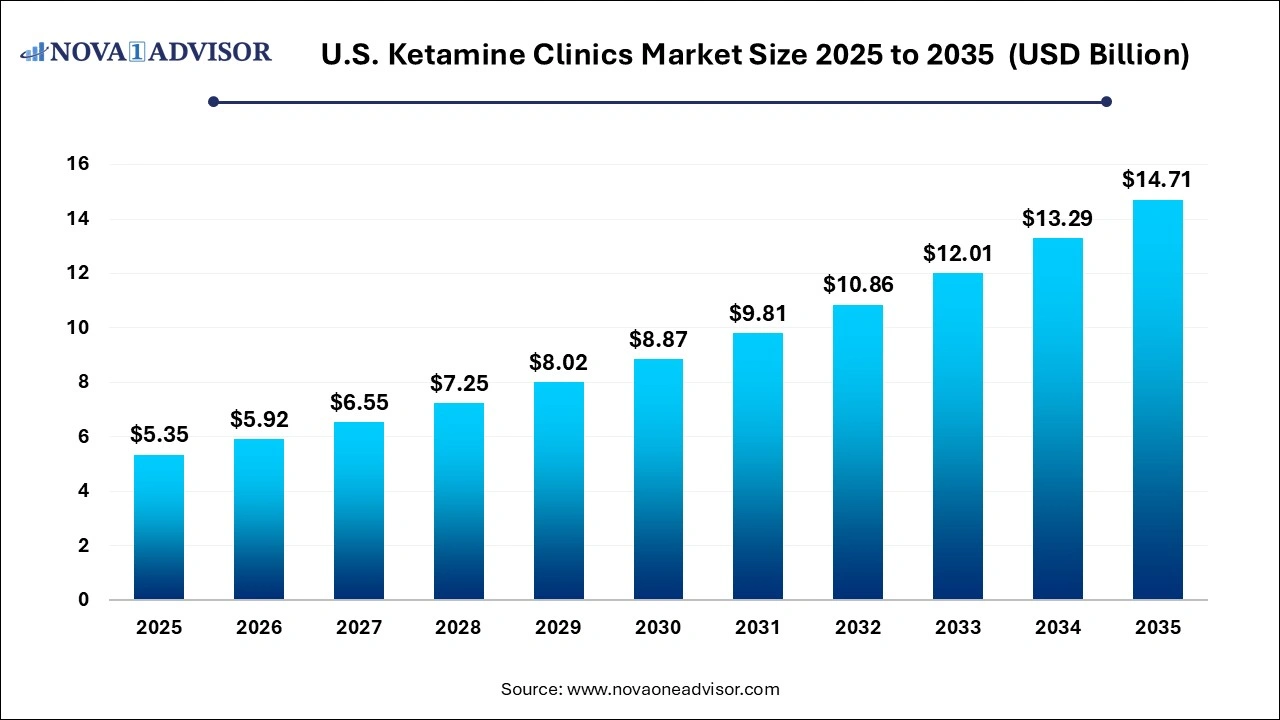

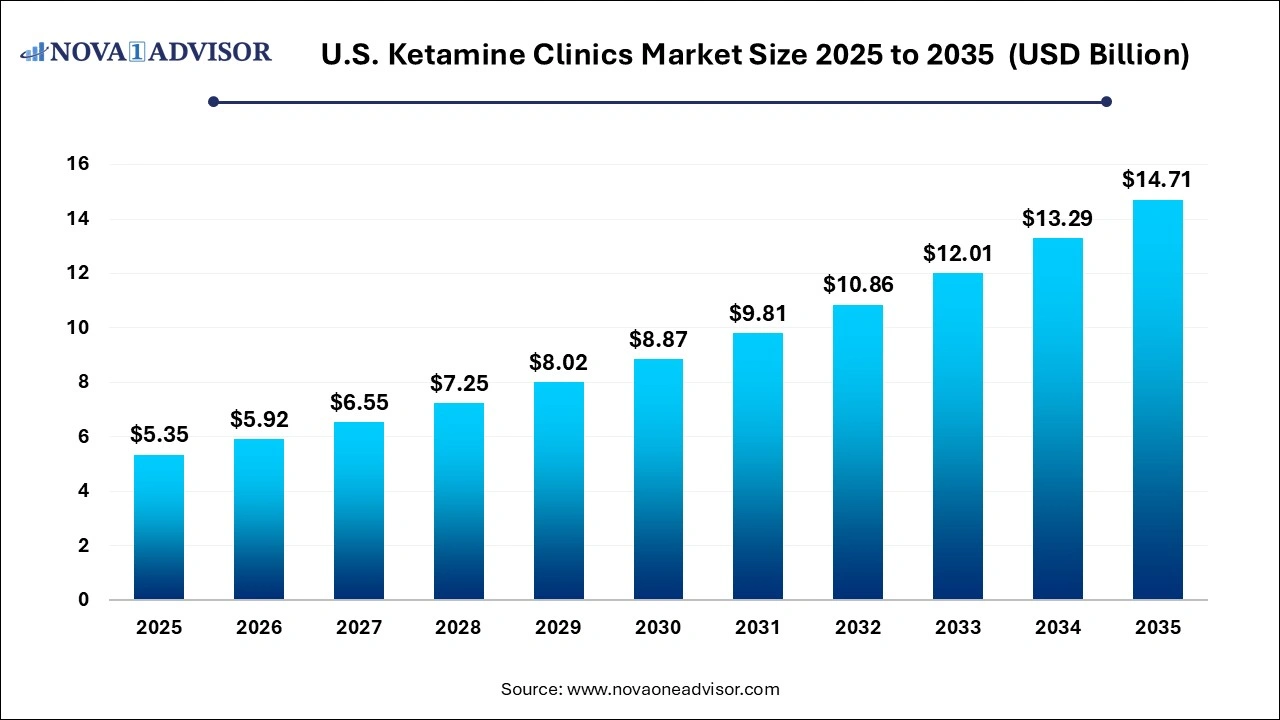

U.S. Ketamine Clinics Market Size and Trends 2026 to 2035

The U.S. ketamine clinics market size was exhibited at USD 5.35 billion in 2025 and is projected to hit around USD 14.71 billion by 2035, growing at a CAGR of 10.64% during the forecast period 2026 to 2035.

U.S. Ketamine Clinics Market Key Takeaways:

- The depression segment dominated the market in 2025 with a market share of 30.15%.

- The anxiety segment is anticipated to grow fastest during the forecast period.

- The onsite therapy segment dominated the market in 2025 with a revenue share of 53.0%.

- The online therapy segment is expected to grow at the fastest growth rate during the forecast period.

Market Overview

The U.S. Ketamine Clinics Market is experiencing a significant transformation, driven by growing awareness of mental health disorders and the increasing acceptance of ketamine as a rapid-acting antidepressant. Ketamine, originally developed as an anesthetic, has seen a repurposing in clinical settings as a treatment option for conditions such as treatment-resistant depression (TRD), anxiety, post-traumatic stress disorder (PTSD), and other psychiatric conditions. With a unique mechanism of action affecting the NMDA receptors in the brain, ketamine provides near-immediate relief from symptoms in some patients, setting it apart from traditional antidepressants that may take weeks to become effective.

The burgeoning mental health crisis in the U.S. fueled in part by the aftereffects of the COVID-19 pandemic, increased social isolation, and systemic gaps in mental healthcare has catalyzed the demand for alternative therapies. As traditional treatment options fail to address all patient needs, ketamine infusion therapy has emerged as a viable and often life-changing intervention for individuals with chronic and severe mental health conditions.

Ketamine clinics have proliferated across urban and suburban areas of the United States, often offering a range of integrative services such as intravenous (IV) ketamine infusions, intramuscular (IM) injections, nasal sprays, and oral lozenges, often coupled with psychotherapy. Clinics are increasingly adopting hybrid models that include both on-site and virtual components to cater to patient convenience and enhance treatment accessibility.

Major Trends in the Market

-

Increased Clinical Trials and Research Support: More academic institutions and biotech companies are funding and conducting research into the long-term efficacy and safety of ketamine in psychiatric use.

