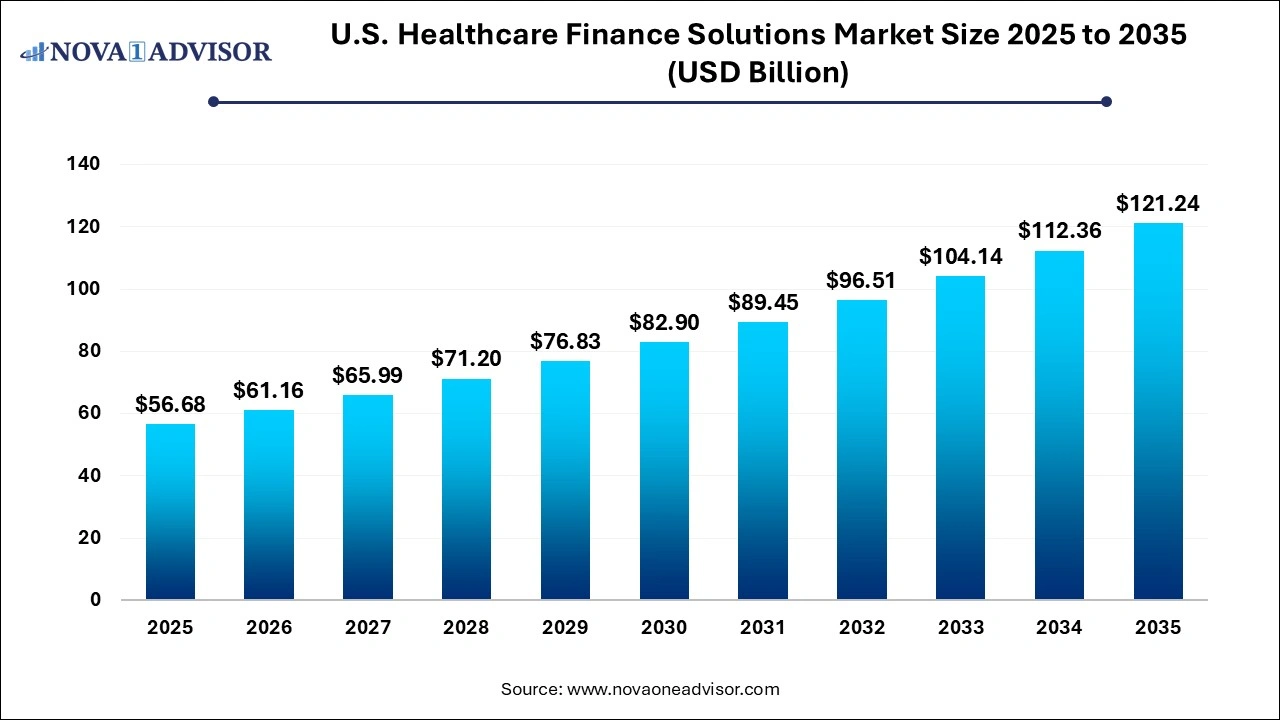

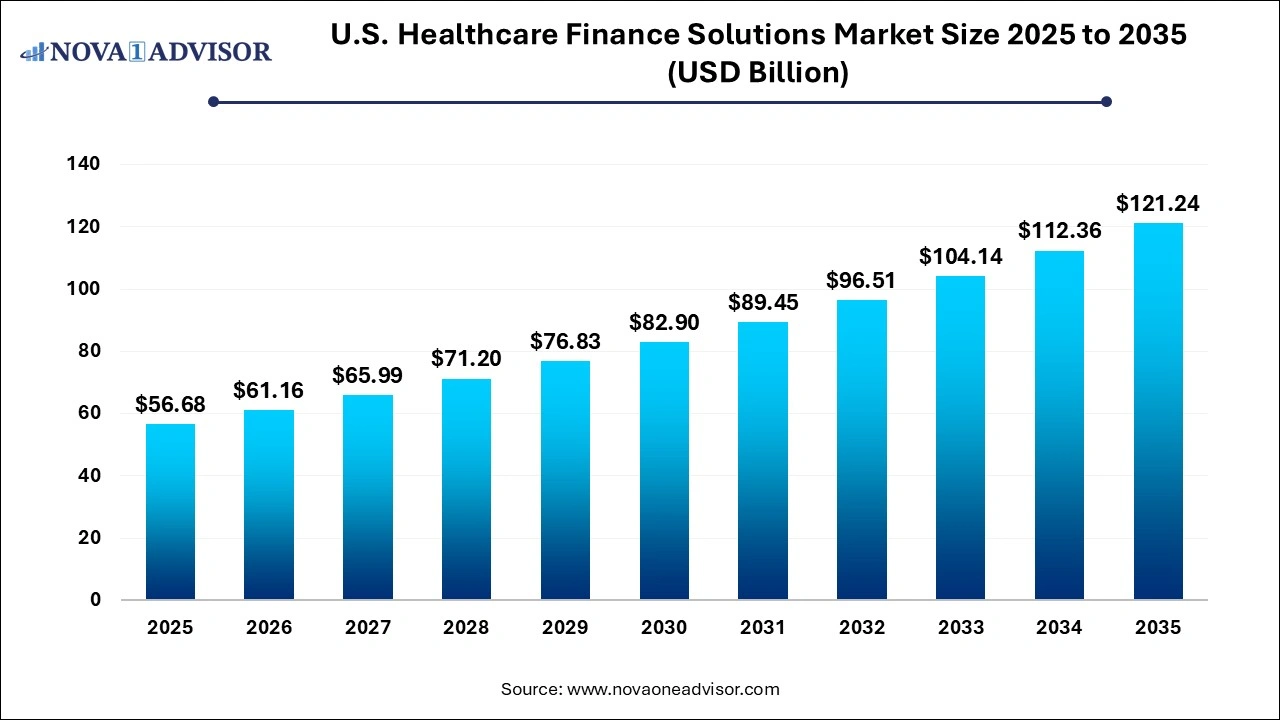

U.S. Healthcare Finance Solutions Market Size and Growth 2026 to 2035

The U.S. healthcare finance solutions market size was exhibited at USD 56.68 billion in 2025 and is projected to hit around USD 121.24 billion by 2035, growing at a CAGR of 7.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The decontamination equipment segment dominated the U.S. healthcare finance solutions market with a 36.0% revenue share in 2025.

- The hospital & health systems were the largest segment in 2025 accounting for 25.0%.

- The private player's segment contributed to the largest market share accounting for 51.1% of the share in 2025.

- Based on services, the equipment and technology finance segment accounted for the largest market share of 47.0% in 2025.

- The private players segment dominated the market with a share of 50.0% in 2025 and is likely to grow at a CAGR of 7.4% during the forecast period.

U.S. Healthcare Finance Solutions Market Overview

The U.S. Healthcare Finance Solutions Market is a vital segment of the broader financial and healthcare industries, designed to address the capital-intensive nature of medical infrastructure, technology, and services. The financial burden associated with equipping healthcare facilities, acquiring advanced medical technology, maintaining hospital operations, and adapting to evolving patient care standards has necessitated specialized financial services tailored to the healthcare sector. Healthcare finance solutions encompass a diverse range of services, including equipment and technology financing, working capital financing, corporate lending, and project financing, among others. These are facilitated through a mix of government agencies, private financial institutions, and other entities.

The growing complexity of healthcare systems in the U.S., marked by the integration of digital technologies, expansion of outpatient services, aging population, and rising prevalence of chronic diseases, continues to drive the need for robust financing frameworks. Hospitals, diagnostic centers, outpatient clinics, skilled nursing facilities, and pharmacies are increasingly relying on customized finance solutions to upgrade facilities, acquire state-of-the-art diagnostics and surgical tools, and optimize service delivery. In this evolving scenario, the demand for healthcare finance solutions has shown significant growth, especially after the COVID-19 pandemic which exposed the structural vulnerabilities in healthcare financing.

The U.S. government, through federal initiatives and healthcare reforms, has also promoted greater access to capital for public and private healthcare providers. Moreover, as value-based care models replace traditional fee-for-service models, financial agility has become essential for providers looking to implement quality-driven healthcare services. Thus, the market is positioned at the intersection of financial services and healthcare innovation, evolving continuously to meet the unique demands of both sectors.

Major Trends in the U.S. Healthcare Finance Solutions Market

-

Digitalization of Healthcare Finance: Integration of fintech platforms for faster processing, real-time analytics, and automated lending decisions.

-

Rise in Equipment Leasing Over Purchasing: Providers prefer leasing to maintain technological relevance without high upfront costs.

-

Growth in Financing for Ambulatory Services: Increasing patient preference for outpatient care has accelerated funding needs for these facilities.

-

Expansion of Greenfield Hospital Projects: Financing for new healthcare infrastructure is increasing in underserved or rural areas.

-

Customized Financing Models: Tailored solutions are being created for small clinics, solo practitioners, and niche healthcare services.

-

Increased Private Equity Participation: High interest from private investors in healthcare ventures is influencing financing trends.

-

Emergence of ESG-Linked Healthcare Loans: Financial institutions are promoting sustainability through environment-linked loans in healthcare.

