U.S. External Counterpulsation Devices Market Size and Trends

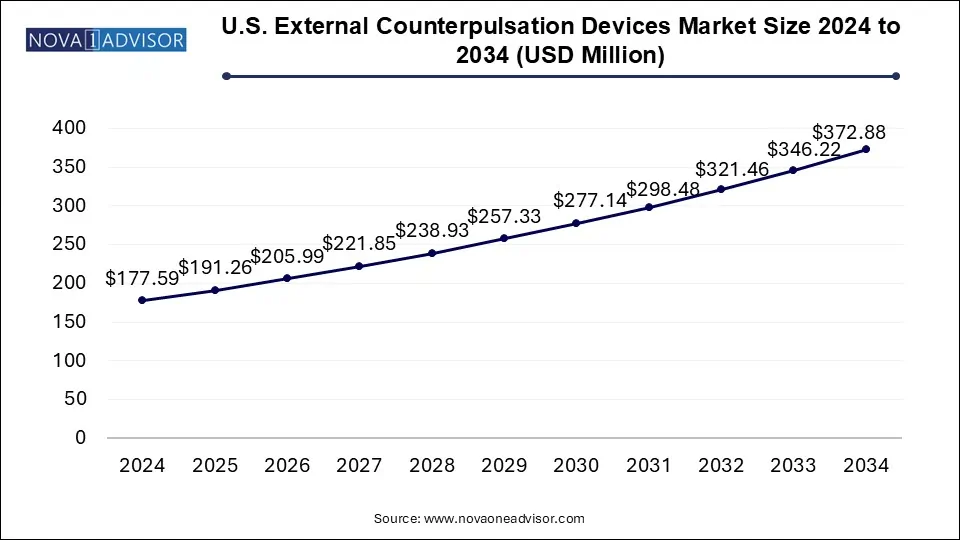

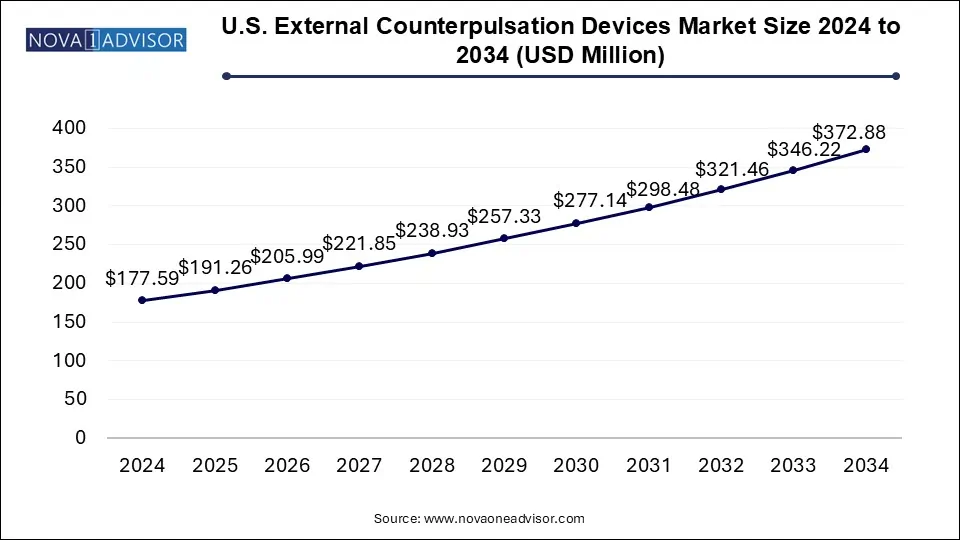

The U.S. external counterpulsation devices market size was exhibited at USD 177.59 million in 2024 and is projected to hit around USD 372.88 million by 2034, growing at a CAGR of 7.7% during the forecast period 2025 to 2034.

U.S. External Counterpulsation Devices Market Key Takeaways:

- In 2024, the pneumatic ECP devices segment held a dominant the market with a share of 35.68%.

- The Enhanced External Counterpulsation (EECP) devices segment is expected to exhibit the highest CAGR during the forecast period.

- The hospital segment dominated the market with a share of 36.0% in 2024

- The cardiac center segment is anticipated to witness the highest CAGR of 8.5% during the forecast period.

Market Overview

The U.S. External Counterpulsation (ECP) Devices Market has experienced notable traction in recent years, driven by a combination of rising cardiovascular disease burden, growing preference for non-invasive treatment modalities, and increasing clinical acceptance of ECP therapy as a viable option for patients with refractory angina and heart failure. External Counterpulsation is a mechanical, non-invasive technique designed to enhance blood flow to the heart and other vital organs, primarily by using pneumatic cuffs applied to the lower extremities. The inflation and deflation of these cuffs are synchronized with the patient’s cardiac cycle, improving coronary perfusion and cardiac output.

