U.S. Home Medical Equipment Market Size, Share, Growth, Report 2026 to 2035

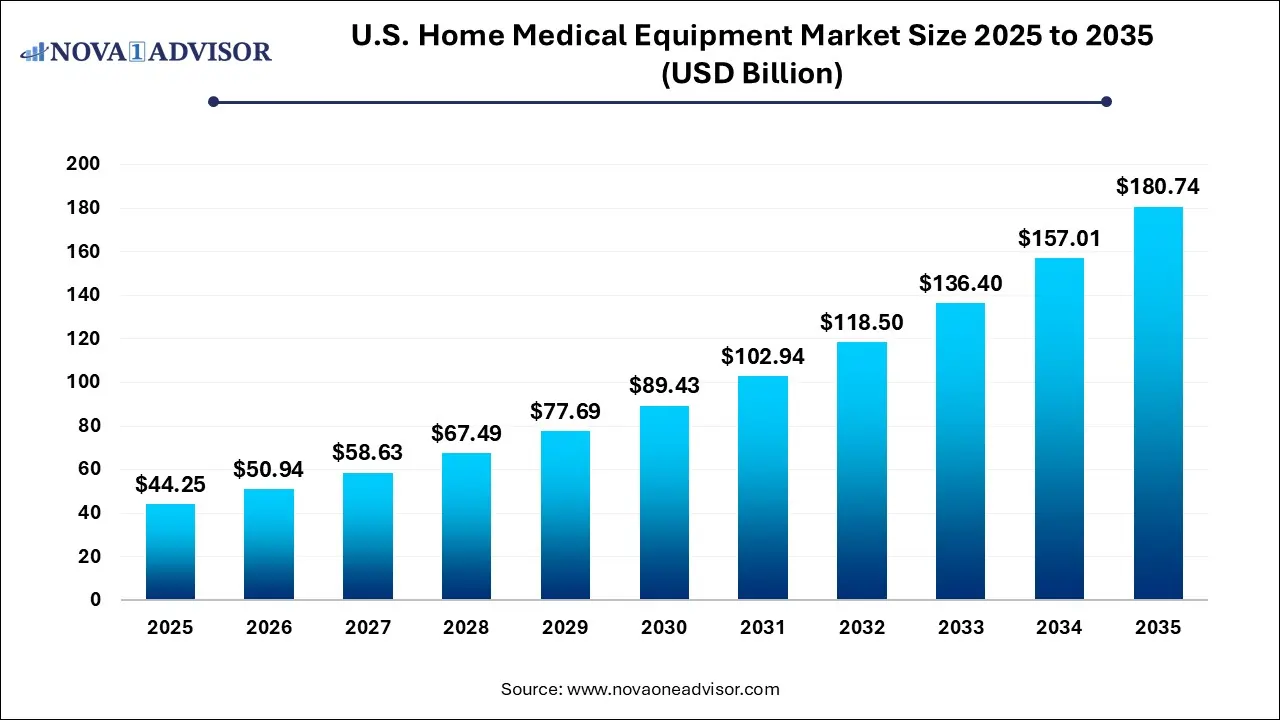

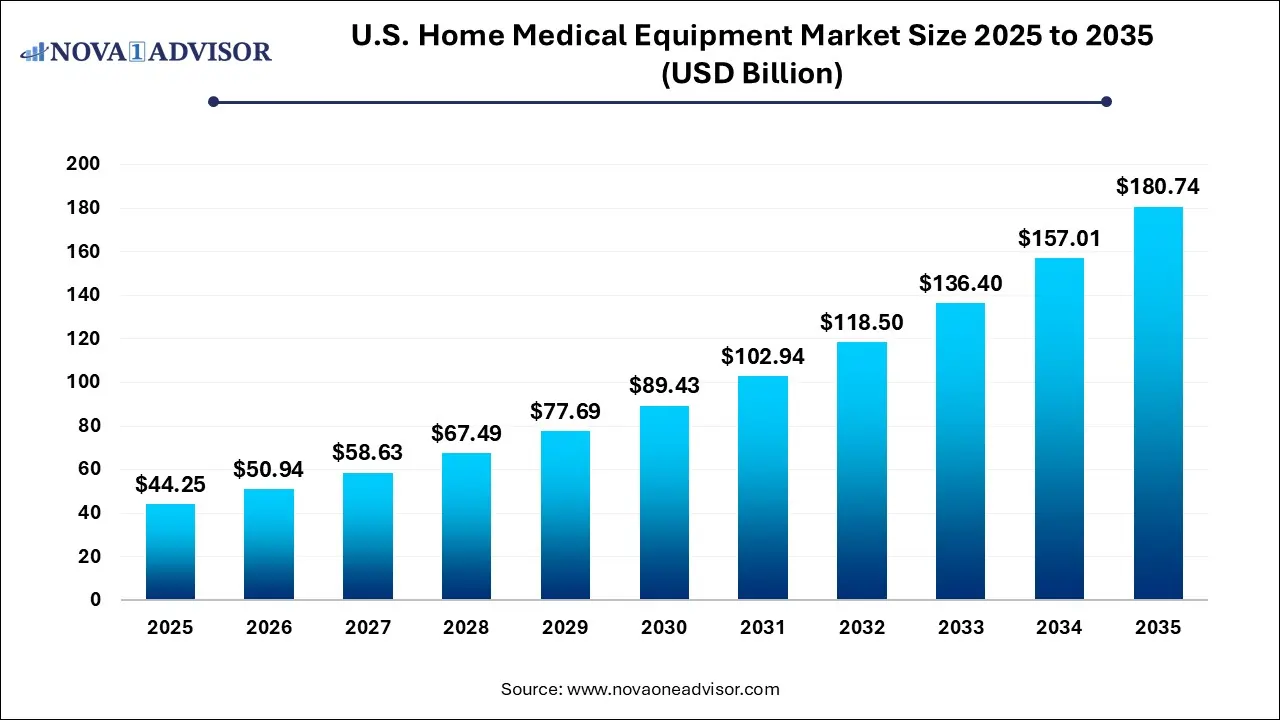

The U.S. home medical equipment market size was exhibited at USD 44.25 Billion in 2025 and is projected to hit around USD 180.74 Billion by 2035, growing at a CAGR of 15.11% during the forecast period 2026 to 2035.

Key Takeaways:

- The mobility assist & patient support equipment segment accounted for the largest home medical equipment market size in 2025

- The mobility assist & patient support equipment segment accounted for the largest home medical equipment market size in 2025

- The largest home medical equipment market size in 2025

- The online segment is anticipated to witness highest CAGR during the forecast period

Market Outlook

- Market Growth Overview: The U.S. home medical equipment market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of chronic illnesses, the shift towards home care, and the focus on self-health management and better healthcare infrastructure.

- Sustainability Trends: Sustainability trends involve circular economy adoption, reprocessing and refurbishment, and energy efficiency and smart technology.

- Major Investors: Major investors in the market include Abbott Laboratories, Philips Healthcare, GE Healthcare, and Medtronic.

- Startup Economy: The startup economy is focused on digital health platforms, remote patient monitoring, and specialized equipment.

Impact of AI on the U.S. Home Medical Equipment Market?

Artificial Intelligence: The Next Growth Catalyst in U.S. Home Medical Equipment

AI is significantly impacting the U.S. home medical equipment (HME) industry by driving a shift towards personalized medicine and efficient remote patient monitoring (RPM). AI-powered devices, such as smart wearables and sensors, collect real-time data on vital signs, enabling proactive health management and early intervention for chronic conditions like diabetes and heart disease. Predictive analytics in these home-based systems helps identify patients at risk of complications, reducing unnecessary hospital visits and associated healthcare costs. Furthermore, AI is enhancing operational efficiency through virtual health assistants and chatbots that provide personalized guidance and medication reminders, reducing the administrative burden on healthcare providers.

Major Trends in the Market

- Integration of Smart Technology and AI

Home medical devices are increasingly incorporating smart technology, artificial intelligence (AI), and the Internet of Medical Things (IoMT) to enable real-time data collection and analysis. This integration allows for enhanced diagnostics, personalized treatment plans, and predictive analytics that can anticipate critical health events, moving beyond basic monitoring to proactive health management.

- Rise of Remote Patient Monitoring (RPM) and Telehealth

There is a significant rise in demand for home-use devices with wireless connectivity that enable remote monitoring by healthcare providers.

- Shift Towards Home-Based Care Models

The healthcare system is shifting toward decentralized, "Hospital at Home" and "aging in place" models, encouraging the use of home medical equipment to manage chronic conditions, recovery from surgery, and long-term care. This transition is driven by the desire for patient comfort and independence, as well as the need for more affordable alternatives to prolonged hospital stays.

- Growing Prevalence of Chronic Diseases and an Aging Population

A major driver for the HME market is the U.S.'s rapidly aging population (the number of Americans aged 65 and older is projected to increase significantly by 2050) and the high incidence of chronic diseases like diabetes, COPD, and cardiovascular conditions.

U.S. Home Medical Equipment Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 50.94 Billion |

| Market Size by 2035 |

USD 180.74 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 15.11% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Distribution Channel, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott Laboratories,Baxter International Inc., B. Braun Melsungen AG, Beckton Dickson and Company,General Electric (GE Healthcare), Invacare Corporation, Johnson & Johnson, Medtronic Plc.,ResMed Inc., Smith & Nephew Plc, Medline Industries, LP and SP Ableware |

Market Driver – Aging Population and Chronic Disease Burden

A major force propelling the U.S. home medical equipment market is the country’s rapidly aging population coupled with a growing chronic disease burden. According to the U.S. Census Bureau, by 2030, all baby boomers will be over 65, accounting for more than 20% of the population. This demographic shift is accompanied by a rise in age-related conditions such as arthritis, diabetes, COPD, and cardiovascular diseases conditions that often require continuous treatment and assistive support.

Home medical equipment, from oxygen delivery systems and mobility aids to remote monitoring devices and beds, enables older adults to maintain quality of life in familiar environments while reducing hospital visits. Medicare’s increasing reimbursement coverage for durable medical equipment (DME) is making such equipment more affordable for elderly populations. Furthermore, a preference among seniors to "age in place" rather than move to long-term care facilities is reinforcing demand for advanced, reliable home medical solutions.

Market Restraint – Regulatory Complexity and Reimbursement Challenges

Despite substantial growth prospects, the U.S. home medical equipment market faces challenges rooted in regulatory and reimbursement complexities. The Food and Drug Administration (FDA) mandates stringent approval and classification procedures for many home-use devices, especially those involving electronic or invasive components. Compliance with manufacturing standards, safety certifications, and labeling requirements adds time and cost to the product lifecycle.

In addition, Medicare and Medicaid reimbursement processes are often slow and bureaucratically complex. Variations in state-level policy, limitations on replacement cycles, and documentation requirements pose barriers to market expansion. Suppliers must navigate audits, coding systems (HCPCS), and reimbursement caps, which can dissuade new entrants and create cash flow challenges for distributors. These hurdles can delay access to critical devices and hinder innovation in smaller firms lacking regulatory expertise.

Market Opportunity – Technological Advancement and Smart Device Integration

An outstanding opportunity in the U.S. HME market lies in the rapid advancement of smart, connected technologies. From IoT-enabled CPAP machines that transmit sleep data to the cloud, to AI-powered glucometers that offer predictive insights, smart devices are revolutionizing home care. These innovations not only empower patients to manage their conditions more effectively but also enable physicians to track health data remotely and intervene early when issues arise.

