U.S. Hematology Diagnostics Market Size and Trends

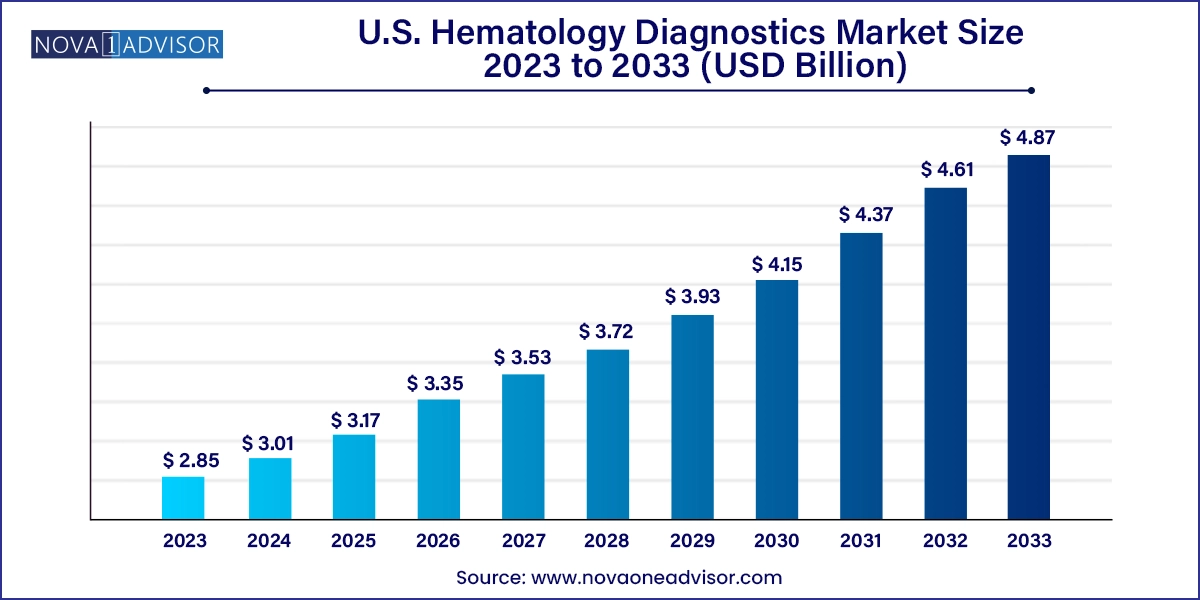

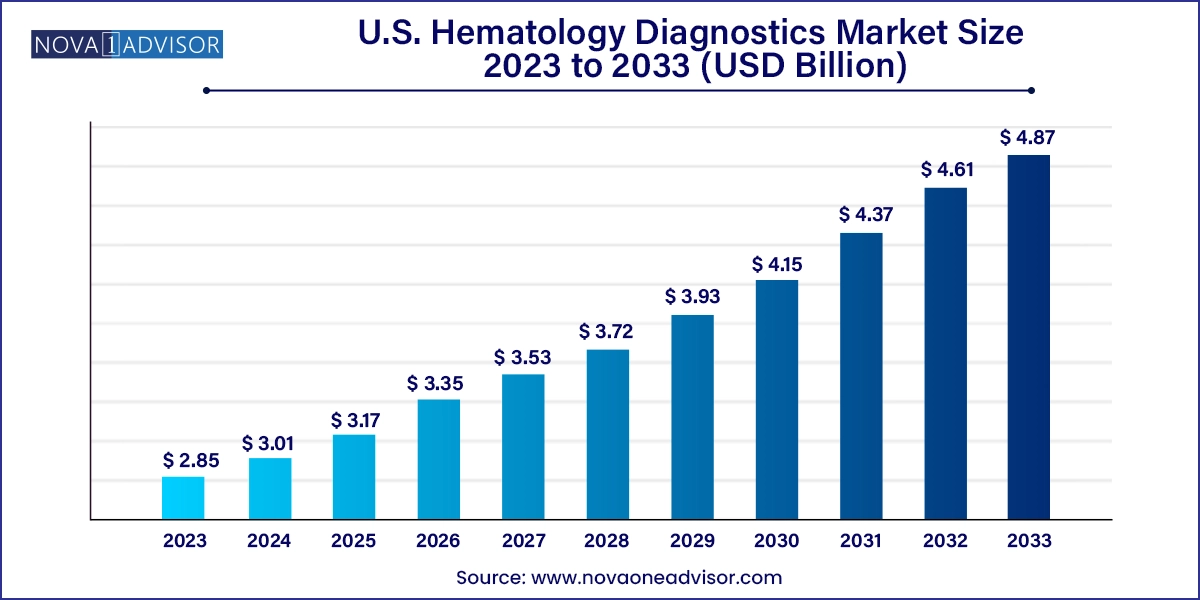

The U.S. hematology diagnostics market size was exhibited at USD 2.85 billion in 2023 and is projected to hit around USD 4.87 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

U.S. Hematology Diagnostics Market Key Takeaways:

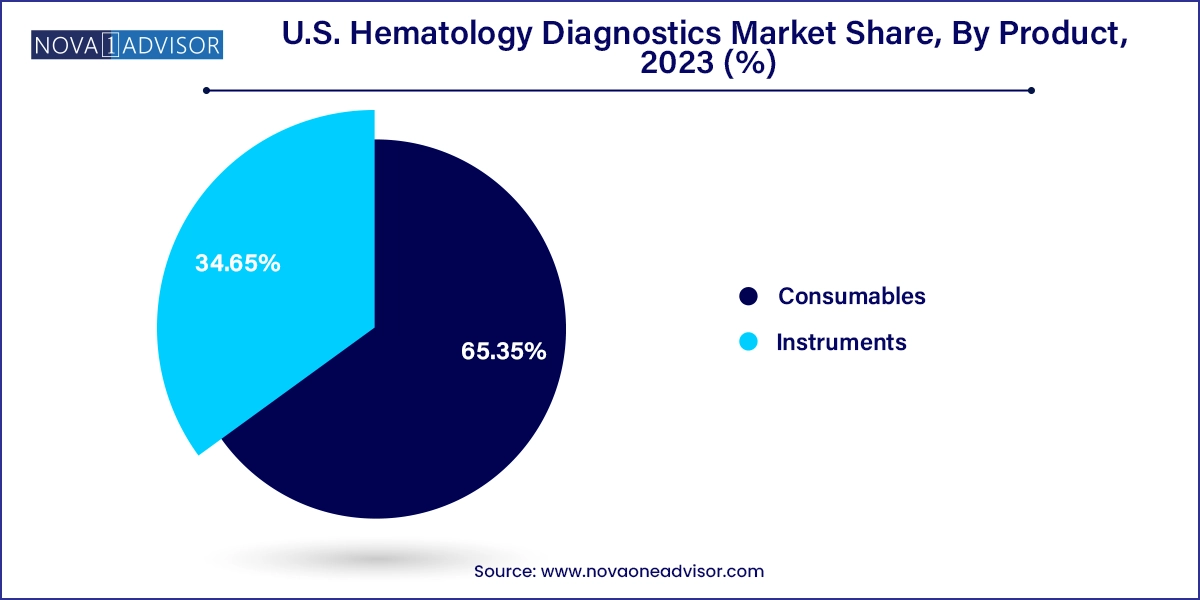

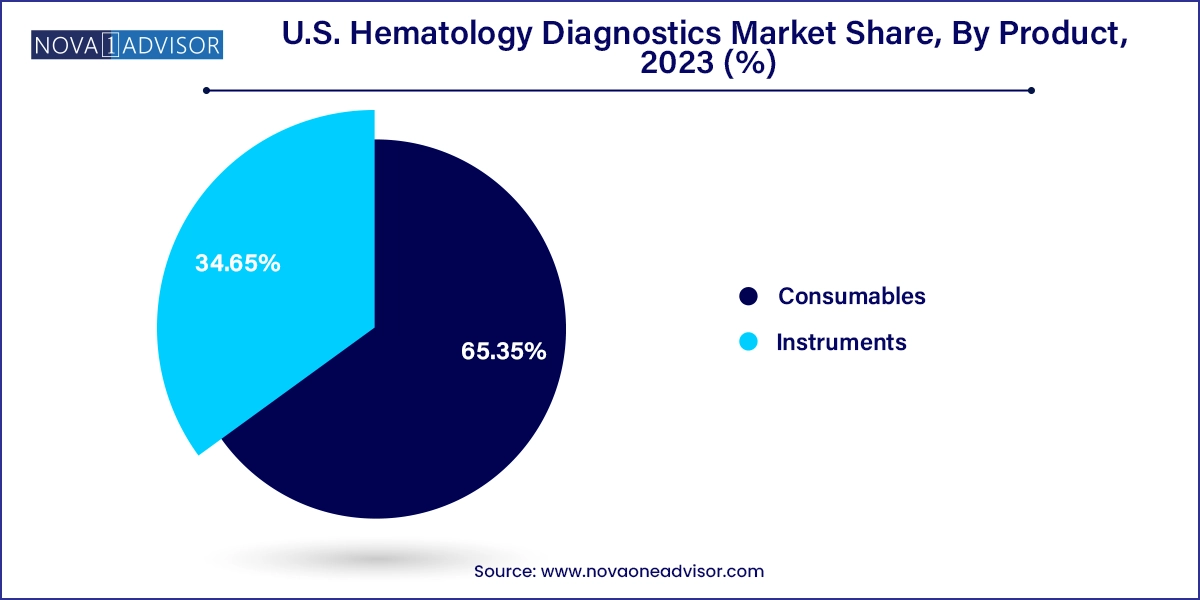

- The consumables segment dominated the market with the largest revenue share of around 65.35% in 2023 and is expected to grow at the fastest CAGR of 5.4% over the forecast period.

- Based on end-use, the hospitals dominated the market with the largest revenue share in 2023.

- The diagnostic labs segment is expected to grow at the fastest CAGR over the forecast period.

- Based on test type, white blood cells (WBC) test dominated the market with the largest revenue share in 2023.

Market Overview

The U.S. hematology diagnostics market is a crucial pillar within the broader diagnostic testing ecosystem, focusing on the analysis of blood components to identify and monitor disorders such as anemia, leukemia, clotting abnormalities, infections, and other blood-related malignancies. This market encompasses a wide range of products including hematology analyzers, flow cytometers, reagents, stains, controls, calibrators, and software platforms integrated into laboratory workflows.

The U.S. market benefits from a highly developed healthcare infrastructure, significant R&D investments, and a growing patient population affected by chronic and hematological diseases. An estimated 3 million Americans suffer from anemia, while leukemia remains one of the most prevalent cancers, particularly among children and older adults. The increasing prevalence of such conditions, along with rising awareness and screening initiatives, has prompted healthcare providers to adopt high-throughput, accurate, and automated hematology diagnostic systems.

Advanced hematology diagnostics go beyond simple blood counts to include differential counts, reticulocyte analysis, platelet indices, and cell morphology studies, supported by AI-powered interpretation tools. The integration of these systems into hospital labs, diagnostic centers, and point-of-care (POC) testing environments is streamlining disease detection, monitoring, and treatment personalization.

The convergence of automation, digital pathology, molecular diagnostics, and personalized medicine is redefining the scope of hematology diagnostics. U.S. laboratories are increasingly adopting modular, connected analyzers that support not only routine CBCs (complete blood counts) but also advanced parameters to improve clinical decisions and efficiency.

Major Trends in the Market

-

Shift Toward High-Throughput and Fully Automated Hematology Analyzers: Labs are transitioning from manual and semi-automated systems to fully integrated analyzers with greater speed and fewer manual steps.

-

Expansion of Point-of-Care Hematology Testing: Increasing demand for rapid, bedside diagnostics in emergency departments, ICUs, and remote clinics is boosting POC analyzer sales.

-

Adoption of Digital Imaging and AI-Based Morphology: Machine learning is being used to assist pathologists with cell classification, flagging abnormalities with high sensitivity.

-

Growth in Personalized Hematological Monitoring: Tailored diagnostics are emerging to guide chemotherapy, anemia treatment, and clotting disorder therapies.

-

Multiparameter Analysis Using Flow Cytometry: Flow cytometers are gaining traction in hematological malignancy diagnosis due to their capacity for simultaneous cell surface and intracellular marker detection.

-

Miniaturization and Modular Instrument Design: Manufacturers are launching compact systems with modular expandability, catering to labs with varying testing volumes.

-

Data Integration with Electronic Medical Records (EMRs): Hematology systems are being optimized for LIS/EMR connectivity, enhancing traceability and decision-making.

Report Scope of U.S. Hematology Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.01 Billion |

| Market Size by 2033 |

USD 4.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Test Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Siemens Healthineers AG; BIOMEDOMICS INC.; Abbott; Danaher; Sysmex Corporation; Beckman Coulter, Inc.; F. Hoffmann-La Roche Ltd; HORIBA, Ltd.; Bio-Rad Laboratories, Inc. |

Market Driver: Rising Prevalence of Hematologic and Chronic Disorders

A key driver of the U.S. hematology diagnostics market is the growing incidence of hematological and chronic diseases such as leukemia, lymphoma, anemia, thrombocytopenia, and autoimmune disorders like systemic lupus erythematosus (SLE). According to the Leukemia & Lymphoma Society, over 180,000 new blood cancer cases are diagnosed annually in the U.S., contributing significantly to testing volume and diagnostic complexity.

Beyond cancer, a substantial portion of the aging population is vulnerable to anemia due to chronic kidney disease, malnutrition, or post-surgical recovery. This has led to increased demand for comprehensive blood profiling, especially in high-risk groups such as geriatrics and immunocompromised patients. In addition, patients undergoing chemotherapy require regular blood monitoring to assess myelosuppression and adjust treatments accordingly. As a result, healthcare providers are adopting automated hematology platforms that support consistent, fast, and accurate results for a growing patient base.

Market Restraint: High Capital Costs and Reagent Dependency

One of the most persistent restraints in the market is the high capital expenditure associated with installing advanced hematology analyzers and maintaining a steady supply of reagents and consumables. Fully automated systems, especially those equipped with integrated digital imaging or multi-lane testing modules, can cost tens of thousands of dollars, excluding the cost of reagents, software licenses, and service contracts.

Moreover, hematology systems are often proprietary, meaning consumables and reagents must be purchased from the same manufacturer, creating long-term dependency and cost inflexibility. Smaller labs and independent diagnostic centers may struggle with these cost structures, often delaying technology upgrades or resorting to manual techniques that lack the efficiency and accuracy of automated systems. Although leasing options and reagent rental models are emerging, the high total cost of ownership continues to limit access in lower-volume and budget-constrained settings.

A promising opportunity for the U.S. hematology diagnostics market lies in the integration of artificial intelligence (AI), cloud-based platforms, and data analytics into hematology systems. AI-powered tools are now capable of performing automated cell classification, anomaly detection, morphology analysis, and even flagging rare abnormalities that are difficult to detect visually.

Moreover, cloud-connected hematology analyzers can share data across integrated hospital networks, facilitating multi-site collaboration, longitudinal patient monitoring, and telepathology. This is especially beneficial in rural or underserved areas, where hematologists may be in short supply. With value-based care gaining traction and reimbursement models tied to outcomes, systems that provide real-time, decision-support analytics will become critical for enhancing diagnostic precision and optimizing treatment pathways.

U.S. Hematology Diagnostics Market By Product Insights

Instruments dominated the U.S. hematology diagnostics market, particularly hematology analyzers used in hospital laboratories and commercial diagnostic labs. These systems support core testing like WBC, RBC, hemoglobin, hematocrit, and platelet counts, which are routinely ordered in nearly every clinical scenario—from emergency care to annual health checkups. Within this category, clinical laboratory testing hematology analyzers lead the market, offering high throughput, broad parameter coverage, and integration with LIS systems.

However, point-of-care testing (POCT) hematology analyzers are gaining momentum, especially in ambulatory clinics, emergency rooms, and remote care settings. These devices enable rapid on-site testing, often delivering results in under 10 minutes, which is critical in time-sensitive situations like trauma or sepsis. Flow cytometers, though more niche, are expanding in oncology and immunology applications due to their capacity to evaluate cell surface markers and intracellular proteins, enabling subtyping of leukemias and lymphomas.

Consumables are the fastest-growing segment, as recurring use of reagents, stains, calibrators, and controls forms the economic backbone of the hematology diagnostics industry. Labs may invest in instruments once every 5–10 years, but consumables are required daily. Reagents, in particular, constitute a large share of recurring revenue for vendors. Vendors are enhancing consumables with improved stability, shorter incubation times, and automation compatibility, further driving demand.

U.S. Hematology Diagnostics Market By End-use Insights

Hospitals dominate the end-use segment, primarily due to their high patient volumes and integrated laboratory infrastructures. Inpatient testing demands rapid and reliable results, especially for preoperative assessments, infection workups, or transfusion requirements. Hospitals typically use high-throughput hematology analyzers, many of which are connected to central lab networks and monitored by skilled laboratory technologists.

Diagnostic laboratories are the fastest-growing segment, benefiting from the rise in preventive health screenings, chronic disease monitoring, and outsourced lab services. National lab networks and regional diagnostic centers are investing in compact, high-speed analyzers that support quick turnaround times. Additionally, ambulatory surgical centers (ASCs) and oncology infusion centers are increasingly incorporating hematology testing into their workflows to support real-time decision-making before procedures or treatment cycles.

U.S. Hematology Diagnostics Market By Test Type Insights

The White Blood Cell (WBC) test segment dominated the market, as WBC counts and differentials are foundational in diagnosing infections, inflammation, hematologic malignancies, and immune disorders. Automated analyzers now offer 5-part and even 7-part differentials, enabling clinicians to distinguish between neutrophils, eosinophils, basophils, monocytes, and lymphocytes, and to identify immature or atypical cells. WBC testing is a standard component of routine CBC panels, often ordered preoperatively or as part of chemotherapy monitoring.

Hemoglobin testing is rapidly expanding, driven by the growing awareness around anemia management, chronic kidney disease (CKD), and nutritional deficiencies. Hemoglobin levels are used to guide iron supplementation, blood transfusions, and erythropoiesis-stimulating agents (ESAs) in CKD patients. Additionally, automated hemoglobinometry tools are being adopted in school health programs, outpatient clinics, and telemedicine-supported primary care settings for basic screening. Tests for platelet function are also gaining interest, particularly in cardiology and hematology-oncology, where platelet disorders can impact bleeding risk and therapeutic outcomes.

Country-Level Analysis

In the U.S., the demand for hematology diagnostics is shaped by factors such as population density, disease prevalence, access to healthcare, and lab network expansion.

The Northeast region leads the market, with strong presence of top academic medical centers, cancer research institutes, and hospital networks. States like New York, Massachusetts, and Pennsylvania have invested significantly in clinical laboratory modernization, digital pathology, and automated hematology platforms. Hospitals like Massachusetts General, Johns Hopkins, and Mount Sinai are known for high-complexity diagnostics and early adoption of AI-enhanced technologies.

Meanwhile, the Southwest region is emerging as the fastest-growing, particularly in Texas and Arizona, where population growth and chronic disease prevalence (e.g., diabetes, cardiovascular disease) are fueling lab test demand. Texas alone houses major healthcare systems like Baylor Scott & White and MD Anderson Cancer Center, which are actively deploying high-volume hematology analyzers to support oncology and transplant services. The expanding footprint of diagnostic labs in suburban and rural areas is also boosting adoption of compact, automated hematology devices.

Some of the prominent players in the U.S. hematology diagnostics market include:

- Siemens Healthineers AG

- BIOMEDOMICS INC.

- Abbott

- Danaher

- Sysmex Corporation

- Beckman Coulter, Inc.

- F. Hoffmann-La Roche Ltd

- HORIBA, Ltd.

- Bio-Rad Laboratories, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. hematology diagnostics market

Product

-

-

- Clinical Laboratory Testing Hematology Analyzers

- Point-Of-Care Testing Hematology Analyzers

-

- Flow Cytometers

- Slide Stainers/Markers

-

- Reagents

- Stains

- Controls And Calibrators

Test Type

- White Blood Cells (WBC) Test

- Red Blood Cells (RBC) Test

- Hemoglobin Test

- Hematocrit Test

- Platelet Function

End-use

- Hospitals

- Diagnostic Labs

- Others

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast