U.S. Healthcare Third-party Logistics Market Size and Research

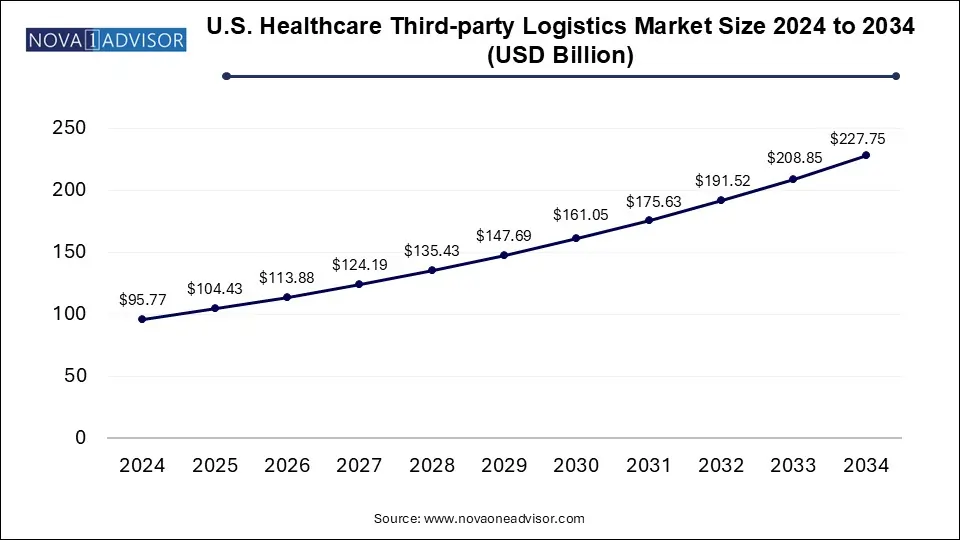

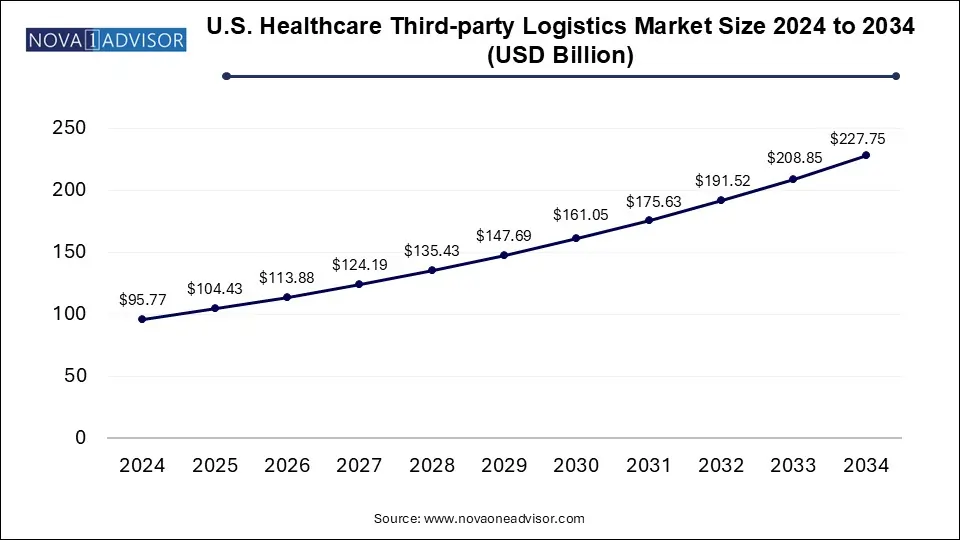

The U.S. healthcare third-party logistics market size was exhibited at USD 95.77 billion in 2024 and is projected to hit around USD 227.75 billion by 2034, growing at a CAGR of 9.05% during the forecast period 2025 to 2034.

U.S. Healthcare Third-party Logistics Market Key Takeaways:

- The biopharmaceutical segment dominated the overall market with a revenue share of over 60.0% in 2024.

- The medical device segment is expected to witness the fastest growth over the forecast period.

- The non-cold chain logistics segment generated the largest revenue share of over 60% in 2024.

- The warehousing and storage segment dominated with the largest revenue share of over 41.0% in 2024.

- The other services segment is expected to register the fastest CAGR during the forecast period.

- The Midwest region dominated the overall market share of over 25.0% in 2024.

Market Overview

The U.S. healthcare third-party logistics (3PL) market has become a vital component of the nation’s healthcare supply chain, ensuring the timely, secure, and compliant movement of pharmaceuticals, biopharmaceuticals, and medical devices. As the healthcare industry expands and diversifies, logistics operations are becoming increasingly complex—requiring specialized services such as temperature-controlled transportation, regulatory documentation, and just-in-time (JIT) inventory management. In this evolving environment, healthcare organizations are increasingly turning to 3PL providers to manage these critical logistics functions.

In essence, 3PL services serve as an outsourced solution for manufacturers and healthcare providers, allowing them to focus on core operations such as research, development, and patient care. In the U.S., the integration of 3PL in healthcare logistics is driven by multiple factors including the growth in e-commerce pharmaceutical sales, the increasing complexity of biopharma products, the expansion of cold chain infrastructure, and heightened regulatory compliance requirements.

Further, the COVID-19 pandemic underscored the importance of reliable, flexible, and scalable logistics systems. With the urgent need for vaccine distribution, PPE deployment, and test kit delivery, 3PL providers demonstrated their strategic value in healthcare delivery. Post-pandemic, the sector continues to gain momentum as healthcare stakeholders seek efficiency, visibility, and traceability in their logistics operations. From urban distribution hubs to remote rural delivery, the demand for healthcare-specific 3PL services in the U.S. is steadily rising.

Major Trends in the Market

-

Growth in Cold Chain Logistics: The rising demand for temperature-sensitive biologics and vaccines is driving investment in advanced cold chain infrastructure.

-

Digitalization of Supply Chains: The adoption of tracking, IoT sensors, and real-time analytics is enhancing visibility and risk management across logistics networks.

-

Compliance-focused Services: Stringent FDA and DEA regulations are fueling demand for 3PL partners with expertise in healthcare-specific regulatory compliance.

-

Increased Outsourcing of Reverse Logistics: Returns and recalls of pharmaceuticals are increasingly being outsourced to specialized 3PL providers.

-

Consolidation Among Providers: Mergers and acquisitions are reshaping the competitive landscape, enabling providers to expand geographically and vertically.

-

Rise in Last-mile Delivery for E-pharmacy Models: As prescription drug sales shift online, 3PL providers are building specialized last-mile networks.

-

Sustainability in Healthcare Logistics: Eco-friendly warehousing, green fleets, and energy-efficient cold storage are emerging as competitive differentiators.

Report Scope of U.S. Healthcare Third-party Logistics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 104.43 Billion |

| Market Size by 2034 |

USD 227.75 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.05% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Industry, Supply Chain, Service Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

ShipMonk; DHL International; Cardinal Health; MCKESSON CORPORATION; Kuehne+Nagel; AmerisourceBergen Corporation; C.H. Robinson; CEVA Logistics; Promptus, LLC; FedEx |

Market Driver: Increasing Complexity of the Biopharmaceutical Supply Chain

A key driver of the U.S. healthcare 3PL market is the increasing complexity and volume of biopharmaceutical products entering the market. Unlike conventional pharmaceuticals, biopharmaceuticals such as monoclonal antibodies, gene therapies, and cell-based treatments require highly specialized storage, handling, and transportation conditions. Many of these products are temperature-sensitive, requiring end-to-end cold chain logistics that maintain strict parameters throughout the supply journey.

As biopharma innovation accelerates, logistics needs have grown to include validated packaging, data loggers, 24/7 monitoring, and secure transit services. For instance, therapies like CAR-T require not just cold storage but real-time chain-of-identity tracking to match patients with the correct biological material. 3PL providers capable of offering specialized, validated logistics for such products are increasingly sought after.

The need for scalability, quality assurance, and geographic reach makes it impractical for many drug manufacturers to manage these operations in-house. Consequently, outsourcing to 3PL partners with biopharma expertise has become not just a cost-saving decision, but a strategic imperative.

Market Restraint: High Capital Investment for Infrastructure Development

Despite the strong growth trajectory, the U.S. healthcare 3PL market is restrained by the high capital investment required to build and maintain specialized infrastructure. Establishing validated cold chain systems, DEA-compliant warehouses, and secure transport fleets necessitates significant financial outlay. Small and mid-sized logistics providers may find it difficult to enter or scale in the healthcare sector due to these costs.

Moreover, maintenance of infrastructure especially for cold chain assets such as temperature-controlled containers, backup power supplies, and real-time monitoring systems requires ongoing operational expenditure. Additionally, regulatory compliance demands staff training, documentation protocols, and audit readiness, which can further increase overhead.

As a result, smaller logistics players may be hesitant to pivot into healthcare logistics, while existing providers may be selective in expanding their service offerings. This financial barrier limits market entry and can slow down service innovation or geographic expansion for newer entrants.

Market Opportunity: Expansion of E-commerce and Direct-to-patient Delivery Models

One of the most exciting opportunities in the U.S. healthcare 3PL market lies in the rapid expansion of e-commerce-based pharmaceutical sales and direct-to-patient (DTP) delivery models. The rise of digital health platforms and online pharmacies has transformed how medications are purchased and delivered. As consumers increasingly seek home delivery of prescriptions, 3PL providers have a unique opportunity to become essential facilitators of last-mile healthcare logistics.

E-pharmacies, virtual clinics, and digital therapeutics platforms are outsourcing logistics to specialized 3PLs that can manage temperature-sensitive deliveries, ensure secure handling, and provide delivery confirmation with HIPAA-compliant protocols. This trend is especially significant in chronic disease management, where patients require regular medication refills or injectable therapies delivered directly to their homes.

With increasing venture capital flowing into digital health startups, 3PL providers that offer nimble, scalable DTP capabilities—along with cold chain and reverse logistics support—are well-positioned to capture new business. This convergence of healthcare, e-commerce, and logistics is set to reshape how medications reach patients in the post-pandemic era.

U.S. Healthcare Third-party Logistics Market By Industry Insights

The pharmaceutical segment currently dominates the U.S. healthcare 3PL market due to the sheer scale of generic and branded drug distribution across retail and institutional channels. From warehousing to overland distribution, pharmaceutical logistics requires regulatory compliance (e.g., DSCSA serialization), temperature control (room temperature or refrigerated), and reverse logistics for expired or recalled drugs. Large pharmacy chains, wholesalers, and distributors rely heavily on third-party logistics providers to ensure uninterrupted supply.

However, the biopharmaceutical segment is the fastest growing due to the proliferation of biologics, biosimilars, and advanced therapeutics. These products demand ultra-cold storage, time-critical delivery, and real-time environmental monitoring. For instance, mRNA vaccines introduced during the COVID-19 pandemic required cold chain infrastructure capable of maintaining temperatures as low as -80°C. As gene therapy and personalized medicine gain traction, biopharma logistics is expected to account for an increasingly large share of healthcare 3PL demand.

U.S. Healthcare Third-party Logistics Market By Supply Chain Insights

Non-cold chain logistics services currently dominate due to their role in transporting the majority of pharmaceuticals and medical devices that do not require temperature-sensitive handling. These include standard tablet medications, over-the-counter drugs, diagnostic kits, and surgical instruments. Non-cold chain services are widely distributed across retail and hospital supply networks and benefit from existing infrastructure and optimized delivery models.

Cold chain logistics, on the other hand, is the fastest-growing segment due to the increasing number of temperature-sensitive therapies entering the market. This includes not only biologics and vaccines but also certain medical devices like blood glucose test strips and certain reagents. Recent trends such as the need for consistent ultra-low-temperature control, chain-of-custody, and data-validated transit conditions are pushing 3PL providers to expand and upgrade their cold chain capabilities. Growth in this segment is expected to accelerate with FDA approval of more advanced biologics and expansion of precision medicine.

U.S. Healthcare Third-party Logistics Market By Service Type Insights

Transportation remains the dominant service type, encompassing air freight, sea freight, and overland transportation. Among these, overland transport is the most widely used, especially for last-mile delivery within the U.S. Air freight plays a critical role for time-sensitive biologics, while sea freight is reserved for bulk international imports. Pharmaceutical and medical device companies often rely on dedicated or shared-fleet transportation managed by 3PLs to ensure compliant, timely distribution across vast U.S. geographies.

Warehousing and storage is the fastest-growing segment due to increasing demand for temperature-controlled and DEA-compliant facilities. As drug manufacturers look to optimize inventory and manage regional distribution, decentralized warehousing strategies are gaining popularity. Warehousing services now extend beyond storage to include inventory management, serialization, fulfillment, and value-added services like relabeling and kitting. With the push toward faster delivery times and local inventory stocking, 3PL firms are investing heavily in advanced warehousing technologies and strategically located hubs.

U.S. Healthcare Third-party Logistics Market By Regional Insights

As the world’s largest healthcare market, the United States represents a unique environment for third-party logistics providers. The country’s fragmented healthcare delivery model, complex regulatory environment, and vast geography create both challenges and opportunities for logistics innovation. Major hubs such as California, Texas, New York, and Illinois serve as distribution centers for medical products, often supported by large-scale 3PL operations.

Federal mandates like the Drug Supply Chain Security Act (DSCSA) are forcing drug manufacturers and distributors to adopt serialized tracking systems a requirement that many 3PL providers now offer as a value-added service. Moreover, the rise in biologics and at-home care models is creating demand for cold chain storage and direct-to-consumer logistics. The U.S. healthcare system's dependence on just-in-time inventory and its embrace of digital health platforms further boost the role of 3PL providers as operational enablers across the pharmaceutical and medical device supply chain.

Some of the prominent players in the U.S. healthcare third-party logistics market include:

- ShipMonk

- DHL International

- Cardinal Health

- MCKESSON CORPORATION

- Kuehne+Nagel

- AmerisourceBergen Corporation

- C.H. Robinson

- CEVA Logistics

- Promptus, LLC

- FedEx

Recent Developments

-

April 2025: UPS Healthcare announced the opening of a new 250,000 sq. ft. cold chain warehouse in Louisville, KY, aimed at supporting biologics and cell & gene therapy distribution.

-

March 2025: AmerisourceBergen expanded its partnership with Catalent to offer integrated 3PL solutions for clinical trial logistics in the U.S., focusing on time-sensitive delivery models.

-

February 2025: FedEx Supply Chain launched a specialized pharmaceutical returns and reverse logistics solution designed for retail pharmacies and hospital networks.

-

January 2025: DHL Supply Chain USA unveiled its next-generation smart warehouse in Pennsylvania with automated cold chain zones and AI-driven inventory management.

-

December 2024: Cardinal Health signed a multi-year agreement with a biotech manufacturer to manage the distribution of a new gene therapy product requiring sub-zero logistics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare third-party logistics market

By Industry

- Biopharmaceutical

- Pharmaceutical

- Medical Device

By Supply Chain

- Cold Chain

- Non-cold Chain

By Service Type

-

- Air Freight

- Sea Freight

- Overland Transportation

- Warehousing And Storage

- Others

By Regional

- Northeast

- Southwest

- West

- Southeast

- Midwest