The integration of AI, cloud computing, and wearable technology into HME enhances diagnosis accuracy, facilitates personalized therapy, and contributes to preventive healthcare. Devices like Bluetooth-enabled BP monitors, app-linked thermometers, and GPS-tracked mobility scooters represent the future of patient-centric care. Manufacturers investing in telehealth-compatible, easy-to-use, and interoperable solutions are well-positioned to tap into this growing segment. Furthermore, partnerships with digital health companies and EHR platforms are amplifying the reach and effectiveness of such technologies.

Segmental Analysis

By Functionality

Therapeutic equipment dominated the market, primarily due to the high demand for respiratory therapy equipment, home dialysis products, and IV administration kits. The increasing incidence of sleep apnea, chronic obstructive pulmonary disease (COPD), and kidney failure has fueled widespread adoption of home-based therapeutic solutions. CPAP machines and oxygen concentrators are widely used for long-term respiratory management, while home dialysis equipment allows end-stage renal disease (ESRD) patients to maintain a flexible lifestyle without frequent hospital visits. Moreover, home wound therapy products and feeding pumps are enabling post-acute care for patients recovering from surgeries or serious illnesses.

Home dialysis equipment is emerging as one of the fastest-growing therapeutic segments, driven by technological advancements and policy support. Portable peritoneal dialysis machines and home hemodialysis systems are being designed for easier setup, better mobility, and real-time monitoring. Companies like Outset Medical and Baxter International are innovating in this area, empowering patients with user-friendly interfaces, safety alerts, and data analytics. Increased patient autonomy, better quality of life, and lower care costs make home dialysis an attractive alternative to center-based care. Government push for home-first dialysis and favorable insurance coverage are accelerating this trend.

By Patient Monitoring Equipment

Blood glucose monitors led this segment, given the high prevalence of diabetes in the U.S., where over 37 million people are affected according to CDC data. Patients rely on blood glucose meters to monitor sugar levels and prevent complications like hypoglycemia or hyperglycemia. Advances in continuous glucose monitoring (CGM) devices, such as Dexcom and FreeStyle Libre, offer real-time tracking and mobile alerts, significantly improving patient compliance and control. These devices also integrate with smartphone apps, insulin pumps, and cloud storage platforms, enhancing data access and enabling personalized treatment plans.

Coagulation monitors and apnea monitors are among the fastest-growing, especially for patients on blood thinners and those with sleep disorders or premature infants. As outpatient care becomes common for post-surgery recovery, these devices help clinicians detect abnormalities before they escalate. Apnea monitors, in particular, are in demand among new parents and sleep disorder clinics. They monitor breathing patterns and oxygen levels, triggering alerts for medical intervention. With the expansion of remote patient monitoring programs under Medicare, adoption of these devices is expected to rise rapidly.

By Mobility Assist & Patient Support Equipment

Wheelchairs dominated this category, owing to widespread use among seniors, rehabilitation patients, and individuals with physical disabilities. The U.S. market includes manual wheelchairs for temporary or short-distance use, powered wheelchairs for those with severe mobility limitations, and transport chairs for caregiver-assisted mobility. Manufacturers are offering customized wheelchairs with lightweight materials, foldable designs, and smart navigational features for enhanced independence. Veterans and individuals with spinal cord injuries represent significant customer bases supported by government funding and private insurance.

Mobility scooters and walking assist devices are witnessing rapid growth, particularly in urban and retirement communities. These products help users move around homes, stores, and parks safely and comfortably. Lightweight mobility scooters with ergonomic design, long battery life, and terrain adaptability are growing in popularity. Similarly, walkers, rollators, and canes with shock-absorbing features, adjustable height, and anti-slip grips are seeing increased demand. As fall prevention becomes a key priority in senior care, these devices play a critical role in enhancing safety and quality of life.

