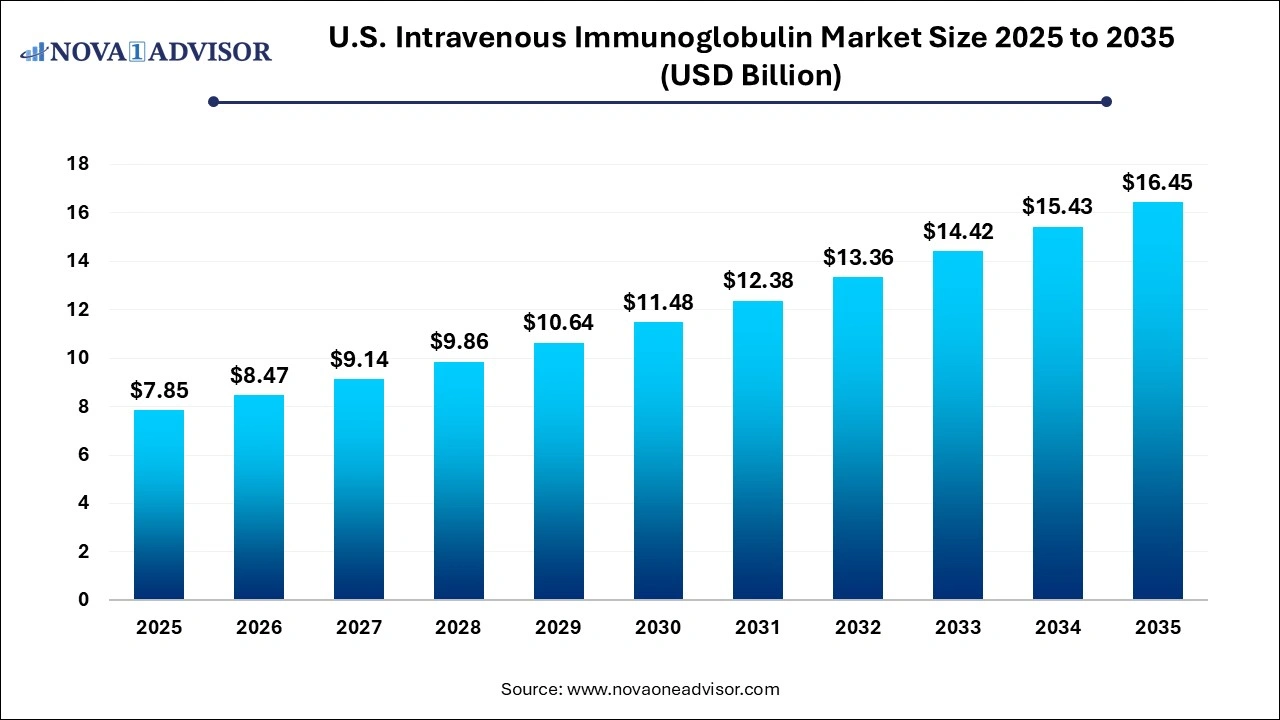

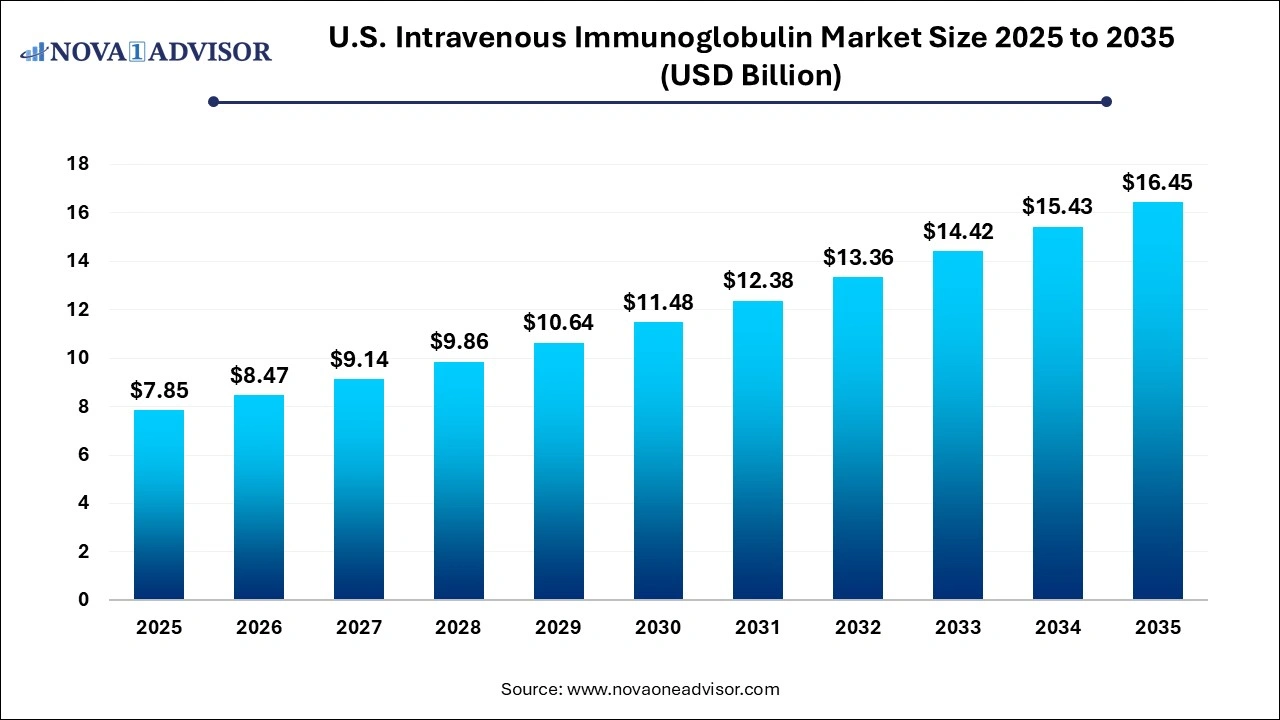

U.S. Intravenous Immunoglobulin Market Size, Share and Trends 2026 to 2035

The U.S. intravenous immunoglobulin market size was exhibited at USD 7.85 billion in 2025 and is projected to hit around USD 16.45 billion by 2035, growing at a CAGR of 7.68% during the forecast period 2026 to 2035.

Key Takeaways:

- The primary immunodeficiency diseases segment held the largest market share of 21.32% of the U.S. IVIG market in 2025.

- The hospital pharmacies segment accounted for the largest revenue share of 58.46% of the U.S. IVIG market in 2025.

U.S. Intravenous Immunoglobulin Market Overview

The U.S. Intravenous Immunoglobulin (IVIG) market represents a critical segment of the broader immunotherapy and rare disease treatment landscape. Intravenous immunoglobulin therapy involves the administration of a mixture of antibodies (immunoglobulins) collected from thousands of healthy donors to treat patients with immune deficiencies, autoimmune diseases, and certain inflammatory conditions. As the demand for immunotherapy continues to grow across the United States, IVIG has emerged as a cornerstone treatment option.

With rising prevalence of immunological and neurological disorders such as Chronic Inflammatory Demyelinating Polyradiculoneuropathy (CIDP), Primary Immunodeficiency Diseases (PIDD), and Myasthenia Gravis, the IVIG market is experiencing substantial growth. Furthermore, advancements in plasma fractionation technologies, increased availability of plasma donors, and improved disease awareness have enhanced the scalability and accessibility of IVIG therapies.

The U.S. market is driven by a sophisticated healthcare infrastructure, high per capita healthcare expenditure, and strong reimbursement frameworks. In addition, ongoing clinical trials exploring IVIG in emerging applications such as Alzheimer’s disease and severe COVID-19 underscore the market’s dynamic evolution.

Major Trends in the U.S. Intravenous Immunoglobulin Market

-

Expansion of IVIG Indications: New therapeutic indications are being explored for IVIG, expanding its usage beyond traditional immune disorders.

-

Shift Toward Specialty Pharmacies: Distribution of IVIG is increasingly shifting from hospital settings to specialty pharmacies for cost-effectiveness and patient convenience.

-

Rising Plasma Collection Initiatives: Leading biopharma players are investing in plasma collection infrastructure to meet increasing demand.

-

Growth in Home Infusion Services: Demand for home-based IVIG administration is rising, especially among chronic disease patients.

-

Emphasis on Subcutaneous Immunoglobulin (SCIG) Alternatives: Although IVIG remains dominant, SCIG is emerging as a complementary therapy due to patient preference and safety profile.

-

Increased Focus on Rare Neurological Disorders: The pipeline for rare neuromuscular and autoimmune diseases is propelling clinical adoption of IVIG.

Report Scope of The U.S. Intravenous Immunoglobulin Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 8.47 Billion |

| Market Size by 2035 |

USD 16.45 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.68% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Application, Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Biotest AG; Octapharma AG; LFB Biotechnologies S.A.S; China Biologics Products Holdings, Inc.; Grifols; S.A.; Kedrion S.P.A.; CSL ; Takeda Pharmaceutical Company Limited; Bio Products Laboratory Ltd.; Pfizer, Inc.; ADMA Biologics, Inc. |

U.S. Intravenous Immunoglobulin Market Segmental Insights

By Application Insights

Primary Immunodeficiency led the application segment in the U.S. IVIG market. These rare genetic disorders impair the immune system, making affected individuals vulnerable to infections. IVIG therapy plays a central role in providing passive immunity for these patients. Due to lifelong dependence on IVIG, consistent demand for treatment exists across pediatric and adult patient populations. Governmental and institutional support for PIDD diagnosis and treatment has contributed to sustained market leadership of this segment.

In contrast, CIDP is the fastest-growing application area, with IVIG being a first-line therapy. CIDP is a rare neurological disorder where IVIG significantly improves motor function and reduces relapse. As awareness of CIDP increases and early diagnosis becomes more prevalent, neurologists are turning to IVIG as a long-term management strategy. Multiple randomized clinical trials validating IVIG’s efficacy in CIDP have further reinforced its growing clinical uptake.

By Distribution Channel Insights

Hospital Pharmacies dominated the distribution channel segment, owing to their central role in administering IVIG, especially for inpatients or during acute exacerbations. Hospitals often manage complex cases involving IVIG, such as immunodeficient children, Guillain-Barre Syndrome patients, or those undergoing hematologic treatments. Their access to centralized infusion centers and critical care support makes them a primary channel for IVIG therapy.

Specialty Pharmacies, however, are the fastest-growing distribution channel, driven by the decentralization of care and a growing trend toward home-based therapy. Specialty pharmacies offer tailored services such as patient counseling, medication adherence programs, and coordination with home infusion providers. With a significant portion of IVIG being used in chronic outpatient care, these pharmacies are emerging as a preferred channel for both patients and insurers.

Country-Level Insights

The U.S. Intravenous Immunoglobulin market benefits from a unique ecosystem of robust clinical research, high healthcare spending, and progressive payer policies. The Food and Drug Administration (FDA) has approved IVIG for multiple indications, and the presence of numerous plasma donation centers ensures a stable supply of immunoglobulin. National organizations such as the Immune Deficiency Foundation and the Neuropathy Association have played instrumental roles in raising awareness and facilitating patient access to care.

Policy advancements supporting rare disease treatments and expanded insurance reimbursements continue to push the IVIG market forward. However, supply chain challenges and stringent donor eligibility criteria occasionally disrupt product availability. To mitigate these challenges, the government and private sector are investing in domestic plasma collection infrastructure. With rising diagnostic capabilities and expanding outpatient care services, IVIG demand is expected to escalate steadily across the U.S.

Some of the prominent players in the U.S. intravenous immunoglobulin market include:

- Biotest AG

- China Biologics Products Holdings, Inc.

- Octapharma AG

- LFB Biotechnologies S.A.S

- Takeda Pharmaceutical Company Limited

- Bio Products Laboratory Ltd.

- Pfizer, Inc.

- CSL

- ADMA Biologics, Inc.

- Grifols, S.A.

- Kedrion S.P.A.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. intravenous immunoglobulin market.

Application

- Primary Immunodeficiency

- Chronic Inflammatory Demyelinating Polyradiculoneuropathy (CIDP)

- Primary Immunodeficiency Diseases (PIDD)

- Congenital AIDS

- Chronic Lymphocytic Leukemia

- Myasthenia Gravis

- Multifocal Motor Neuropathy

- Immune Thrombocytopenia (ITP)

- Kawasaki Disease

- Guillain-Barre Syndrome

- Others

Distribution Channel

- Hospital Pharmacy

- Specialty Pharmacy

- Others