The U.S. influenza diagnostics market size was estimated at USD 199.90 million in 2023 and is expected to surpass around USD 329.04 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 5.11% during the forecast period 2024 to 2033.

.jpg)

Key Takeaways:

- The RIDT segment dominated the market with the largest revenue share of 37.2% in 2023 and is also expected to expand at the fastest CAGR of 6.6% from 2024 to 2033.

- The RT-PCR segment held a significant share of 21.9% of the market in 2022.

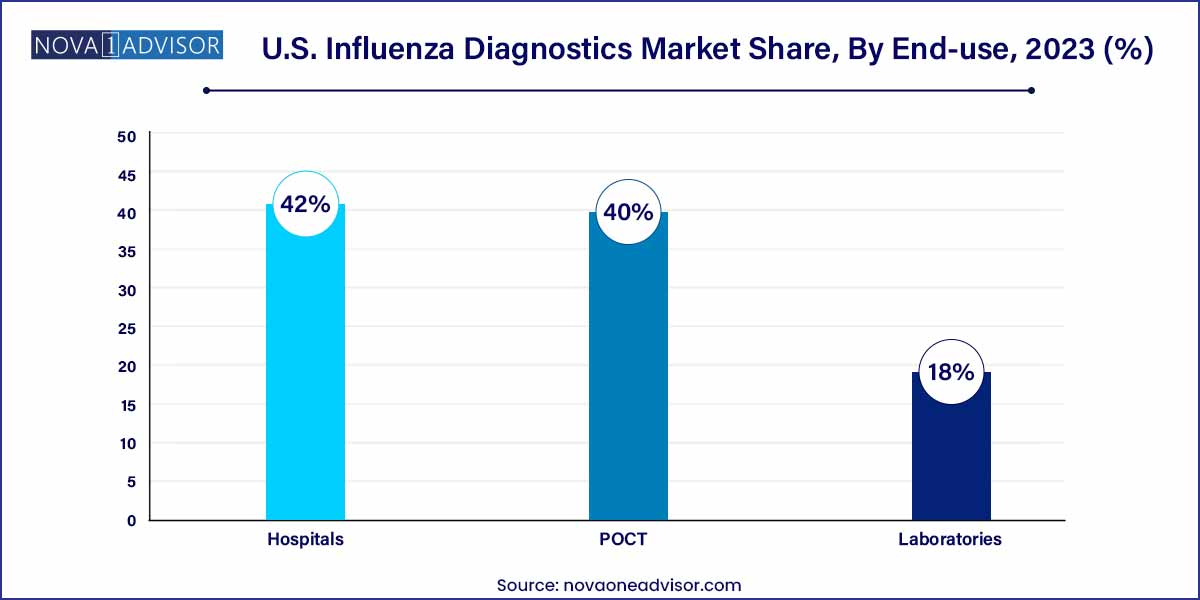

- The hospitals segment dominated the market with the largest revenue share of 42% in 2022

- The POCT segment is expected to advance at the fastest CAGR of 6.4% over the forecast period.

Market Overview

The U.S. Influenza Diagnostics Market plays a vital role in national public health, supporting timely detection and management of seasonal and pandemic flu outbreaks. Influenza, a highly contagious respiratory illness caused by influenza viruses, presents a recurring public health burden, particularly during the flu season between October and May. Early and accurate diagnosis is essential to control disease spread, initiate appropriate treatment, and mitigate healthcare system burdens.

The U.S. has witnessed several seasonal flu epidemics and significant outbreaks of novel strains (e.g., H1N1 in 2009), reinforcing the necessity of robust influenza diagnostic tools. The COVID-19 pandemic also dramatically highlighted the importance of respiratory virus diagnostics, accelerating the development and deployment of rapid, accurate, and point-of-care testing (POCT) platforms.

Flu symptoms often overlap with other respiratory infections, especially COVID-19 and RSV (respiratory syncytial virus), increasing the demand for differentiated and multiplexed diagnostics. Rapid Influenza Diagnostic Tests (RIDTs) remain the most common frontline tests due to their speed and convenience, although Reverse Transcription Polymerase Chain Reaction (RT-PCR) is recognized as the gold standard for accuracy.

