U.S. Healthcare Payer Analytics Market Size and Trends

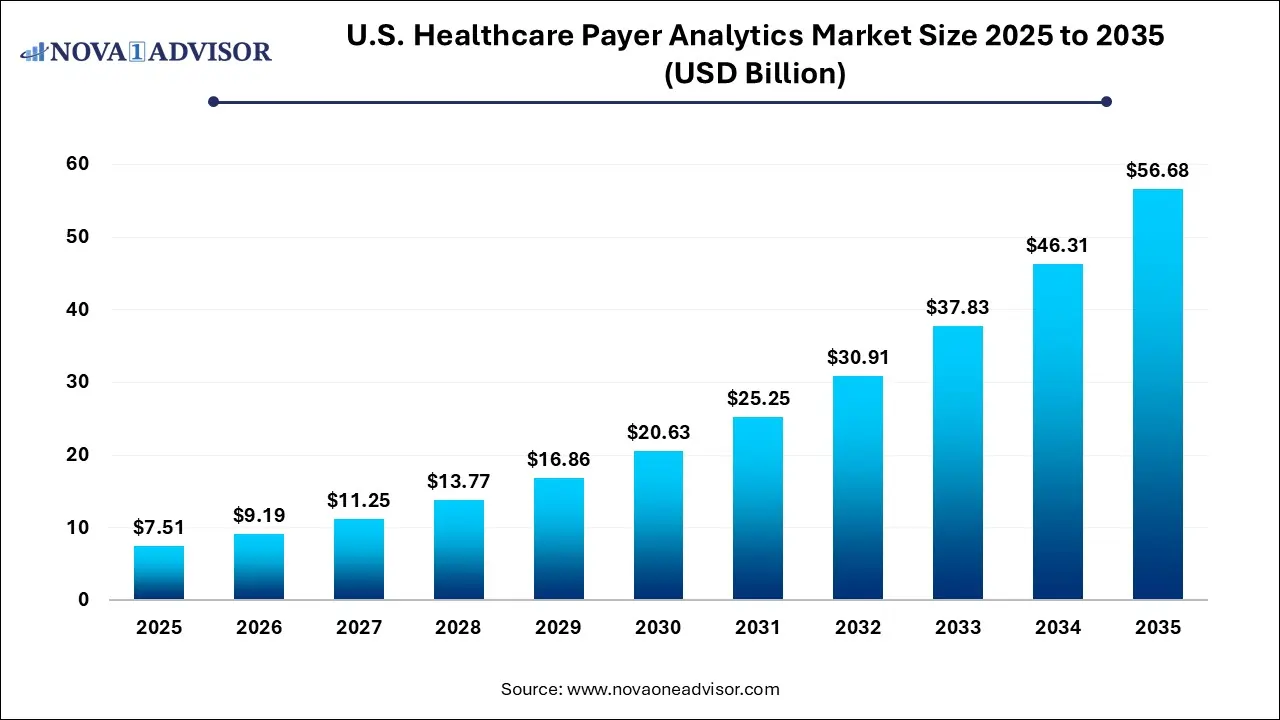

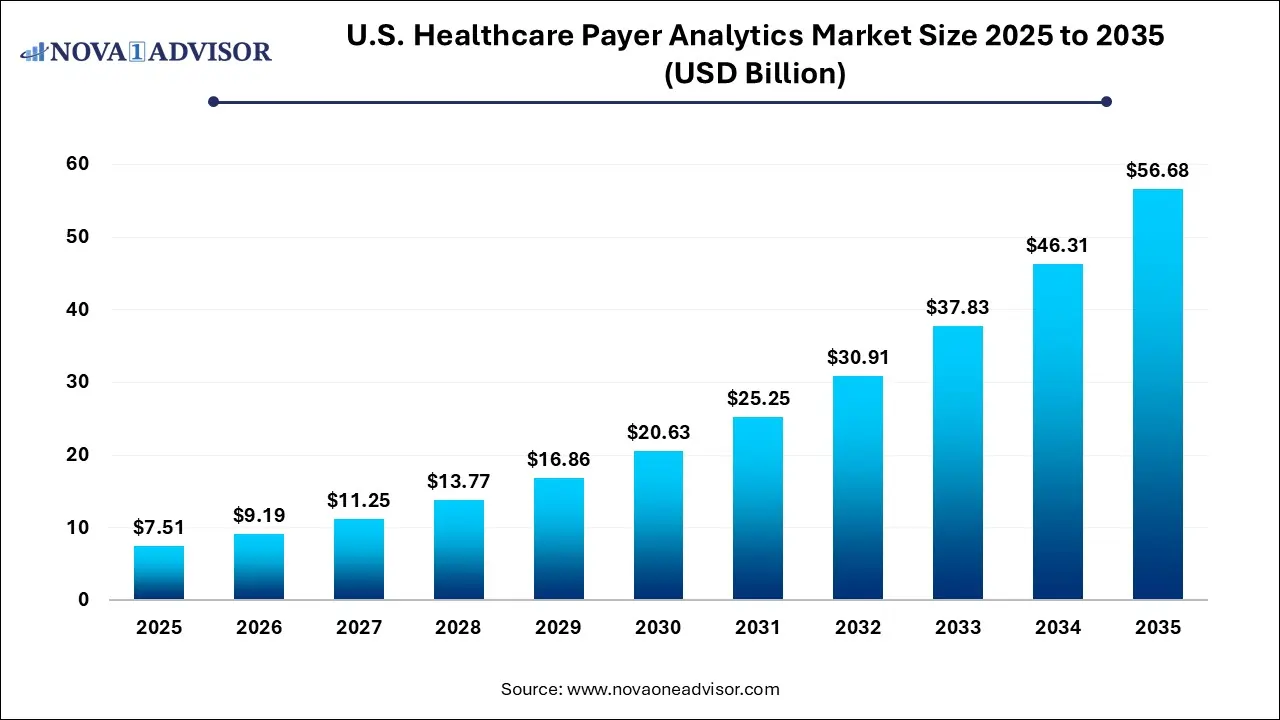

The U.S. healthcare payer analytics market size was exhibited at USD 7.51 billion in 2025 and is projected to hit around USD 56.68 billion by 2035, growing at a CAGR of 22.4% during the forecast period 2026 to 2035.

U.S. Healthcare Payer Analytics Market Key Takeaways:

- The descriptive analytics segment had the largest market share of 35.8% in 2025.

- The fastest growing segment is predictive analysis, with a CAGR of 26.4% for the forecast period.

- On-premises delivery model dominated the market with a share of 48.6% in 2024.

- The financial application segment dominated the market with a revenue share of 35.7% in 2024.

- Financial is anticipated to register the fastest growth rate of 23.1%.

- In the component segment, the services had the largest market share of 42.0% as of 2024.

- In 2024, services accounted for the largest revenue share of 42.0%, the services segment was recorded to have the fastest

- growth rate of 22.7%.

Market Overview

The U.S. healthcare payer analytics market is experiencing unprecedented growth driven by the demand for data-driven insights that enable insurers and payers to manage costs, improve care delivery, and enhance member satisfaction. As the healthcare industry undergoes digital transformation, payer organizations including commercial insurers, Medicaid and Medicare plans, and employer-sponsored plans are leveraging analytics tools to optimize claims processing, prevent fraud, assess risk, and predict utilization patterns.