Report Scope of The U.S. Healthcare Finance Solutions Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 61.16 Billion |

| Market Size by 2035 |

USD 121.24 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Equipment Type, Healthcare Facility Type, Services, Lenders |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Siemens Financial Services, Inc.; General Electric Company; Commerce Bankshares, Inc.; Thermo Fisher Scientific, Inc.; Siena Healthcare Finance; CIT Group, Inc.; Stryker; Gemino Healthcare Finance; Oxford Finance LLC; TCF Capital Solutions |

Key Market Driver: Shift Toward Outpatient and Ambulatory Care

One of the most significant drivers in the U.S. healthcare finance solutions market is the shift from inpatient to outpatient care. As healthcare reforms and technological advancements make it feasible to perform complex diagnostics and minor surgical procedures outside of hospitals, outpatient and ambulatory centers are proliferating. These centers require funding for high-end imaging devices, surgical instruments, IT infrastructure, and digital health platforms.

This transformation is not only reducing hospital overcrowding but also leading to cost savings and enhanced patient satisfaction. However, establishing an outpatient facility demands substantial capital. Here, financial solutions play a pivotal role in bridging the investment gap. Equipment leasing, working capital loans, and technology finance enable providers to operate efficiently without the burden of large upfront costs. Consequently, this trend has become a critical accelerator for the healthcare finance market.

Key Market Restraint: Regulatory Complexity and Bureaucratic Delays

Despite robust demand, the healthcare finance solutions market in the U.S. is significantly hindered by regulatory complexity. The healthcare sector is tightly regulated, involving multiple layers of compliance from HIPAA (Health Insurance Portability and Accountability Act), FDA regulations, and local health department requirements. Financial institutions must navigate a labyrinth of regulations before extending loans, especially when government agencies are involved.

This complexity often results in bureaucratic delays, slowing down funding approvals and disbursements. For healthcare providers, especially smaller clinics and independent practitioners, these delays can be detrimental to planned expansions or technological upgrades. Moreover, any changes in federal healthcare policy or insurance reimbursement models can further complicate the financial landscape, making it risky for lenders and cumbersome for borrowers.

Key Market Opportunity: Integration of AI and Predictive Analytics in Credit Assessment

With the advancement of AI and machine learning, a major opportunity lies in incorporating predictive analytics into credit assessment for healthcare providers. Traditional credit assessment methods often fail to capture the nuanced financial health of healthcare organizations, particularly small to mid-sized facilities. By leveraging AI, financial institutions can analyze historical performance, insurance reimbursement cycles, patient footfall, and even EHR (Electronic Health Record) data to make more informed lending decisions.

Such integration can lead to more inclusive financing where even less-established or rural healthcare units can access credit based on predictive revenue models rather than just historical balance sheets. This not only expands the market reach for lenders but also empowers underserved areas with better healthcare infrastructure.

U.S. Healthcare Finance Solutions Market By Equipment Type Insights

Diagnostic/Imaging Equipment dominated the equipment type segment in 2025, owing to the rapid expansion of outpatient imaging centers and the increasing use of MRI, CT, and PET scans in early disease detection. These devices are highly capital-intensive, making them a natural fit for financial solutions. Equipment finance and leasing options allow facilities to stay updated with cutting-edge diagnostic technologies without recurring capital expenses. Furthermore, as precision medicine gains traction, the demand for high-resolution imaging devices will likely remain elevated, sustaining the dominance of this segment.

On the other hand, IT Equipment is emerging as the fastest-growing segment due to the digitization of healthcare workflows, from EHR systems to telemedicine platforms. The post-pandemic period witnessed an aggressive push for remote care and AI-driven diagnostics, increasing the need for advanced IT infrastructure. Healthcare facilities are opting for IT equipment financing to build scalable digital ecosystems that ensure operational efficiency and data interoperability. The anticipated growth of AI, cloud-based health platforms, and cybersecurity tools will further fuel this segment.

U.S. Healthcare Finance Solutions Market By Healthcare Facility Type Insights

Hospitals & Health Systems hold the dominant position in the healthcare facility segment due to their sheer size, extensive service offerings, and higher funding needs for specialized beds, surgical tools, and infrastructure expansion. Large hospitals often seek multi-tiered financing plans involving equipment finance, working capital loans, and long-term infrastructure projects. These facilities also have higher credit ratings, making them favorable clients for both public and private lenders.

In contrast, Physician Practices & Outpatient Clinics are witnessing the fastest growth. The growing consumer inclination toward personalized, quicker, and affordable healthcare services has accelerated the emergence of decentralized care settings. Such facilities prefer asset-light models and require support to finance smaller-scale but advanced equipment and IT tools. The agility and niche expertise of these clinics make them ideal candidates for customized financing solutions, especially from fintech players and private lenders.

U.S. Healthcare Finance Solutions Market By Lenders Insights

Private Players dominate the lending ecosystem in the U.S. healthcare finance solutions market. Their ability to customize loan products, speed up approvals, and incorporate digital tools has made them preferred partners for many healthcare providers. Large financial institutions like Wells Fargo, Bank of America, and various healthcare-focused fintech firms offer a comprehensive suite of services, including equipment loans, project financing, and corporate lending.

However, Government & Other Federal Agencies are playing an increasingly supportive role, especially through subsidized financing for public hospitals, veteran care facilities, and pandemic recovery programs. Programs from the U.S. Department of Health and Human Services (HHS) and the Centers for Medicare & Medicaid Services (CMS) continue to provide strategic financial backing to key institutions, particularly in times of crisis.

U.S. Healthcare Finance Solutions Market By Services Insights

Among services, Equipment & Technology Finance remains the most dominant, largely due to the continuous technological upgrades required in healthcare. Hospitals and diagnostic labs regularly update equipment to comply with regulatory standards and deliver precise diagnostics and treatments. This has made equipment leasing and technology-based funding indispensable tools for financial planning.

.webp) Working Capital Finance is experiencing the fastest growth, particularly driven by small to medium healthcare providers that need operational liquidity for salaries, inventory, and daily management. With delayed reimbursements from insurers and increasing payroll requirements, providers are opting for short-term capital injections. This segment is especially popular among diagnostic labs, outpatient clinics, and urgent care centers that operate on lean financial structures.

Working Capital Finance is experiencing the fastest growth, particularly driven by small to medium healthcare providers that need operational liquidity for salaries, inventory, and daily management. With delayed reimbursements from insurers and increasing payroll requirements, providers are opting for short-term capital injections. This segment is especially popular among diagnostic labs, outpatient clinics, and urgent care centers that operate on lean financial structures.

Country-Level Insights

In the United States, the demand for healthcare finance solutions has reached unprecedented levels due to rising healthcare costs and technological transformations. Urban areas like New York, Los Angeles, and Chicago are witnessing large-scale investments in smart hospitals and AI-enabled diagnostic centers. These urban giants are major recipients of both public and private healthcare financing.

Meanwhile, rural America is increasingly in focus, with federal and state governments launching programs aimed at bridging the infrastructure gap. The Health Resources and Services Administration (HRSA) has recently introduced grants and low-interest loans for rural hospitals. Furthermore, telehealth and mobile health units are being financed to improve reach in underserved regions. Such initiatives have created a dual-market scenario, with distinct financing models tailored for urban and rural needs.

Recent developments:

-

February 2025: Bank of America announced the expansion of its healthcare finance division, introducing a $2 billion fund for small and mid-sized outpatient centers across the U.S.

-

January 2025: Siemens Financial Services signed an agreement with a Midwest hospital chain to provide $300 million in equipment finance for imaging and diagnostic devices.

-

November 2024: GE HealthCare collaborated with Capital One to roll out AI-driven credit solutions for healthcare providers, aiming to speed up the loan approval process.

-

October 2024: U.S. Department of Health and Human Services (HHS) launched a $500 million fund for rural hospitals to upgrade surgical and decontamination equipment.

Some of the prominent players in the U.S. healthcare finance solutions market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare finance solutions market

Equipment Type

- Diagnostic/Imaging Equipment

- Specialist Beds

- Surgical Instruments

- Decontamination Equipment

- IT Equipment

Healthcare Facility Type

- Hospitals & Health Systems

- Outpatient Imaging Centers

- Outpatient Surgery Centers

- Physician Practices & Outpatient Clinics

- Diagnostic Laboratories

- Urgent Care Clinics

- Skilled Nursing Facilities

- Pharmacies

Services

- Equipment & Technology Finance

-

- Government & Other Federal Agencies

- Private Players

- Others

-

- Government & Other Federal Agencies

- Private Players

- Others

- Project Finance Solutions

-

- Government & Other Federal Agencies

- Private Players

- Others

-

- Government & Other Federal Agencies

- Private Players

- Others

Lenders

- Government & Other Federal Agencies

- Private Players

- Others

.webp) Working Capital Finance is experiencing the fastest growth, particularly driven by small to medium healthcare providers that need operational liquidity for salaries, inventory, and daily management. With delayed reimbursements from insurers and increasing payroll requirements, providers are opting for short-term capital injections. This segment is especially popular among diagnostic labs, outpatient clinics, and urgent care centers that operate on lean financial structures.

Working Capital Finance is experiencing the fastest growth, particularly driven by small to medium healthcare providers that need operational liquidity for salaries, inventory, and daily management. With delayed reimbursements from insurers and increasing payroll requirements, providers are opting for short-term capital injections. This segment is especially popular among diagnostic labs, outpatient clinics, and urgent care centers that operate on lean financial structures.