Driven by federal health programs, growing consumer awareness, hospital preparedness, and innovations in diagnostic technology, the U.S. market continues to evolve rapidly, with significant participation from clinical labs, hospitals, urgent care centers, and retail testing sites.

Major Trends in the Market

-

Surging Demand for Multiplex Testing Panels Combining Influenza, RSV, and COVID-19

-

Wider Adoption of Molecular Point-of-Care (POC) Platforms

-

Increased Public Health Funding for Flu Surveillance and Testing

-

Growth in Home-based Testing Kits for Influenza

-

Integration of AI and Digital Platforms for Remote Flu Monitoring

-

Development of Ultra-sensitive Molecular Assays with Reduced Turnaround Times

-

Use of Electronic Health Records (EHRs) for Syndromic Surveillance and Case Tracking

-

Rising Awareness Campaigns About Early Testing During Flu Season

U.S. Influenza Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 210.11 Million |

| Market Size by 2033 |

USD 329.04 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.11% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Test type, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

3M; Abbott; BD; Meridian Bioscience; Quidel Corporation; F. Hoffmann-La Roche Ltd; SA Scientific Ltd.; SEKISUI Diagnostics; Thermo Fisher Scientific Inc. |

U.S. Influenza Diagnostics Market Dynamics

Drivers

- Increasing Disease Prevalence: The rising incidence of influenza cases in the U.S. serves as a primary driver for the growth of the diagnostics market. As the frequency of influenza outbreaks continues to escalate, there is a heightened demand for accurate and timely diagnostic solutions.

- Emphasis on Early Detection: A growing awareness of the importance of early detection and prompt intervention is a significant driver. The emphasis on early diagnosis not only aids in providing timely and effective medical care but also helps in implementing preventive measures to curb the spread of the virus.

Restraints

- Regulatory Challenges: Stringent regulatory requirements for diagnostic tests pose a significant restraint. Compliance with these regulations is essential for market players, leading to increased costs and potentially hindering the rapid development and commercialization of new diagnostic solutions.

- Reimbursement Issues: Challenges related to reimbursement for diagnostic tests can impede market growth. Inconsistent reimbursement policies and delays in reimbursement approvals may discourage both healthcare providers and patients from adopting advanced influenza diagnostics, affecting market penetration.

Opportunities

- Technological Advancements: Ongoing advancements in diagnostic technologies offer opportunities for the development of more accurate and efficient influenza diagnostic tools. Innovations in molecular diagnostics, artificial intelligence applications, and high-throughput screening can enhance diagnostic capabilities.

- Point-of-Care Testing Expansion: The increasing adoption of point-of-care testing presents a significant opportunity. As healthcare settings move towards decentralized diagnostics, there is a growing market for rapid and portable influenza diagnostic solutions that offer quick and convenient results.

Challenges

- Reimbursement Issues: Inconsistent reimbursement policies for diagnostic tests present a challenge to market stakeholders. Delays in reimbursement approvals and uncertainties in reimbursement rates can hinder the widespread adoption of advanced influenza diagnostics.

- Complexity of Multiplex Testing: While multiplex testing is a growing trend, the complexity and cost associated with these advanced diagnostic methods can be a challenge. Implementation challenges and the need for specialized expertise may limit the widespread adoption of multiplex testing.

Segments Insights

By Test Type

RIDTs Dominated the Market

Rapid Influenza Diagnostic Tests (RIDTs) currently dominate the test type segment due to their speed, cost-effectiveness, and ease of use in outpatient and point-of-care settings. These immunoassay-based tests deliver results within 10 to 30 minutes and are widely used in urgent care centers, retail clinics, and rural health outposts.

RIDTs are often the first line of testing, particularly for pediatric and geriatric patients, where quick triage is critical. Their availability in CLIA-waived formats allows broader adoption by non-specialized clinics, supporting diagnosis in under-resourced regions. While their accuracy may be lower than molecular tests, newer generations with digital readers and improved sensitivity are gaining traction.

RT-PCR is the Fastest-Growing Test Type

RT-PCR (Reverse Transcription Polymerase Chain Reaction) is the fastest-growing segment, recognized as the gold standard in influenza diagnostics. RT-PCR detects viral RNA with high sensitivity and specificity, making it indispensable in hospitals, laboratories, and surveillance programs.

Since the COVID-19 pandemic, the U.S. has dramatically expanded molecular diagnostic infrastructure, and this momentum has spilled over into influenza testing. Laboratories are increasingly using multiplex RT-PCR panels that detect influenza A, B, SARS-CoV-2, and RSV in a single run, enhancing cost-efficiency and diagnostic accuracy. Additionally, automated platforms like Cepheid’s GeneXpert and Roche’s cobas Liat have enabled rapid molecular POC testing in clinics, driving this segment’s growth.

By End-use

Hospitals Dominate the Market

Hospitals remain the largest end-users of influenza diagnostics, driven by their role in treating moderate to severe cases, immunocompromised patients, and individuals with complications. Hospital labs typically use a combination of RIDTs and molecular diagnostics for both patient care and epidemiological reporting.

In inpatient settings, particularly intensive care units, accurate diagnosis via RT-PCR is vital to guide antiviral treatment, infection control protocols, and isolate infectious patients to prevent nosocomial outbreaks. Hospitals also play a key role in national flu surveillance, contributing samples to CDC-coordinated reporting programs like FluView.

Point-of-Care Testing (POCT) is the Fastest-Growing End-use

POCT settings, including urgent care centers, retail clinics, schools, and physician offices, are the fastest-growing end-use segment. These settings rely on quick results to make same-day treatment decisions. The shift in consumer behavior toward walk-in flu testing, especially among working adults and students, has led to increased POCT adoption.

Technology improvements have made CLIA-waived molecular devices and high-sensitivity RIDTs viable for these settings. Simultaneously, manufacturers are launching portable, cartridge-based RT-PCR platforms suited for decentralized use, facilitating rapid diagnosis without central lab infrastructure.

Country-Level Analysis

In the United States, the influenza diagnostics market benefits from well-established public health surveillance programs, expansive healthcare infrastructure, and government-funded vaccination and testing campaigns. Programs like the CDC's Influenza Hospitalization Surveillance Network (FluSurv-NET) and Outpatient Influenza-like Illness Surveillance Network (ILINet) rely on accurate diagnostics to track outbreaks and allocate resources.

Federal and state governments actively support free or low-cost flu testing during peak seasons, especially in community clinics, elderly care centers, and schools. Major health systems invest in molecular diagnostic platforms capable of flu detection to streamline care and reduce hospital stays.

Commercial diagnostic laboratories such as Labcorp and Quest Diagnostics also play a key role in seasonal and pandemic flu testing. The U.S. market shows strong momentum for innovation, with companies investing in home test kits, AI-powered diagnostic tools, and integrated patient data platforms to improve flu response and treatment.

Key U.S. Influenza Diagnostics Companies:

- 3M

- Abbott

- BD

- Meridian Bioscience

- Quidel Corporation

- F. Hoffmann-La Roche Ltd

- SA Scientific Ltd.

- SEKISUI Diagnostics

- Thermo Fisher Scientific Inc.

Recent Developments

-

March 2025 – Lucira Health launched a new FDA-approved at-home test that detects Influenza A/B and COVID-19 with a single nasal swab and delivers results via smartphone in 30 minutes.

-

February 2025 – Roche Diagnostics expanded U.S. availability of its cobas Liat system for multiplex detection of Flu A/B and SARS-CoV-2 across Walgreens pharmacies.

-

January 2025 – QuidelOrtho announced the launch of its next-generation Sofia Q immunoassay analyzer, enhancing RIDT sensitivity for influenza testing in POC settings.

-

December 2024 – Cepheid received FDA clearance for its updated Xpert Xpress Flu/RSV test, compatible with rapid throughput for decentralized testing locations.

-

November 2024 – BD (Becton, Dickinson and Company) began distributing its BD Veritor Plus Flu A/B assay nationwide, with integration into EHR platforms for automatic result reporting.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Influenza Diagnostics market.

By Test Type

- RIDT

- RT-PCR

- Cell Culture

- Others

By End-use

- Hospitals

- POCT

- Laboratories

.jpg)