This sector’s momentum is fueled by regulatory mandates such as value-based payment models, interoperability requirements, and increasing pressure to control rising healthcare expenditures. Payers now depend on sophisticated analytics platforms to stratify risk, engage members, measure outcomes, and align incentives across stakeholders. The shift from fee-for-service to value-based care models has made it essential to use analytics for population health management, predictive modeling, and identifying gaps in care.

Healthcare payer analytics platforms encompass a range of capabilities including descriptive analytics (reporting what has happened), predictive analytics (forecasting future events), and prescriptive analytics (recommending actions). Integrated with AI, machine learning, and cloud computing, these tools provide actionable intelligence that enables real-time decisions and strategic planning. The growing emphasis on consumer-centric health plans, precision underwriting, and outcome-based reimbursement further underlines the market's significance in reshaping the U.S. health insurance ecosystem.

Major Trends in the Market

-

Increased Adoption of AI and Machine Learning for Predictive Risk Stratification: Payers are using AI to identify members likely to develop chronic diseases or have high-cost episodes.

-

Integration of Social Determinants of Health (SDoH): Analytics platforms now incorporate non-clinical data to improve member engagement and reduce disparities in care delivery.

-

Expansion of Cloud-Based Analytics Platforms: Cloud infrastructure offers scalability, interoperability, and real-time data sharing across payer networks.

-

Fraud, Waste, and Abuse (FWA) Detection through Advanced Algorithms: Predictive analytics are increasingly used to detect anomalous claims and prevent improper reimbursements.

-

Consumer-Centric Plan Design and Behavioral Insights: Payers use analytics to design personalized benefit plans and communication strategies based on member behavior.

Report Scope of U.S. Healthcare Payer Analytics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 9.19 Billion |

| Market Size by 2035 |

USD 56.68 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 22.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Analytics Type, Component, Delivery Mode, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

CitiusTech, Inc.; Oracle; Cerner Corporation; SAS Institute, Inc.; Allscripts Healthcare, LLC; McKesson Corporation; MedeAnalytics, Inc.; HMS; IBM; Optum, Inc. |

Key Market Driver: Shift Toward Value-Based Care Models

The most critical driver of the U.S. healthcare payer analytics market is the shift from volume-based to value-based reimbursement models. Under value-based care, insurers reimburse providers based on the quality and outcomes of care rather than the quantity of services delivered. To succeed in this model, payers must collect, analyze, and act upon vast amounts of data related to patient health outcomes, cost efficiency, and provider performance.

Analytics tools are central to this process, enabling payers to identify high-risk patients, track clinical outcomes, forecast medical utilization, and design appropriate intervention strategies. For instance, a payer can use predictive analytics to detect diabetic patients at risk of hospitalization and implement targeted case management programs. In this way, analytics not only support cost containment but also improve member health, provider collaboration, and regulatory compliance.

Key Market Restraint: Data Silos and Interoperability Challenges

One of the primary restraints in the U.S. healthcare payer analytics market is the continued challenge of data silos and interoperability issues. Healthcare data often exists across disparate systems claims databases, electronic health records (EHRs), pharmacy benefit managers, third-party wellness platforms, and social service providers. Integrating this fragmented data into a unified analytics platform requires substantial technical infrastructure, data governance, and standardization.

Lack of real-time data exchange between payers and providers also hinders timely decision-making. Moreover, variations in coding systems, privacy concerns under HIPAA, and inconsistent data formats make data integration complex and costly. Without fully harmonized data, analytics outcomes may be limited in accuracy or timeliness, thus reducing their value for proactive care management or financial forecasting.

Key Market Opportunity: Personalized Health Plan Optimization

A major opportunity lies in leveraging analytics to create highly personalized health plan offerings based on member behavior, preferences, and clinical profiles. As consumers demand greater control and transparency in their healthcare choices, payers can differentiate themselves by offering customized benefit designs, real-time member engagement tools, and incentive programs that align with individual health goals.

Using analytics, insurers can identify which members respond to digital nudges, which ones are likely to benefit from wellness incentives, and which service bundles can drive preventive health outcomes. Behavioral analytics and natural language processing (NLP) are being used to evaluate call center data and member communications to improve satisfaction and retention. Personalization also extends to network design—ensuring that high-performing providers are matched with members most in need of their services, thus enhancing both outcomes and efficiency.

U.S. Healthcare Payer Analytics Market By Analytics Insights

Descriptive analytics dominated the U.S. healthcare payer analytics market, as it forms the foundational layer of most analytics systems. Descriptive analytics enables payers to understand historical trends in claims utilization, member demographics, disease prevalence, and cost performance. These insights inform operational decisions, regulatory reporting, and provider benchmarking. For example, payers routinely generate dashboards tracking chronic disease prevalence by region, utilization patterns of high-cost services, and performance against key health indicators.

While essential, descriptive analytics is increasingly being complemented by predictive analytics, which is the fastest-growing segment. Payers are now moving beyond "what happened" to "what will happen," using statistical models and machine learning algorithms to forecast member behavior and healthcare needs. Predictive analytics is being widely used in hospital readmission prediction, chronic disease onset modeling, and fraud detection. It enables proactive outreach and resource allocation, reducing avoidable costs and improving care quality. As computing power and access to longitudinal health data improve, predictive modeling is becoming a cornerstone of payer strategy.

U.S. Healthcare Payer Analytics Market By Delivery Model Insights

Cloud-based analytics platforms dominate the delivery model segment, offering unparalleled scalability, interoperability, and real-time data processing. The cloud enables payers to centralize massive datasets, reduce hardware costs, and accelerate software updates. Cloud-native solutions are particularly useful in facilitating multi-stakeholder collaboration—enabling seamless data exchange between payers, providers, government agencies, and third-party administrators.

While on-premises systems still serve legacy organizations, web-hosted models are witnessing rapid adoption, particularly among regional and niche payers seeking hybrid solutions. These models offer a balance between control and scalability and are often used for staging or secondary analytics environments. Regulatory changes like the ONC interoperability rule and the adoption of FHIR (Fast Healthcare Interoperability Resources) APIs are accelerating the shift toward hosted and cloud-based analytics ecosystems across the country.

U.S. Healthcare Payer Analytics Market By Application Insights

Financial analytics remains the dominant application area, as it directly supports payer core functions such as claims management, revenue forecasting, risk adjustment, and premium pricing. Advanced financial analytics helps insurers detect upcoding or duplicate claims, manage actuarial risk, and optimize provider payment models. In an environment of narrow margins and value-based contracts, financial visibility is a strategic imperative.

Operational and administrative analytics is the fastest-growing application segment, fueled by the need to streamline internal workflows, reduce administrative burdens, and improve customer service. This segment includes tools that analyze call center efficiency, claims adjudication speed, workforce productivity, and regulatory compliance. Especially as payer organizations adopt digital front doors and self-service portals, operational analytics becomes essential in driving process optimization and improving the member experience.

U.S. Healthcare Payer Analytics Market By Component Insights

Software solutions represent the dominant component in the market, accounting for the majority of revenue as payers invest in integrated analytics platforms that combine real-time dashboards, machine learning tools, and data visualization capabilities. These platforms are deployed to centralize data ingestion, automate compliance reporting, and enable dynamic risk scoring. Leading software vendors offer modules tailored to various applications from claims adjudication to population health management making them indispensable to payer operations.

Services, however, are the fastest-growing component, driven by the need for implementation support, data engineering, training, and ongoing optimization. Many payer organizations lack in-house expertise to deploy and customize analytics platforms, prompting them to partner with health IT consulting firms and third-party vendors. Service providers help configure algorithms, establish KPIs, and ensure regulatory compliance, especially under evolving rules from CMS and state health exchanges. Additionally, managed analytics services are gaining popularity among mid-sized insurers seeking rapid deployment with minimal IT investment.

Country-Level Analysis: United States

In the United States, the healthcare payer analytics landscape is evolving rapidly, shaped by federal policy shifts, rising healthcare costs, and growing consumer expectations. The country’s mixed public-private payer model including Medicare Advantage plans, Medicaid Managed Care Organizations (MCOs), and commercial health insurers necessitates highly adaptive analytics platforms that can meet diverse regulatory and operational requirements.

Government mandates such as the CMS Interoperability Rule and the ACA’s risk adjustment programs have spurred investment in analytics infrastructure among both public and private payers. Private insurers are also partnering with state Medicaid programs to build integrated data ecosystems that enable social risk stratification and community health interventions. Health equity, transparency, and fraud prevention are becoming top national priorities, each demanding advanced analytics to support measurement and action.

The U.S. market also benefits from a robust vendor ecosystem, with homegrown health IT firms and consulting giants developing tailored analytics solutions. This competitive environment accelerates innovation but also necessitates strategic vendor selection and change management for payer organizations transitioning from legacy systems.

Some of the prominent players in the U.S. healthcare payer analytics market include:

- CloudMedx

- DataSmart Solutions

- Amitech Solutions

- Altegra Health

- Caserta Concepts

- Greenway Health, LLC

- IMAT Solutions

- Health Catalyst

- Indegene

- IBM

- Optum

- Oracle

- HMS

- Citius Tech

- MedeAnalytics

Recent Developments

-

Optum (April 2025) launched an AI-powered predictive analytics engine within its payer platform, aiming to reduce emergency room visits among high-risk Medicaid members by 18% within 12 months.

-

Change Healthcare (March 2025) introduced a cloud-native fraud detection tool for Medicare Advantage plans, integrating real-time behavioral modeling and anomaly detection to identify improper claims faster.

-

IBM Watson Health (February 2025) announced a strategic collaboration with a major Blue Cross Blue Shield plan to deploy prescriptive analytics tools for precision benefit design and cost forecasting.

-

HealthEdge (January 2025) released its new web-hosted payer analytics module with FHIR-based interoperability, simplifying data ingestion from EHRs and pharmacy benefit managers.

-

EXL Service (December 2024) expanded its payer analytics services with a new cognitive automation suite targeting claims adjudication and denial management optimization for large health plans.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare payer analytics market

By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Component

- Software

- Hardware

- Services

By Delivery Model

- On–Premises

- Web-Hosted

- Cloud-Based

By Application

- Clinical

- Financial

- Operational & Administrative