In the United States, heart disease continues to be the leading cause of death, with over 800,000 related fatalities annually. This epidemic of cardiovascular disease has necessitated the evolution of alternative therapies that are both cost-effective and suitable for patients who are either ineligible or unwilling to undergo surgical interventions such as coronary artery bypass grafting (CABG) or percutaneous coronary intervention (PCI). ECP therapy, particularly the enhanced variant—EECP—has emerged as an essential clinical tool in this context.

From an economic standpoint, the U.S. healthcare system's shift toward value-based care is encouraging broader adoption of outpatient and non-invasive treatments. EECP has been included in treatment guidelines by several clinical societies and is increasingly reimbursed under Medicare, further fueling market growth. Additionally, innovations in device miniaturization, real-time monitoring integration, and home-based therapy models are expanding the therapeutic potential and accessibility of ECP devices in the U.S.

Major Trends in the Market

-

Increasing Prevalence of Cardiovascular Diseases: High rates of ischemic heart disease and congestive heart failure are amplifying the need for supplemental and alternative treatments such as ECP therapy.

-

Shift Toward Non-Invasive Therapies: Patients and clinicians alike are favoring non-invasive and outpatient therapies, particularly for chronic and treatment-resistant conditions.

-

Integration of AI and Telemedicine in ECP Devices: Companies are embedding smart monitoring features and connectivity for remote tracking, aligning with the broader trend of digital health.

-

Rising Awareness Through Physician Education: Targeted awareness campaigns and training programs by manufacturers and cardiac societies are leading to wider physician endorsement.

-

Expanded Reimbursement Policies: Medicare and several private insurers in the U.S. now cover EECP therapy under specific clinical guidelines, enhancing affordability and accessibility.

-

Home-Based EECP Therapy Models: Pilot programs and trials in the U.S. are exploring home-based versions of EECP, aimed at enhancing convenience and adherence, particularly for elderly patients.

-

Collaborations with Cardiac Centers for Technology Adoption: Manufacturers are increasingly partnering with specialized cardiac centers to pilot new devices, validate clinical outcomes, and drive adoption.

Report Scope of U.S. External Counterpulsation Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 191.26 Million |

| Market Size by 2034 |

USD 372.88 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Vaso Corporation; ACS Diagnostics; Scottcare Corporation; Cardiomedics Inc |

Key Market Driver: Escalating Cardiovascular Disease Burden and Treatment Gaps

The most prominent driver for the U.S. External Counterpulsation Devices Market is the alarming and persistent burden of cardiovascular diseases. According to the Centers for Disease Control and Prevention (CDC), approximately 20 million Americans suffer from some form of coronary artery disease (CAD), with a significant subset experiencing refractory angina or chronic heart failure. For these patients, conventional interventions such as angioplasty or bypass surgery may not always be feasible due to age, comorbidities, or financial constraints.

ECP devices offer a life-enhancing alternative that is FDA-approved for patients with chronic stable angina not amenable to invasive procedures. The procedure is safe, typically conducted in outpatient settings, and associated with minimal side effects. Clinical studies have shown improvements in exercise tolerance, angina class, and quality of life in patients undergoing EECP therapy. In addition to enhancing myocardial perfusion, EECP appears to initiate systemic benefits through the stimulation of collateral vessel formation and improved endothelial function. This growing body of clinical evidence, paired with rising physician and patient awareness, is propelling the uptake of ECP devices across the country.

Key Market Restraint: Limited Awareness and Low Referral Rates Among Cardiologists

Despite its therapeutic promise, the ECP market in the U.S. continues to face an enduring challenge—limited awareness and endorsement among cardiologists. While EECP has been FDA-approved since the 1990s, it remains underutilized in mainstream clinical practice. A major contributor to this underuse is the historical skepticism about its long-term efficacy, coupled with the perception that it is only a “last resort” therapy.

Many practicing cardiologists in the U.S. still prioritize invasive procedures due to their familiarity, immediate results, and established reimbursement structures. As a result, EECP is often introduced too late in the patient care pathway or not at all. Additionally, a lack of standardized protocols for patient selection and a dearth of clinical champions within hospital systems continue to hamper broader adoption. Overcoming these barriers will require ongoing education, investment in clinical trials, and inclusion in more comprehensive treatment guidelines by leading cardiovascular societies.

Key Opportunity: Home-Based EECP Therapy and Digital Integration

A key emerging opportunity lies in the development and deployment of home-based EECP therapy models, which leverage compact device designs and digital connectivity. With the aging population in the U.S. and a growing number of patients requiring long-term cardiac management, at-home care models offer a compelling value proposition. This innovation has the potential to significantly increase therapy adherence, reduce healthcare costs, and improve patient satisfaction.

Several startups and established players are already exploring mobile or miniaturized EECP units equipped with remote monitoring features. These devices can transmit real-time data to physicians, ensuring that therapy protocols are being followed and enabling early intervention if complications arise. In combination with telemedicine platforms, these systems are aligning with the broader trend of decentralized healthcare. Furthermore, home-based EECP holds promise in rural and underserved communities, where access to specialized cardiac centers is limited. If properly regulated and supported by reimbursement policies, this opportunity could revolutionize how ECP therapy is delivered in the U.S.

U.S. External Counterpulsation Devices Market By Product Insights

Enhanced External Counterpulsation (EECP) devices dominated the U.S. market, given their superior clinical outcomes and FDA approval for multiple cardiovascular indications. EECP devices utilize sophisticated timing and feedback systems that synchronize precisely with the patient’s ECG waveform, optimizing diastolic augmentation and coronary perfusion. These devices are particularly effective in treating refractory angina, ischemic cardiomyopathy, and post-angioplasty patients. Their non-invasive nature and outpatient applicability have made them the gold standard in ECP therapy. EECP devices are supported by extensive clinical literature and are commonly found in specialized cardiac centers and some high-volume hospitals.

Electrocardiogram (ECG)-synchronized ECP devices are anticipated to be the fastest-growing sub-segment, thanks to technological advancements and their emerging use in combination therapies. These devices offer real-time ECG monitoring and adaptive pressure systems that enhance the precision and comfort of therapy sessions. Startups and innovators in the U.S. are working on AI-enhanced ECG synchronization for improved safety and personalization. While not all ECG-synchronized devices are categorized under EECP, their compatibility with telehealth platforms and remote monitoring positions them well for future growth, especially in home-care scenarios.

U.S. External Counterpulsation Devices Market By End-use Insights

Hospitals emerged as the largest end-use segment, accounting for the majority of ECP device installations in the U.S. This is attributed to hospitals’ infrastructure, multidisciplinary care teams, and ability to handle comorbid and high-risk patients. Large urban hospitals and academic medical centers are particularly well-equipped to conduct EECP therapy. These settings also allow for close clinical monitoring and management of potential complications. Furthermore, the inclusion of EECP in cardiac rehabilitation programs within hospital networks is expanding its role beyond symptomatic relief to preventive and maintenance therapy.

Cardiac centers are the fastest-growing end-use segment, spurred by their focused expertise, outpatient model, and flexibility. Independent and affiliated cardiac care centers are increasingly adopting ECP devices as part of holistic management plans for angina and heart failure patients. These centers often work in partnership with primary care providers and specialists to identify suitable candidates early, improving outcomes. Cardiac centers are also more agile in piloting newer devices and therapy models, such as mobile ECP units and AI-integrated treatment protocols. Their leaner administrative structures allow faster adoption of innovative reimbursement models and bundled payment schemes.

Country-Level Analysis

The United States holds a uniquely influential position in the global ECP market due to its combination of high disease prevalence, progressive healthcare infrastructure, and a growing culture of preventative care. Approximately 18.2 million Americans aged 20 and older have coronary artery disease, creating a substantial pool of patients who could benefit from ECP therapy.

Government initiatives such as the Million Hearts program and CMS (Centers for Medicare & Medicaid Services) efforts to curb hospital readmissions have created a fertile policy environment for adopting outpatient cardiac therapies like EECP. Moreover, the inclusion of EECP in CMS reimbursement schedules under specific conditions has removed a significant barrier for healthcare providers.

In urban regions such as New York, Chicago, and Los Angeles, leading cardiac hospitals have integrated EECP into their cardiovascular wellness programs. Conversely, rural regions, particularly in states like Alabama and Mississippi, are exploring home-based therapy trials to combat healthcare access disparities. Additionally, U.S.-based companies have been at the forefront of device innovation, setting the tone for global ECP developments.

Some of the prominent players in the U.S. external counterpulsation devices market include:

- Vaso Corporation

- ACS Diagnostics

- Scottcare Corporation

- Cardiomedics Inc

Recent Developments

-

VasoMedical Inc., one of the pioneers in EECP technology, announced in February 2025 that it is developing a compact EECP device prototype designed for home use. The device will include wireless monitoring and AI-driven pressure modulation systems.

-

Renew Group Private Limited, although based in Singapore, has expanded its U.S. presence by partnering with cardiac centers in Florida and Texas in March 2025, rolling out its new Renew NCP-5 EECP model equipped with ECG synchronization.

-

Applied Cardiac Systems, based in California, launched a pilot program in April 2025 in collaboration with Cleveland Clinic to evaluate the effectiveness of home-based EECP therapy in heart failure patients.

-

In January 2025, Cardiowave Inc., a U.S. med-tech startup, secured a $12 million Series A funding round to develop portable EECP devices with Bluetooth-enabled physician dashboards aimed at outpatient and home-care settings.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. external counterpulsation devices market

By Product

- Pneumatic ECP Devices

- Electrocardiogram (ECG)-Synchronized ECP Devices

- Enhanced External Counterpulsation (EECP) Devices

By End-use

- Hospitals

- Cardiac Centers