-

Integration of Psychotherapy with Ketamine Treatment: Many clinics now combine ketamine sessions with psychotherapy (e.g., cognitive behavioral therapy), known as ketamine-assisted psychotherapy (KAP).

-

Expansion of Online Ketamine Therapy Platforms: Companies are launching virtual platforms offering ketamine lozenges or nasal sprays with telehealth support, meeting growing demand from patients unable to visit clinics physically.

-

FDA’s Approval of Esketamine: The approval of Spravato (esketamine) by the FDA has provided legitimacy to ketamine’s role in treating depression and has encouraged more insurers and clinics to support this therapy.

-

Consolidation and Franchising of Clinics: A wave of acquisitions and partnerships is creating chains of ketamine clinics, allowing for standardized treatment protocols and brand expansion.

-

Awareness Campaigns and Mental Health Advocacy: Increased media attention and public awareness campaigns are helping destigmatize psychedelic therapies and mental health treatments.

-

Adoption of Wearable Technology in Therapy Monitoring: Some clinics are integrating biometric monitoring and patient tracking to personalize treatment plans and monitor post-treatment outcomes.

Report Scope of U.S. Ketamine Clinics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 5.92 Billion |

| Market Size by 2035 |

USD 14.71 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.64% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Treatment, Therapy |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Better U, Inc.; Innerwell (KBS, Inc.); Ketamine Clinics Los Angeles; Klarisana Health; Klarity Clinic (Tebra Inc.); Mindbloom, Inc.; Nue Life Health (NueCo Holdings, P.B.C.); NY Ketamine Infusions; Stella MSO LLC dba Field Trip Health; Vitalitas Denver Ketamine Infusion Center |

Market Driver: Rising Prevalence of Treatment-Resistant Depression

A primary driver of the U.S. Ketamine Clinics Market is the growing prevalence of treatment-resistant depression (TRD). TRD affects nearly one-third of individuals diagnosed with major depressive disorder (MDD), who fail to respond to at least two antidepressant regimens of adequate dose and duration. Traditional treatments often require prolonged periods to take effect and may carry severe side effects, pushing patients and practitioners to explore alternative therapies. Ketamine's fast-acting mechanism enables rapid symptom relief often within hours of administration making it a game-changer for individuals with acute suicidal ideation or long-standing depressive symptoms. This rapid onset, combined with favorable clinical trial outcomes, is propelling ketamine therapy into mainstream psychiatry and driving clinic proliferation across the United States.

Market Restraint: Lack of Insurance Coverage

Despite its clinical promise, a significant restraint in the U.S. ketamine clinics market is the lack of comprehensive insurance coverage. Many insurers classify ketamine therapy as “off-label” and elective, resulting in patients having to pay out-of-pocket for treatments, which can range from $400 to $800 per session. This financial burden makes treatment inaccessible to a significant portion of the population, especially those already burdened with mental health-related functional impairments. Furthermore, the repeat nature of ketamine infusions often requiring multiple sessions over several weeks further escalates costs, impeding adoption among middle- and lower-income groups. Without greater insurance reimbursement or governmental support, the growth of this therapy may be constrained to more affluent demographic segments.

Market Opportunity: Expansion into Rural and Underserved Communities

One of the most compelling opportunities for the U.S. ketamine clinics market lies in expanding access to underserved and rural communities. While urban centers boast a concentration of clinics, patients in remote areas often face long travel times or lack awareness about the availability of ketamine therapy. With the rise of online therapy platforms and at-home ketamine lozenge models, clinics have the opportunity to serve these populations more effectively. Public-private partnerships and telepsychiatry initiatives could further bridge the access gap. Establishing satellite clinics or mobile infusion units in collaboration with local health departments or non-profits can also help extend reach, promote mental health equity, and capture an untapped market segment.

U.S. Ketamine Clinics Market By Treatment Insights

Depression dominated the treatment segment due to the high prevalence of major depressive disorder and the rising demand for alternatives to traditional antidepressants. Ketamine has demonstrated high efficacy in rapidly alleviating depressive symptoms, especially in treatment-resistant cases. Its approval by the FDA in the form of esketamine (Spravato) for depression has further validated its clinical role. Clinics across the U.S. are primarily focused on addressing depressive disorders, and many structure their pricing, appointment schedules, and follow-up care around depression-related treatment plans. Additionally, depression’s high economic burden, costing the U.S. economy over $210 billion annually, ensures sustained demand for innovative treatment options.

