U.S. Flexitank Market Size and Trends

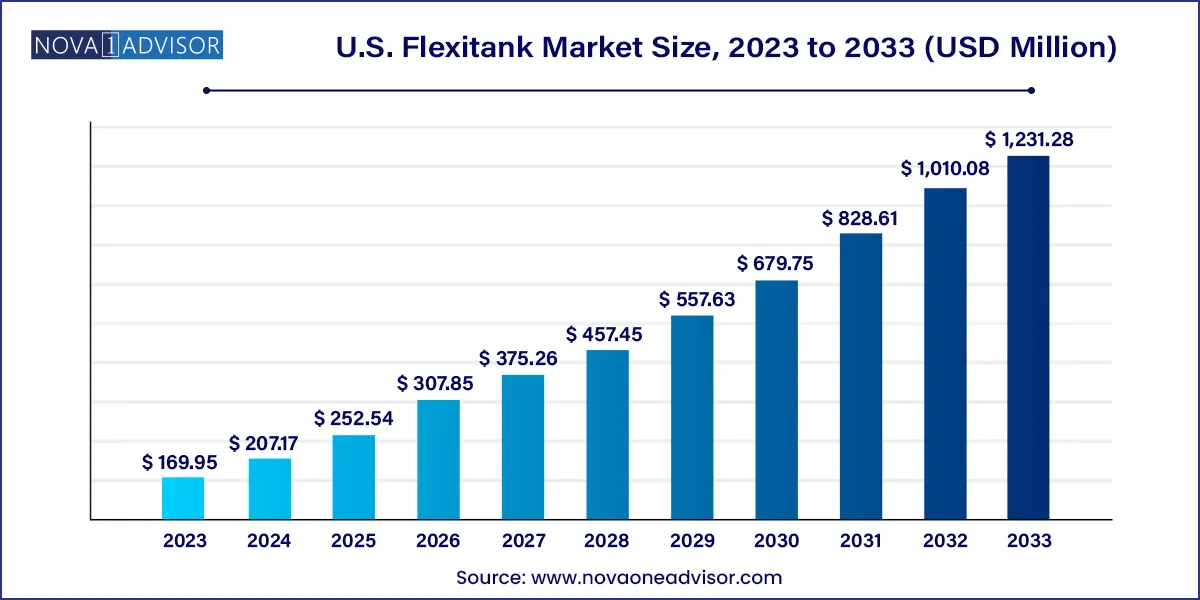

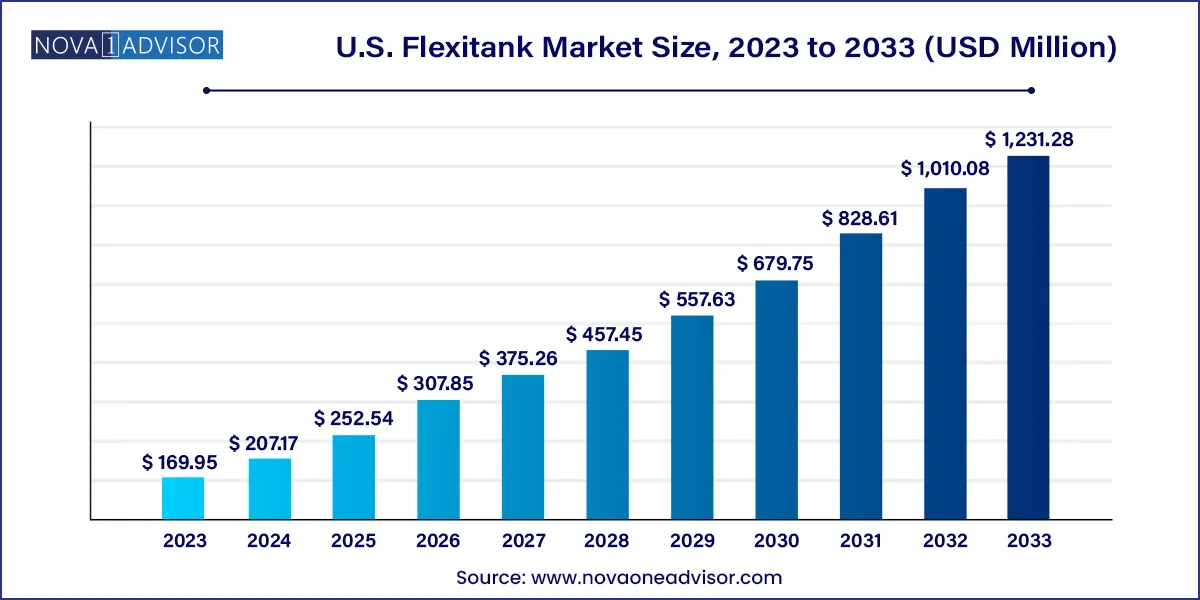

The U.S. flexitank market size was exhibited at USD 169.95 million in 2023 and is projected to hit around USD 1,231.28 million by 2033, growing at a CAGR of 21.9% during the forecast period 2024 to 2033.

U.S. Flexitank Market Key Takeaways:

- The industrial products segment dominated the market and accounted for largest revenue share of over 21.0% in 2023.

- The single-trip segment led flexitank market in U.S. and registered largest market share of over 92.0% in 2023.

- The multi-trip segment maintained a substantial market share in 2023.

Market Overview

The U.S. Flexitank Market has evolved into a vital component of the nation’s bulk liquid logistics infrastructure, offering a modern alternative to traditional drums, IBCs (Intermediate Bulk Containers), and ISO tanks. A flexitank is a large, multilayered, flexible container made from polyethylene and polypropylene, designed to fit into standard 20-foot containers to transport non-hazardous liquids in bulk quantities typically up to 24,000 liters.

In the United States, demand for efficient and cost-effective bulk liquid transport has surged, driven by rapid growth in agriculture exports, chemical manufacturing, wine and beverage shipments, and pharmaceutical supply chains. Flexitanks offer superior loading capacity, ease of installation, single-use sanitation, and reduced carbon footprint, all of which align with the evolving needs of U.S. shippers, especially in the context of sustainability, efficiency, and automation.

The competitive edge of flexitanks lies in their adaptability, hygienic transport assurance, and ability to convert a dry container into a liquid-carrying unit without significant infrastructure changes. As industries across the U.S. expand their global trade footprint, especially to Asia and Latin America, the domestic flexitank market is expected to scale in tandem with growing liquid cargo volumes.

Major Trends in the Market

-

Adoption of Single-use Sanitary Flexitanks: U.S. shippers are increasingly favoring disposable flexitanks, particularly for food-grade and pharmaceutical liquids, to minimize contamination risks.

-

Integration with Smart Logistics: Flexitanks embedded with IoT sensors and remote monitoring systems are being used to track temperature, pressure, and movement in real-time.

-

Sustainability Focus: Companies are shifting to recyclable and biodegradable flexitank materials to align with corporate ESG goals and state-level waste reduction mandates.

-

Surge in Wine and Beverage Exports: California's wine industry is adopting flexitanks for bulk exports due to reduced spoilage, cost savings, and quality preservation during transit.

-

Shift Toward Multi-Trip Models for Domestic Logistics: While export still favors single-use, local bulk transport is exploring reusable flexitank models, especially in chemicals and oils.

-

Regulatory Acceptance and Standardization: Growing compliance with FDA, USDA, and ISO standards has enhanced trust in flexitanks for critical sectors like pharma and food.

-

E-commerce-driven Packaging Evolution: As D2C (Direct-to-Consumer) food and beverage businesses scale, there's a rising need for last-mile compatible flexitank modules for centralized filling and distribution.

Report Scope of U.S. Flexitank Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 207.17 Million |

| Market Size by 2033 |

USD 1,231.28 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 21.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Environmental Packaging Technologies, Inc.; TechnoGroupUSA; Trans Ocean Bulk Logistics; SIA Flexitanks; UWL Inc.; ASF Logistics; TSC Container Freight; Transolve global; ECU Worldwide. |

Key Market Driver: Efficiency and Cost-Savings in Bulk Liquid Transportation

One of the primary drivers of the U.S. flexitank market is the significant cost-efficiency and operational benefits flexitanks provide over conventional bulk liquid transport methods. Compared to drums and IBCs, a flexitank can carry up to 40% more product per container, reducing the number of containers required per shipment. This directly translates into lower freight costs, improved fuel efficiency, and reduced handling time at both origin and destination.

For example, a 20-foot container using IBCs or drums can typically carry around 16,000 liters of liquid, whereas a flexitank can hold up to 24,000 liters. The reduction in container count, labor for cleaning or repositioning, and administrative coordination offers substantial savings for businesses transporting edible oils, chemicals, and wine—three major sectors with high bulk liquid shipping volumes in the U.S.

Additionally, U.S.-based exporters find flexitanks highly advantageous for international shipments, especially to Asia-Pacific, Latin America, and Europe, where handling infrastructure is compatible and importers prefer bulk liquid formats for local bottling and processing.

Key Market Restraint: Limitations with Hazardous Liquids and Regulatory Restrictions

Despite the numerous advantages, the flexitank market faces a significant restraint: incompatibility with hazardous or reactive chemicals. U.S. federal transportation guidelines, including those governed by the Department of Transportation (DOT) and the Environmental Protection Agency (EPA), limit the use of flexitanks for corrosive, flammable, or highly volatile substances due to safety concerns.

Materials like concentrated acids, solvents, and certain petroleum-based liquids cannot be transported using flexitanks under current regulations. Furthermore, improper installation or usage can lead to leaks, ruptures, or contamination, which pose safety, legal, and reputational risks for shippers.

Another challenge is the lack of consistent recycling infrastructure for used flexitank films across U.S. ports. While recycling initiatives exist in some states, others still face issues with waste management and regulatory clarity regarding multi-material laminate disposal.

Key Market Opportunity: Expansion into Pharmaceutical and Temperature-Sensitive Goods

A significant emerging opportunity for the U.S. flexitank market lies in the transport of pharmaceutical goods and temperature-sensitive liquids, such as biological enzymes, glucose solutions, liquid nutraceuticals, and fermentation products. As pharma manufacturers seek sterile, contamination-free, and tamper-evident transport solutions, flexitanks are gaining traction—especially bag-in-bag systems designed to meet stringent GMP, USP, and FDA regulations.

Innovations such as insulated flexitanks, multi-layer high-barrier films, and real-time temperature monitoring systems are making it feasible to use flexitanks in cold chain and controlled-temperature logistics, which previously relied on high-cost alternatives like refrigerated ISO tanks.

This application area is particularly promising for U.S. companies involved in vaccine ingredients, blood plasma derivatives, and fermentation-based active pharmaceutical ingredients (APIs). With increasing demand for domestic and cross-border pharma transport, flexitank-enabled logistics provide a scalable, sanitary, and cost-efficient alternative.

U.S. Flexitank Market By Application Insights

Food stuffs hold the largest market share within applications, driven by robust U.S. exports of edible oils (soybean, corn, sunflower), sweeteners, syrups, and liquid concentrates. Flexitanks are increasingly used in the export of bulk tomato paste, fruit juices, and liquid glucose, reducing reliance on drums and metal containers. The segment's dominance is bolstered by the FDA's acceptance of flexitanks for food-grade cargo, provided appropriate certification and handling protocols are followed.

Pharmaceutical goods are the fastest-growing application segment, due to increased demand for specialty chemical transport and temperature-sensitive biological ingredients. U.S. pharmaceutical logistics providers are exploring flexitank use in bioprocessing supply chains, including the bulk shipment of media buffers, fermentation broths, and other high-value liquids. The recent shift toward domestic manufacturing and regional distribution of biologics also supports greater adoption of high-performance, pharma-grade flexitanks.

U.S. Flexitank Market By Type Insights

Single-trip flexitanks dominated the market, especially for international exports. These are designed for one-time use, ensuring sanitary transport without the risk of cross-contamination. The U.S. agriculture and beverage sectors, particularly soy oil exporters and wine producers, overwhelmingly prefer single-use tanks due to their hygiene, cost efficiency, and disposal ease. These tanks also align well with U.S. sanitary export requirements and are often certified under international food-grade standards.

Multi-trip flexitanks are the fastest-growing segment, primarily in domestic intermodal and road transport. Industrial users shipping base oils, lubricants, or adhesives are beginning to adopt re-usable flexitanks due to improved liner durability and economic returns from repeated usage. Additionally, advancements in cleaning technologies and reconditioning protocols are allowing certain U.S. carriers to offer closed-loop logistics solutions for clients interested in sustainability and waste minimization.

Country-Level Analysis

As the sole country under analysis, the United States leads in the adoption, manufacturing, and export use of flexitank systems within North America. U.S.-based exporters, particularly those in California, Texas, and the Midwest, are key drivers of volume due to their involvement in wine, oilseed, corn syrup, and chemical production.

U.S. ports such as Long Beach, Savannah, Houston, and Newark are equipped with facilities to handle flexitank shipments, and many third-party logistics providers (3PLs) now offer installation, loading, and disposal services as part of end-to-end bulk liquid transport offerings.

Additionally, with U.S. exporters seeking alternatives to ISO tanks in a post-pandemic global trade environment marked by container shortages and rising freight costs, flexitanks are being embraced as a flexible, agile solution. Domestic freight operators are also leveraging flexitanks for intermodal applications across states where tanker availability is limited or cost-prohibitive.

Some of the prominent players in the U.S. flexitank market include:

- Environmental Packaging Technologies, Inc.

- TechnoGroupUSA

- Trans Ocean Bulk Logistics

- SIA Flexitanks

- UWL Inc.

- ASF Logistics

- TSC Container Freight

- Transolve global

- ECU Worldwide

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. flexitank market

Type

Application

- Food Stuffs

- Wine & Spirits

- Chemicals

- Oils

- Industrial Products

- Pharmaceuticals Goods

- Others