U.S. Intracranial Aneurysm Market Size and Trends

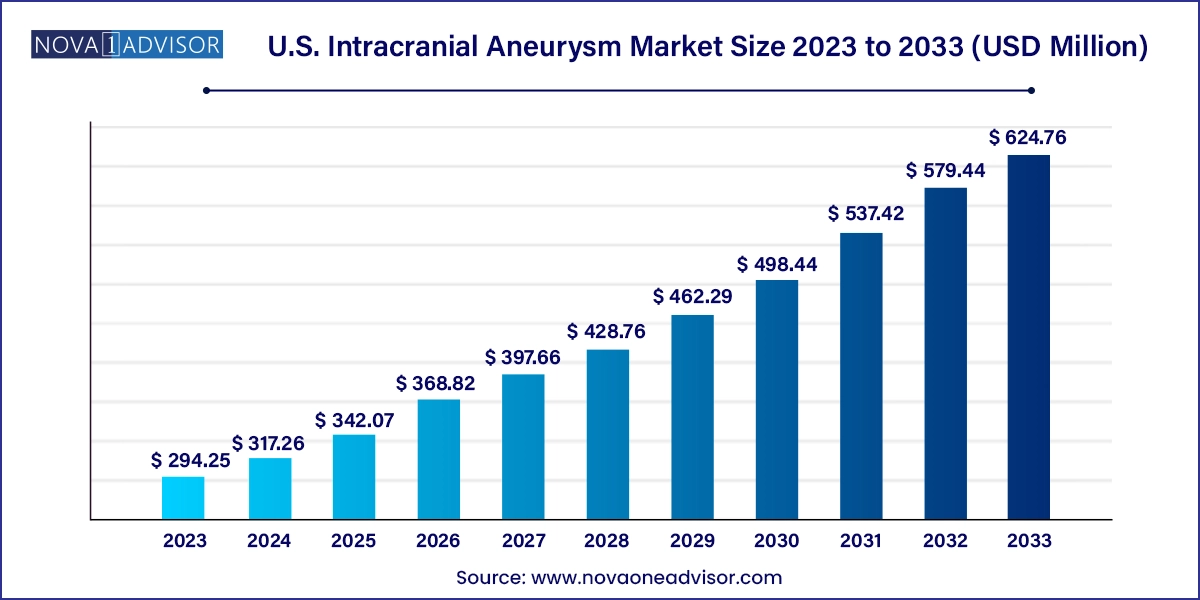

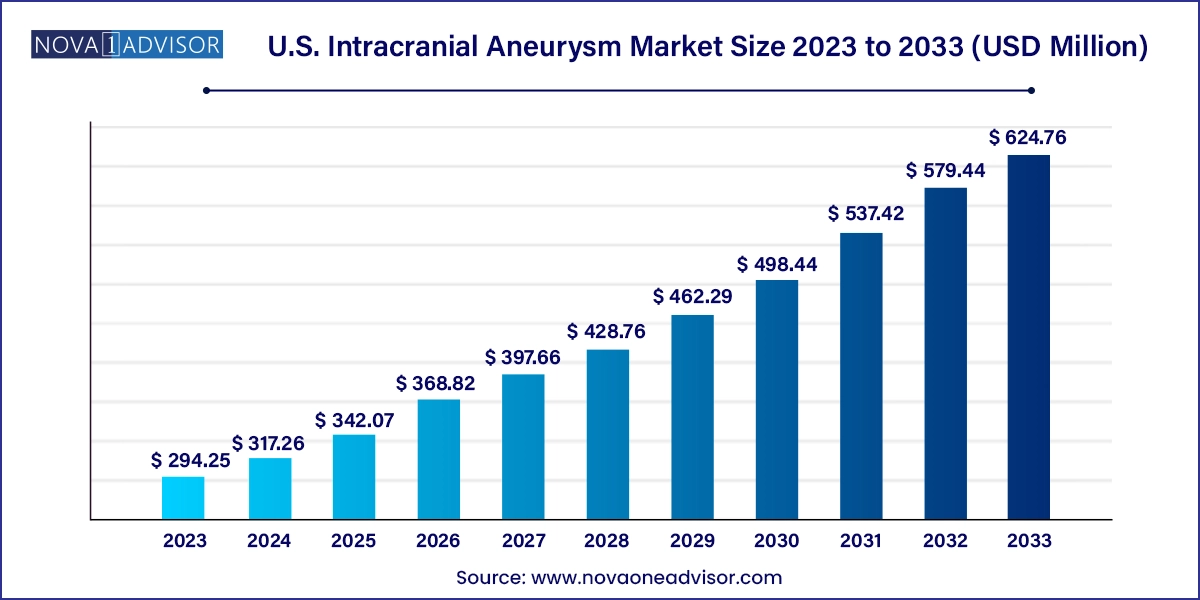

The U.S. intracranial aneurysm market size was exhibited at USD 294.25 million in 2023 and is projected to hit around USD 624.76 million by 2033, growing at a CAGR of 7.82% during the forecast period 2024 to 2033.

U.S. Intracranial Aneurysm Market Key Takeaways:

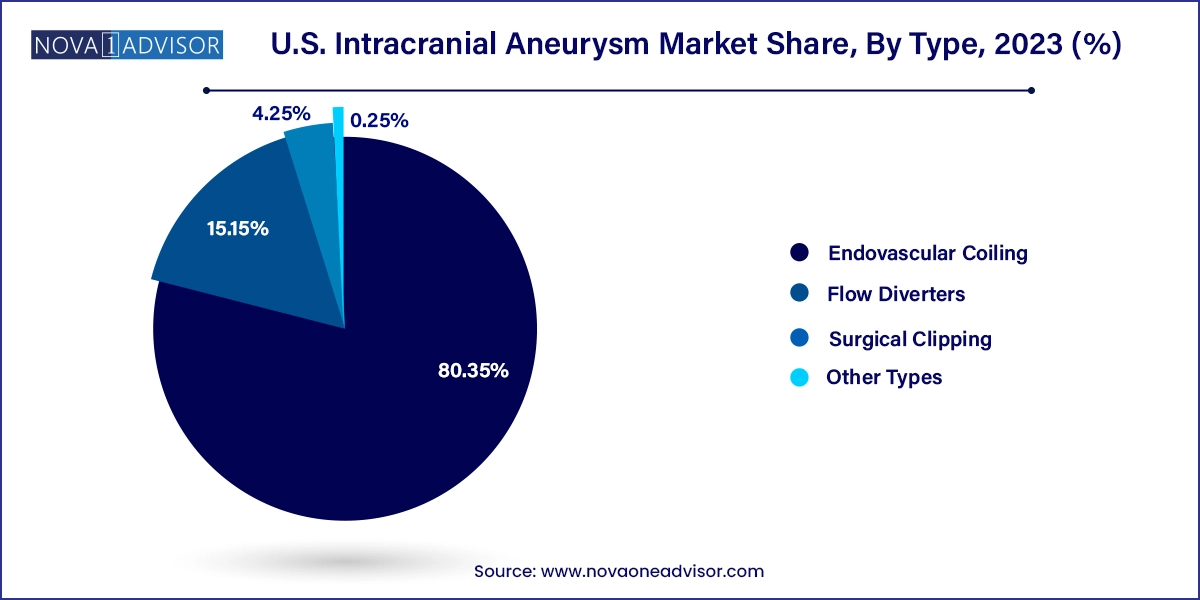

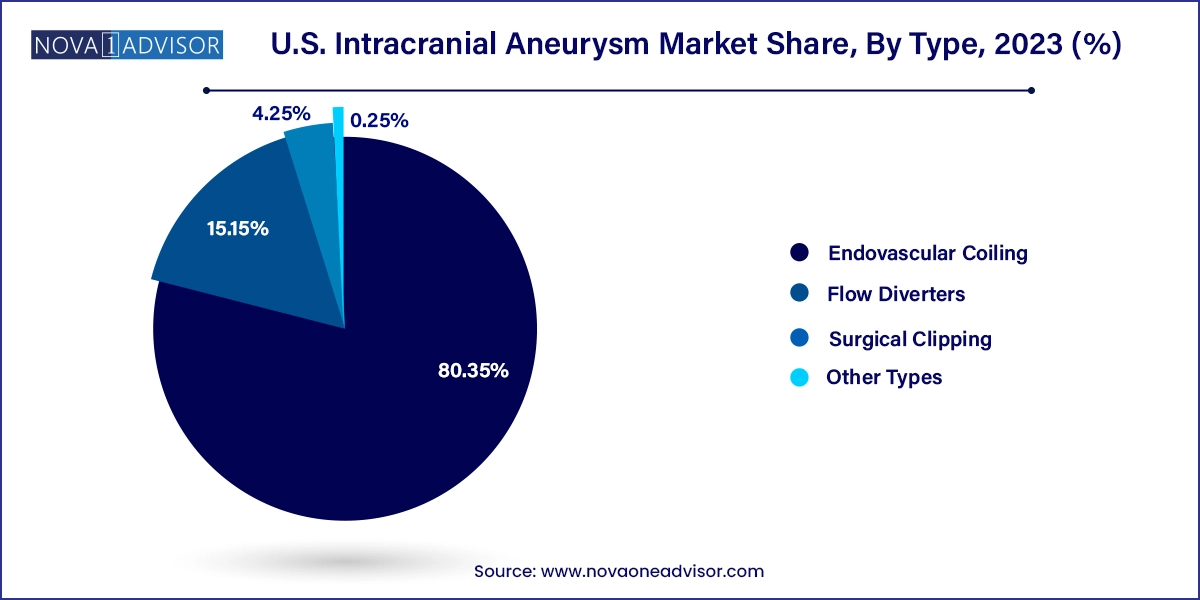

- Endovascular coiling led the market with over 80.35% in 2023.

- Flow diverters are expected to experience the highest growth rate during the forecast period.

- The U.S. intracranial aneurysm devices market segmented by end-users includes hospitals, clinics, and others.

- The clinics segment is anticipated to experience significant growth from 2024 to 2033.

Market Overview

The U.S. intracranial aneurysm market is an evolving and crucial segment of the broader neurology and neurovascular medical landscape. Intracranial aneurysms refer to the abnormal bulging or ballooning in the wall of a blood vessel in the brain. While many of these aneurysms remain asymptomatic, rupture can lead to life-threatening subarachnoid hemorrhage (SAH), stroke, or even death. As awareness about the risks of brain aneurysms grows and diagnostic imaging becomes more advanced, the demand for effective treatment modalities has intensified in the United States.

The market is driven by a growing geriatric population, high incidence of hypertension, smoking, and other lifestyle diseases, coupled with an increasing focus on minimally invasive neurosurgical procedures. Technological innovation in neuro-interventional devices and increased investments by key companies to bring safer, more efficient treatment options have significantly enhanced the standard of care. According to studies, nearly 1 in 50 people in the U.S. harbor an unruptured brain aneurysm, emphasizing the importance of early detection and treatment. As a result, clinical strategies are transitioning toward preventive interventions rather than reactive management.

Moreover, advancements in diagnostic imaging modalities such as magnetic resonance angiography (MRA) and computed tomography angiography (CTA) are enabling early identification of aneurysms. Hospitals and neurosurgical clinics across the U.S. are increasingly integrating these technologies to improve patient outcomes. Health insurance reimbursement reforms are also helping drive adoption, particularly of newer and often costlier treatment techniques like flow diversion therapy.

Major Trends in the Market

-

Increased Adoption of Flow Diversion Techniques: Flow diverters are emerging as a transformative treatment for wide-necked and complex aneurysms, offering a less invasive alternative to traditional surgical methods.

-

Rise in Artificial Intelligence (AI) Integration: AI-powered diagnostic and surgical planning tools are being used for aneurysm detection, risk stratification, and procedural simulation.

-

Growth in Preventive Healthcare Programs: With a rise in patient awareness and screening initiatives, unruptured aneurysms are increasingly being detected earlier, improving chances of successful treatment.

-

Minimally Invasive Procedures Gaining Ground: Endovascular techniques such as coiling are becoming more popular due to shorter hospital stays, less trauma, and quicker recovery times.

-

Strategic Collaborations and Acquisitions: Key market players are collaborating with research institutions and acquiring smaller innovators to expand their neurovascular device portfolios.

-

Customized and 3D Printed Implants: Personalized treatment devices such as patient-specific stents are gaining attention, improving fit, efficacy, and reducing complications.

-

Expansion of Neurovascular Centers of Excellence: Leading hospitals in the U.S. are setting up specialized neurovascular units to offer dedicated and high-quality care.

-

FDA Accelerated Approvals for New Devices: The FDA has been increasingly supportive of innovative neurovascular treatments, streamlining regulatory pathways for new devices.

Report Scope of U.S. Intracranial Aneurysm Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 317.26 Million |

| Market Size by 2033 |

USD 624.76 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.82% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Medtronic plc; Stryker Corporation; MicroPort Scientific Corporation; Johnson & Johnson Services, Inc.; MicroVention Inc.; B. Braun Melsungen AG; Integra LifeSciences; Terumo Corporation; Delta Surgical; Rapid Medical; Mizuho Medical Incorporation; Evonos GmbH & Co. KG |

Key Market Driver

Advancements in Neuro-interventional Technologies

The leading driver of the U.S. intracranial aneurysm market is the rapid advancement in neuro-interventional technologies, particularly the evolution of minimally invasive techniques. Traditional open surgeries such as surgical clipping, though still in use, are gradually being replaced by endovascular solutions like coiling and flow diversion. These techniques involve accessing the brain's blood vessels via the femoral artery, reducing the need for open cranial procedures. This shift is particularly significant in the U.S., where a large proportion of the population is aging and at high risk for cerebrovascular complications but often unable or unwilling to undergo invasive surgery.

Companies like Stryker and Medtronic are spearheading research into newer coil materials, enhanced delivery systems, and next-generation flow diverters. These innovations not only increase procedural safety and effectiveness but also enable physicians to treat previously inoperable aneurysms. As hospitals seek to improve patient outcomes while reducing treatment times and costs, the demand for such cutting-edge devices continues to escalate.

Key Market Restraint

High Cost of Treatment and Limited Accessibility

Despite technological innovations, the high cost associated with treating intracranial aneurysms remains a significant barrier. Endovascular procedures, though less invasive, often involve expensive equipment and consumables, including coils, catheters, and stents. The average cost of an endovascular coiling procedure in the U.S. can range from $30,000 to $60,000, excluding post-operative care and diagnostic imaging.

This economic burden becomes particularly pronounced for underinsured or uninsured populations. Although Medicare and private insurance plans often provide partial coverage, reimbursement processes can be complex and vary by state and provider. Furthermore, not all medical facilities, especially those in rural or economically disadvantaged areas, are equipped with the infrastructure or skilled professionals necessary to offer advanced neurovascular interventions. This cost-driven disparity hinders equitable access to care across the U.S.

Key Market Opportunity

Integration of Artificial Intelligence in Diagnosis and Treatment

One of the most promising opportunities in the U.S. intracranial aneurysm market lies in the integration of artificial intelligence (AI) and machine learning tools into diagnostic and treatment workflows. AI algorithms can assist in analyzing imaging data from CT or MR angiograms to identify aneurysms at earlier stages and predict rupture risk with higher precision. These tools are also being developed to simulate endovascular procedures, providing neurosurgeons with real-time procedural guidance and improving outcomes.

Startups such as Viz.ai and Aidoc are actively developing AI-based imaging tools tailored for neurovascular applications. In early 2025, a multi-center U.S. clinical trial began evaluating an AI algorithm that identifies high-risk unruptured aneurysms based on morphological features and hemodynamic stress patterns. If these tools are adopted widely, they could revolutionize screening programs, reduce misdiagnosis, and support timely intervention thereby offering both clinical and economic benefits to the healthcare ecosystem.

U.S. Intracranial Aneurysm Market By Type Insights

Endovascular coiling dominated the U.S. intracranial aneurysm market in terms of both volume and revenue in 2024, owing to its minimally invasive nature, shorter hospital stay, and lower risk of complications. This technique involves inserting a catheter through the femoral artery to place platinum coils inside the aneurysm sac, which promotes blood clotting and reduces rupture risk. Coiling has become the standard of care for small to medium-sized aneurysms, especially those located in surgically challenging regions like the posterior circulation. A large base of interventional radiologists and neurosurgeons trained in this method and favorable insurance reimbursement policies have also bolstered its adoption.

However, flow diverters are projected to be the fastest growing segment over the forecast period through 2034. Flow diverters like the Pipeline Embolization Device (Medtronic) or Surpass Streamline (Stryker) are particularly useful in treating wide-necked or fusiform aneurysms that are not ideal candidates for clipping or coiling. These stent-like devices are placed across the neck of the aneurysm and redirect blood flow away from the aneurysm sac, encouraging vessel remodeling. With several new devices under development and ongoing clinical trials for complex cases, the demand for flow diverters is expected to surge in the coming years.

U.S. Intracranial Aneurysm Market By End-use Insights

Hospitals dominated the market in 2024, as they house the necessary infrastructure, such as advanced imaging units and hybrid operating rooms, essential for the successful execution of neurovascular procedures. Large hospitals also tend to employ multidisciplinary teams comprising neurologists, neurosurgeons, interventional radiologists, and critical care specialists who work together to manage complex aneurysm cases. Furthermore, U.S. hospitals often serve as clinical trial hubs for device testing, giving them early access to novel treatment options. High procedure volumes and institutional trust among patients contribute significantly to the dominance of this segment.

Meanwhile, clinics are emerging as the fastest growing end-user segment, especially specialty neurology and neurosurgery clinics in urban areas. These clinics are increasingly adopting compact imaging and intervention suites and partnering with hospitals for post-procedure care. The appeal lies in their lower procedural costs, reduced wait times, and more personalized care. Technological miniaturization has made it feasible for standalone clinics to perform diagnostic angiographies and minor interventional procedures. With outpatient care models gaining traction, this segment is poised to experience robust growth through 2034.

Country-level Analysis

In the United States, the incidence and management of intracranial aneurysms have garnered increasing attention due to both demographic and systemic factors. The aging population, with age being a key risk factor for aneurysm formation and rupture, has led to a higher volume of diagnostic screening. According to the Brain Aneurysm Foundation, approximately 6.5 million people in the U.S. have an unruptured brain aneurysm, and around 30,000 suffer a rupture annually. This underscores the need for widespread early intervention capabilities and advanced treatment technologies.

Additionally, the U.S. healthcare system, characterized by high insurance penetration and rapid technology adoption, has created a fertile environment for market growth. Top-tier hospitals like the Mayo Clinic, Cleveland Clinic, and Johns Hopkins Hospital are equipped with state-of-the-art neurovascular intervention suites and are often involved in research and development of newer techniques. The country also has one of the most favorable regulatory environments, with the FDA frequently fast-tracking breakthrough neurosurgical devices. However, disparities remain in rural and underserved regions where access to such advanced care is limited.

Some of the prominent players in the U.S. ENT devices market include:

- Medtronic plc

- Stryker Corporation

- MicroPort Scientific Corporation

- Johnson & Johnson Services, Inc.

- MicroVention Inc.

- B. Braun Melsungen AG

- Integra LifeSciences

- Terumo Corporation

- Delta Surgical

- Rapid Medical

- Mizuho Medical Incorporation

- Evonos GmbH & Co. KG

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. intracranial aneurysm market

Type

- Surgical Clipping

- Endovascular Coiling

- Flow Diverters

- Other Types

End-use

- Hospitals

- Clinics

- Other End-users