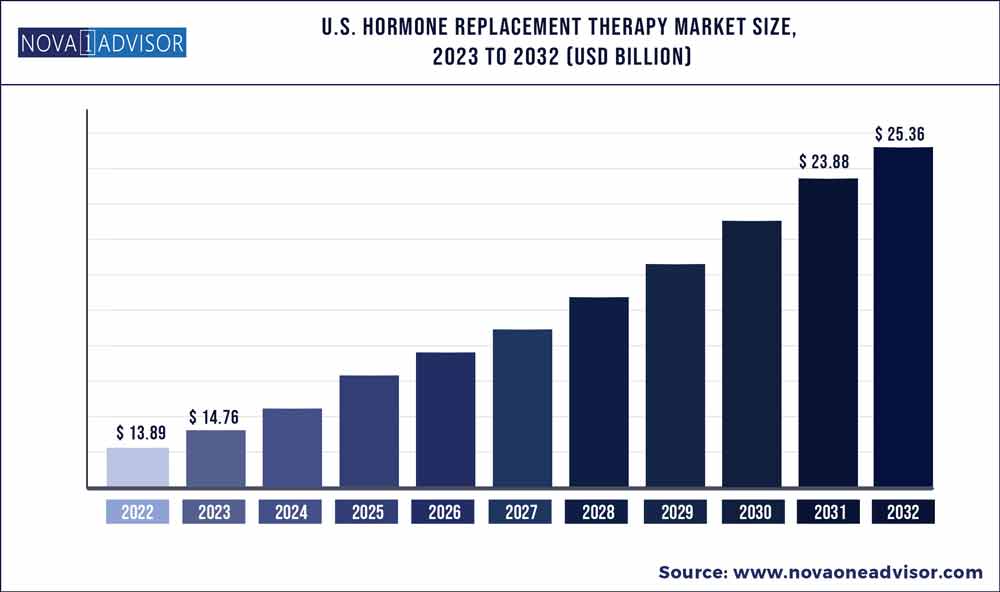

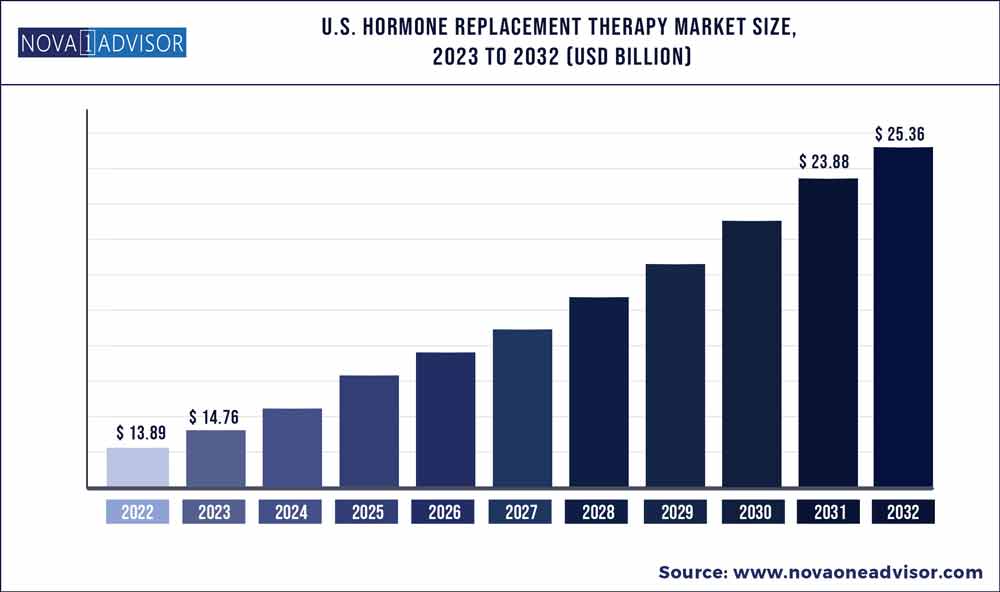

The U.S. hormone replacement therapy market size was estimated at USD 13.89 billion in 2022 and is expected to surpass around USD 25.36 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 6.2% during the forecast period 2023 to 2032.

Key Takeaways:

- The estrogen and progesterone replacement therapy segment accounted for the largest revenue share of 45.1% in 2022.

- Furthermore, the parathyroid hormone segment is expected to witness a CAGR of 10.3% over the forecast period

- The menopause segment dominated the U.S. hormone replacement therapy market and accounted for the largest revenue share of 44.6% in 2022

- The oral hormone replacement therapy segment accounted for the largest revenue share of 48.1% in 2022.

U.S. Hormone Replacement Therapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 14.76 Billion |

| Market Size by 2032 |

USD 25.36 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 6.2% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product, Route of administration, Disease type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott; Pfizer, Inc.; AbbVie Inc; Mylan N.V.; Merck & Co. Inc.; Novo Nordisk A/S; Bayer AG; Eli Lilly and Company; F. Hoffmann La Roche Ltd. |

The rising incidence of various hormonal imbalance disorders and the increasing population of geriatric and neonates suffering from these diseases is expected to boost market growth.

According to the University of Wisconsin Hospitals and Clinics Authority, the prevalence of hypogonadism increases with age and around 13.0% of men in their 50’s and 20.0% of men in their 60’s suffer from hypogonadism in the U.S. It also reported that in most of the cases, hypogonadism remains underdiagnosed and undertreated. However, increasing awareness about such diseases is anticipated to boost the growth of the market for hormone replacement therapy.

