U.S. Immunoassay Market Size & Trends

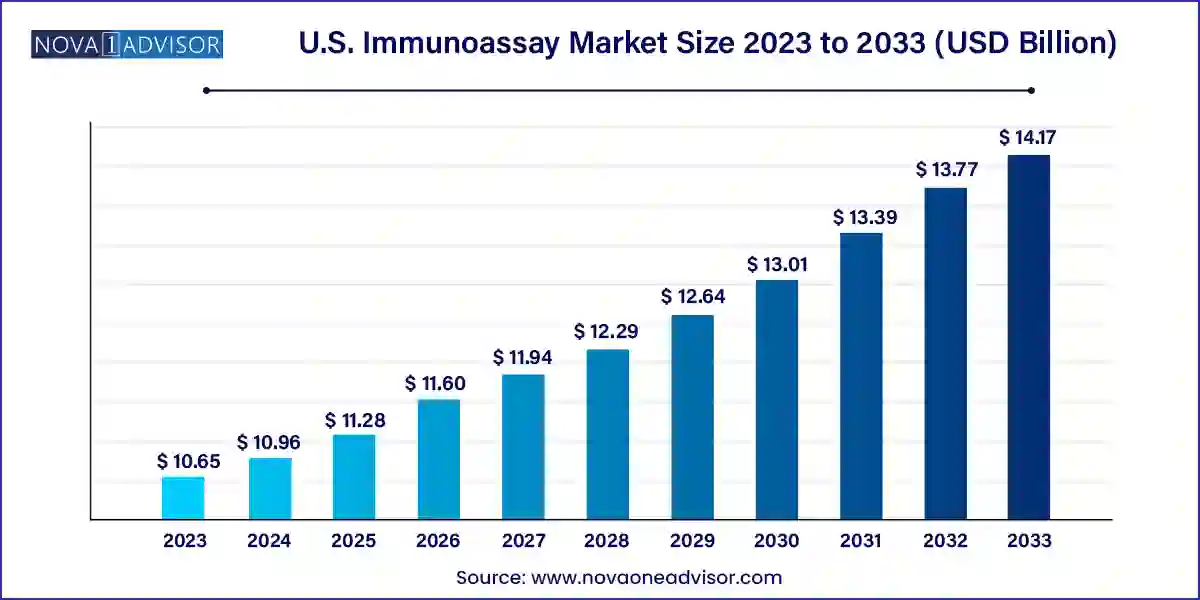

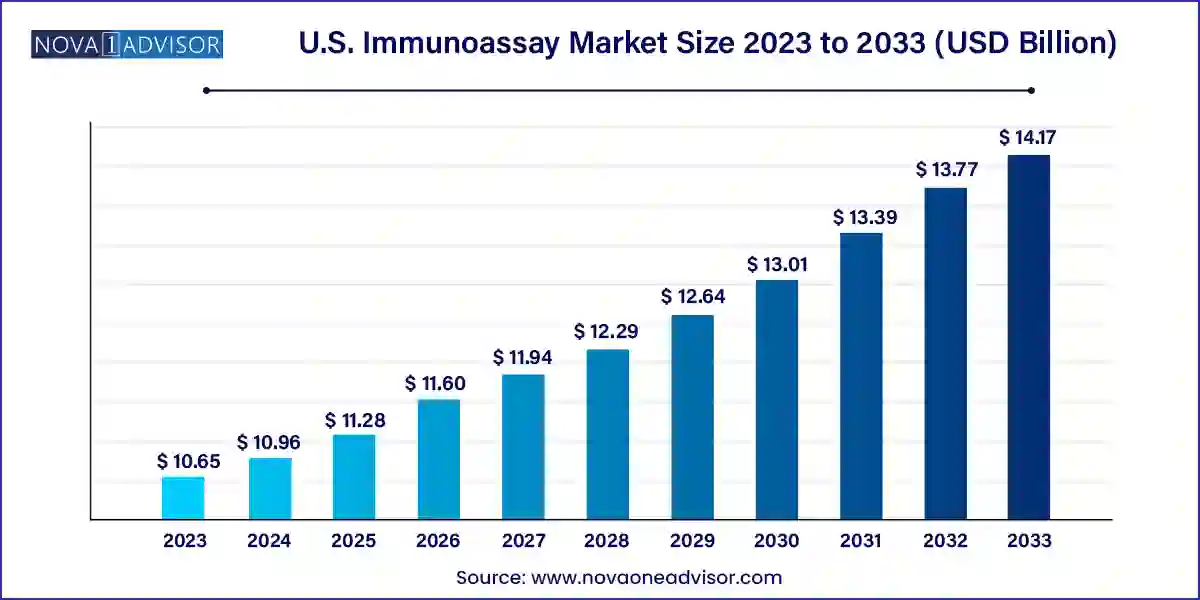

The U.S. immunoassay market size was exhibited at USD 10.65 billion in 2023 and is projected to hit around USD 14.17 billion by 2033, growing at a CAGR of 2.9% during the forecast period 2024 to 2033.

