U.S. Healthcare BPO Market Size and Trends

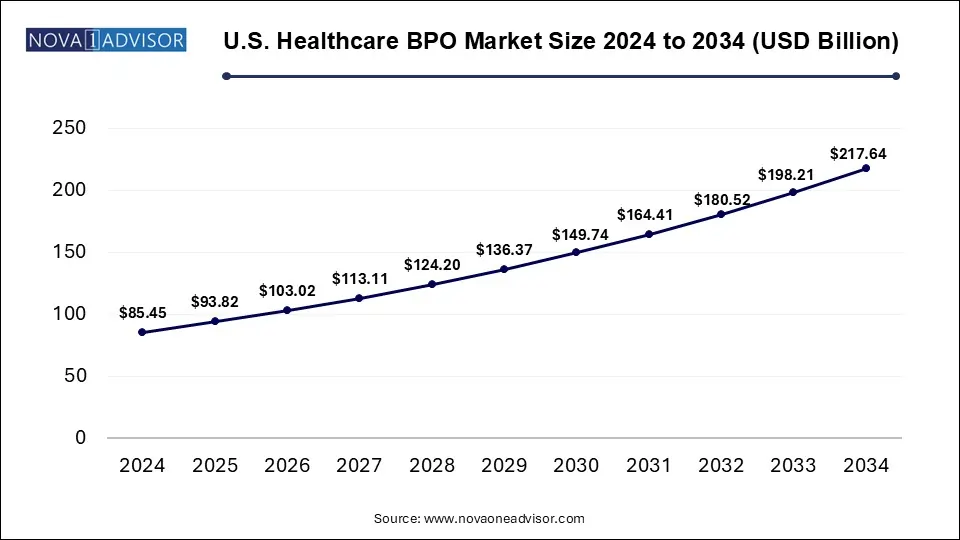

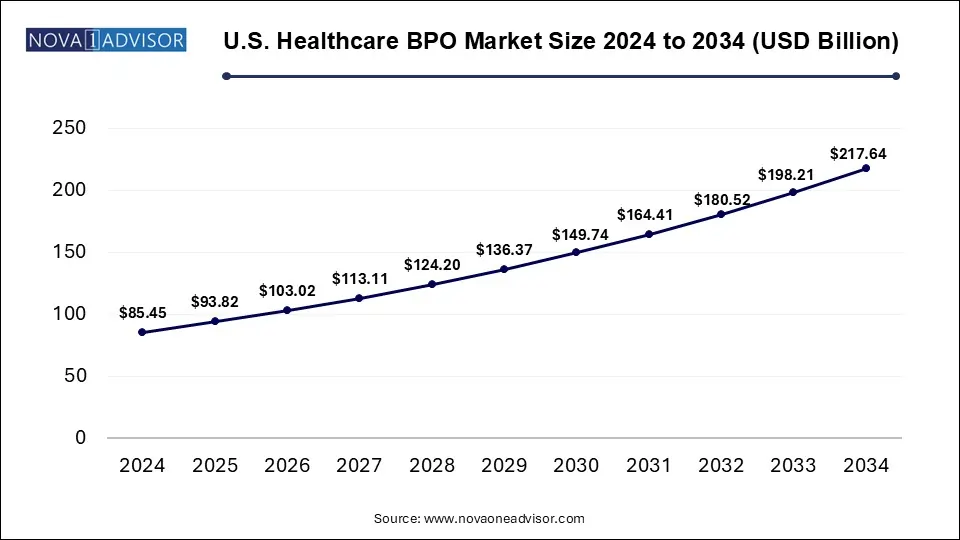

The U.S. healthcare BPO market was valued at USD 85.45 billion in 2024 and is projected to Hits USD 217.64 billion by 2034, registering a CAGR of 9.8% from 2025 to 2034. The U.S. healthcare BPO market growth is attributed to the increasing outsourcing in the biopharma and pharma industries.

U.S. Healthcare BPO Market Key Takeaways

- By service type insights, the provider services segment dominated the U.S. healthcare BPO market in 2024.

- By service type insights, the payer services segment is expected to grow fastest during the forecast period.

- By deployment mode insights, the onshore segment dominated the market share in 2024.

- By deployment mode insights, the offshore segment is expected to grow fastest during the forecast period.

- By end-user insights, the healthcare providers segment dominated the U.S. healthcare BPO market in 2024.

- By end-user insights, the healthcare payers segment is expected to grow fastest during the forecast period.

U.S. Healthcare BPO Market Overview

The U.S. healthcare BPO market deals with processes a company hires another company to handle specific processes or tasks such as data entry, payroll, or customer service. Businesses can focus on their core activities by accessing specialized skills and resources, reducing costs, and outsourcing these tasks to improve productivity and efficiency. The increasing need for revenue cycle management (RCM) and increasing demand for medical billing services are expected to drive market growth in the U.S. during the forecast period.

The U.S. healthcare BPO market is witnessing rapid growth due to factors such as a rapid shift toward patient-centric care across the country, operational efficiency, increasing emphasis on cost reduction, and rising need for streamlined healthcare administrative processes. In addition, due to the ongoing pursuit of cost containment in the healthcare sector, the increasing number of third-party service providers seeking cost-effective solutions, rising advancements in data management and technology, and the increasing complexity of healthcare compliance requirements and regulations are further expected to propel the growth of the U.S. healthcare BPO market.

Major Trends Contributing to Market Demand

- Evolving regulations: Healthcare BPO can support healthcare organizations in minimizing the risk of legal and financial penalties and complying with several laws that are expected to drive market growth.

- Growth of telehealth services: The increasing growth of telehealth services is expected to drive the market growth.

- The integration of telehealth into routine care has led to increased demand that can enhance administrative processes.

- Increasing demand for cost-effective solutions: The increasing demand for cost-effective solutions is the major factor propelled by the increasing pressure on healthcare providers in the U.S. healthcare BPO market.

- Adoption of telemedicine solutions: To meet the rising demand for efficient telemedicine solutions, healthcare providers are increasingly outsourcing tasks such as remote patient monitoring, medical transcription, and telehealth support are expected to enhance the market expansion.

Rapid adoption of advanced technologies creates opportunities

There is a rising trend towards integrating advanced technologies such as data analytics, robotic process automation (RPA), and AI into healthcare BPO services. These technologies streamline administrative processes, improve patient care enhance operational efficiency, and make them attractive to healthcare organizations seeking cost-effective solutions. These technologies are being utilized to enhance member engagement, reduce costs, and streamline administrative processes. In addition, the integration of AI enables employees to focus on higher-value activities. While ensuring that patients receive personalized care, this strategy enhances operational efficiency which may further create significant growth opportunities in the U.S. healthcare BPO market in the coming years.

Service quality issues may hamper market growth

Poor quality services, such as delayed responses, publicizing errors, and medical coding or transcription, lead to dissatisfaction among clients. This dissatisfaction can result in reduced client trust, loss of reputation, and contract terminations, posing challenges for BPO firms to maintain competitiveness and retain clients in the market. Due to service quality issues, customer dissatisfaction represents a significant restraint in the U.S. healthcare BPO market.

Report Scope of U.S. Healthcare BPO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 93.82 Billion |

| Market Size by 2034 |

USD 217.64 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service Type, By Deployment Mode, By End-User And By Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Accenture Plc , Cognizant Technology Solutions Corporation , Genpact Plc , Wipro Limited , IQVIA Inc. , Infosys Limited , Sutherland Global Services, Inc. , Access Healthcare , Global Virtuoso, Inc. , Flatworld Solutions Inc. Others |

Segment Insights

U.S. Healthcare BPO Market By Service Type

The provider services segment dominated the U.S. healthcare BPO market in 2024. The segment growth in the market is attributed to the increasing demand for coding services, medical billing, and revenue cycle management among healthcare providers. Automation streamlines communication between healthcare providers and patients, which further enhances communication with patients. In addition, the payer services segment is expected to grow fastest during the forecast period. The segment growth in the U.S. is driven by the increasing demand for compliance solutions, member management, and claims processing. Healthcare payer services leverage power technology and platforms to enable seamless, intelligent, and simpler experiences, which further drives the segment growth.

U.S. Healthcare BPO Market By Deployment Mode

The onshore segment dominated the U.S. healthcare BPO market in 2024. The segment growth in the U.S. is attributed to factors such as data security concerns, regulatory compliance and customer proximity. The segment is allowing healthcare providers flexibility in outsourcing, which may drive the segment growth. Whereas the offshore segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by the increasing capacity to handle high-volume administrative duties, access to trained labor, and cost-effectiveness.

U.S. Healthcare BPO Market By End-use

The healthcare providers segment dominated the U.S. healthcare BPO market in 2024. The increasing demand for coding services, billing services, and cycle management is expected to drive segment growth in the U.S. In addition, the healthcare payers segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by the emergence of value-based care models, member administration, and the increasing complexity of claims processing.

Some of The Prominent Players in The U.S. Healthcare BPO Market Include:

U.S. Healthcare BPO Market Recent Developments

- In March 2025, Uganda’s National Guidance and Ministry of ICT launched the country’s new business process outsourcing (BPO) policy. The aim behind this launch was to create 150,000 jobs by 2030 and position Uganda as a leading outsourcing hub in the U.S.

- In February 2024, a global leader in customer experience and business process outsourcing, Acquire BPO announced the launch of its new division, Acquire.AI. This innovative consulting service is designed to guide businesses through the intricacies of the artificial intelligence revolution. Acquire.AI stands poised to transform industries by assisting businesses in implementing, prioritizing, and recognizing tailored solutions to enhance customer experiences.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Healthcare BPO Market

By Service Type

- Provider Services

- Payer Services

By Deployment Mode

By End-user

- Healthcare Providers

- Healthcare Payers