PTSD is projected to be the fastest-growing treatment segment in the forecast period. With increasing attention on mental health in veteran and first responder communities, ketamine’s efficacy in reducing PTSD symptoms is under growing investigation. According to the Department of Veterans Affairs, PTSD affects 11-20% of veterans annually, representing a substantial patient population. Ketamine’s ability to modulate memory reconsolidation and emotional processing makes it particularly promising for PTSD treatment. Clinics are beginning to tailor treatment protocols for PTSD-specific needs, combining infusion therapy with trauma-informed psychotherapy. This shift is expected to accelerate as regulatory guidelines and research support become more robust.

U.S. Ketamine Clinics Market By Therapy Insights

On-site therapy dominated the therapy segment, reflecting the clinical need for closely monitored ketamine administration. Intravenous and intramuscular treatments, which are the most effective forms of delivery, are typically administered in-office under professional supervision due to the risk of dissociation, elevated blood pressure, and other side effects. Clinics emphasize ambient therapy rooms, heart rate and oxygen monitoring, and post-treatment support to optimize patient outcomes. Furthermore, the presence of on-site mental health professionals, such as psychotherapists and psychiatrists, facilitates the integration of talk therapy and behavioral assessments, enhancing the treatment’s overall impact.

Online therapy is emerging as the fastest-growing therapy segment, driven by the rise of at-home ketamine treatment models. With advancements in telepsychiatry and FDA-approved ketamine derivatives like oral lozenges and nasal sprays, clinics are offering virtual platforms for therapy and drug administration. Companies like Mindbloom and Nue Life Health provide at-home treatments coupled with online consultations and integration sessions, especially for anxiety and depression management. These models appeal to tech-savvy patients, offer greater convenience, and lower the barrier to entry for those unable to travel. The segment’s growth is likely to be fueled by further digital innovation and growing patient comfort with remote mental healthcare delivery.

Country-Level Analysis: United States

The United States remains the global leader in the ketamine clinic market, both in terms of infrastructure and patient volume. The growing acceptance of psychedelic-assisted therapies within mainstream psychiatry and the expanding mental health crisis have prompted a nationwide proliferation of clinics in states such as California, New York, Texas, Florida, and Colorado. Notably, progressive states like Oregon and Colorado have introduced legal frameworks to support psychedelic-assisted therapy, further normalizing and legitimizing clinical ketamine usage.

Urban centers dominate in terms of clinic density, but there's rising demand from suburban and rural populations. Additionally, health systems and private mental health providers are exploring integration of ketamine therapy within broader behavioral health services. Academic institutions like Yale and Johns Hopkins continue to publish groundbreaking research, bolstering the scientific legitimacy of ketamine as a mental health intervention. Moreover, as more states push for mental healthcare reforms, ketamine clinics are well-positioned to benefit from expanded funding and reduced regulatory barriers.

U.S. Ketamine Clinics Market Recent Developments

-

April 2025 – Field Trip Health & Wellness Ltd., a prominent ketamine clinic chain, announced the expansion of its “digital therapy ecosystem” with a focus on virtual ketamine-assisted therapy, targeting rural U.S. populations.

-

February 2025 – Nue Life Health launched a strategic partnership with wearable tech company Whoop to integrate biometric feedback into ketamine therapy programs, allowing real-time treatment customization.

-

December 2024 – Mindbloom, a pioneer in at-home ketamine therapy, reported a 120% increase in patients year-over-year and expanded operations into 10 new states, including underserved regions like Montana and Idaho.

-

September 2024 – The FDA approved a Phase 3 clinical trial for Atai Life Sciences' new intranasal ketamine formulation targeting PTSD, further bolstering R&D in the field.

Some of the prominent players in the U.S. ketamine clinics market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. ketamine clinics market

Treatment

- Depression

- Anxiety

- PTSD

- Others

Therapy

- On-Site Therapy

- Online Therapy