Key Takeaways:

- The reagents and kits led the market with the largest revenue share of 65.82% in 2023.

- Based on technology, the enzyme immunoassays (EIA) segment led the market with the largest revenue share of 63.49% in 2023.

- Based on application, the infectious diseases testing segment led the market with the largest revenue share of 29.55% in 2023.

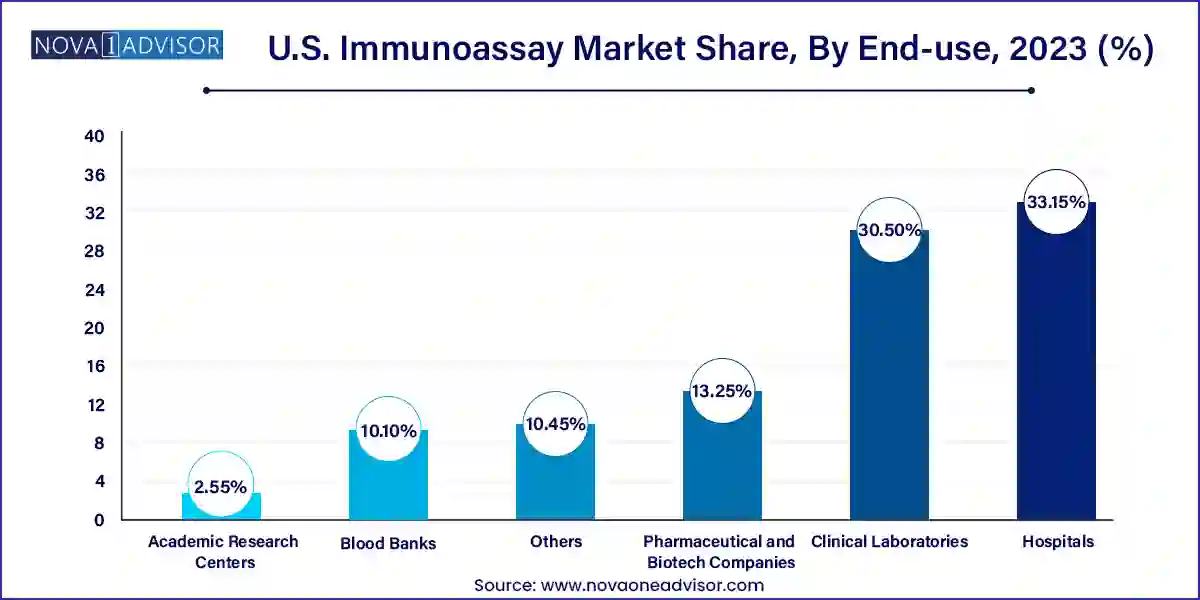

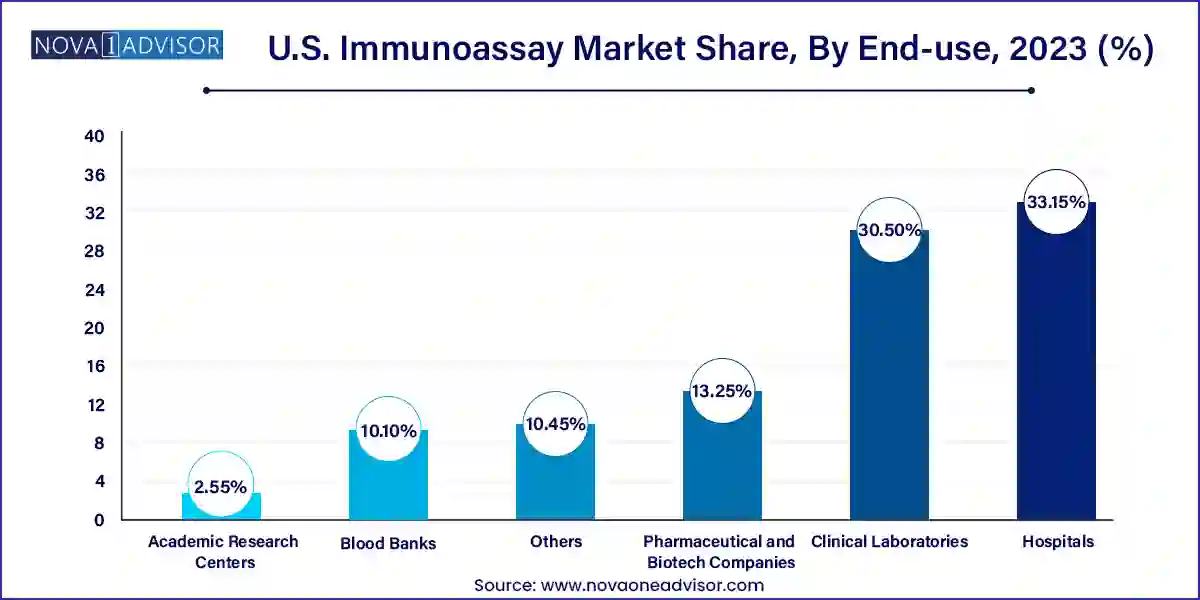

- Based on end-use, the hospital segment led the market with the largest revenue share of 33.15% in 2023.

- The clinical laboratories sector is expected to register at the fastest CAGR during the forecast period.

- Based on specimen, the blood segment led the market with the largest revenue share of 43.19% in 2023

- The urine specimen segment is expected to register at the fastest CAGR during the forecast period.

Market Overview

The U.S. immunoassay market has evolved into a cornerstone of clinical diagnostics, biotechnology, pharmaceutical development, and academic research. Immunoassays analytical techniques that rely on the specificity of antigen-antibody interactions—have become indispensable tools for the detection, quantification, and monitoring of analytes in various biological specimens. These include hormones, pathogens, drugs, tumor markers, and proteins involved in immune responses.

The market encompasses a broad array of technologies and products, ranging from traditional enzyme-linked immunosorbent assays (ELISA) to advanced chemiluminescence immunoassays (CLIA), fluorescence immunoassays (FIA), and rapid diagnostic tests. This technological diversity has allowed immunoassays to infiltrate a wide spectrum of applications, including infectious disease diagnostics, therapeutic drug monitoring, cancer detection, cardiology, and autoimmune disorders.

As the U.S. healthcare system pivots toward value-based care, early detection, and personalized treatment, the demand for rapid, high-throughput, and accurate diagnostic technologies has intensified. Immunoassays, with their adaptability and high sensitivity, meet these demands exceptionally well. Further, the COVID-19 pandemic significantly increased public and institutional reliance on immunoassay-based testing, catalyzing market growth and driving innovation.