In addition, the American Thyroid Association suggested that around 13.0% of the U.S. population is estimated to suffer from thyroid disorder during their lifetime. It also reported that approximately 21.0 million U.S. citizens have some form of thyroid disease. In addition, a high incidence of congenital disorders in newborns is expected to drive the market. According to the CDC, about 1 in every 2,000 to 4,000 neonates suffers from congenital hypothyroidism, which if left unattended leads to mental retardation.

The key players are engaged in the development of products with different formulation to increase patient acceptability and compliance, which may further boost the market growth. For instance, the introduction of capsule formulation such as Bijuva for estrogen and testosterone replacement therapy in October 2018 will drive growth. Bijuva is a first of its kind bioidentical hormone therapy combination of estradiol and progesterone.

However, the FDA has identified certain drugs in estrogen therapy that can cause adverse reactions and increase the risk of cancer in women. Such severe adverse effects act as a key restraint for market growth.

Product Insights

The estrogen and progesterone replacement therapy segment accounted for the largest revenue share of 45.1% in 2022. Estrogen and progesterone replacement therapy is prescribed for post-menopause or hysterectomy to help maintain hormonal balance. The therapy includes treatment by estrogen drugs or a combination of estrogen and progesterone. Progesterone is not used in cases where a patient has undergone hysterectomies. The drugs are available in the form of creams, oral tablets, transdermal patches, gels, implants, and vaginal rings.

The introduction of novel and innovative products may contribute to the growth of the segment. For instance, in October 2018, TherapeuticsMD, Inc. announced the U.S. FDA approval for BIJUVA (estradiol and progesterone) capsules having a dose strength of 1 mg/100 mg. This is the first FDA-approved estradiol and progesterone bio-identical hormone therapy combination in a single capsule used for vasomotor symptoms in postmenopausal women.

Furthermore, the parathyroid hormone segment is expected to witness a CAGR of 10.3% over the forecast period in the market for hormone replacement therapy. In 2015, the U.S. Food and Drug Administration approved the use of recombinant human parathyroid hormone (1-84) [rhPTH(1-84)] as a treatment for adult patients with chronic hypoparathyroidism who are uncontrolled with conventional therapy.

Disease Type Insights

The menopause segment dominated the U.S. hormone replacement therapy market and accounted for the largest revenue share of 44.6% in 2022 owing to the increase in the number of menopausal women. Furthermore, the rising number of women in the age group of 45 to 60 years and increasing incidence of vasomotor symptoms and vaginal atrophy that may lead to severe conditions, such as osteoporosis, are expected to fuel the market growth. According to the American Congress of Obstetricians and Gynecologists, around 6,000 women reach menopause daily. In addition, the North American Menopause Society (NAMS) suggests that 75.0% of women experience postmenopausal symptoms.

Hypoparathyroidism is expected to witness the fastest growth in the market for hormone replacement therapy over the forecast period. This growth is attributed to increasing novel treatments and the introduction of products. For instance, in September 2020, Ascendis Pharma A/S showcased the TransCon technologies at the American Society for Bone and Mineral Research (ASBMR) 2020 Annual Meeting. The company also presented the phase 2 clinical trial result of TransCon PTH as replacement therapy for hypoparathyroidism.

Route of Administration Insights

The oral hormone replacement therapy segment accounted for the largest revenue share of 48.1% in 2022. The parenteral segment is expected to witness the highest growth rate over the forecast period. The launch of pen-based versions and long-acting growth hormones to promote accurate dosing and reduce adverse effects due to overdosing is anticipated to propel the growth of the parenteral segment.

In the case of an oral formulation, the introduction of oral testosterone products such as TLANDO may contribute to segment growth. Moreover, levothyroxine sodium tablets contribute significant revenue to the segment with over 1o0 million prescriptions being dispensed annually in the U.S.

Key Companies & Market Share Insights

Key market players are introducing novel products to strengthen their product portfolio in the hormone replacement therapy market. For instance, in August 2020, Novo Nordisk A/S announced the U.S. FDA approval for Biologics License Application for Sogroya. Sogroya is somapacitan-beco based once-weekly injectable for adults with growth hormone deficiency. The company is finalizing its plan to commercialize the product in the market.

Furthermore, companies are adopting strategies that enable them to use their resources to aid the development of products and also enhance the supply chain. In September 2020, Bayer AG announced the completion of its acquisition of KaNDy Therapeutics Ltd. for the expansion of women’s healthcare pipeline. This acquisition may help the company strengthen its position in the market with potential drug candidates. Some of the prominent players in the U.S. hormone replacement therapy market include:

- Merck & Co., Inc.

- Mylan N.V.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Noven Pharmaceuticals, Inc.

- ASCEND Therapeutics US, LLC.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Hormone Replacement Therapy market.

By Product

- Estrogen and Progesterone Replacement Therapy

- Human Growth Hormone (HGH) Replacement Therapy

- Thyroid Hormone Replacement Therapy

- Testosterone Replacement Therapy

- Parathyroid Hormone

By Route of Administration

- Oral

- Parenteral

- Transdermal

- Others

By Disease Type

- Menopause

- Hypothyroidism

- Male Hypogonadism

- Growth Hormone Deficiency

- Hypoparathyroidism