U.S. Generic Drugs Market Size and Trends

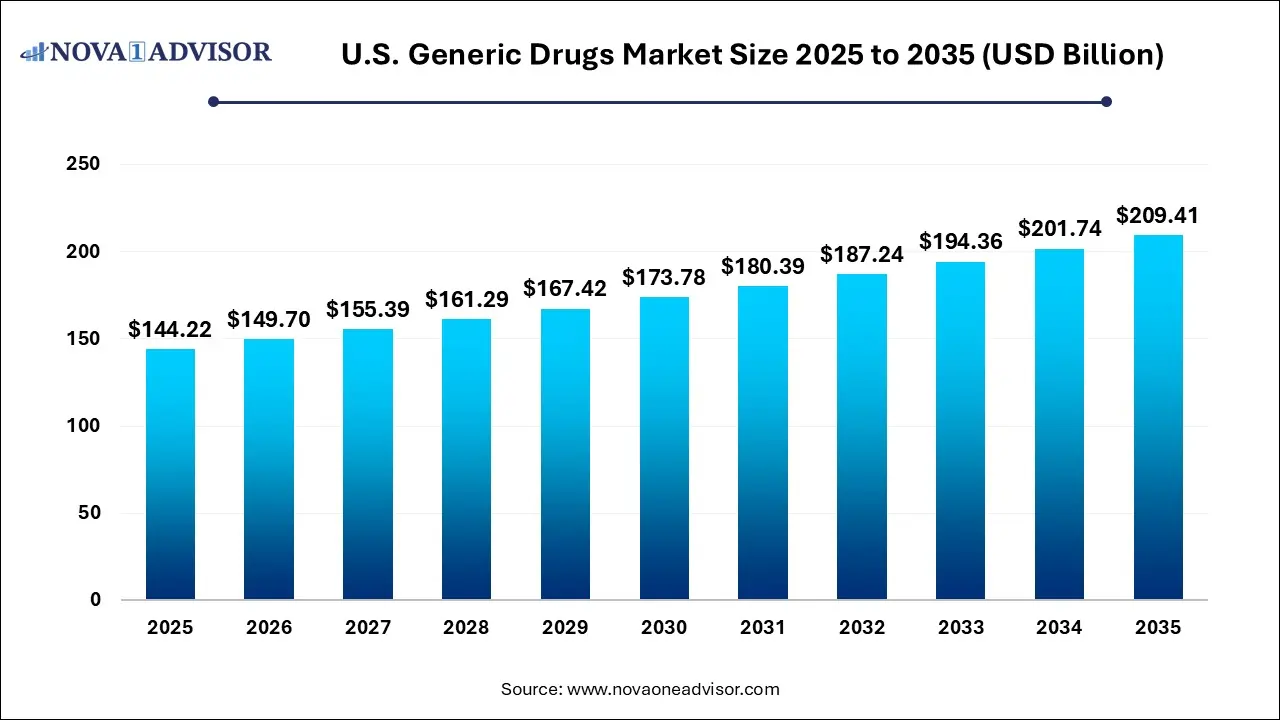

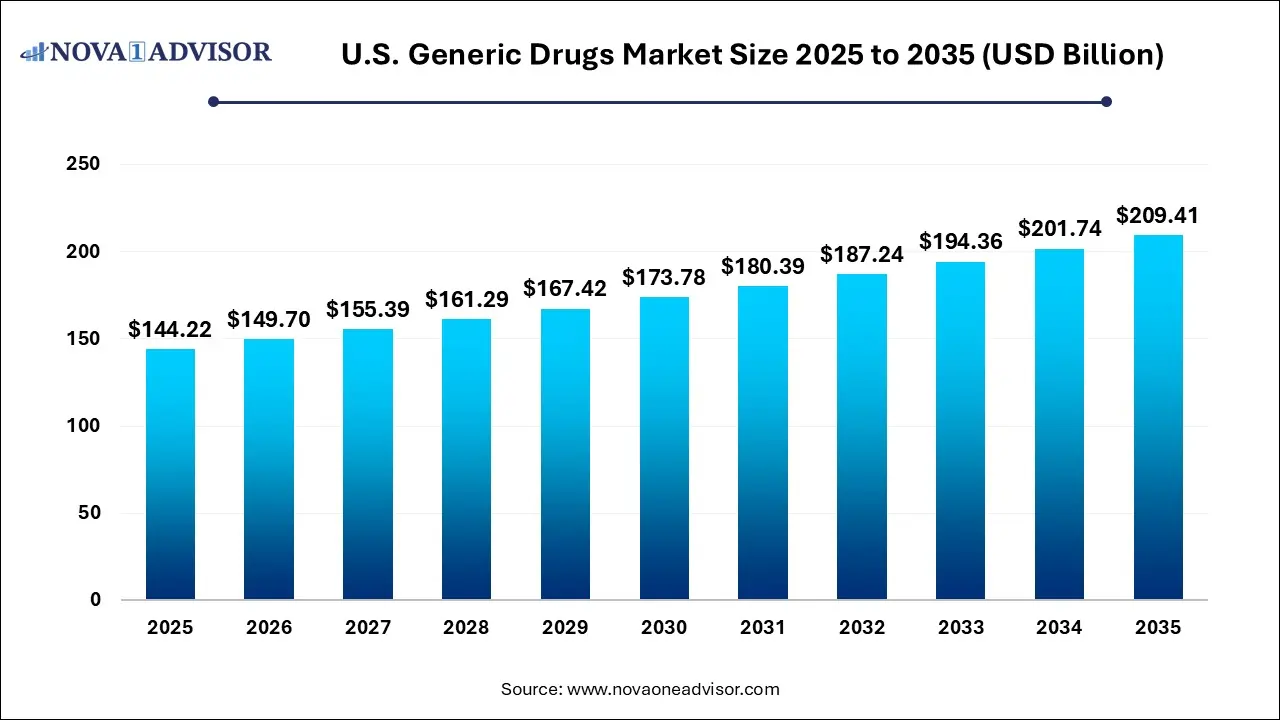

The U.S. generic drugs market size was estimated at USD 144.22 billion in 2025 and is projected to hit around USD 209.41 billion by 2035, expanding at a CAGR of 3.8% during the forecast period from 2026 to 2035. The rising prevalence of chronic diseases and increasing government funding in research and development activities in the generic drugs sector are expected to boost the expansion of the market in the coming years.

Strategic Overview of the Global U.S. Generic Drugs Industry

Generic drugs are non-patented medications that are bioequivalent to the original drug in terms of dosage, potency, quality, form, efficacy, intended use, side effects, and route of administration. In the United States, there has been a considerable increase in the production of generic drugs, which are less expensive than the original drugs and do not require lengthy research or testing. Furthermore, the introduction of generic drugs has increased patient access while saving taxpayers, employers, and insurers money, thus preserving the nation's healthcare system.

The United States is home to several top pharmaceutical firms. Factors such as the increasing popularity of pure generic drugs, the growing presence of key market players, the rising aging population, rising integration of Artificial Intelligence (AI), significantly fuel the U.S. generic drugs market during the forecast period.

In the United States, generic drug approvals are increasing due to the implementation of the FDA's Drug Competition Action Plan, which aims to remove the barriers faced by generic drug manufacturers. To improve the development and approval process for generic drugs, the U.S. Food and Drug Administration (USFDA) reapproved the Generic License Fee Amendment in 2017, providing the FDA with additional resources for the review of generic drugs.

Generic medicines are considered the backbone of the U.S. prescription drug market, supplying more than 9 out of every 10 prescriptions.

Impact of AI on the U.S. Generic Drugs Market?

Artificial Intelligence: The Next Growth Catalyst in U.S. Generic Drugs

AI is significantly impacting the U.S. generic drugs industry by accelerating development timelines, reducing operational costs, and enabling the creation of more complex formulations. Through the use of machine learning and predictive analytics, generic manufacturers can more efficiently analyze existing brand-name drug data to find biosimilars, predict bioequivalence, and optimize formulation designs, reducing the traditional trial-and-error approach. Additionally, AI enhances manufacturing efficiency and supply chain management through demand forecasting and predictive maintenance, ensuring high quality and consistent product availability.

Report Scope of U.S. Generic Drugs Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 149.70 Billion |

| Market Size by 2035 |

USD 209.41 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 3.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Drug Type, By Brand, By Route of Administration, By Therapeutic Application, By Distribution Channels |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Pfizer Inc, Teva pharmaceuticals USA, Inc, Aurobindo pharma USA, Inc, Sun pharma Inc, Abbott Laboratories Inc, Lupin pharmaceuticals, Inc, Mylan, Dr. Reddy’s, Novartis, Eli Lilly company and Others. |

Key trends contributing to U.S. generic drugs market growth

- The rising generic drug approvals by the US FDA are expected to contribute to the expansion of the U.S. generic drug market in the region. For instance, In December 2024, US FDA approved the first generic daily GLP-1 injection for type 2 diabetes, to improve glycemic control in patients aged 10 years and older with type 2 diabetes (T2D).

- The rising awareness regarding the benefits of generic drugs and improved healthcare access in the country offer significant opportunities for manufacturers in the pharmaceutical industry.

- The growing population along with age-related diseases are expected to spur the demand for generic drugs, accelerating the market’s revenue in the coming years.

- The increasing popularity of pure generic drugs is anticipated to drive the growth of the market. Generic medicines tend to be less expensive than branded medicines because they do not have to repeat the animal and clinical (human) studies that branded medicines need to demonstrate their safety and efficacy. Additionally, multiple generics are often approved for the same single product. This creates competition in the market and usually drives prices down.

Opportunity:

Increasing prevalence of various life-threatening diseases is providing the future opportunity to drive the market

The rising prevalence of various life-threatening diseases is projected to offer lucrative growth opportunities to the U.S. generic drugs market during the forecast period. The market is growing rapidly due to the rising prevalence of chronic diseases in the region including cardiovascular disease, diabetes, Alzheimer's disease, autoimmune diseases, multiple sclerosis, Parkinson's disease, and cancer. The U.S. Food and Drug Administration plays a crucial role in the generic drugs market. The FDA Generic Drug Program conducts thorough preapproval evaluations to verify that generic medications fulfill these standards. In addition, the FDA inspects manufacturing facilities to ensure they follow agency requirements on good manufacturing practices.

Restraint:

FDA regulations limit the expansion of the generic drug market

The FDA's stringent approval and distribution process restricts the expansion of the generic drug industry, The FDA works on adverse event data, the safety and efficacy of drugs, and ingredients on generic medications, failing to follow the requirements can delay the approval of the generic drug. It hindered the growth during the forecast period. It may restrict the expansion of the global U.S. generic drugs market.

Segment insights

U.S. Generic Drugs Market By Brand Insights

Based on brand pure generic drugs are pure generic drugs than branded generic, they require less amount of time in research and development and require fewer clinical trials for approvals as compared to branded generic.

The pure generic drugs segment accounted for more than 54.0% in 2025, it required more money for its research and development process and it required many animal and human trials for its approval, it required more amount of time for its approval from the FDA.

U.S. Generic Drugs Market By Route of Administration Insights

For generic medicines and vaccines, according to current estimates, oral formulations make up around 90% of the global market for all pharmaceutical formulations designed for human consumption. Approximately 84 percent of the top-selling medications are drugs taken orally. The World Health Organization estimates that each year there are between 2 and 3 million instances of non-melanoma skin cancer and 132,000 cases of melanoma skin cancer. Since topical drug administration is the primary method of therapy for the majority of skin conditions, the market for advanced topical products is projected to grow in the upcoming years.

U.S. Generic Drugs Market By Therapeutic Application Insights

The diabetes segment accounted for the highest market share in the U.S. generic drug market owing to the increasing prevalence of diabetes around the world. For instance, as per the Centers for Disease Control and Prevention report for 2022, 38.4 million people, or 11.6 percent of the United States population, have diabetes. Diabetes treatment necessitates the increasing use of generic drugs. Generic drugs can significantly reduce the financial burden on low- and middle-income groups.

n the other hand, the cardiovascular diseases segment is expected to witness remarkable growth during the forecast period owing to the rising incidence of cardiovascular diseases. For instance, according to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with 1 person dying every 33 seconds from cardiovascular disease. Nearly 695,000 people in the United States died from heart disease in 2021, that's 1 in every 5 deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year. The generic drugs assist heart patients with living longer and saving money.

U.S. Generic Drugs Market By Distribution Channels Insights

Generic drugs are sold in hospitals, pharmacies, and online pharmacies. The retail pharmacy holds a leading position in the distribution channel segment as increasingly people prefer to buy their medicines from retail shops On the other hand, online distribution is more trending as people prefer more online modes of shopping to avail attractive discounts and add on services.

Value Chain Analysis of the U.S. Generic Drugs Market

Research & Development (R&D) and Regulatory Approval: This stage involves identifying off-patent drugs, reverse-engineering formulations, demonstrating bioequivalence to the branded product, and submitting an Abbreviated New Drug Application (ANDA) to the FDA.

- Key Players: Teva Pharmaceuticals USA, Inc., Mylan (part of Viatris), Sandoz (a spin-out from Novartis), Sun Pharmaceutical Industries Ltd., and Aurobindo Pharma Limited.

Active Pharmaceutical Ingredient (API) Manufacturing: This stage involves the high-volume, cost-effective production of the core chemical component of the generic drug, which is often outsourced to specialized producers located outside the U.S.

- Key Players: Aurobindo Pharma, Sun Pharmaceutical Industries, Lupin Limited, AbbVie Inc., Pfizer Inc., and Johnson & Johnson.

Formulation & Manufacturing (Finished Dosage Form): In this stage, the API is formulated into the final consumable medicine (tablets, capsules, injectables, etc.) and packaged for the market.

- Key Players: Teva, Mylan, Sandoz, and Sun Pharma.

Distribution & Logistics: This stage involves the efficient delivery of the finished products to various markets, ensuring availability and accessibility through a complex supply chain network.

- Key Players: WBAD (Walgreens Boots Alliance Development), Red Oak, and McKesson.

U.S. Generic Drugs Market Companies

- Pfizer Inc.: Through its "Pfizer CentreOne" and legacy sterile injectables business, Pfizer is a major supplier of complex hospital-based generics and biosimilars in the U.S.

- Teva Pharmaceuticals USA, Inc.: Teva remains the largest generic drug manufacturer in the U.S., offering one of the broadest portfolios that covers nearly every therapeutic category.

- Aurobindo Pharma USA, Inc.: Aurobindo is a critical volume provider for the U.S. market, specializing in high-demand oral solids and antiretroviral medications.

- Sun Pharma Inc.: As a leader in specialty generics, Sun Pharma contributes high-quality, affordable medicines in the fields of dermatology, ophthalmology, and oncology.

- Abbott Laboratories Inc.: While Abbott is primarily known for branded products, its "Branded Generics" segment provides high-quality, trusted off-patent medications that bridge the gap between innovation and affordability.

- Lupin Pharmaceuticals, Inc.: Lupin is a major U.S. supplier of generic oral contraceptives and inhalation products, holding a significant share in the women's health and respiratory sectors.

- Mylan (Viatris): Now operating as Viatris, the company is a global powerhouse that supplies essential generics for non-communicable and infectious diseases across the U.S. healthcare system.

- Dr. Reddy’s: Dr. Reddy’s contributes to the U.S. market through a robust pipeline of complex generics and difficult-to-make injectable formulations.

- Novartis (Sandoz): Following its successful spin-off, Sandoz (formerly a Novartis division) is now the global leader in generic and biosimilar medicines, with a massive impact on the U.S. oncology and immunology markets.

- Eli Lilly and Company: While primarily an innovator, Lilly contributes to the generic landscape through its "Lilly-Direct" platform and authorized generic versions of its blockbuster insulin and obesity treatments.

U.S. Generic Drugs Market Recent developments

- In October 2025, the FDA Domestic Pilot Program launched, its initiative grants priority review to abbreviated new drug applications (ANDAs) from companies that conduct both manufacturing and testing entirely within the U.S.

- In March 2025, Biocon Biologics & Civica, a strategic collaboration aimed at providing low-cost Insulin Aspart across the U.S., was tackling insulin affordability.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. generic drugs market

By Brand

- Pure Generic Drugs

- Branded Generic Drugs

By Route of Administration

- Oral

- Injection

- Cutaneous

- Others

By Therapeutic Application

- Central Nervous System (CNS)

- Cardiovascular

- Diabetes

- Infectious Diseases

- Musculoskeletal Diseases

- Respiratory

- Oncology

- Others

By Distribution Channels

- Retail Pharmacy

- Hospital Pharmacy

- Online and Others