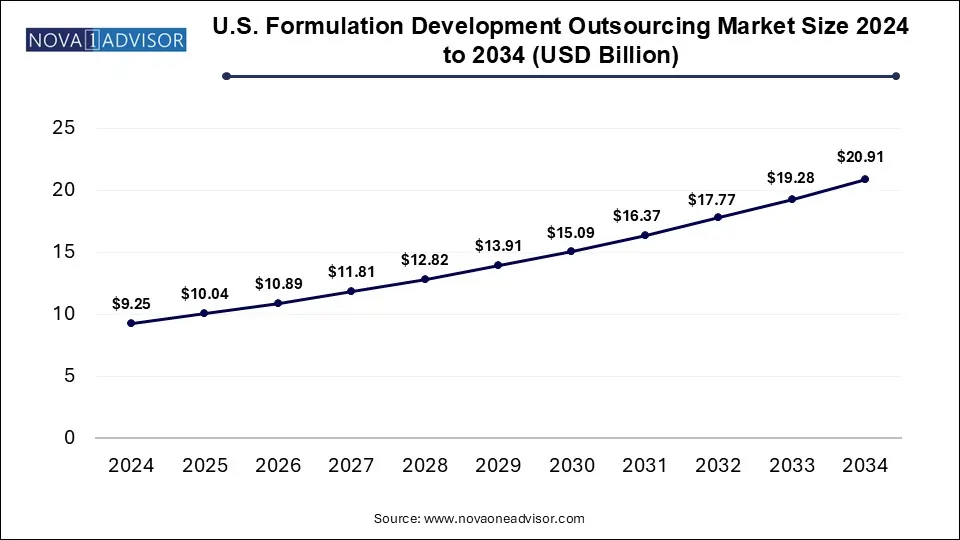

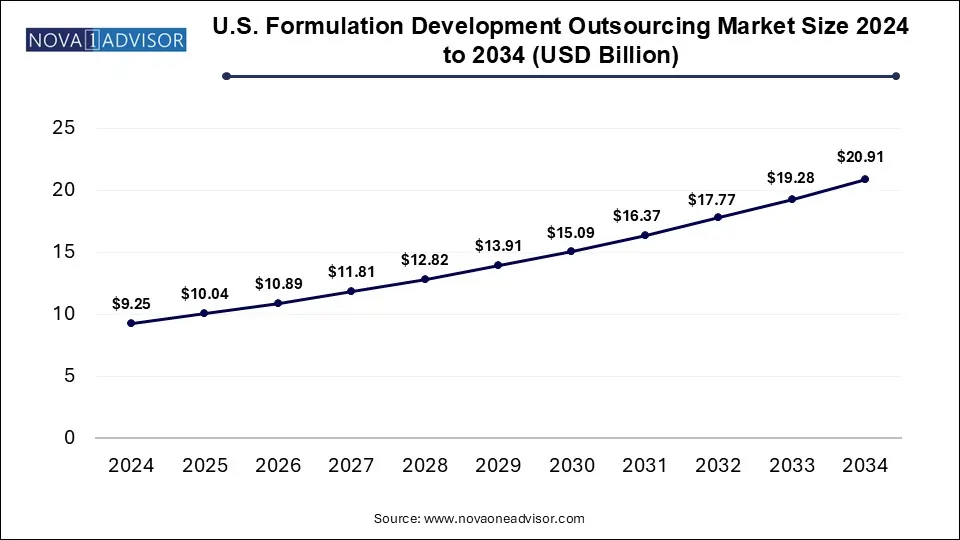

The U.S. formulation development outsourcing market size was exhibited at USD 9.25 billion in 2024 and is projected to hit around USD 20.91 billion by 2034, growing at a CAGR of 8.5% during the forecast period 2025 to 2034.

-

Formulation development services held the leading position in the U.S. formulation development outsourcing market, capturing 78% of the total revenue in 2024.

-

Pre-formulation services are projected to experience notable growth, registering a CAGR of 7.6% throughout the forecast period.

-

Oral formulations emerged as the top segment in the U.S. formulation development outsourcing space, accounting for the highest revenue share in 2024.

-

The oncology therapeutic area was the dominant contributor to revenue in the U.S. formulation development outsourcing market in 2024.

-

Pharmaceutical and biopharmaceutical firms were the primary clients in the U.S. formulation development outsourcing sector, generating the largest portion of revenue in 2024.

Market Overview

The U.S. formulation development outsourcing market plays a pivotal role in the evolution of pharmaceutical innovation, providing a critical bridge between drug discovery and commercialization. As the demand for complex and targeted therapies increases, the need for advanced formulation strategies has surged, leading many pharmaceutical and biotechnology companies to seek external expertise to optimize their R&D pipelines. Formulation development involves the process of designing and testing how a drug is delivered to the patient whether via oral tablets, injectables, topical solutions, or other methods to ensure stability, efficacy, safety, and patient compliance.

Outsourcing these processes allows pharmaceutical developers to reduce time to market, leverage specialized scientific knowledge, minimize operational costs, and enhance flexibility. In the highly regulated and innovation-driven U.S. pharmaceutical environment, contract development and manufacturing organizations (CDMOs) and contract research organizations (CROs) offer formulation services that include preformulation, prototype development, analytical testing, stability assessment, scale-up, and regulatory documentation.

As novel modalities such as biologics, RNA-based drugs, and personalized therapeutics enter the mainstream, the formulation complexity increases. Consequently, many pharma companies particularly small and mid-sized biotechs—outsource development to access cutting-edge technologies like lipid nanoparticle delivery systems, sustained-release formulations, and solubility enhancement platforms. This dynamic has transformed formulation outsourcing into a strategic and indispensable component of drug development in the U.S.

The growth of this market is further supported by robust venture funding in biotech, FDA fast-track approvals, the expansion of orphan drug development, and increasing demand for generic and specialty drugs. As innovation accelerates and regulatory expectations grow, formulation outsourcing partners that provide integrated, high-quality, and compliant services are becoming critical collaborators in the U.S. pharmaceutical value chain.

Major Trends in the Market

-

Rise of Biologics and Complex Molecules: Increasing pipeline complexity has led to demand for advanced formulation technologies tailored to large molecules and poorly soluble compounds.

-

Specialization of CDMOs: Niche players focusing on specific dosage forms (e.g., injectables or oral thin films) are gaining traction for their deep technical expertise.

-

Integrated Outsourcing Models: Clients prefer end-to-end services from preformulation to commercial-scale manufacturing—under one roof, reducing handoff risks.

-

Personalized and Precision Formulations: With the rise of genomics and personalized medicine, customized formulations tailored to individual patients or small populations are being explored.

-

AI and Data-Driven Formulation Design: Artificial intelligence is increasingly used to predict formulation behavior, optimize excipient selection, and reduce trial-and-error experimentation.

-

Growth in Virtual Pharma and Biotech Firms: Emerging biopharmaceutical startups with no internal labs rely entirely on outsourcing partners for formulation development.

-

Regulatory Streamlining for Fast-Tracked Drugs: Accelerated approval pathways require rapid and reliable formulation development, encouraging outsourcing partnerships to expedite timelines.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.04 Billion |

| Market Size by 2034 |

USD 20.91 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2033 |

| Segments Covered |

Service, formulation, therapeutic area |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

SGS S.A.; Intertek Group plc; Recipharm; Lonza; Charles River Laboratories International, Inc.; Eurofins Scientific SE; Element; Labcorp; Thermo Fisher Scientific, Inc. (Patheon); Catalent Inc. |

Market Driver: Expanding Pipeline of Complex Drugs

A key driver propelling the U.S. formulation development outsourcing market is the growing pipeline of complex drugs, including biologics, controlled-release formulations, and combination therapies. As these drugs require highly customized formulation strategies, drug developers are increasingly reliant on the specialized knowledge and infrastructure of outsourcing partners.

For instance, biologics often pose stability challenges due to their sensitivity to temperature, pH, and mechanical stress. Developing suitable delivery systems for such therapeutics like lyophilized formulations or lipid-based carriers demands expertise that is not commonly available in-house. Outsourcing formulation development not only brings in that specialized capability but also accelerates the path from lab to clinic, thus offering competitive advantages. This complexity, coupled with the necessity for stringent regulatory compliance, makes outsourcing a strategic choice rather than just an economic one.

Market Restraint: Intellectual Property (IP) and Data Security Concerns

Despite the clear advantages, a prominent restraint in the market remains the concern over intellectual property protection and data confidentiality. Pharmaceutical companies, especially those involved in novel drug development, are often hesitant to disclose proprietary molecular data, process information, or formulation blueprints to third-party vendors.

This is particularly critical when the formulation represents a core competitive differentiator or is under patent filing. Breaches or leaks, intentional or accidental, could severely impact business operations and lead to potential legal liabilities. To mitigate these risks, companies must invest heavily in robust legal agreements and vetting procedures when choosing outsourcing partners, which can lengthen the decision-making timeline and increase the cost of partnership.

Market Opportunity: Rise of Personalized Medicine and Targeted Therapies

A transformative opportunity for the U.S. formulation development outsourcing market lies in the surge of personalized medicine and targeted therapies. As healthcare increasingly shifts towards patient-centric models, the need for customized drug formulations tailored to specific genetic profiles, disease pathways, or treatment histories is growing rapidly.

For example, therapies aimed at rare diseases or specific mutations require unique dosages, excipients, and delivery routes, often at small batch scales. CDMOs with flexible manufacturing setups, deep expertise in micro-dosing, and the ability to scale rapidly stand to benefit. The rise in companion diagnostics and gene-based therapies also demands novel delivery systems that require advanced formulation development, opening new avenues for outsourced innovation.

Formulation development dominated the service segment due to its critical role in bridging the gap between drug discovery and commercialization. This phase includes the optimization of dosage forms, excipient selection, bioavailability enhancement, and stability testing components that are central to drug performance and regulatory approval. Pharmaceutical firms increasingly outsource this service to CDMOs for their access to specialized equipment and compliance expertise. Particularly in the development of oral and injectable formulations, outsourcing allows companies to expedite go-to-market timelines while managing costs.

Conversely, the preformulation segment is expected to witness the fastest growth as early-stage drug developers recognize the strategic value of robust preformulation data. This phase includes solubility profiling, polymorph screening, and compatibility studies factors that greatly influence downstream development. As more biotech startups and virtual pharma firms enter the market, often with limited in-house capacity, the demand for outsourced preformulation services will continue to rise. Additionally, preformulation findings now feed into advanced computational models, further expanding its significance.

Oral formulations currently dominate the U.S. market owing to their patient-friendly nature, manufacturing scalability, and broad applicability across therapeutic areas. Tablets and capsules continue to be the preferred dosage forms for both generic and branded drugs. Outsourcing formulation development for oral drugs allows companies to tap into specialized expertise for enhancing solubility of poorly water-soluble drugs or developing modified-release mechanisms. For example, CDMOs specializing in solid dispersion and nano-milling are crucial partners in oral drug development.

On the other hand, injectable formulations are the fastest-growing segment, fueled by the rising prevalence of biologics and emergency care drugs. Unlike oral dosage forms, injectables offer rapid onset of action and high bioavailability, which is essential for drugs used in oncology, diabetes, and autoimmune disorders. CDMOs with aseptic processing capabilities, lyophilization technology, and container-closure systems (e.g., prefilled syringes, autoinjectors) are witnessing increasing demand. Growth is further supported by the FDA’s push for advanced delivery systems and the rising number of outpatient care facilities.

Oncology continues to dominate the therapeutic area segmentation, reflecting its central role in the drug development landscape. Cancer drugs, especially targeted therapies and immunotherapies, require complex formulations, often with narrow therapeutic windows and precise delivery requirements. Formulation development in this segment includes solubilization of poorly soluble actives, development of nanoparticle carriers, and cytotoxic handling—all tasks that are increasingly being outsourced due to their complexity and regulatory demands. The rise in orphan oncology drugs and precision medicine further amplifies the need for advanced formulation strategies.

Meanwhile, neurology is emerging as the fastest-growing therapeutic segment in formulation development outsourcing. Neurological disorders often necessitate innovative delivery routes, such as intranasal, transdermal, or extended-release oral systems, to cross the blood-brain barrier or ensure steady drug levels. This complexity drives demand for outsourcing partners with experience in CNS drug formulation and bioequivalence strategies. Furthermore, with the rise in neurodegenerative conditions like Alzheimer’s and Parkinson’s, and a growing aging population, the volume of neurology drugs in development is expected to surge in the coming years.

Country-Level Analysis

The United States stands as the epicenter of pharmaceutical innovation, housing a vast network of biotech startups, established pharma giants, and world-class research institutions. This dynamic ecosystem is significantly fueling the formulation development outsourcing market.

The U.S. Food and Drug Administration (FDA) has fostered a conducive regulatory framework that supports expedited review pathways for breakthrough and orphan drugs. This has, in turn, accelerated formulation activities, especially among smaller companies that prefer to outsource technical development tasks. High labor costs and an emphasis on speed and efficiency further push domestic companies to seek specialized outsourcing partners.

Furthermore, U.S.-based CDMOs have carved a global reputation for their regulatory compliance, scientific rigor, and technical innovation. Many are expanding their facilities and incorporating cutting-edge technologies like real-time release testing, automated formulation labs, and AI-integrated modeling to stay ahead of client demands.

- SGS Société Générale de Surveillance SA

- Intertek Group plc

- Recipharm AB

- Lonza

- Charles River Laboratories

- Eurofins Scientific

- Element

- Labcorp

- Thermo Fisher Scientific Inc.

- Catalent, Inc

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. formulation development outsourcing market

Service

- Preformulation

- Formulation Development

Formulation

- Oral

- Injectable

- Topical

- Others

Therapeutic Area

- Oncology

- Infectious Diseases

- Neurology

- Hematology

- Respiratory

- Cardiovascular

- Dermatology

- Others

By End Use

- Pharmaceutical and Biopharmaceutical Companies

- Government and Academic Institutes

- Others