Strong R&D investment, technological convergence, favorable reimbursement structures, and regulatory support for diagnostic development underpin the continued growth of the U.S. immunoassay market. As precision medicine becomes mainstream and diagnostic testing shifts closer to the patient, immunoassays will remain at the forefront of transformative healthcare delivery.

Major Trends in the Market

-

Shift toward automation and integrated platforms that allow high-throughput testing with minimal human intervention.

-

Rising use of chemiluminescence and fluorescence-based immunoassays due to their superior sensitivity and dynamic range.

-

Adoption of immunoassay testing in point-of-care (PoC) settings to support rapid clinical decision-making and decentralized diagnostics.

-

Increasing application of multiplex immunoassays in oncology and infectious disease research for simultaneous biomarker detection.

-

Integration of AI and machine learning in immunoassay data analysis to enhance diagnostic accuracy and interpret complex patterns.

-

Expanding use of saliva and other non-invasive specimens, especially for at-home and wearable diagnostic devices.

-

Growth of companion diagnostics using immunoassays as targeted therapies gain traction in oncology and rare diseases.

-

Emergence of rapid immunoassays in public health responses, especially during epidemics and bioterrorism preparedness.

Report Scope of U.S. Immunoassay Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10.96 Billion |

| Market Size by 2033 |

USD 14.17 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, Application, End-use, Specimen |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

F. Hoffmann-La Roche AG; Abbott Laboratories; Siemens Healthineers; Danaher Corporation; Thermo Fisher Scientific; Bio-Rad Laboratories; Sysmex Corporation; DiaSorin; Agilent Technologies |

Market Driver: Increasing Prevalence of Infectious and Chronic Diseases

A primary driver for the U.S. immunoassay market is the growing prevalence of infectious diseases and chronic health conditions. Diseases such as HIV, hepatitis, tuberculosis, and more recently, COVID-19, have highlighted the need for reliable, fast, and scalable diagnostic tests. Simultaneously, chronic conditions such as cancer, cardiovascular diseases, and autoimmune disorders require continuous biomarker monitoring, an area where immunoassays offer unmatched precision.

In the case of infectious diseases, immunoassays provide early detection and monitoring capabilities critical for both individual treatment and broader public health surveillance. For example, during the COVID-19 pandemic, serology-based immunoassays were widely adopted to monitor antibody responses and community spread. Similarly, in oncology, tests like HER2 and PSA immunoassays are standard in cancer diagnostics and monitoring. This wide-ranging application in disease management continues to fuel demand across hospital, laboratory, and point-of-care settings.

Market Restraint: Stringent Regulatory and Validation Requirements

Despite the expanding demand, the U.S. immunoassay market faces a key restraint in the form of complex and evolving regulatory frameworks, especially for diagnostic applications. Immunoassays developed for clinical use must meet rigorous criteria for sensitivity, specificity, reproducibility, and stability criteria closely monitored by the U.S. Food and Drug Administration (FDA) and Centers for Medicare & Medicaid Services (CMS).

For manufacturers, gaining approval involves comprehensive clinical validation, costly trials, and continuous quality control adherence, which can delay time-to-market and inflate development costs. Moreover, the dynamic nature of pathogens such as frequent mutations in viruses like SARS-CoV-2 or HIV necessitates continual assay refinement. These regulatory and scientific hurdles may limit innovation by smaller players or delay the commercialization of otherwise promising tests.

Market Opportunity: Expansion of Immunoassays into At-home and Remote Diagnostics

A promising opportunity in the U.S. immunoassay market lies in the expansion of testing into home-based and remote settings. The consumerization of diagnostics, catalyzed by the COVID-19 pandemic, has led to increased acceptance and demand for reliable, user-friendly tests that can be performed outside of clinical laboratories.

Innovations in lateral flow immunoassays and microfluidic platforms have enabled compact, disposable test kits capable of delivering accurate results within minutes. Examples include at-home COVID-19 antigen tests, pregnancy kits, and now emerging rapid immunoassays for influenza and other respiratory conditions. As telehealth becomes more mainstream, home-based immunoassays will play a critical role in bridging diagnostic gaps, reducing hospital visits, and enabling earlier intervention, particularly in rural or underserved areas.

U.S. Immunoassay Market By Product Insights

Reagents and kits dominated the product segment in 2024, due to their recurring demand and critical role in every immunoassay process. Within this category, ELISA reagents and rapid test kits held the lion’s share. ELISA kits are the gold standard for high-throughput laboratory testing due to their versatility in detecting a wide range of analytes, from hormones to antibodies. Rapid test kits, on the other hand, surged during the pandemic, being vital for mass testing initiatives. The need for continual replenishment of these reagents in clinical labs, blood banks, and PoC settings ensures a consistent revenue stream for manufacturers.

However, the software & services segment is emerging as the fastest-growing due to the need for efficient assay data interpretation and remote diagnostics. With the increasing complexity of multiplex immunoassays and integration of connected diagnostic devices, laboratories and healthcare providers are investing in intelligent software that can analyze, report, and store results in real-time. Software also facilitates compliance with regulatory documentation and supports digital connectivity with hospital information systems (HIS). Moreover, service offerings such as custom assay development, assay validation, and post-market technical support are creating long-term customer engagement opportunities for vendors.

U.S. Immunoassay Market By Technology Insights

Enzyme immunoassays (EIA), particularly chemiluminescence immunoassays (CLIA), remained the dominant technology in the market due to their sensitivity and adaptability. CLIA combines the robustness of traditional ELISA with enhanced signal detection, enabling high-throughput testing with minimal interference. It is especially valued in applications like thyroid function testing, infectious disease screening, and oncology. Hospitals and large clinical laboratories often favor CLIA-based platforms due to their automation capability and compatibility with sample pooling.

The rapid test technology segment, however, is growing at the fastest rate due to the demand for decentralized and immediate diagnostics. These tests, often based on lateral flow immunoassays, offer results within minutes without needing lab infrastructure. The use of rapid tests expanded beyond COVID-19 to influenza, RSV, and even STI testing. They have also found utility in field-based diagnostics and emergency medical services. With regulatory push for broader access to diagnostics, rapid immunoassay platforms are expected to see continued innovation and commercialization.

U.S. Immunoassay Market By Application Insights

Infectious disease testing was the dominant application segment, largely due to its scale and public health impact. This includes immunoassays for detecting hepatitis, HIV, COVID-19, tuberculosis, and more. Their widespread deployment across hospitals, labs, and mobile clinics demonstrates the clinical value of early and reliable pathogen detection. Institutions like the CDC and NIH also use immunoassays in surveillance programs and outbreak control.

On the other hand, therapeutic drug monitoring (TDM) is emerging as a rapidly expanding application due to the growth of personalized medicine. Immunoassays are used in TDM to measure drug concentrations in the bloodstream, ensuring therapeutic efficacy while avoiding toxicity. For patients on immunosuppressants, antibiotics, antiepileptics, or cancer therapies, precision dosing is critical. As the number of complex therapies increases especially biologics and targeted drugs TDM immunoassays are becoming more essential in both inpatient and outpatient care.

U.S. Immunoassay Market By End-use Insights

Hospitals were the largest end-use segment in the U.S. immunoassay market, reflecting the comprehensive diagnostic services they offer. Hospitals manage everything from emergency care to chronic disease management, and immunoassays are used extensively for patient screening, surgical readiness, infection control, and more. Given the trend of hospital consolidation and integrated care systems, large-scale centralized testing models are becoming increasingly common, further reinforcing this segment’s dominance.

Meanwhile, pharmaceutical and biotech companies are the fastest-growing end users, driven by immunoassay use in R&D, biomarker discovery, and drug development. Immunoassays are integral in preclinical and clinical trials for assessing immunogenicity, pharmacokinetics, and efficacy. Additionally, biopharma companies use them to support regulatory submissions and companion diagnostics for novel therapies. With rising investment in biologics and immunotherapies, demand for specialized immunoassays in research settings is expected to soar.

U.S. Immunoassay Market By Specimen Insights

Blood remained the dominant specimen used in immunoassays, accounting for the majority of diagnostic tests. Serum and plasma samples offer reliable biomarker profiles for conditions ranging from metabolic syndromes to infectious diseases. Standardized protocols for blood sample collection, processing, and storage have made it the preferred matrix in most healthcare settings.

However, saliva is gaining momentum as the fastest-growing specimen type due to its non-invasive nature and ease of collection. Saliva-based immunoassays are particularly beneficial for pediatric, geriatric, and at-home testing applications. They are increasingly being used to detect cortisol, hormones, antibodies, and drugs. Companies developing wearable oral biosensors and mail-in saliva kits are expanding access to testing while reducing the burden on healthcare infrastructure.

Country-Level Analysis

In the United States, the immunoassay market is strongly influenced by a complex interplay of healthcare demands, technological infrastructure, and federal health policies. Leading states like California, Massachusetts, New York, and Texas house major academic research institutions, biotech hubs, and diagnostic manufacturing centers. These regions lead in both innovation and adoption of immunoassay platforms.

Federal bodies such as the National Institutes of Health (NIH) and Biomedical Advanced Research and Development Authority (BARDA) continue to fund immunoassay innovation, particularly in the areas of emerging infectious diseases and biodefense. Moreover, the U.S. Centers for Medicare & Medicaid Services (CMS) supports immunoassay reimbursement through Current Procedural Terminology (CPT) codes, which encourages broader clinical use. The growing penetration of digital health and precision medicine platforms further propels the adoption of immunoassays across the country.

Recent Developments

-

March 2025 – Abbott Laboratories announced the launch of a new multiplex CLIA platform for simultaneous detection of influenza, RSV, and COVID-19 in hospital settings.

-

February 2025 – Thermo Fisher Scientific partnered with the FDA to develop rapid immunoassays for public health emergencies, as part of a pandemic preparedness initiative.

-

January 2025 – Roche Diagnostics received expanded FDA approval for its Elecsys Anti-p53 immunoassay, used in oncology risk assessment.

-

December 2024 – Bio-Rad Laboratories introduced an updated ELISA kit for autoimmune disease detection, with enhanced sensitivity for ANA markers.

-

November 2024 – Danaher Corporation (Beckman Coulter) acquired a startup specializing in AI-enhanced immunoassay data interpretation for cardiology diagnostics.

Some of the prominent players in the U.S. immunoassay market include:

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Sysmex Corporation

- DiaSorin

- Agilent Technologies

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. immunoassay market

Product

-

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- ELISPOT Reagents & Kits

- Western Blot Reagents & Kits

- Other Reagents & Kits

-

- Open Ended Systems

- Closed Ended Systems

Technology

- Radioimmunoassay (RIA)

- Enzyme Immunoassays (EIA)

-

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

Application

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Disease Testing

- Autoimmune Diseases

- Others

End-use

- Hospitals

- Blood Banks

- Clinical Laboratories

- Pharmaceutical and Biotech Companies

- Academic Research Centers

- Others

Specimen

- Blood

- Saliva

- Urine

- Other Specimens

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast