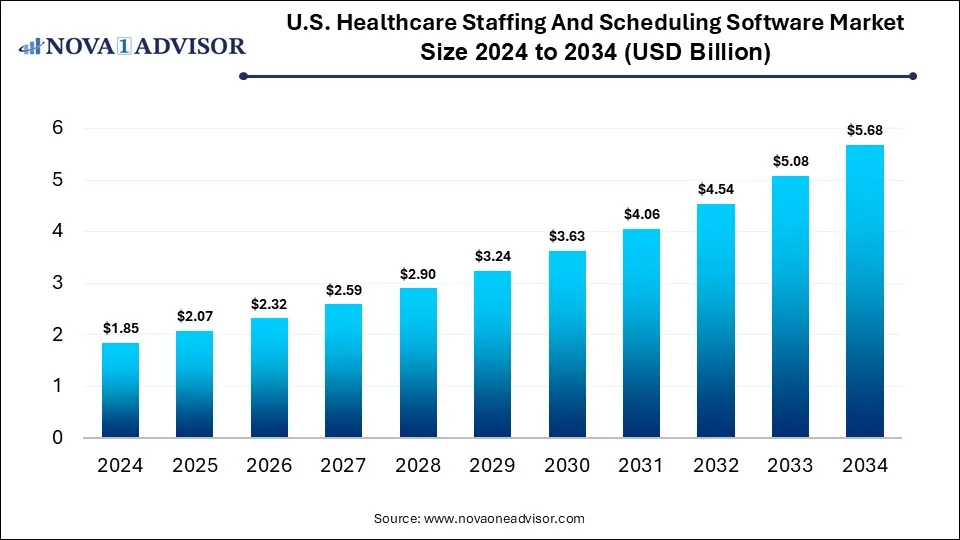

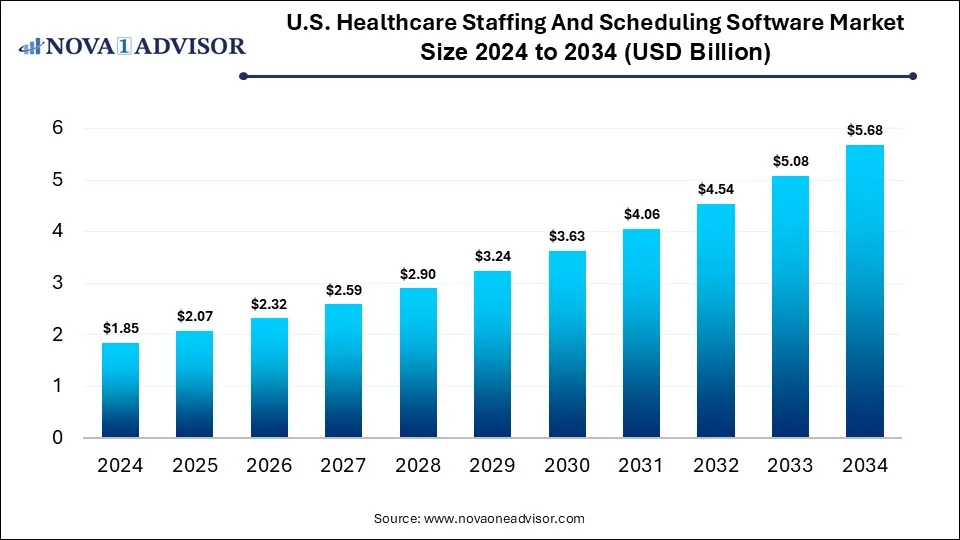

U.S. Healthcare Staffing And Scheduling Software Market Size and Forecast 2025 to 2034

The U.S. healthcare staffing and scheduling software market size was calculated at USD 1.85 billion in 2024 and is expected to reach USD 5.68 billion by 2034, expanding at a CAGR of 11.88% during the forecast period 2025 to 2034. The growth of the market is attributed to healthcare workforce shortages, focus on cost reduction, and rising demand for specialized care.

Key Takeaways

- By deployment mode, the cloud-based segment dominated the market in 2024.

- By deployment mode, the web-based segment is expected to expand at a significant growth rate between 2025 and 2034.

- By application, the time and attendance segment led the market in 2024.

- By application, the staff scheduling segment is expected to expand at the highest CAGR over the projection period.

- By end use, the healthcare facilities segment contributed the largest market share in 2024.

- By end use, the home care settings segment is likely to expand at the fastest CAGR in the coming years.

How is AI Impacting the U.S. Healthcare Staffing And Scheduling Software Market?

AI is significantly transforming the U.S. healthcare staffing and scheduling software market by enabling smarter, data-driven workforce management. AI-powered tools can analyze historical staffing patterns, patient volume trends, and employee availability to generate optimized schedules that reduce understaffing, overstaffing, and last-minute shift changes. These systems also enhance predictive capabilities, allowing healthcare facilities to anticipate demand surges and proactively adjust staffing levels.

AI-driven automation reduces administrative burdens on managers, improves compliance with labor regulations, and minimizes human error in scheduling processes. Additionally, AI tools can improve staff satisfaction by offering personalized shift recommendations based on preferences, fatigue levels, and workload balance. As healthcare organizations strive for greater efficiency and cost control, AI is becoming a crucial component of modern staffing and scheduling solutions.

- In July 2025, ShiftMed, a U.S.-based company, launched its Workforce AI Suite, an intelligent toolset that automates shift fulfillment and optimizes workforce management for health systems. Designed to reduce reliance on costly labor and streamline scheduling amid rising costs and changing Medicaid reimbursements, the AI-powered suite helps hospitals improve efficiency and contain staffing expenses without sacrificing care quality.

Market Overview

The U.S. healthcare staffing and scheduling software market refers to the segment of health IT solutions designed to streamline the management of workforce resources in medical settings such as hospitals, clinics, long-term care centers, and home care services. These platforms help automate and optimize complex tasks like shift planning, time and attendance tracking, compliance management, and staff allocation, ensuring that the right personnel are available at the right time. The software offers numerous benefits across various applications, including reducing administrative workload, minimizing labor costs, improving patient care quality, enhancing employee satisfaction, and ensuring compliance with labor laws and healthcare regulations.

The growth of this market is being driven by ongoing healthcare workforce shortages, rising patient volumes, increasing pressure to reduce operational costs, and a growing shift toward digital transformation within healthcare systems. The adoption of AI-powered scheduling, cloud-based platforms, and mobile accessibility is further accelerating market expansion, as providers seek scalable, efficient, and data-driven solutions to manage an increasingly complex and dynamic workforce environment.

What are the Major Trends in the U.S. Healthcare Staffing And Scheduling Software Market?

- AI and Predictive Analytics Integration

Healthcare organizations are increasingly adopting AI-powered tools that use predictive analytics to forecast staffing needs, optimize schedules, and minimize last-minute changes. These technologies help improve workforce planning, reduce costs, and enhance patient care delivery.

- Mobile and Remote Access Solutions

The demand for mobile-friendly platforms is growing as healthcare workers seek the flexibility to manage schedules, swap shifts, and receive updates from their smartphones or tablets. This trend supports the rise of hybrid work models and enhances employee engagement.

- Shift Toward Cloud-Based Platforms

Cloud-based deployment is becoming the preferred choice due to its scalability, lower upfront costs, and ease of integration with other healthcare IT systems. It also enables real-time updates and centralized management across multi-location healthcare networks.

Rising Adoption in Home Healthcare and Long-Term Care

With the increasing emphasis on aging-in-place and post-acute care, there is growing adoption of staffing software in home health and long-term care settings. These environments require flexible, decentralized scheduling tools that can efficiently manage mobile and part-time workforces.

How Macroeconomic Variables Impact the U.S. Healthcare Staffing And Scheduling Software Market?

GDP

GDP generally drives the growth of the market, as a stronger economy increases government and private sector investment in healthcare infrastructure and technology. Higher GDP levels typically lead to larger healthcare budgets, enabling facilities to invest in advanced workforce management solutions to improve efficiency and reduce costs. Conversely, during periods of low GDP or economic downturn, healthcare providers may delay or reduce tech investments, potentially restraining market growth temporarily.

Inflation

Inflation restrains the growth of the market by increasing operational costs and reducing the purchasing power of healthcare providers. As expenses for labor, equipment, and technology rise, many organizations may delay or scale back investments in new software solutions. However, in some cases, inflation can indirectly drive interest in scheduling software as providers seek to control labor costs and improve efficiency to offset financial pressures.

U.S. Tariffs

U.S. tariffs can have a direct positive impact on the market, but they can indirectly restrain growth if they lead to higher costs for hardware, IT infrastructure, or imported technology components. Increased operational expenses due to tariffs may force healthcare providers to reprioritize budgets, potentially delaying investment in non-essential software upgrades. However, since most staffing software is developed domestically or delivered via cloud platforms, the overall effect of tariffs on this specific market remains minimal.

Economic Uncertainty

Economic uncertainty affects the market growth, as healthcare providers may delay or reduce investments in new technologies due to budget constraints and financial caution. Unpredictable economic conditions can lead to tighter capital spending, making organizations hesitant to adopt or upgrade workforce management solutions. However, in some cases, economic pressure may also encourage providers to seek cost-saving tools like scheduling software to optimize staffing and improve efficiency with limited resources.

Report Scope of U.S. Healthcare Staffing And Scheduling Software Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.07 Billion |

| Market Size by 2034 |

USD 5.68 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.88% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Deployment Mode, Application, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

Market Dynamics

Drivers

Nursing Shortage and Workforce Constraints

The ongoing nursing shortage and workforce constraints are key drivers of growth in the U.S. healthcare staffing and scheduling software market because they create urgent pressure on healthcare providers to optimize limited human resources. With fewer nurses available to cover increasing patient loads, facilities rely on advanced scheduling tools to efficiently allocate shifts, minimize overtime, and reduce burnout. These staffing and scheduling software solutions help identify staffing gaps in real time and enable faster adjustments, ensuring patient care continuity despite workforce challenges. Additionally, better scheduling improves job satisfaction and retention by accommodating employee preferences and preventing overwork. As a result, healthcare organizations are increasingly investing in staffing software to manage these constraints and maintain high-quality care.

- The US Bureau of Labor Statistics projects a need for over 275,000 additional nurses between 2020 and 2030.

Regulatory Compliance

Regulatory compliance is also driving the growth of the market as healthcare organizations must adhere to complex labor laws, credentialing requirements, and patient safety regulations. Staffing software helps automate compliance by tracking staff certifications, ensuring proper shift lengths, and maintaining accurate records for audits. This reduces the risk of costly penalties, legal issues, and staffing errors that can arise from manual scheduling processes. As regulations continue to evolve, healthcare providers increasingly rely on these solutions to stay compliant while managing workforce complexity efficiently. Consequently, the need for robust compliance features is fueling the adoption of advanced staffing and scheduling software across the industry.

Restraints

High Implementation Costs and Integration Challenges

High implementation costs and integration challenges restrain the growth of the U.S. healthcare staffing and scheduling software market. Many healthcare organizations, especially smaller facilities, find the upfront investment for software installation, customization, and training to be prohibitively expensive. Additionally, integrating new staffing solutions with existing legacy systems like EHRs and payroll platforms can be complex and time-consuming, often causing delays and increased project costs. These hurdles discourage some providers from adopting advanced scheduling software or lead to slow deployment, limiting market expansion. As a result, overcoming these financial and technical barriers remains critical for broader market growth.

Data Security Concerns

Data security concerns significantly restrain the growth of the market due to the sensitive nature of employee and patient information involved. Healthcare organizations face stringent regulations like HIPAA that require robust data protection measures, and any breach can lead to severe legal and financial consequences. Many providers hesitate to adopt new software solutions out of fear that cloud-based or web-based platforms may expose their data to cyberattacks or unauthorized access. Ensuring secure data storage, transmission, and compliance increases the complexity and cost of implementing these systems. Consequently, concerns around data privacy and security create adoption barriers that slow down market growth.

Opportunities

Demand for Value-Based Care

The growing demand for value-based care creates immense opportunities in the U.S. healthcare staffing and scheduling software market by driving the need for more efficient and cost-effective workforce management. Value-based care emphasizes quality outcomes and patient satisfaction, which require healthcare providers to optimize staff allocation to ensure timely, coordinated care. Staffing software enables better matching of staff skills with patient needs, reduces unnecessary overtime, and improves overall operational efficiency. By supporting data-driven decision-making, these solutions help organizations meet performance metrics and reduce costs associated with inefficient staffing. This shift toward value-based models is pushing more healthcare providers to invest in advanced scheduling tools that enhance both care quality and financial performance.

Expansion of Home Healthcare

The expansion of home healthcare presents significant opportunities for the market. As more patients opt for care in their homes, the demand for flexible and decentralized workforce management solutions rises. Home healthcare providers need specialized scheduling tools to efficiently coordinate visits, manage mobile caregivers, and adapt to varying patient needs in real time. These software solutions help improve caregiver utilization, reduce travel time, and ensure compliance with regulatory requirements specific to home care. Additionally, the growing elderly population and focus on aging in place are accelerating market growth by increasing the volume and complexity of home care services. As a result, providers are investing heavily in advanced scheduling platforms tailored to the unique challenges of home healthcare.

Segment Outlook

Deployment Mode Insights

What Made Cloud-Based the Dominant Segment in the Market in 2024?

The cloud-based segment dominated the U.S. healthcare staffing and scheduling software market with the largest share in 2024. This is mainly due to the high scalability, flexibility, and lower upfront costs of cloud-based systems compared to on-premises systems. Healthcare providers, especially amid staffing shortages and budget pressures, increasingly preferred cloud platforms for their ability to support remote access, real-time updates, and seamless integration with other digital health systems like EHRs and HR platforms.

Additionally, cloud-based tools enabled faster deployment and easier maintenance, reducing the IT burden on hospitals and clinics. The growing shift toward mobile workforce management and telehealth further reinforced the demand for cloud-native scheduling systems that can support decentralized and hybrid care models. Enhanced security features and compliance with HIPAA and other regulations also contributed to their widespread adoption.

The web-based segment is expected to grow at a significant rate during the forecast period due to its accessibility, ease of use, and cost-effectiveness for small to mid-sized healthcare facilities. Unlike traditional on-premise systems, web-based platforms require minimal infrastructure and allow users to access scheduling tools from any internet-enabled device, which is crucial for managing a dispersed or hybrid workforce. These solutions also offer quicker implementation, regular automatic updates, and lower maintenance costs, making them attractive for organizations with limited IT resources.

As healthcare providers increasingly prioritize flexibility and remote accessibility, web-based systems are becoming a preferred choice. Additionally, advancements in web technologies are narrowing the gap between web-based and cloud-native systems, further accelerating their adoption.

U.S. Healthcare Staffing And Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Web-Based |

0.46 |

0.51 |

0.56 |

0.61 |

0.67 |

0.73 |

0.80 |

0.87 |

0.95 |

1.04 |

1.14 |

| Cloud-Based |

0.65 |

0.75 |

0.86 |

0.98 |

1.13 |

1.30 |

1.49 |

1.70 |

1.95 |

2.24 |

2.56 |

| On-Premises |

0.46 |

0.51 |

0.56 |

0.61 |

0.67 |

0.73 |

0.80 |

0.87 |

0.95 |

1.04 |

1.14 |

| Mobile Installed |

0.28 |

0.31 |

0.35 |

0.39 |

0.43 |

0.49 |

0.54 |

0.61 |

0.68 |

0.76 |

0.85 |

Application Insights

Why Did the Time and Attendance Segment Lead the Market in 2024?

The time and attendance segment led the U.S. healthcare staffing and scheduling software market in 2024. The dominance of the segment stems from the critical need for accurate workforce tracking and labor cost management in healthcare settings. With ongoing staffing shortages and increasing labor costs, healthcare providers prioritized tools that could monitor employee hours, reduce unauthorized overtime, and ensure compliance with labor laws and union rules.

Time and attendance systems also played a key role in streamlining payroll processes and minimizing errors, which are essential in large, complex healthcare environments. The integration of biometric and mobile clock-in solutions further enhanced efficiency and accountability. As a result, these systems became indispensable for optimizing workforce utilization and maintaining operational efficiency across hospitals and clinics.

The staff scheduling segment is expected to expand at the highest CAGR during the upcoming period, driven by the increasing demand for efficient workforce management amid ongoing staffing shortages and fluctuating patient volumes. Healthcare providers are seeking dynamic scheduling tools that can adapt in real time, minimize shift gaps, and reduce reliance on costly agency staff. Advanced staff scheduling solutions powered by AI and predictive analytics enable more accurate forecasting of staffing needs, improving both patient care and employee satisfaction.

The shift toward flexible work models and the rise in part-time and per diem staff further drive the need for agile, automated scheduling systems. As healthcare organizations focus on reducing burnout and optimizing labor resources, investment in advanced staff scheduling tools is becoming a top priority.

U.S. Healthcare Staffing And Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Time and Attendance |

0.4 |

0.4 |

0.5 |

0.5 |

0.6 |

0.7 |

0.7 |

0.8 |

0.9 |

1.1 |

1.2 |

| HR and Payroll |

0.3 |

0.4 |

0.4 |

0.5 |

0.5 |

0.6 |

0.7 |

0.7 |

0.8 |

0.9 |

1.0 |

| Scheduling |

0.5 |

0.5 |

0.6 |

0.7 |

0.7 |

0.8 |

0.9 |

1.0 |

1.2 |

1.3 |

1.5 |

| Talent Management |

0.2 |

0.3 |

0.3 |

0.3 |

0.4 |

0.4 |

0.5 |

0.5 |

0.6 |

0.7 |

0.7 |

| Reporting & Analytics |

0.3 |

0.3 |

0.4 |

0.4 |

0.4 |

0.5 |

0.6 |

0.6 |

0.7 |

0.8 |

0.9 |

| Others |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

End Use Insights

Why Did Healthcare Facilities Hold the Largest Market Share in 2024?

The healthcare facilities segment held the largest share of the U.S. healthcare staffing and scheduling software market in 2024 due to the high demand for efficient workforce management across hospitals, clinics, and long-term care centers. These facilities face constant challenges such as staff shortages, high patient volumes, and regulatory compliance, making advanced scheduling and time-tracking tools essential for maintaining operational efficiency. The need to minimize labor costs, reduce employee burnout, and ensure adequate staffing levels across multiple departments further drove the adoption of these solutions. Additionally, healthcare facilities were early adopters of integrated digital systems, allowing for smoother implementation of staffing and scheduling software.

The home care settings segment is expected to expand at the fastest CAGR over the projection period. The growth of the segment is attributed to the rising demand for in-home healthcare services driven by an aging population, chronic disease prevalence, and a shift toward value-based care. As more patients opt for care outside traditional hospital settings, home healthcare providers are increasingly adopting staffing and scheduling software to manage a dispersed and mobile workforce efficiently.

These tools help ensure timely visits, optimize caregiver routes, and maintain compliance with regulatory requirements. The flexibility and scalability of modern scheduling solutions are particularly well-suited to the dynamic nature of home care operations. Additionally, growing investment in digital health and remote care technologies is accelerating the adoption of workforce management tools in home care settings.

U.S. Healthcare Staffing And Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Healthcare Facilities |

1.39 |

1.55 |

1.73 |

1.93 |

2.15 |

2.40 |

2.68 |

2.99 |

3.33 |

3.72 |

4.15 |

| Home Care Settings |

0.46 |

0.52 |

0.59 |

0.66 |

0.75 |

0.84 |

0.95 |

1.07 |

1.21 |

1.36 |

1.53 |

U.S. Healthcare Staffing and Scheduling Software Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves designing, testing, and developing innovative software solutions that address the complex needs of healthcare staffing and scheduling. Companies invest in AI, machine learning, and predictive analytics to build features like real-time scheduling, demand forecasting, and compliance management.

2. Software Development & Integration

Once research is complete, this stage includes the actual coding, development, and beta testing of the software, followed by integration capabilities with existing systems such as EHRs, payroll, and timekeeping platforms. Key players develop scalable, secure platforms that can seamlessly integrate with diverse IT infrastructures across healthcare organizations.

3. Marketing & Sales

In this stage, companies promote their products to hospitals, clinics, long-term care facilities, and home health agencies through targeted marketing campaigns, trade shows, healthcare IT conferences, and digital platforms. Sales teams work directly with healthcare decision-makers to demonstrate ROI, cost savings, and compliance benefits associated with adopting their software solutions.

4. Deployment & Implementation Services

This stage involves configuring the software to the client’s specific needs, including user access control, department structures, labor rule customization, and compliance requirements. Companies also provide implementation support, staff training, and data migration services to ensure a smooth transition from legacy systems.

5. Support & Maintenance

After deployment, vendors offer continuous technical support, system updates, and maintenance services to ensure long-term performance, data security, and user satisfaction. This stage is crucial for customer retention and includes services like help desks, troubleshooting, compliance updates, and software enhancements.

6. End-Users

Healthcare facilities and home care settings use the software to manage scheduling, monitor attendance, ensure compliance with labor laws, and improve patient care delivery. The effectiveness of the software at this stage directly impacts workforce efficiency, employee satisfaction, and operational cost savings.

Key Players Operating in the U.S. Healthcare Staffing and Scheduling Software Market

1. UKG (Ultimate Kronos Group)

UKG offers robust workforce management and scheduling solutions tailored for healthcare, focusing on improving staff productivity and regulatory compliance. Their platform integrates timekeeping, labor analytics, and employee engagement tools, helping healthcare organizations optimize shift management and reduce labor costs.

2. BookJane

BookJane provides an AI-driven platform that automates on-demand staffing and shift scheduling for healthcare providers, enabling quick fill of open shifts with qualified professionals. Their technology reduces administrative overhead and improves workforce flexibility in dynamic healthcare environments.

3. AMN Healthcare

AMN Healthcare combines staffing services with technology solutions, offering scheduling platforms that improve workforce allocation and reduce gaps in care delivery. Their software is supported by deep industry expertise, making it highly effective for managing temporary and permanent healthcare staff.

4. Oracle (Cerner)

Oracle, through its Cerner acquisition, integrates workforce management into its comprehensive EHR systems, facilitating seamless scheduling and credential tracking for healthcare providers. This integration streamlines clinical operations and enhances staff coordination across various departments.

5. Aya Healthcare

Aya Healthcare specializes in travel nurse staffing and offers proprietary scheduling software that ensures efficient placement and management of temporary healthcare workers. Their platform supports real-time shift assignments and compliance management, addressing the unique challenges of contingent staffing.

6. ShiftMed

ShiftMed operates a mobile-first platform focused on real-time, on-demand nursing and healthcare staff scheduling, enhancing workforce responsiveness. The solution allows healthcare facilities to fill shifts quickly while offering caregivers greater scheduling flexibility.

7. QGenda, LLC

QGenda provides automated, cloud-based scheduling solutions for physicians and clinical staff, enabling real-time updates and credential management. Their platform helps reduce scheduling conflicts and improve staff utilization across hospitals and healthcare systems.

8. RLDatix

RLDatix delivers workforce management tools emphasizing regulatory compliance and risk management, ensuring healthcare staffing adheres to legal and safety standards. Their scheduling software supports healthcare providers in mitigating staffing risks while maintaining operational efficiency.

9. Bullhorn Inc.

Bullhorn offers recruitment CRM and staffing software solutions widely used by healthcare staffing agencies to manage candidate pipelines and coordinate placements. Their technology streamlines the recruitment-to-scheduling process, improving overall staffing efficiency.

10. SmartLinx Solutions

SmartLinx specializes in workforce management software for long-term care and senior living facilities, focusing on scheduling, timekeeping, and payroll integration. Their platform enhances staff productivity and compliance in post-acute care environments.

11. Infor

Infor provides cloud-based workforce management solutions with predictive scheduling, labor analytics, and compliance features tailored for healthcare organizations. Their software helps reduce labor costs while ensuring adherence to complex healthcare regulations.

12. eSchedule

eSchedule offers healthcare-specific scheduling software designed to handle complex shift patterns, employee communication, and attendance tracking. Their platform supports improved operational workflows in hospitals and clinics by simplifying schedule management.

13. Sling

Sling is a user-friendly employee scheduling app popular among healthcare providers for its ease of use, shift swapping, and communication features. It helps streamline shift coordination and reduces scheduling conflicts in fast-paced healthcare settings.

14. Connecteam

Connecteam provides a mobile-first workforce management platform with scheduling, time tracking, and communication tools tailored for frontline healthcare workers. Their solution increases staff engagement and ensures efficient shift management across decentralized care teams.

15. Amergis

Amergis offers digital workforce scheduling and billing solutions primarily for home health, hospice, and behavioral health providers. Their platform integrates clinical and administrative workflows, enhancing staffing efficiency and care delivery in community-based settings.

Recent Developments

- In July 2025, AMN Healthcare sold its Smart Square scheduling software to symplr and formed a commercial partnership with the company. This collaboration combines symplr’s expertise in healthcare operations technology with AMN’s leadership in workforce solutions to better serve customers.

- In December 2024, a U.S.-based talent and staffing software company Aya Healthcare agreed to acquire Cross Country Healthcare for approximately $615 million in an all-cash deal at $18.61 per share. Aya, known for its digital staffing platform covering travel nursing, allied health, and permanent hires, will operate Cross Country as a separate brand post-merger. This acquisition enables Cross Country to expand its presence to all 50 states and enter non-clinical staffing settings.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare staffing and scheduling software market.

By Deployment Mode

- Web-Based

- Cloud-Based

- On-Premises

- Mobile Installed

By Application

- Time and Attendance

- HR and Payroll

- Scheduling

- Talent Management

- Reporting & Analytics

- Others

By End Use

- Healthcare Facilities

- Home Care Settings