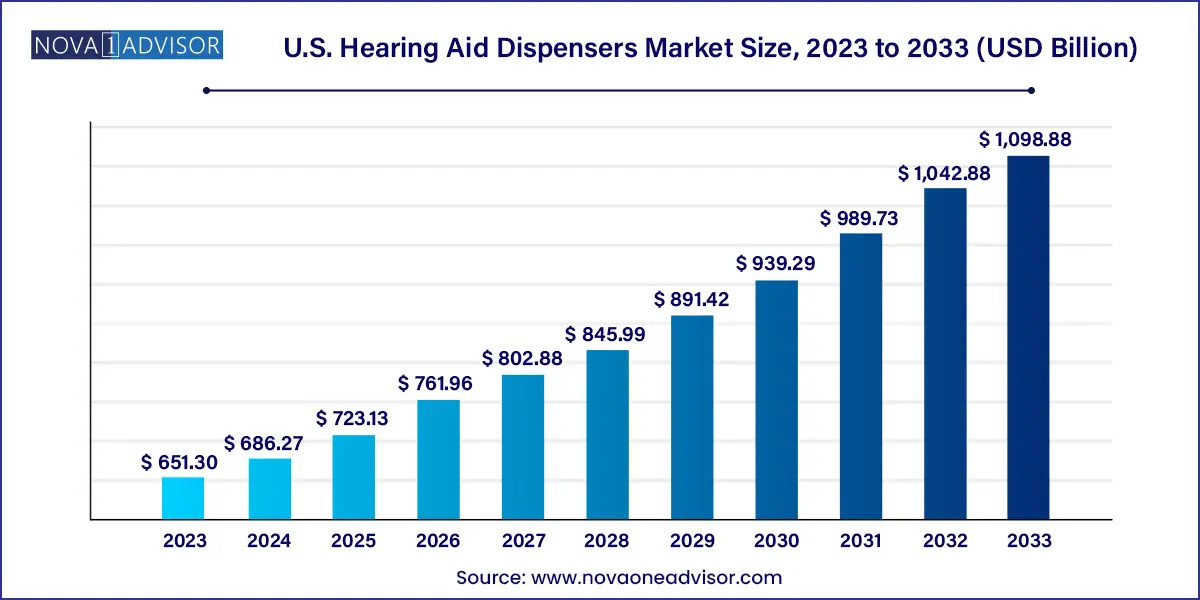

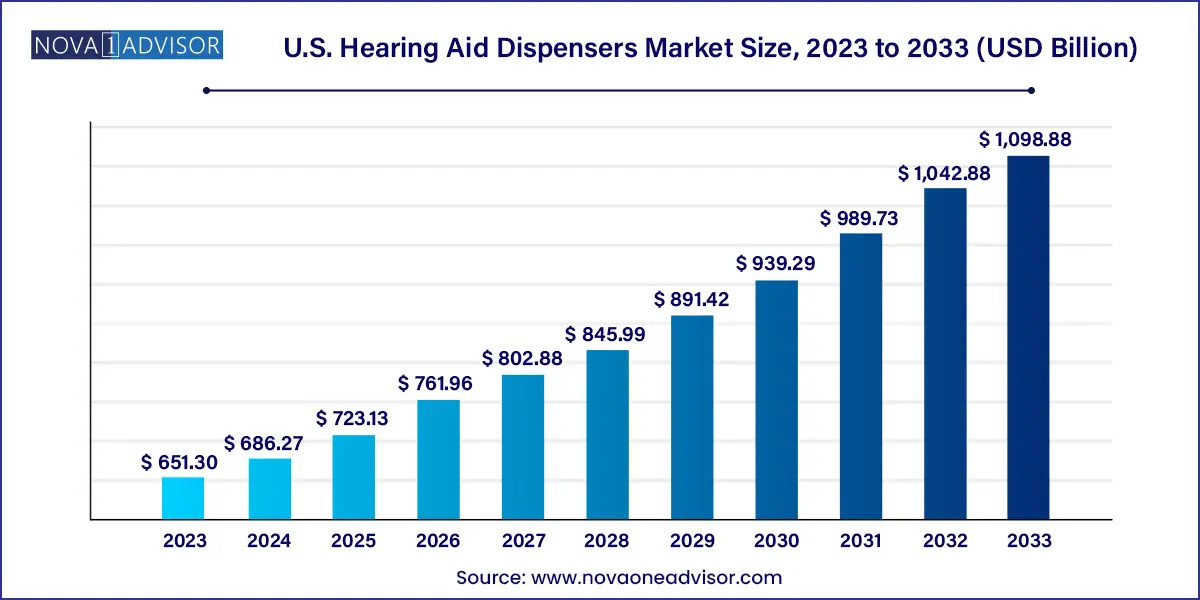

The U.S. Hearing Aid Dispensers market size was estimated at USD 651.30 billion in 2023 and is expected to surpass around USD 1,098.88 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 5.37% during the forecast period 2024 to 2033.

Key Takeaways:

- The male segment dominated the market in with the largest revenue share of 51.75% in 2023.

- The female segment is expected to witness the fastest CAGR over the forecast period.

- The manufacturer-owned segment dominated the market with a revenue share of 31.85% in 2023 and is expected to witness the fastest CAGR from 2024 to 2033.

- The independent segment held a significant market share in 2023

Market Overview

The U.S. hearing aid dispensers market plays a crucial role in the country’s audiological and geriatric healthcare infrastructure. Hearing aid dispensers are licensed professionals or business entities involved in the fitting, distribution, and aftercare of hearing aids to individuals with hearing impairments. With a rising prevalence of age-related hearing loss, increasing noise-induced auditory issues among younger populations, and a growing demand for technologically advanced hearing solutions, the market has gained substantial traction.

According to the Hearing Loss Association of America, approximately 48 million Americans report some degree of hearing loss. Among individuals over the age of 65, roughly one in three experiences hearing impairment. This demographic shift, coupled with longer life expectancies and improved awareness, has intensified the demand for hearing health services. Hearing aid dispensers serve as critical touchpoints for initial diagnosis, product recommendation, fitting, and ongoing care creating a structured pathway between consumers and audiology-based solutions.

Moreover, regulatory changes such as the FDA’s 2022 ruling to allow over-the-counter (OTC) hearing aids for mild to moderate hearing loss have altered the traditional dispenser landscape. While this has widened access, it has also redefined the role of dispensers who now emphasize value-added services like in-depth diagnostics, customization, and long-term support. In this evolving scenario, dispensers must position themselves as more than just vendors they are care partners guiding patients through their auditory journey.

The U.S. market features a blend of independent practices, manufacturer-owned outlets, and retail chains, each with unique market approaches. Dispensers often collaborate with audiologists or otolaryngologists, though many operate autonomously in clinics, pharmacies, and dedicated retail settings. These providers must navigate a market characterized by pricing pressure, evolving technology (like Bluetooth-enabled or rechargeable hearing aids), and growing consumer empowerment.

Major Trends in the Market

-

Surge in OTC Hearing Aid Sales: Following the FDA's 2022 decision, consumers can now purchase certain hearing aids without a prescription, affecting how dispensers position their services.

-

Tech-Integrated Devices Influence Service Models: Dispensers are increasingly required to understand and manage devices that integrate Bluetooth, AI, and smartphone compatibility.

-

Hybrid Retail-Clinical Models: Chains and independent providers are blending in-person services with online consultations and home trials to cater to modern consumer behavior.

-

Expansion of Hearing Aid Services in Pharmacies: Retail pharmacies like CVS and Walgreens are experimenting with in-house hearing care kiosks, impacting traditional dispenser networks.

-

Growing Preference for Subscription-Based Models: Dispensers are offering hearing aids on subscription plans that include device use, servicing, and upgrades.

-

Gender-Based Customization of Services: A noticeable shift is emerging where providers tailor services and product designs based on user gender preferences and ergonomic considerations.

U.S. Hearing Aid Dispensers Market Report Scope

Key Market Driver: Aging Population and Increased Hearing Loss Prevalence

A major driver for the U.S. hearing aid dispensers market is the aging demographic. As the baby boomer generation continues to enter retirement age, the proportion of individuals with age-related hearing loss is increasing dramatically. Age-related hearing impairment (presbycusis) is a natural degenerative condition, and the U.S. Census Bureau projects that by 2030, over 20% of the population will be over 65 years old.

Hearing aid dispensers are on the front lines of serving this population. Unlike younger, tech-savvy users who may opt for OTC hearing aids, older individuals often require in-person guidance, device calibration, and post-sale support, all of which are hallmarks of dispenser services. Many senior centers and assisted living facilities now have partnerships with local dispensers to offer on-site services, highlighting their growing importance in elder care ecosystems. This population shift guarantees sustained demand for professional, personalized auditory care.

Key Market Restraint: Rise of Over-the-Counter (OTC) and Online Sales

The emergence of OTC hearing aids, while increasing accessibility, presents a significant challenge to traditional dispensers. With the FDA's 2022 ruling allowing the sale of OTC hearing aids without prescriptions, many consumers especially tech-savvy younger users are bypassing dispensers entirely. Online platforms now offer self-fitting aids with remote support, often at lower prices.

For dispensers, this means contending with reduced margins and more informed customers. The industry now faces a strategic dilemma: compete on price and convenience or differentiate through clinical excellence and personalized care. Dispensers who fail to adapt risk losing relevance in an increasingly consumer-controlled market.

The integration of tele-audiology and digital health platforms presents a promising opportunity for hearing aid dispensers in the U.S. As digital healthcare becomes mainstream, hearing care is no exception. Forward-thinking dispensers are launching remote consultation services, app-based device tuning, and AI-supported hearing assessments that allow users to access professional care without visiting a physical clinic.

For instance, an independent hearing aid provider in California launched a remote fitting app in 2024, enabling patients to receive consultations and device adjustments via their smartphones. Not only did this expand their geographic reach, but it also catered to working professionals and rural populations who face accessibility barriers. Digital health offers dispensers an edge in retaining relevance while enhancing user engagement and satisfaction.

Segments Insights:

By Ownership

Independent hearing aid dispensers dominated the U.S. market in 2024, owing to their personalized service models, loyal client bases, and ability to establish trust over time. These practices, often family-run or locally branded, offer tailored services like in-depth consultations, individualized fitting, and follow-up maintenance. Patients, particularly older adults, value the consistency and familiarity that independents provide, often forming long-term relationships with a single provider. In many suburban and rural settings, independents are the primary or sole providers of professional hearing care services.

However, retail chains are emerging as the fastest growing segment, driven by aggressive pricing, brand visibility, and strategic placement in high-traffic locations. Major chains such as Costco, Walmart, and Best Buy are investing in hearing care centers within their stores, offering a hybrid model that combines affordability with walk-in convenience. These chains benefit from bulk purchasing power and increasingly offer brand-name devices with optional follow-up services. Their expanding footprint in urban and suburban areas has challenged smaller independents to innovate and upgrade service models.

By Gender

The male demographic accounted for the dominant share of the U.S. hearing aid dispensers market, reflecting higher reported rates of hearing loss among men often linked to occupational noise exposure, recreational noise (e.g., firearms, loud music), and a historical tendency to delay hearing health interventions. Men also represent a sizable portion of the veterans’ community, where hearing loss is one of the most reported disabilities. Dispensers often cater to this demographic through durable, discreet, and easy-to-maintain devices, paired with voice-guided tutorials.

On the other hand, the female segment is witnessing the fastest growth, as awareness, lifestyle integration, and aesthetic preferences drive demand. Women typically seek devices that are not only functional but stylish and discreet. The increasing design flexibility of modern hearing aids available in skin tones, hair color-matching hues, and compact forms—has made them more appealing to women. Additionally, women often exhibit a more proactive approach to health, making them more likely to seek early intervention and continuous dispenser support.

Country-Level Analysis

In the United States, hearing aid dispensers operate under a regulated framework defined by state licensing laws, federal mandates, and industry certifications. The nation has a high demand for auditory healthcare, yet significant portions of the population remain underserved. Major urban centers like New York City, Los Angeles, and Chicago are hubs for dispenser networks offering advanced services, while rural areas continue to face challenges in accessibility.

The presence of Veterans Affairs (VA) health programs and Medicare Advantage plans that cover hearing services further supports the market, especially among retired populations. Additionally, academic partnerships between dispenser businesses and university audiology programs ensure a steady pipeline of trained professionals. Despite regulatory complexities and growing OTC competition, the U.S. remains a global leader in innovation and adoption of hearing care services.

Key U.S. Hearing Aid Dispensers Company Insights

The market is still in its initial stages, with many companies entering the market. Moreover, the companies operating in the market are involved in various strategic decisions, including new service launches, mergers & acquisitions, and partnership & collaborations which better suit the changing market landscape.

Key U.S. Hearing Aid Dispensers Companies:

- Audio Hearing Aid Service, LLC

- Costco Wholesale Corporation

- Davidson Hearing Aid Centres

- Echo Hearing Center

- Elite Hearing Centers of America

- Family Hearing Center

- Hear Well Be Well

- Hearing Unlimited

- HearUSA

- Independent Hearing Services

- LUCID HEARING HOLDING COMPANY, LLC

- Miracle-Ear

- SoundPoint Hearing Centers

Recent Developments

-

February 2025 – Beltone USA launched a new AI-enabled hearing aid fitting system in its U.S. dispenser locations, allowing for real-time environmental sound simulation during consultations.

-

December 2024 – Costco Hearing Aid Centers expanded to 25 new locations across the U.S., introducing lower-cost premium hearing aid models with optional remote care support.

-

October 2024 – Starkey Hearing Technologies partnered with independent dispensers to distribute their Evolv AI series across all 50 states, offering advanced features like fall detection and health tracking.

-

July 2024 – HearingLife, a leading retail chain, introduced a subscription-based service package that bundles devices, annual tests, and unlimited support visits under one monthly fee.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Hearing Aid Dispensers market.

By Ownership

- Independent

- Manufacturer-owned

- Retail chains

- Others

By Gender