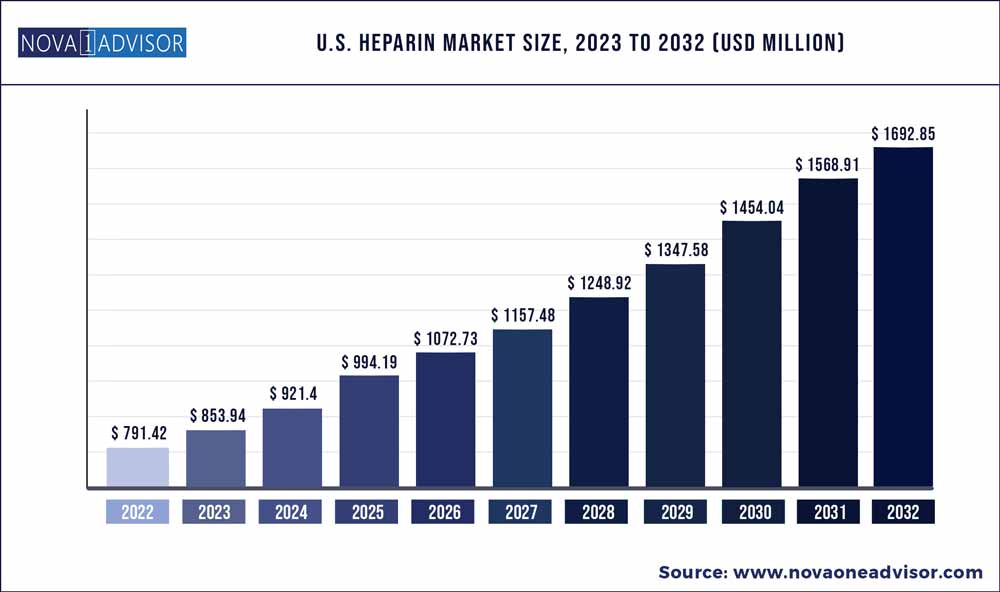

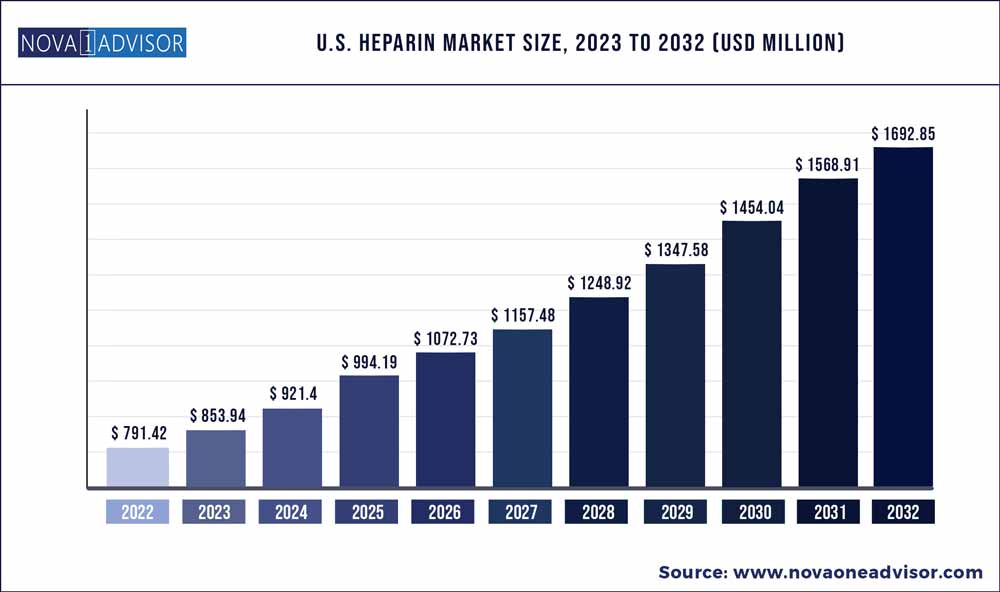

The U.S. heparin market size was exhibited at USD 791.42 million in 2022 and is projected to hit around USD 1692.85 million by 2032, growing at a CAGR of 7.9% during the forecast period 2023 to 2032.

Key Pointers:

- The low molecular weight heparin market valuation in the U.S. was more than USD 635.4 million in 2022.

- The venous thromboembolism segment size was over USD 428 million in 2022 and is expected to show lucrative growth of 6.89% during the forecast period.

- Hospital pharmacy segment in the U.S. accounted for 58.3% heparin market share in 2022.

Report Scope of the U.S. Heparin Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 853.94 million

|

|

Market Size by 2032

|

USD 1692.85 million

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.9%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Product, By Application, By Distribution Channel

|

|

Key companies profiled

|

Pfizer, Amphastar Pharmaceutical, Sanofi, Shenzhen Hepalink, Fresenius Kabi, and Nanjing King-Friend Biochemical Pharmaceutical.

|

Increasing patient pool suffering from chronic illness and rising demand for anticoagulant products will drive the market growth.

Heparin is primarily used in blood transfusion, deep vein thrombosis and kidney dialysis, among others. For instance, according to the National Kidney Foundation report, more than 37 million (15%) individual of U.S. adults are affected by chronic kidney disease (CKD). The report also stated that CKD causes more deaths than breast cancer or prostate cancer. It is one of the under-recognized public health crises. This indicates that there will huge number of patient pool suffering from such disease. Such high prevalence of the disease will increase the heparin market demand in the U.S.

Heparin is an essential anticoagulant drug that are used in critical life-saving surgical procedures. Thus, it can be expected that the COVID-19 outbreak will not directly impact on the manufacturing of products. However, there can be logistical disruptions especially due to the high reliance on Chinese manufacturing. This could disrupt the supply system of heparin and may cause temporary shortages. This can potentially increase the price of heparin API.

The demand for anti-coagulant drugs is on the rise across the U.S. on account of the dependence of most of the vital surgeries on heparin for appropriate and desired outcomes. For instance, procedures such as open-heart surgery, hemodialysis, and interventional procedures are mainly dependent on heparin. Similarly, according to the American Heart Association (AHA) report, coronary heart disease causes around 1 in 7 deaths in U.S aged 25 years and above. The report also stated that, about 3% of the total American suffer from myocardial infarction. This has led to increase in demand for heparin treatment. Such rising cases of chronic illness in both middle aged as well as geriatric people will augment the industry growth.

High dependency on porcine-sourced heparin will restrict the U.S. heparin market size expansion. In U.S., the bovine-sourced heparin was withdrawn due to the spread of bovine spongiform encephalopathy disease in cattle, hence porcine-sourced heparin is the only heparin used in the U.S. Furthermore, the outbreak of swine fever in 2020 has affected about one third of the pig’s population, thus hampering the heparin API supply. However, FDA has encouraged to re-introduce bovine-sourced heparin in U.S. to lower the dependency on porcine that may have positive impact on the market demand.

The low molecular weight heparin market valuation in the U.S. was more than USD 635.4 million in 2022. Low molecular weight heparin are heterogenous compounds and have distinct biochemical and pharmacological properties. Low molecular weight heparin produces a more predictable anticoagulant response, has longer shelf-life and does not require frequent monitoring. Such properties and various applications associated with low molecular weight heparin will increase the adoption rate. Additionally, increasing demand in various healthcare settings owing to growing burden of cardiovascular and chronic diseases will boost the market revenue.

The venous thromboembolism segment size was over USD 428 million in 2022 and is expected to show lucrative growth of 6.89% during the forecast period. Growing rate of chronic diseases including venous thromboembolism will serve as a major factor responsible for the U.S. heparin market growth. For instance, as per the Centers for Disease Control & Prevention (CDC) estimates, about 900,000 people are affected annually by thromboembolism in the U.S. This implicates that there will be a constant increase in the number of patients requiring heparin for treatment of venous thromboembolism. Such high number of chronic conditions will lead to an increased demand for heparin injections for treatment.

Hospital pharmacy segment in the U.S. accounted for 58.3% heparin market share in 2022. Patients tend to prefer hospitals more as compared to other healthcare settings as they offer high quality care and ease of availability of medicines. Hospital pharmacies mainly stock and monitor the supply of larger range of medications that are used in the hospital. Furthermore, constant availability and supply of specialized and life-saving medications will supplement the segment growth.

U.S. Heparin Market Segmentation

| By Product |

By Application |

By Distribution Channel |

|

Low molecular weight heparin

Unfractionated heparin

|

Venous thromboembolism

Atrial fibrillation/flutter

Coronary artery disease

Others

|

Hospital pharmacy

Retail pharmacy

Online pharmacy

|