U.S. Hemoglobinopathies Market Size and Growth 2026 to 2035

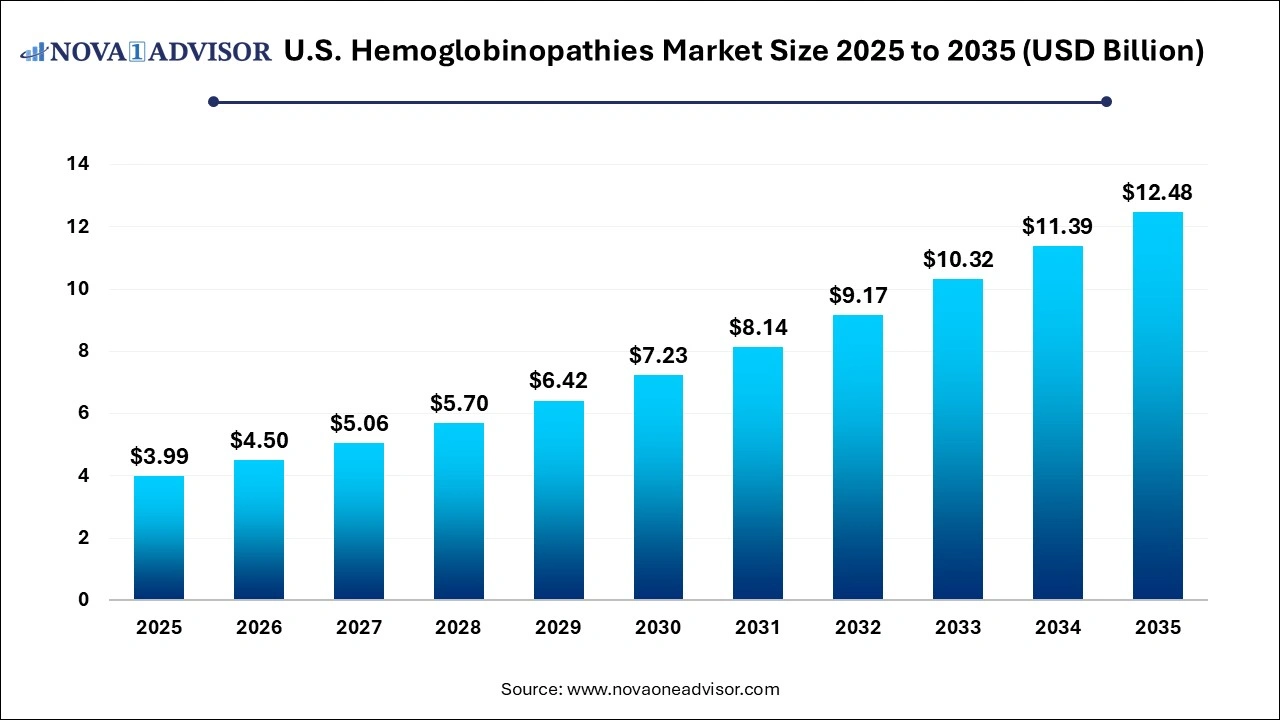

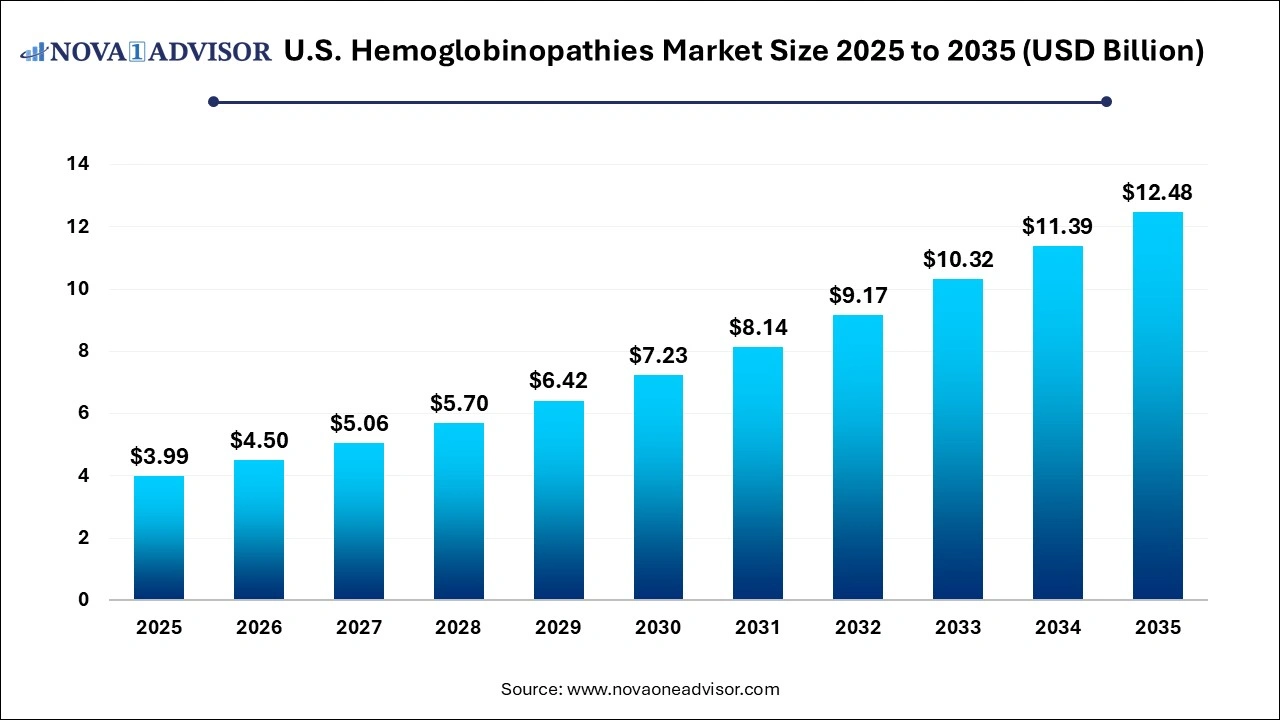

The U.S. hemoglobinopathies market size was exhibited at USD 3.99 billion in 2025 and is projected to hit around USD 12.48 billion by 2035, growing at a CAGR of 12.8% during the forecast period 2026 to 2035.

U.S. Hemoglobinopathies Market Key Takeaways:

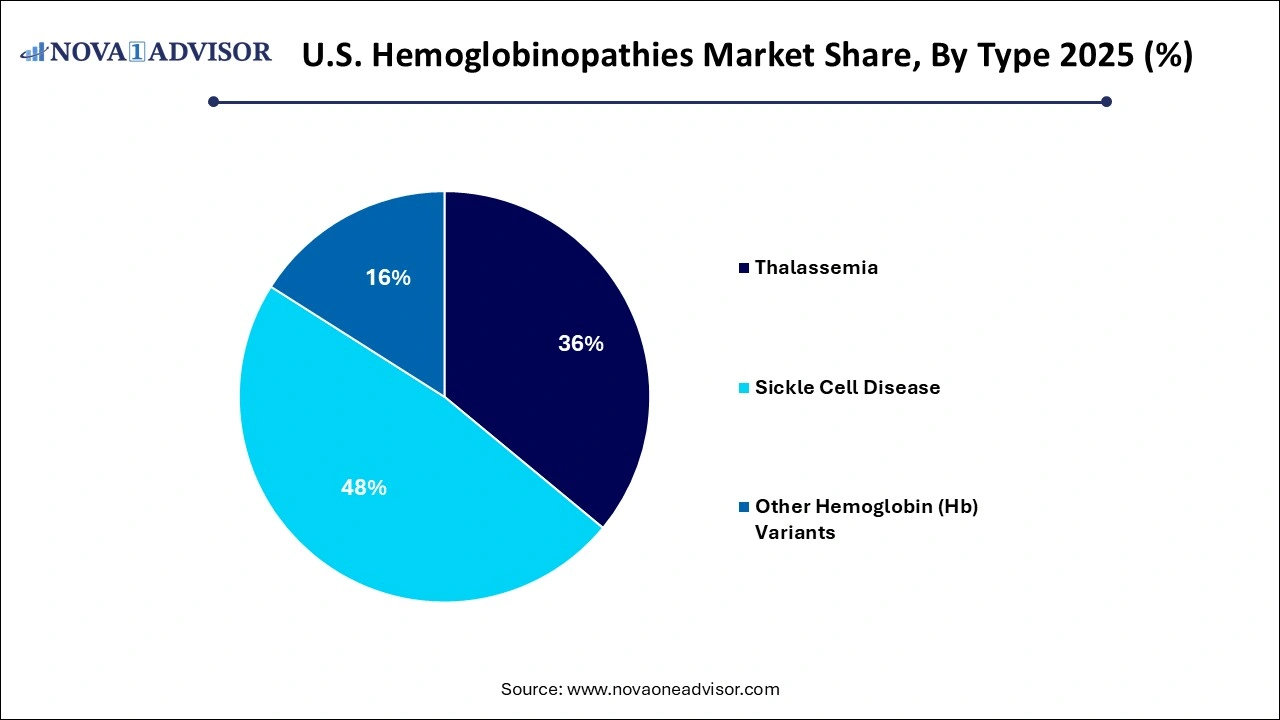

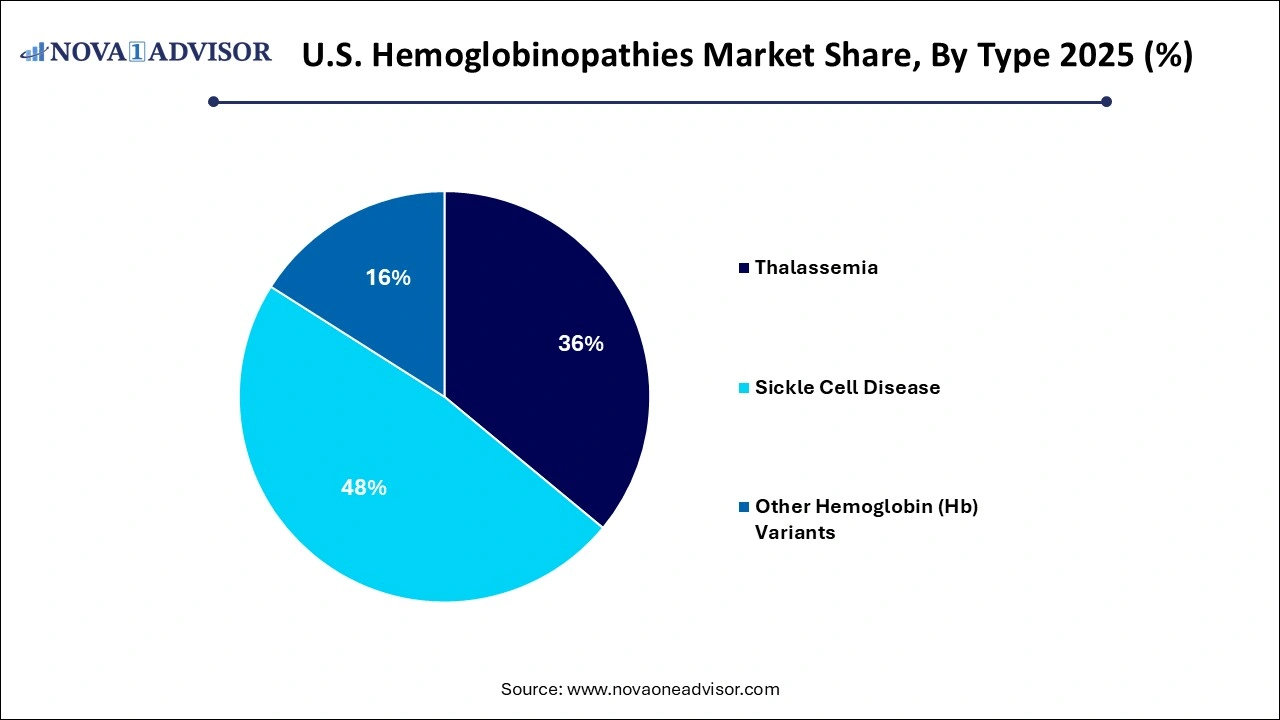

- Sickle cell disease dominated the market and accounted for a share of 60.15% in 2025.

- Sickle cell disease accounted for the largest market revenue share in 2025 and is expected to grow at the fastest CAGR over the forecast period.

- The sickle cell disease segment dominated the market in 2025 and is anticipated to grow at fastest CAGR over the forecast period.

- Bone marrow transplant (BMT) therapy is poised for significant growth in the upcoming period.

U.S. Hemoglobinopathies Market Overview

The U.S. hemoglobinopathies market represents a critical and evolving component of the broader rare disease and genetic disorder landscape. Hemoglobinopathies are inherited blood disorders characterized by the abnormal structure or production of hemoglobin the protein in red blood cells responsible for carrying oxygen throughout the body. The two most prevalent forms in the U.S. are sickle cell disease (SCD) and thalassemia, while rarer hemoglobin (Hb) variants also contribute to the disease burden.

The impact of hemoglobinopathies in the U.S. is both clinical and socio-economic. According to the Centers for Disease Control and Prevention (CDC), approximately 100,000 individuals in the U.S. are living with sickle cell disease, predominantly affecting African American and Hispanic populations. Thalassemia, while less common, poses significant challenges in terms of lifelong transfusions, iron overload, and limited curative options. Until recently, treatment for these disorders was primarily palliative focused on managing symptoms and preventing complications through blood transfusions, iron chelation therapy, hydroxyurea, and occasional bone marrow transplants.

However, the market is undergoing a paradigm shift with the emergence of gene therapy, cell therapy, and targeted pharmacological interventions. Companies like Vertex Pharmaceuticals, CRISPR Therapeutics, bluebird bio, and Editas Medicine are pioneering the landscape with curative intent through genome editing and stem cell-based therapeutics. Moreover, the approval of CASGEVY™ (exagamglogene autotemcel) in March 2024 by the FDA marks a milestone in the therapeutic transformation of SCD. With substantial public and private investments, growing newborn screening programs, and increasing awareness among clinicians and patients, the U.S. hemoglobinopathies market is on the cusp of innovation-driven expansion.

Major Trends in the U.S. Hemoglobinopathies Market

-

Approval of gene-editing-based therapies (e.g., CRISPR-Cas9) for sickle cell disease and beta-thalassemia.

-

Increased use of prenatal and preimplantation genetic testing to identify carriers and plan early interventions.

-

Shift from symptom management to disease-modifying and curative treatment modalities.

-

Growth of newborn screening programs for early detection of SCD and thalassemia across U.S. states.

-

Rising number of clinical trials exploring lentiviral vectors, base editing, and autologous stem cell therapies.

-

Expansion of personalized care models integrating genetic data with treatment algorithms.

-

Public and private sector partnerships promoting awareness and funding for rare blood disorders.

-

Movement toward at-home blood transfusion and remote monitoring technologies to reduce hospital burden.

Report Scope of U.S. Hemoglobinopathies Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.5 Billion |

| Market Size by 2035 |

USD 12.48 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.8% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, Diagnosis, Therapy, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Sangamo Therapeutics, Inc.; Global Blood Therapeutics, Inc.; bluebird bio, Inc.; Emmaus Life Sciences Inc.; Pfizer, Inc.; Novartis AG; Prolong Pharmaceuticals, LLC; Bioverativ Inc.; Celgene Corp. |

Key Market Driver: Regulatory Support and FDA Approvals for Gene Therapy

A significant driver of the U.S. hemoglobinopathies market is the growing regulatory support for advanced therapeutics, culminating in the FDA’s landmark approval of gene-edited therapies. In March 2024, the FDA approved CASGEVY™, a gene-edited therapy developed by Vertex Pharmaceuticals and CRISPR Therapeutics for the treatment of sickle cell disease. This approval represents not only a milestone in gene editing (using CRISPR-Cas9 technology) but also the first-ever CRISPR-based therapy approved in the United States.

The regulatory shift reflects a broader institutional push to fast-track treatments for rare and severe genetic conditions. The Orphan Drug Act, Breakthrough Therapy Designation, and Priority Review Voucher programs have provided the necessary framework for accelerating development timelines. These pathways are encouraging investments and collaborative R&D in hemoglobinopathies, particularly in curative platforms that were previously unviable due to cost, risk, or technical limitations. The FDA’s proactive engagement with companies during trials, flexible endpoints, and adaptive review models serve as a powerful catalyst for therapeutic innovation and market growth.

Key Market Restraint: High Treatment Costs and Limited Accessibility

Despite the promising influx of innovative therapies, a major restraint in the U.S. hemoglobinopathies market is the prohibitive cost of treatment and limited access for underserved populations. Novel gene therapies like CASGEVY™, while potentially curative, come with extremely high upfront costs—estimates range between $2 to $3 million per patient, which includes pre-conditioning, stem cell collection, and follow-up care. Such prices present a considerable barrier to adoption, especially in a condition like SCD that disproportionately affects economically disadvantaged communities.

Additionally, health inequities in the U.S. exacerbate access challenges. Many patients live in areas with limited access to specialized hematology centers, and insurance coverage for experimental or high-cost therapies remains inconsistent across states. Although Medicaid and federal programs support pediatric and newborn screening, adult patients often fall through coverage gaps. Until robust reimbursement mechanisms, equitable access programs, and scalable manufacturing infrastructures are fully established, cost and logistics will remain significant constraints to market penetration.

Key Market Opportunity: Expansion of Genetic Testing and Early Diagnosis

A compelling opportunity in the U.S. hemoglobinopathies market lies in the expansion of genetic screening and early diagnosis platforms. With the increasing integration of genetic counseling, next-generation sequencing (NGS), prenatal diagnostics, and carrier screening, the healthcare system can proactively identify at-risk individuals before disease onset. Prenatal and preimplantation genetic diagnosis (PGD) offer reproductive decision-making tools for at-risk couples, especially those from high-prevalence ethnic groups.

The availability of advanced diagnostics such as Hb electrophoresis, DNA mutation panels, and single-gene NGS kits has also improved the accuracy of differential diagnosis between types of thalassemia and Hb variants. Public health programs and payer incentives promoting early diagnosis not only improve long-term outcomes but also support market expansion across the diagnostics segment. Companies specializing in precision medicine diagnostics—such as Invitae, Natera, and Myriad Genetics—are poised to benefit as personalized treatment becomes more deeply integrated with front-end diagnostics.

U.S. Hemoglobinopathies Market Segmental Insights

By Type Insights

Sickle cell disease dominates the U.S. hemoglobinopathies market, representing the most prevalent inherited blood disorder in the country. Affecting primarily African American and Latino populations, SCD has received significant attention from both public health authorities and pharmaceutical innovators. Standard therapies like hydroxyurea, chronic transfusion regimens, and supportive care have long been used, but new disease-modifying treatments including voxelotor, crizanlizumab, and CASGEVY™ are expanding the therapeutic arsenal. Clinical and policy momentum surrounding SCD, along with active advocacy groups, continue to push investment into innovative, high-impact solutions.

Thalassemia is the fastest-growing type segment, driven by population migration, increased diagnosis rates, and the advent of gene and cell therapies. Though relatively rare compared to SCD in the U.S., thalassemia (especially beta-thalassemia major) presents a high disease burden requiring frequent transfusions and iron chelation. Innovative approaches, such as Zynteglo (from bluebird bio), a gene therapy for beta-thalassemia, are opening new possibilities. Alpha-thalassemia, often underdiagnosed due to its varied presentations, is gaining research attention and being increasingly identified through expanded screening protocols.

By Diagnosis Insights

Blood tests are the most commonly used diagnostic method across all hemoglobinopathy types. Complete blood counts (CBC), reticulocyte counts, and Hb electrophoresis are standard initial assessments in suspected patients. They are inexpensive, widely available, and provide immediate insights into anemia types and RBC morphology. Particularly in newborn screening, high-throughput blood tests play a foundational role and are now standard practice across all 50 U.S. states for detecting SCD.

Genetic testing is the fastest-growing diagnostic modality, fueled by improvements in sequencing technology, insurance reimbursement for rare disease diagnostics, and consumer awareness. DNA-based assays help identify mutation types, differentiate compound heterozygotes, and facilitate family risk assessment. Moreover, pre-implantation genetic diagnosis (PGD) and prenatal testing using chorionic villus sampling (CVS) or amniocentesis are being increasingly recommended for couples known to be carriers. These tools are expanding beyond academic centers to high-risk OB/GYN and fertility clinics, making genetic diagnosis a linchpin of modern hemoglobinopathy management.

By Therapy Insights

Blood transfusion remains the dominant therapy, especially for beta-thalassemia and severe SCD cases. Transfusions help manage anemia, reduce stroke risk, and stabilize acute crises. They are widely administered in hospitals and increasingly in outpatient infusion centers or even home-based settings under close monitoring. However, the long-term dependency on transfusions leads to iron overload, necessitating iron chelation with agents like deferasirox or deferoxamine.

Gene therapy and hydroxyurea-based regimens are among the fastest-growing therapeutic approaches. Hydroxyurea remains the gold standard for SCD management, reducing vaso-occlusive crises, hospitalizations, and need for transfusions. The real disruption, however, comes from gene therapies like CASGEVY™ (for SCD) and Zynteglo (for beta-thalassemia). These therapies aim to offer functional cures and reduce life-long dependence on symptomatic treatment. The inclusion of bone marrow transplant and gene editing in the therapeutic landscape is expected to radically alter the patient care continuum over the next decade.

Country-Level Insights

The U.S. remains one of the largest and most dynamic markets for hemoglobinopathy diagnosis and treatment, owing to its research infrastructure, regulatory agility, and funding ecosystem. State-wide newborn screening ensures early identification of SCD, while major academic hospitals and NIH-funded centers provide clinical care, trials, and genetic counseling for affected families. Health disparities remain a concern, particularly for underserved communities disproportionately affected by SCD, but policy initiatives and advocacy have improved care access over time.

In terms of research, the U.S. is a global hub for hemoglobinopathy trials, housing more than 150 active clinical trials as of 2025. Institutions like St. Jude Children’s Research Hospital, NIH, and major medical centers in New York, California, and Massachusetts lead translational efforts. Public-private collaborations are increasing, with the Cure Sickle Cell Initiative and Accelerating Cures Consortium acting as catalysts for innovation and equitable access. As insurance frameworks evolve to cover gene therapies and remote care, the U.S. market is poised for transformational change.

Recent Developments

-

March 2024 – Vertex Pharmaceuticals and CRISPR Therapeutics received FDA approval for CASGEVY™, a CRISPR-Cas9-based gene therapy for sickle cell disease. This historic approval is expected to redefine the treatment landscape for eligible patients aged 12 and above.

-

February 2024 – bluebird bio reported promising data for Zynteglo in patients with transfusion-dependent beta-thalassemia, demonstrating transfusion independence in 88% of trial participants over a 12-month follow-up.

-

January 2024 – Editas Medicine launched a new base editing program for rare hemoglobin variants, including HbE and HbD, targeting specific mutations with minimal off-target risk.

-

December 2023 – Emmaus Life Sciences expanded its distribution of Endari®, an FDA-approved treatment for sickle cell disease, into U.S. outpatient pharmacies and Medicaid programs across southern states.

-

November 2023 – Global Blood Therapeutics (a Pfizer company) initiated a real-world outcomes study to assess the long-term benefits of Oxbryta® (voxelotor) in children with SCD, aiming to support expanded labeling.

Some of the prominent players in the U.S. hemoglobinopathies market include:

- Sangamo Therapeutics, Inc.

- Global Blood Therapeutics, Inc.

- bluebird bio, Inc.

- Emmaus Life Sciences Inc.

- Pfizer, Inc.

- Novartis AG

- Prolong Pharmaceuticals, LLC

- Bioverativ Inc.

- Celgene Corp.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. hemoglobinopathies market

Type

- Thalassemia

- Sickle Cell Disease

- Other Hemoglobin (Hb) Variants

Diagnosis

-

-

- Blood Test

- Genetic Test

- Prenatal Genetic Test

- Pre-implantation Genetic Diagnosis

- Electrophoresis

- Others

-

-

- Blood Test

- Genetic Test

- Prenatal Genetic Test

- Pre-implantation Genetic Diagnosis

- Electrophoresis

- Others

-

- Blood Test

- Genetic Test

- Prenatal Genetic Test

- Electrophoresis

- Others

-

- Blood Test

- Genetic Test

- Prenatal Genetic Test

- Electrophoresis

- Others

Therapy

-

-

- Blood Transfusion

- Iron Chelation Therapy

- Bone Marrow Transplant

- Others

-

-

- Blood Transfusion

- Iron Chelation Therapy

- Bone Marrow Transplant

- Others

-

- Blood Transfusion

- Hydroxyurea

- Bone Marrow Transplant

- Others

-

- Blood Transfusion

- Hydroxyurea

- Bone Marrow Transplant

- Others

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast