U.S. Eye Care Services Market Size and Research

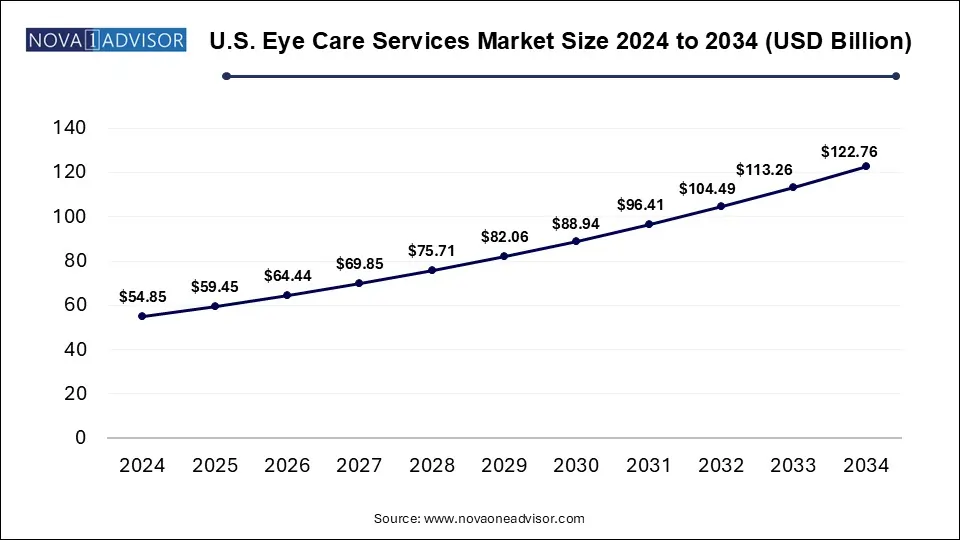

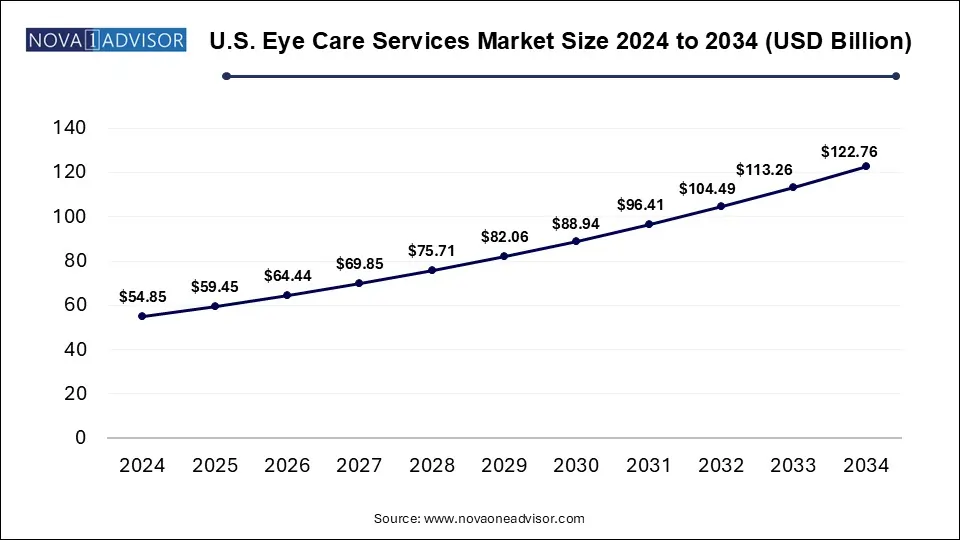

The U.S. eye care services market size was exhibited at USD 54.85 billion in 2024 and is projected to hit around USD 122.76 billion by 2034, growing at a CAGR of 8.39% during the forecast period 2025 to 2034.

Key Takeaways:

- Surgical interventions emerged as the top-performing segment in 2024, accounting for the highest revenue contribution at 46%.

- Refractive errors, encompassing conditions like myopia, hyperopia, astigmatism, and presbyopia, represented the most lucrative indication category, generating 39% of total market revenue in 2024.

- Standalone eye clinics captured the largest portion of the provider segment, holding a dominant 35% share of market revenue in 2024.

- In 2024, the Southeast region took the lead in the U.S. eye care services market, commanding the highest regional revenue share at 27%.

Market Overview

The U.S. eye care services market represents a robust and evolving component of the nation's healthcare system, addressing both preventive and curative eye health needs for millions of individuals. Valued at billions of dollars in 2024, this market is driven by the growing prevalence of visual impairments, increased awareness about eye health, rising geriatric population, and technological advancements in diagnostic and surgical procedures. The market encompasses a wide array of services, from basic vision testing and prescription eyewear to highly sophisticated surgeries addressing complex ocular disorders such as cataracts, glaucoma, and diabetic retinopathy.

Demand for eye care services is further fueled by systemic conditions like diabetes and hypertension, which can manifest as secondary eye conditions. The increasing screen time due to digital device usage across age groups has also contributed to the growing need for vision correction, eye strain management, and dry eye treatments. The U.S. government and private insurers have gradually expanded coverage for vision-related services, supporting a broader patient base.

According to the Centers for Disease Control and Prevention (CDC), approximately 93 million adults in the U.S. are at high risk for serious vision loss, yet only about half have visited an eye doctor in the past year. This disparity points to a significant opportunity within the market for expanded services, awareness campaigns, and improved access to care. The rise of optical retail chains offering in-house optometry, increased specialization in standalone clinics, and partnerships between academic institutions and care providers continue to reshape the competitive landscape.

Major Trends in the Market

-

Rise of tele-optometry services: Virtual consultations for eye exams and follow-up care surged post-COVID-19, increasing convenience and access for rural or mobility-limited patients.

-

Integration of AI in diagnostics: AI-based retinal image analysis and predictive modeling tools are increasingly being adopted for early detection of diabetic retinopathy and age-related macular degeneration.

-

Retail-driven eye care expansion: Chains like Warby Parker and LensCrafters are integrating diagnostics and refractive services into retail environments to streamline care.

-

Increasing preference for minimally invasive surgeries: Technological advancements have made surgeries such as LASIK and glaucoma interventions less invasive, with faster recovery times.

-

Blue light filtering and digital strain solutions: Demand for computer vision syndrome products and services is growing due to increased screen exposure in working professionals and students.

-

Pediatric ophthalmology growth: Early detection programs in schools and the increasing recognition of childhood vision disorders are expanding pediatric services.

-

Personalized medicine in ocular care: Genetic testing and tailored treatment plans are emerging in advanced eye disease management.

Report Scope of U.S. Eye Care Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 59.45 Billion |

| Market Size by 2034 |

USD 122.76 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.39% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service Type, Indication, Provider Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

US Eye; Alcon; Topcon Corporation; iCARE HEALTH SOLUTIONS; Eye Associates of New Mexico; St. Michael's Eye & Laser Institute; Cleveland Clinic; UC San Diego Health; Eye Center of Northern Colorado; UH Health; Wills Eye Hospital |

Market Driver: Growing Prevalence of Eye Disorders Among Aging Population

One of the most significant drivers in the U.S. eye care services market is the increasing prevalence of vision disorders among the aging population. The Baby Boomer generation, now reaching retirement age, is experiencing higher rates of age-related eye conditions such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy. According to the National Eye Institute, by 2030, the number of Americans suffering from blindness or low vision is expected to double to over 8 million due to the aging demographic.

This demographic shift places immense pressure on the eye care services infrastructure to scale diagnostic, surgical, and maintenance services. Older adults also require more frequent visits to manage progressive conditions, increasing the lifetime value of each patient. The Medicare program's coverage for eye exams related to diabetes and other conditions has further supported access for seniors, leading to higher volumes of service utilization across both public and private sectors.

Market Restraint: Unequal Access and Insurance Coverage Limitations

A prominent restraint in the U.S. eye care services market is the unequal access to care stemming from variable insurance coverage and geographic disparities. Despite efforts to include vision services under health plans, many routine procedures, particularly for adults, remain out-of-pocket expenses under employer-based or individual insurance policies. Medicaid coverage for eye care also varies significantly from state to state.

This inconsistency in financial support limits access for low-income populations and discourages preventative care, often resulting in more severe conditions that are costlier to treat. In rural areas, the shortage of optometrists and ophthalmologists adds a geographic barrier, compounding the problem. The result is a market that, while lucrative in urban and suburban centers, faces stagnation in underserved regions where the need for services is equally, if not more, pressing.

Market Opportunity: Technological Integration in Routine Eye Care

An emerging opportunity lies in the integration of technology into routine eye care services, particularly through AI-powered diagnostics, mobile eye testing tools, and teleophthalmology platforms. As software becomes more sophisticated, optometrists and ophthalmologists can offer faster, more accurate diagnoses for conditions such as diabetic retinopathy, glaucoma, and macular degeneration.

Several startups and established firms have developed cloud-based platforms where patients can upload images of their retina taken via mobile devices or kiosks and receive risk assessments. Retailers are also installing digital kiosks for automated eye exams. The introduction of virtual try-on technology for eyewear, combined with online scheduling and prescription management, enhances the consumer experience and opens new revenue streams for clinics and optical retailers alike.

Segmental Analysis

Service Type Outlook

Vision testing and eye exams dominated the service type segment in 2024 due to their widespread application across all age groups for both routine and diagnostic purposes. This segment benefits from its relatively low cost and high frequency of use, often serving as the entry point for patients into the broader eye care ecosystem. Routine checkups are especially important for early detection of refractive errors and ocular diseases such as glaucoma or AMD, making them a critical revenue stream. Insurance providers and wellness programs also incentivize annual vision exams, further solidifying the segment’s dominance.

Surgical interventions are expected to be the fastest-growing segment over the forecast period. With an aging population and greater awareness of corrective procedures, surgeries like cataract removal, LASIK, and glaucoma treatments are increasing in demand. Cataract surgery, in particular, is the most performed outpatient procedure in the U.S., with over 3 million surgeries annually. Refractive surgeries are also seeing increased traction among younger populations seeking alternatives to glasses or contact lenses. The availability of advanced technologies such as femtosecond lasers and robotic-assisted surgery is making procedures safer, faster, and more appealing.

Indication Outlook

Refractive errors accounted for the largest market share in the indication segment as they affect a vast majority of the U.S. population across all age groups. Conditions such as myopia, hyperopia, and astigmatism are typically addressed through prescription eyewear, contact lenses, or surgical correction, creating steady demand. The ubiquity of digital screens in work and educational environments has also led to an increase in screen-related eye strain, exacerbating refractive issues in younger demographics. Regular eye exams to correct vision through lenses continue to be the primary intervention strategy.

Dry eye syndrome is expected to witness the fastest growth during the forecast period, largely due to lifestyle and environmental changes. Increased screen time, air pollution, aging, and side effects of certain medications contribute to the growing prevalence of this condition. The rise in minimally invasive treatments, such as intense pulsed light (IPL) therapy, combined with over-the-counter artificial tear products and prescription medications, has broadened the therapeutic landscape. Moreover, consumer education campaigns have increased awareness, leading more individuals to seek professional care rather than self-medicate.

Provider Type Outlook

Standalone eye clinics led the provider segment in 2024, driven by their specialization, convenience, and ability to deliver personalized care. These clinics often offer a comprehensive range of services under one roof, including diagnostics, vision correction, and even minor surgical procedures. Their agility in adopting new technologies and offering flexible appointment options makes them highly attractive, especially in suburban and urban regions. Many standalone clinics also develop strong referral networks with opticians and primary care providers, increasing their patient base.

Optical retail chains with in-house eye care services are projected to be the fastest-growing provider type. Companies like Warby Parker and Walmart Vision Center are redefining eye care access by integrating clinical services with product sales. This vertical integration allows for quick turnarounds from diagnosis to eyewear purchase, enhancing customer convenience. These chains also benefit from economies of scale, making services more affordable and attractive to cost-conscious consumers. Their presence in both urban and semi-urban areas has enabled rapid expansion and customer acquisition.

Country-Level Analysis (U.S.)

Across the United States, regional disparities in healthcare infrastructure have created varying demand levels for eye care services.

The Northeast region leads in per capita utilization of eye care services due to its dense urban population, higher income levels, and better access to specialists and clinics. States like New York and Massachusetts have some of the highest rates of vision insurance coverage and ophthalmologist availability. The region also benefits from the presence of academic institutions and research hospitals contributing to innovations in eye care.

The Southeast and Midwest regions show significant growth potential, driven by efforts to address historically underserved populations. Teleophthalmology and mobile diagnostic units have gained traction in rural counties, improving early detection and access. State-level public health initiatives targeting diabetic eye disease and pediatric vision screenings are also enhancing demand. In contrast, the Southwest and Western states, particularly California and Arizona, are seeing growth fueled by aging populations and an influx of retirees.

Some of The Prominent Players in The U.S. Eye Care Services Market Include:

- US Eye

- Alcon

- Topcon Corporation

- iCARE HEALTH SOLUTIONS

- Eye Associates of New Mexico

- St. Michaels Eye & Laser Institute

- Cleveland Clinic

- UC San Diego Health

- Eye Center of Northern Colorado

- UH Health

- Wills Eye Hospital

Recent Developments

-

April 2025 – Warby Parker announced the expansion of its in-house optometry services across 100 new retail locations in the U.S., targeting both urban and suburban populations.

-

February 2025 – Johnson & Johnson Vision received FDA clearance for its next-generation TECNIS Synergy IOL, expanding options for cataract surgery patients seeking enhanced visual outcomes.

-

January 2025 – VSP Vision Care launched a new AI-powered screening tool integrated with electronic health records, aiming to improve detection of diabetic retinopathy during routine visits.

-

November 2024 – EyeCare Partners, a leading U.S. provider of clinically integrated eye care, acquired Retina Consultants of Texas to expand its footprint in specialized retinal services.

-

September 2024 – Bausch + Lomb introduced a new line of over-the-counter eye drops formulated specifically for prolonged digital device users, under the brand name Lumify Max.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Eye Care Services Market.

By Service Type

- Vision Testing & Eye Exams

- Surgical Interventions

-

- Cataract Surgery

- Refractive Surgery

- Glaucoma Surgery

- Retinal Surgery

- Corneal Surgery

- Others

- Primary care services

- Others

By Indication

- Refractive Errors

- Cataracts

- Glaucoma

- Age-related Macular Degeneration (AMD)

- Diabetic Retinopathy

- Dry Eye Syndrome

- Others

By Provider Type

- Standalone Eye Clinics

- Multispecialty Hospitals

- Optical Retail Chains with Eye Care Services

- Academic & Research Institutions

- Others

By Country

- Northeast

- Southeast

- Midwest

- Southwest

- West