By Distribution Channel

Offline channels remain dominant, as brick-and-mortar medical supply stores and pharmacies continue to serve as the primary point of sale for many customers, especially seniors. Offline purchases are favored for high-involvement products like mobility equipment, where sizing, fitting, and setup guidance are essential. Additionally, many insurance claims and Medicare reimbursements require purchases through authorized dealers. Hospitals and home healthcare agencies also source large volumes of equipment through offline distributors under negotiated contracts.

Online distribution is the fastest-growing channel, driven by convenience, wider product selection, and competitive pricing. Platforms like Amazon, Walmart, and CVS offer everything from blood pressure monitors and bath safety equipment to CPAP accessories and IV kits. Specialty websites like Apria, 1800wheelchair, and Medline are also expanding direct-to-consumer services. The rise of tech-savvy caregivers and increased digital literacy among seniors is fostering comfort with online purchasing, a trend accelerated by the pandemic. Subscription models, auto-refill programs, and virtual consultations further enhance e-commerce penetration.

Country-Level Analysis – United States

In the United States, the home medical equipment market reflects a robust interplay of demographic demand, technological innovation, and evolving care delivery models. States with large senior populations—such as Florida, California, Texas, and Pennsylvania—account for significant demand, especially for mobility aids, monitoring devices, and home therapeutic solutions. Urban centers show high adoption of smart and connected equipment, while rural areas are witnessing growing reliance on telehealth-compatible tools due to limited access to facilities.

Federal initiatives like CMS's Hospital at Home model and expanded Medicare reimbursement for remote monitoring are reinforcing market expansion. Furthermore, private insurance plans are gradually broadening coverage for durable medical equipment (DME), especially for post-discharge care, chronic disease management, and palliative support. Technology hubs such as Massachusetts and California also drive innovation, while logistics and distribution hubs across the Midwest support supply chain efficiencies.

Value Chain Analysis of the U.S. Home Medical Equipment Market

Research and Development (R&D) & Design

This initial stage focuses on innovating new devices, improving existing products, and designing solutions that meet unmet clinical needs in home healthcare settings.

- Key Players: Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, GE Healthcare, ResMed Inc.

Raw Material Sourcing & Manufacturing

This stage involves the procurement of high-quality, specialized materials (e.g., medical-grade plastics, metals) and the subsequent production and assembly of medical components into finished products.

- Key Players: Becton, Dickinson and Company (BD), Baxter International Inc., B. Braun Melsungen AG, Medline Industries, LP, Invacare Corporation

Regulatory Approval & Compliance

Before products can be sold, they must obtain regulatory clearance or approval from relevant authorities, such as the U.S. Food and Drug Administration (FDA).

- Key Players: Becton, Dickinson and Company (BD), Medtronic PLC, Johnson & Johnson, Abbott Laboratories.

Distribution & Supply Chain

Once approved, finished products are moved through various channels, including distributors, wholesalers, and healthcare providers, to reach the end consumer.

- Key Players (Distributors): McKesson Corporation, Cardinal Health, Medline Industries, Owens & Minor

U.S. Home Medical Equipment Market Companies

- Abbott Laboratories: Abbott is a leader in home-based metabolic monitoring, specifically through its FreeStyle Libre continuous glucose monitoring ecosystem.

- Baxter International Inc.: Baxter provides advanced home dialysis technologies, such as the Homechoice Claria system, which allows patients with kidney failure to receive life-sustaining treatment in their own bedrooms.

- B. Braun Melsungen AG: B. Braun contributes to the HME market through high-quality infusion pumps and clinical nutrition products designed for safe use by patients and home-care nurses.

- Becton, Dickinson and Company (BD): BD provides essential home-care supplies, including insulin delivery needles, catheters, and specimen collection devices that ensure clinical-grade safety in residential environments.

- GE Healthcare: GE Healthcare contributes to the market with portable diagnostic devices, such as the Vscan Air handheld ultrasound, which enables visiting doctors to perform advanced imaging at the bedside.

- Invacare Corporation: Invacare is a primary manufacturer of durable medical equipment, including power wheelchairs, pressure-relieving mattresses, and home respiratory systems.

- Johnson & Johnson: Through its Ethicon and DePuy Synthes divisions, J&J provides specialized wound care products and orthopedic recovery tools used during home-based post-surgical rehabilitation.

- Medtronic Plc.: Medtronic is a pioneer in "smart" home medical devices, offering automated insulin pumps and remote monitoring systems for patients with cardiac implants.

- ResMed Inc.: ResMed dominates the home respiratory market with its AirSense series of CPAP machines and cloud-connected ventilators for sleep apnea and COPD.

- Smith & Nephew Plc: Smith & Nephew provides advanced wound management systems, such as the PICO single-use negative pressure wound therapy device, for at-home healing of complex injuries.

- Medline Industries, LP: Medline is a massive distributor and manufacturer of everyday HME supplies, ranging from bathroom safety equipment to disposable incontinence products.

- SP Ableware (Maddak): SP Ableware specializes in "activities of daily living" (ADL) aids, such as reachers, dressing aids, and specialized kitchen tools for those with limited mobility or arthritis.

Recent Developments

-

March 2025 – Outset Medical announced a nationwide rollout of its Tablo Hemodialysis System for at-home use, following strong pilot results with Medicare patients.

-

February 2025 – ResMed released its AirSense 11 CPAP machine with enhanced cloud connectivity and sleep coaching tools, targeting obstructive sleep apnea patients in the U.S.

-

January 2025 – Invacare Corporation unveiled a new lightweight power wheelchair with smart navigation and caregiver assist tools for use in assisted living settings.

-

November 2024 – Medline Industries expanded its DTC product catalog, offering bundled home care kits including bath safety products, gloves, thermometers, and wound dressings.

-

October 2024 – Philips Respironics introduced a new AI-enabled oxygen concentrator integrated with the Care Orchestrator platform for real-time respiratory monitoring.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Home Medical Equipment market.

By Functionality

- Therapeutic equipment

- Home respiratory therapy equipment

- Continuous positive airway pressure equipment

- CPAP machines

- CPAP accessories

- Oxygen delivery equipment

- Oxygen concentrators

- Home liquid oxygen containers

- Oxygen cannula

- Other home oxygen delivery equipment

- Ventilators

- Nebulizers

- Humidifiers

- Home IV equipment

- IV pumps

- IV administration

- IV accessories

- Home dialysis equipment

- Home peritoneal dialysis

- Home hemodialysis products

- Other home therapeutic equipment

- Home physical therapy equipment

- Home negative pressure wound therapy devices

- Home braces & related products

- Home enteral feeding products

- Home automated external defibrillators

- Home muscle & nerve stimulators

- Patient monitoring equipment

- Blood glucose monitors

- Blood pressure monitors

- Holter monitors

- Peak flow meters

- Apnea monitors

- Heart rate monitors

- Baby monitors

- Electronic thermometer

- Coagulation monitors

- Others

- Mobility assist & patient support equipment

- Wheelchairs

- Manual wheelchairs

- Powered wheelchairs

- Transport chairs

- Wheelchair accessories

- Mobility scooters

- Walking assist device

- Walker, Walker accessories & rollators

- Canes, canes accessories & walking sticks

- Crutches & crutches accessories

- Medical furniture

- Lift chairs

- Medical beds

- Stairs lifts

- Medical furniture accessories

- Bathroom safety equipment

- Grab Bars

- .Shower chairs

- Elevated toilets seats

- Commodes

- Tub Rail

- Toilet Safety Frame

- Personal Care

- Cushion

- Cast Protector

- Reacher

- .Urinal

- Ring Cushion

- Bed Rail

- Hot Water Bottle

- Sitz Bath

- Adaptive cutlery

By Distribution Channel

- Offline channel

- Online channel