U.S. Family Floater Health Insurance Market Size and Trends

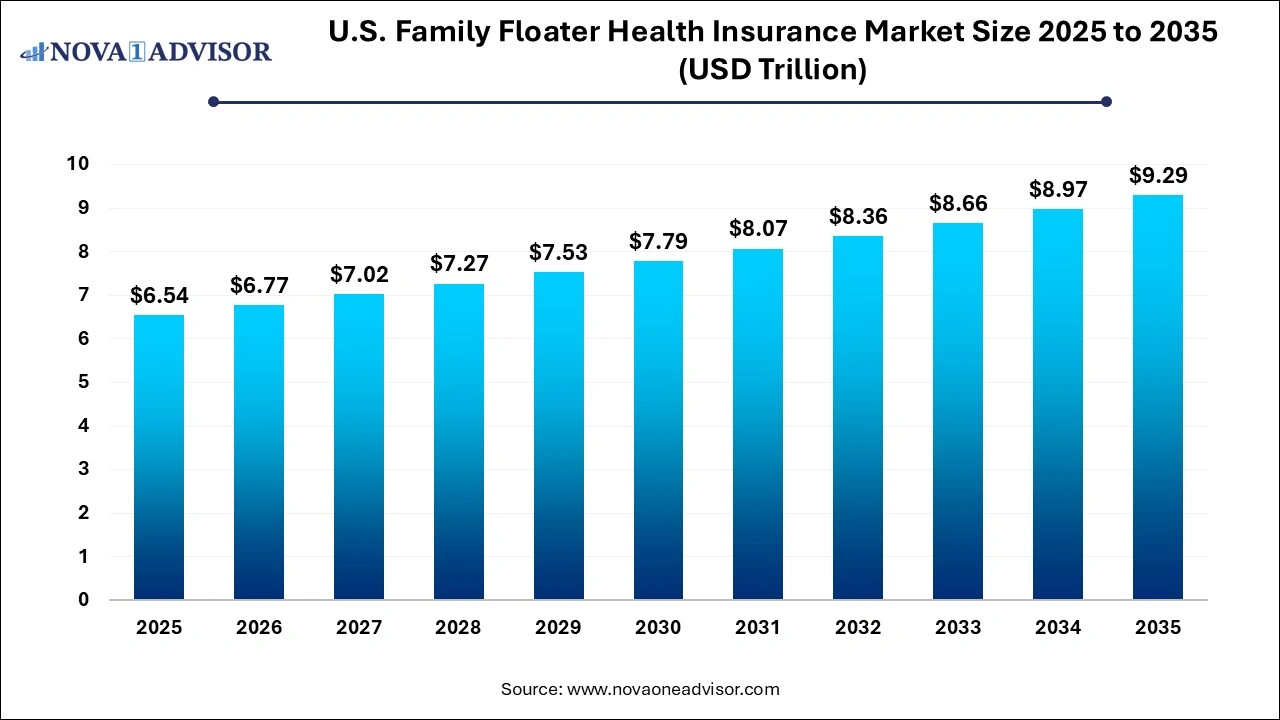

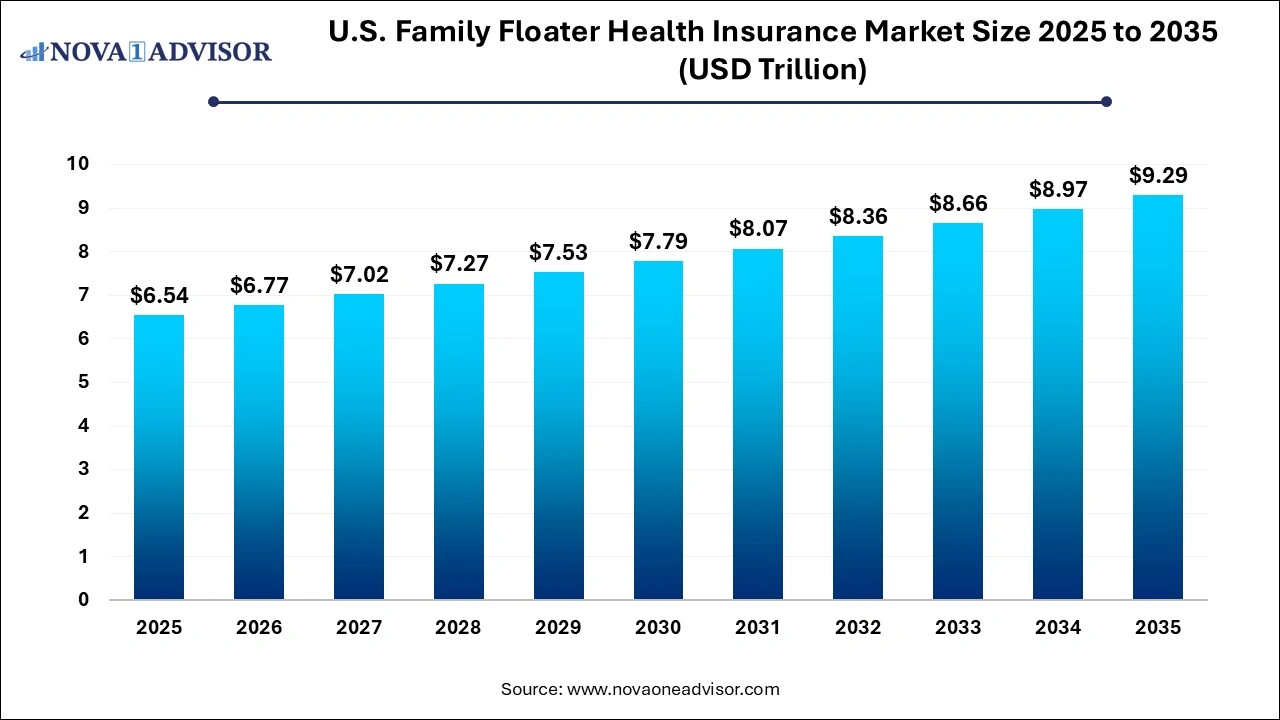

The U.S. family floater health insurance market size was exhibited at USD 6.54 trillionin 2025 and is projected to hit around USD 9.29 trillion by 2035, growing at a CAGR of 3.57% during the forecast period 2026 to 2035.

Key Takeaways:

- According to type, the private segment dominated the market in 2025.

- In 2023, the married couples segment commanded the largest revenue share, due to a significant percentage of married couples implementing family floater insurance.

- The unmarried female reference person held the second-highest market share in 2025 and is expected to witness maximum growth over the forecast period.

- At or above 400 percent of the poverty segment accounted for the highest market share in 2025.

U.S. Family Floater Health Insurance Market Overview

The U.S. family floater health insurance market represents a growing subset of the broader health insurance ecosystem, specifically designed to offer consolidated medical coverage to entire families under a single premium. A family floater plan insures multiple members usually including parents and children under one sum insured, which can be utilized by any insured family member during the policy term. This model is increasingly appealing in the U.S. healthcare landscape due to its cost-efficiency, simplicity, and alignment with evolving household structures.

Traditionally more popular in countries like India, the family floater model is now gaining traction in the U.S., where rising healthcare costs, demand for flexible coverage, and personalized plan designs are driving interest. As healthcare inflation surges and households become more budget-conscious, insurers are exploring ways to offer tailored solutions that reduce premium outlays while expanding coverage access. The family floater plan addresses this need by allowing families to pool resources under a unified coverage limit, simplifying administrative processes and improving affordability.

The U.S. market is also characterized by diversity in household types from married couples with dependents to multigenerational families, unmarried individuals with children, and unrelated subfamilies. This diversity has fueled innovation in policy structures and insurer strategies, leading to a more inclusive insurance landscape. Public and private insurers are both contributing to the growth of this segment, with state Medicaid programs, marketplace plans under the Affordable Care Act (ACA), and private carriers offering group and individual floater options.

In a healthcare environment that emphasizes preventive care, affordability, and streamlined service, family floater health insurance is poised to become a vital tool for comprehensive household risk management in the United States.

Major Trends in the U.S. Family Floater Health Insurance Market

-

Flexible Plan Structures for Diverse Families: Insurers are tailoring plans for non-traditional households, including single-parent families, cohabiting partners, and unrelated subfamilies.

-

Integration with Preventive and Wellness Services: Floater plans increasingly include benefits such as annual checkups, telehealth consultations, mental health support, and fitness incentives.

-

Digital Enrollment and App-Based Management: Carriers are offering mobile platforms to help families manage claims, track deductibles, and find in-network care.

-

Customizable Deductible and Co-pay Models: Plans now allow policyholders to adjust deductibles and copays based on income and healthcare preferences.

-

Rise in Marketplace Adoption: ACA marketplaces are offering expanded family plans with increased subsidies, driving enrollment across income brackets.

-

Bundled Benefits: Some insurers are offering family floaters bundled with dental, vision, and even maternity or pediatric-specific riders.

-

Employer-Sponsored Flexibility: Large employers are allowing employees to include non-spousal dependents under broader floater plans.

-

Focus on Health Equity: Tailored plans aim to serve low-income households and racially diverse communities with higher uninsured rates.

Report Scope of The U.S. Family Floater Health Insurance Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.77 Trillion |

| Market Size by 2035 |

USD 9.29 Trillion |

| Growth Rate From 2026 to 2035 |

CAGR of 3.57% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Household Relations, Income-to-poverty Ratio, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

Northeast; Midwest; South; West |

| Key Companies Profiled |

Cigna; Bupa; Now Health International; Blue Cross Blue Shield Association; Kaiser Foundation Grp; Anthem, Inc. (Now Elevance Health); The IHC Group; Health Partners Group Ltd.; Aviva; Providence Health Plan; Harvard Pilgrim Health Care, Inc. |

Market Driver: Increasing Demand for Cost-Efficient, Simplified Family Coverage

A primary driver of the U.S. family floater health insurance market is growing consumer demand for cost-efficient, simplified coverage that addresses the entire household’s needs without the complexity of managing multiple individual plans. As medical premiums and out-of-pocket expenses continue to rise, families are seeking solutions that combine affordability with convenience. A family floater plan streamlines policy management, aggregates claims under one deductible and one out-of-pocket maximum, and ensures consistent coverage terms across all dependents.

For example, consider a married couple with two children. Rather than buying four separate plans or individual coverage for adults and dependents, the family floater allows a shared annual limit say $20,000 usable by any member as needed. This flexibility is particularly advantageous when medical costs are unpredictable, or one member requires higher care than others. Additionally, insurers save on administrative overhead, allowing them to pass cost benefits on to policyholders. As a result, these plans are becoming a go-to option for middle-income families aiming to protect their loved ones without straining household budgets.

Market Restraint: Regulatory Complexity and Limited Awareness

Despite its benefits, a key restraint in the U.S. market is regulatory complexity coupled with limited consumer awareness of family floater plans. Health insurance in the U.S. is governed by a mix of federal mandates, state-specific rules, and private underwriting criteria, making it difficult to design standardized floater offerings that are compliant across all jurisdictions.

Furthermore, the concept of "family" differs legally and culturally, impacting who qualifies as a dependent or eligible member under a single policy. This ambiguity often leads to hesitancy among insurers, especially in segments where unconventional household configurations such as unmarried partners or adult dependents are involved. Additionally, most consumers are more familiar with traditional individual or employer-sponsored plans and may not understand the potential advantages of a floater structure. Overcoming this gap will require targeted marketing, regulatory collaboration, and consumer education initiatives.

Market Opportunity: Expansion Through ACA Subsidies and Medicaid Innovation

An emerging opportunity lies in leveraging ACA subsidies and Medicaid innovations to expand family floater offerings among low- and middle-income households. With the extension of premium tax credits under the American Rescue Plan and Inflation Reduction Act, millions of families now qualify for subsidized marketplace coverage. This policy environment enables insurers to design family plans that are more affordable and broadly accessible.

States experimenting with Medicaid buy-in options and managed care models also create room for public-sector floaters, particularly for families with mixed eligibility (e.g., one parent on Medicaid, others on CHIP or employer coverage). For instance, a state could allow a Medicaid managed care organization to offer a floater-style plan with income-adjusted premiums and integrated pediatric dental, behavioral health, and chronic care management services. These public-private hybrid models can fill coverage gaps, promote health equity, and reduce administrative fragmentation—presenting a lucrative opportunity for insurers and policymakers alike.

Segmental Insights

By Type Insights

Private insurers dominate the U.S. family floater health insurance market, particularly among middle- to high-income earners seeking customized, network-flexible plans. Carriers like Blue Cross Blue Shield, Aetna, and UnitedHealthcare have launched tailored family policies with a range of deductible options, telemedicine integrations, and multi-specialty access. These private offerings often come with added value services such as fitness rewards, nutrition counseling, and pharmacy benefits management, which appeal to urban and suburban households.

Public plans are the fastest growing, thanks to expanded ACA subsidies and Medicaid eligibility across many states. Programs like CHIP and Medicaid Managed Care are offering more inclusive, family-centric benefits, targeting low-income populations that historically struggled with fragmented or incomplete coverage. States like California and New York have introduced models that allow for mixed household coverage coordination, ensuring families aren’t forced to split between public and private plans. As regulatory clarity increases and federal funding stabilizes, public sector family floaters are likely to see accelerated adoption.

By Household Relations Insights

Married couple families represent the dominant segment, reflecting the traditional structure around which most family health insurance products are designed. These households typically include two adults and one or more dependent children. Insurers cater to this group with bundled policies offering pediatric care, maternity coverage, and family preventive screenings. These plans often include tiered co-pay structures and are marketed as predictable, all-in-one solutions for nuclear families with stable incomes.

Unmarried female reference persons are the fastest growing household segment in the family floater market. This trend reflects the increasing number of single mothers, cohabiting partners, and women-led households, many of which face unique economic and healthcare challenges. In 2024, several insurers introduced new family plan designs aimed at single mothers, including postpartum support, pediatric behavioral health, and subsidized wellness services. These plans often offer flexibility around who can be included as a dependent, recognizing that traditional definitions of “family” no longer capture the full demographic spectrum.

By Income-to-Poverty Ratio Insights

Households earning at or above 400% of the federal poverty level (FPL) dominate the family floater market, as they can typically afford unsubsidized or minimally subsidized premiums. These consumers often select private marketplace plans or employer-sponsored family policies with generous networks and low deductibles. They also show higher engagement with add-on services like mental health support, alternative therapies, and maternity navigation. This segment favors choice and service quality, making it a key target for innovation and upselling.

Families with income below 200% of FPL are the fastest growing participants, owing to expanded federal subsidies and Medicaid enrollment growth. The enhanced tax credits provided under recent legislation allow many of these families to access quality coverage for less than $100 per month. Insurers and state exchanges are responding with simplified enrollment tools, multilingual outreach, and plan designs tailored to lower-income households. This affordability surge is expected to drive high-volume growth in floater enrollments within this demographic, especially for plans with integrated behavioral and child health components.

Country-Level Insights – United States

The U.S. Family Floater Health Insurance Market is uniquely shaped by its decentralized healthcare system, regulatory fragmentation, and diversity of household structures. While most insurers continue to offer individual and employer-linked coverage as the primary model, the family floater concept is gradually being integrated into both public and private offerings to meet evolving demands. Legislative changes under the ACA and subsequent expansions have facilitated wider coverage, but challenges around affordability, plan design complexity, and health equity persist.

Federal and state exchanges, such as Healthcare.gov and Covered California, are increasingly featuring family-based plans that emphasize tax savings and broader coverage benefits. At the same time, Medicaid programs in states like Minnesota, Oregon, and Massachusetts are experimenting with family-centric delivery models that blend preventive services with chronic disease management. Insurance literacy and culturally competent outreach are also gaining attention, as diverse households seek clarity around eligibility, premiums, and benefit coordination.

The U.S. continues to be a pioneer in healthcare financing innovation, and the integration of floater models into family insurance portfolios is part of a broader shift toward consumer-centered, value-based care systems. As digital tools mature and regulatory frameworks evolve, the U.S. is expected to witness a sharp uptick in family floater adoption, especially among non-traditional households and lower-income groups.

Some of the prominent players in the U.S. family floater health insurance market include:

- Cigna

- Bupa

- Now Health International

- Blue Cross Blue Shield Association

- Kaiser Foundation Grp

- Anthem, Inc. (Now Elevance Health)

- The IHC Group

- Health Partners Group Ltd

- Aviva

- Providence Health Plan

- Harvard Pilgrim Health Care, Inc.

Recent Developments

-

February 2024 – Blue Cross Blue Shield announced a suite of new family plans that include expanded pediatric telehealth and prenatal care for single-parent households, targeting both public and private marketplace enrollees.

-

January 2024 – Cigna Healthcare introduced an AI-driven claims and care coordination app for family floater policyholders, improving real-time deductible tracking and benefit usage optimization.

-

December 2023 – UnitedHealthcare expanded its family policy options in 12 states, including features such as virtual behavioral health, lifestyle coaching, and family-centered maternity support.

-

October 2023 – Kaiser Permanente piloted a family wellness plan in California offering combined services for parents and children, including nutrition counseling and ADHD screening within a single bundled premium.

-

August 2023 – Oscar Health launched a marketplace plan designed specifically for LGBTQ+ families, offering expanded definitions of household members and inclusive fertility

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. family floater health insurance market

Type

Household Relations

- Married Couple Family

- Unmarried Male Reference Person

- Unmarried Female Reference Person

- Unrelated Subfamilies

- Secondary Individuals

Income-to-Poverty Ratio

- Below 100 Percent of Poverty

- Between 100 And 199 Percent of Poverty

- Between 200 And 299 Percent of Poverty

- Between 300 And 399 Percent of Poverty

- At Or Above 400 Percent of Poverty

Regional