific extractables profiling and toxicological risk assessments.

Country Insights

The U.S. stands as the most developed and largest market for extractable and leachable testing services. The FDA’s strong enforcement of product safety standards, combined with its guidance documents such as the “Container Closure Systems for Packaging Human Drugs and Biologics,” has institutionalized the role of E&L studies in regulatory submissions. The growing pipeline of biologics, biosimilars, and drug-device combination products has generated sustained demand for E&L testing.

Additionally, the U.S. has a dense network of CROs, CDMOs, and specialized labs that offer high-throughput, GLP-compliant E&L testing services. Major cities such as Boston, San Diego, and Raleigh-Durham serve as biotech hubs where early-stage companies and established players outsource E&L analysis to expedite time-to-market. The expanding telehealth drug delivery ecosystem, which includes wearable injectors and smart drug pens, also poses new E&L considerations and drives service innovation. As the FDA explores tighter post-market surveillance, demand for ongoing leachable monitoring is expected to grow.

Some of the prominent players in the U.S. & Europe extractable and leachable testing services market include:

U.S. & Europe Extractable And Leachable Testing Services Market Recent Development

-

In March 2025, Nelson Labs, a leading provider of E&L testing, expanded its analytical chemistry division in Salt Lake City, U.S., to meet rising demand from biologics manufacturers.

-

Eurofins Scientific announced in April 2025 the acquisition of a Netherlands-based contract lab specializing in inhalation device E&L testing, enhancing its European capabilities in the OINDP segment.

-

In January 2025, SGS launched a new suite of digital tools for automated data capture and reporting in E&L studies, aimed at improving compliance traceability for global clients.

-

Intertek Group plc opened a new materials compatibility testing facility in Frankfurt, Germany, in February 2025, with a focus on single-use systems and bioprocessing materials.

-

Pace Analytical Life Sciences partnered with a leading biopharma CDMO in May 2025 to offer co-located E&L testing support for rapid product development in the U.S.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. & Europe extractable and leachable testing services market

By Product

- Container Closure Systems

- Single-use Systems

- Drug Delivery Systems

- Others

By Application

- Parenteral Drug Products

- Orally Inhaled and Nasal Drug Products (OINDP)

- Ophthalmic

By Country

-

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway