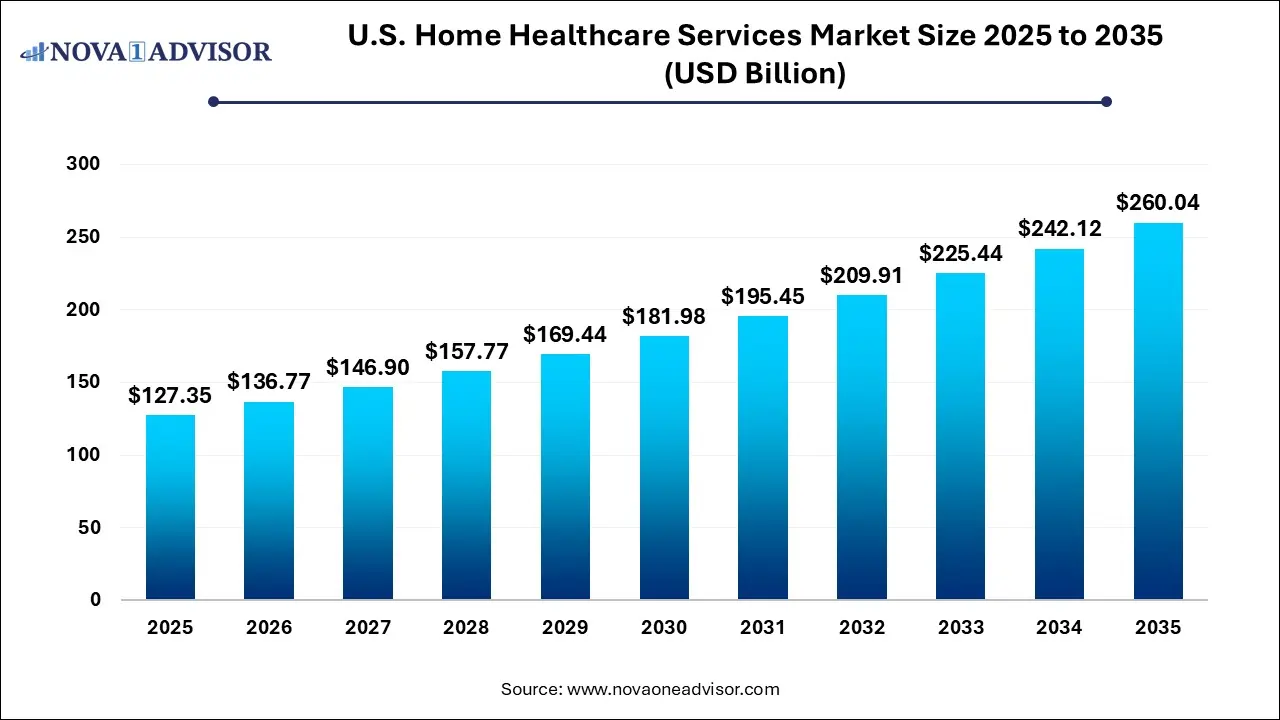

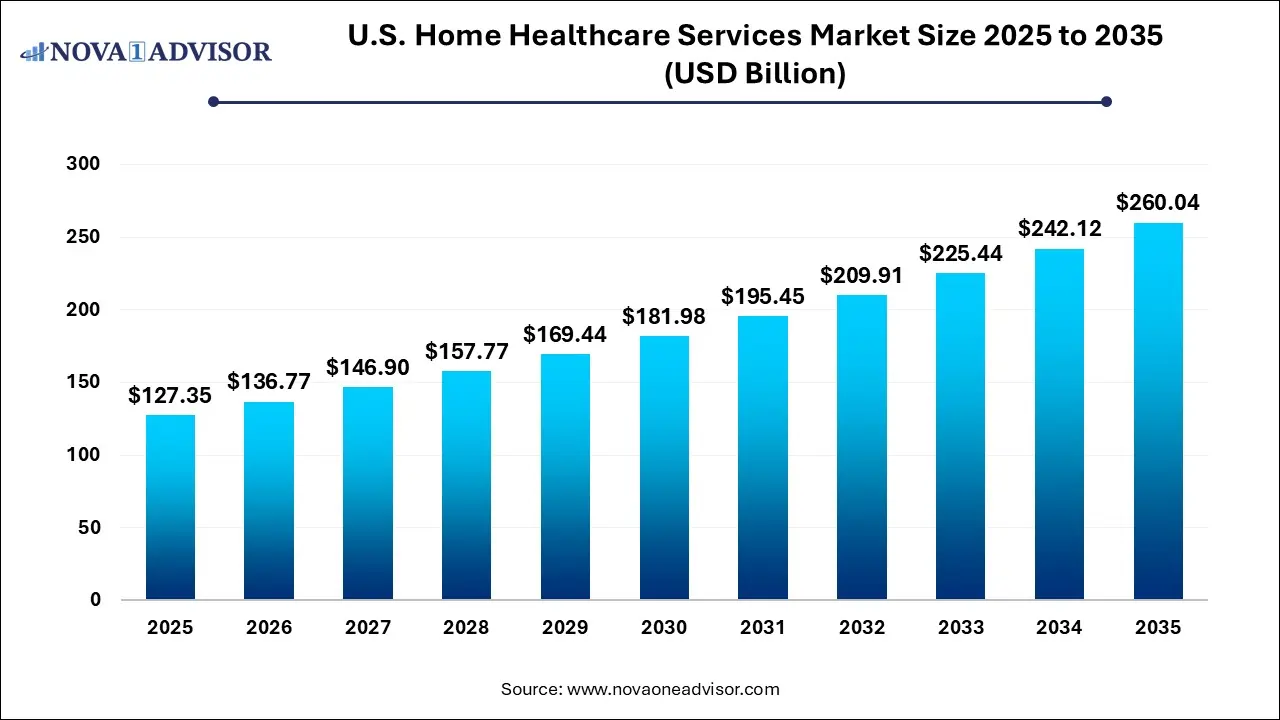

U.S. Home Healthcare Services Market Size and Growth 2026 to 2035

The U.S. home healthcare services market size was estimated at USD 127.35 billion in 2025 and is expected to surpass around USD 260.04 billion by 2035 and poised to grow at a compound annual growth rate (CAGR) of 7.4% during the forecast period 2026 to 2035.

Key Takeaways:

- The skilled care segment accounted for the largest share in terms of market revenue and is expected to register the fastest CAGR over the forecast period due to the launch of programs, such as Hospitals Without Walls, and the increase in demand for at-home medical services

- The COVID-19 pandemic has led to increasing adoption of home health services across the nation as it helps in treating patients with professional support at home itself, avoiding the risk of infection. Healthcare facilities are providing care programs such as hospital-at-home and SNF-at-home that is reducing the stress on facilities and saving healthcare expenditure for the patients.

- Integration of technology in the service portfolio to provide efficient care, and mergers and acquisitions to increase the market presence are some of the key strategies adopted by major players in the market. For instance, in February 2021, Humana Inc. made an agreement with in-home care provider DispatchHealth to provide its patients with home healthcare in Tacoma and Denver. However, the lack of capital acts as a hurdle for certain organizations to enter the market

Market Overview

The U.S. home healthcare services market represents one of the most structurally important components of the country’s evolving healthcare delivery system. It encompasses a broad range of medical and non-medical services delivered to patients in their homes, aimed at improving clinical outcomes, enhancing patient comfort, and reducing the overall cost burden on hospitals and long-term care facilities. As healthcare systems shift away from institution-centric care models toward patient-centric and value-based care, home healthcare has emerged as a preferred alternative for managing chronic diseases, post-acute recovery, and age-related health needs.

The market is primarily driven by demographic shifts, particularly the rapid growth of the aging population in the United States. Individuals aged 65 and above are more likely to require continuous medical monitoring, rehabilitation, and assistance with daily activities, all of which can be efficiently delivered in a home setting. According to demographic projections, the U.S. is witnessing a sustained rise in its elderly population, directly expanding the addressable patient pool for home healthcare services. This demographic trend is further amplified by the increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, respiratory disorders, and neurological impairments.

From a cost perspective, home healthcare services offer a compelling economic advantage over hospital-based or institutional care. Payers, including Medicare, Medicaid, and private insurers, increasingly recognize home-based care as a cost-effective solution that reduces hospital readmissions and shortens lengths of stay. As reimbursement frameworks evolve to reward outcomes rather than service volume, providers are actively expanding home healthcare offerings to align with payer incentives and regulatory priorities.

Technological advancements have also strengthened the market’s foundation. The integration of remote patient monitoring, telehealth platforms, electronic health records, and AI-driven care coordination tools has significantly enhanced the quality and scalability of home healthcare services. These technologies allow providers to deliver skilled care remotely, improve patient adherence, and monitor health parameters in real time, thereby increasing clinical efficiency while maintaining patient safety.

Overall, the U.S. home healthcare services market is positioned as a critical enabler of healthcare system sustainability, balancing clinical quality, patient satisfaction, and economic efficiency

Major Trends in the Market

- Shift from Institutional Care to Home-Based Models: Hospitals and health systems are increasingly transitioning post-acute and chronic care services to the home to reduce costs and improve patient experience.

- Expansion of Skilled Home Healthcare Services: Demand for nursing care, therapy services, and physician-led home visits is rising as clinical complexity within home settings increases.

- Integration of Digital Health Technologies: Remote monitoring, telehealth consultations, and mobile health applications are becoming standard components of home healthcare delivery.

- Value-Based Care Alignment: Providers are restructuring service models to align with outcome-based reimbursement structures, particularly under Medicare Advantage and bundled payment programs.

- Growth of Hospital-at-Home Programs: Large healthcare systems are piloting and expanding hospital-level care delivered in patients’ homes.

- Workforce Optimization and Upskilling: Agencies are investing in workforce training, retention strategies, and hybrid care models to address skilled labor shortages.

- Rising Demand for Palliative and Hospice Care at Home: Patients and families increasingly prefer end-of-life care in familiar home environments.

U.S. Home Healthcare Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 136.77 Billion |

| Market Size by 2035 |

USD 260.04 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Genesis Healthcare, Inc.; Capital Senior Living Corporation; Diversicare Healthcare Services, Inc.; Senior Care Center; Atria Senior Living, Inc.; Amedisys, Inc.; Home Instead, Inc. |

Key Market Driver – Aging Population and Chronic Disease Burden

The most significant driver of the U.S. home healthcare services market is the rapidly aging population combined with the rising prevalence of chronic diseases. Older adults are disproportionately affected by conditions such as arthritis, diabetes, heart disease, stroke, and cognitive disorders, which require ongoing medical attention rather than episodic hospital treatment. Home healthcare enables continuous monitoring, medication management, rehabilitation, and supportive care without the physical and emotional strain associated with institutional settings.

In addition, many chronic diseases now require long-term management rather than acute intervention. Home-based skilled nursing and therapy services provide a sustainable care pathway that reduces emergency room visits and hospital readmissions. From a payer perspective, managing chronic conditions at home significantly lowers per-patient healthcare expenditures, reinforcing policy and reimbursement support for home healthcare models. As longevity increases and chronic disease incidence continues to rise, this driver will remain structurally embedded in market growth.

Key Market Restraint – Workforce Shortages and Caregiver Burnout

Despite strong demand fundamentals, workforce shortages represent a major restraint on market expansion. Home healthcare services rely heavily on skilled professionals such as nurses, therapists, and home health aides, many of whom are already in short supply across the U.S. healthcare system. Competition from hospitals, outpatient facilities, and travel nursing agencies has intensified recruitment challenges for home healthcare providers.

Additionally, caregiver burnout and high attrition rates further strain service capacity. Home healthcare roles often involve travel, irregular schedules, and emotional labor, making retention difficult. While technology and automation can improve operational efficiency, they cannot fully replace hands-on care delivery. Without sustained investment in workforce development, compensation, and training, provider capacity constraints may limit the market’s ability to meet growing demand.

Key Market Opportunity – Hospital-at-Home and Advanced Care Models

A major opportunity lies in the expansion of hospital-at-home and advanced clinical care models. These programs deliver hospital-level services such as intravenous therapy, advanced diagnostics, and continuous monitoring directly in patients’ homes. Supported by regulatory flexibility and payer pilot programs, hospital-at-home initiatives have demonstrated strong outcomes, including reduced complications, lower costs, and higher patient satisfaction.

As technology enables more complex care delivery in home settings, providers can expand service portfolios beyond traditional skilled nursing and therapy. Partnerships between hospitals, home healthcare agencies, and technology firms are accelerating this transition. Over the long term, hospital-at-home models could redefine care pathways for acute and post-acute treatment, creating a high-value growth avenue within the broader home healthcare services market.

By Type Insights

Skilled care dominated the U.S. home healthcare services market due to its critical role in managing complex medical conditions, post-surgical recovery, and chronic disease treatment. Skilled care services require licensed professionals and are typically reimbursed under Medicare and private insurance, making them a financially significant segment. The dominance of skilled care is reinforced by increasing clinical acuity among home healthcare patients, who often require nursing interventions, therapy services, and physician oversight after hospital discharge.

Within skilled care, nursing care and therapy services represent the largest revenue contributors. Nursing care includes wound management, medication administration, and disease monitoring, while physical, occupational, and speech therapy support functional recovery and mobility. Hospice and palliative care have also gained prominence as patient preferences shift toward comfort-focused care at home. The skilled care segment benefits from strong reimbursement structures and alignment with value-based care objectives, ensuring its continued market leadership.

Skilled care is also expected to remain the fastest-growing segment, driven by advancements in remote monitoring and clinical technologies that enable more complex interventions at home. Physician-led home care and integrated care models are expanding access to primary and specialty services outside traditional settings. As payers increasingly reimburse higher-acuity home-based care, skilled services are evolving beyond traditional boundaries, further accelerating growth within this segment.

Key Companies & Market Share Insights

Recent Developments

- March 2024: Amedisys announced the expansion of its hospital-at-home partnerships with regional health systems to support acute care delivery in residential settings.

- June 2024: LHC Group reported strategic investments in advanced analytics and remote patient monitoring to enhance care coordination across its home health and hospice services.

- September 2024: Bayada Home Health Care launched new workforce training programs focused on upskilling nurses and aides for high-acuity home care.

- January 2025: Kindred at Home expanded its hospice and palliative care footprint across multiple U.S. states, responding to growing demand for end-of-life care at home.

- April 2025: Encompass Health strengthened its home health segment through technology integration aimed at reducing hospital readmissions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Home Healthcare Services market.

By Type

- Skilled Care

- Physician/primary care

- Nursing Care

- Physical, Occupational, and/or Speech Therapy

- Nutritional Support

- Hospice & Palliative Care

- Other Skilled Care Services

- Unskilled Care