U.S. Laboratory Disposable Products Market Size and Research

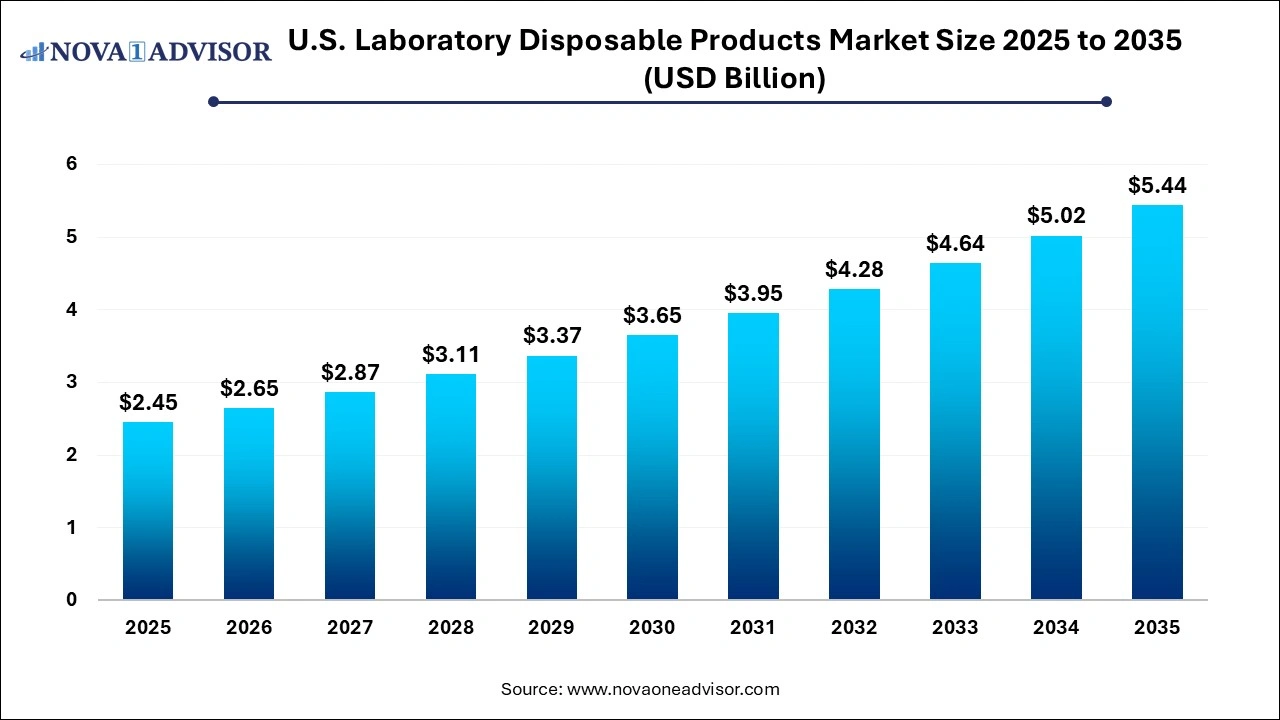

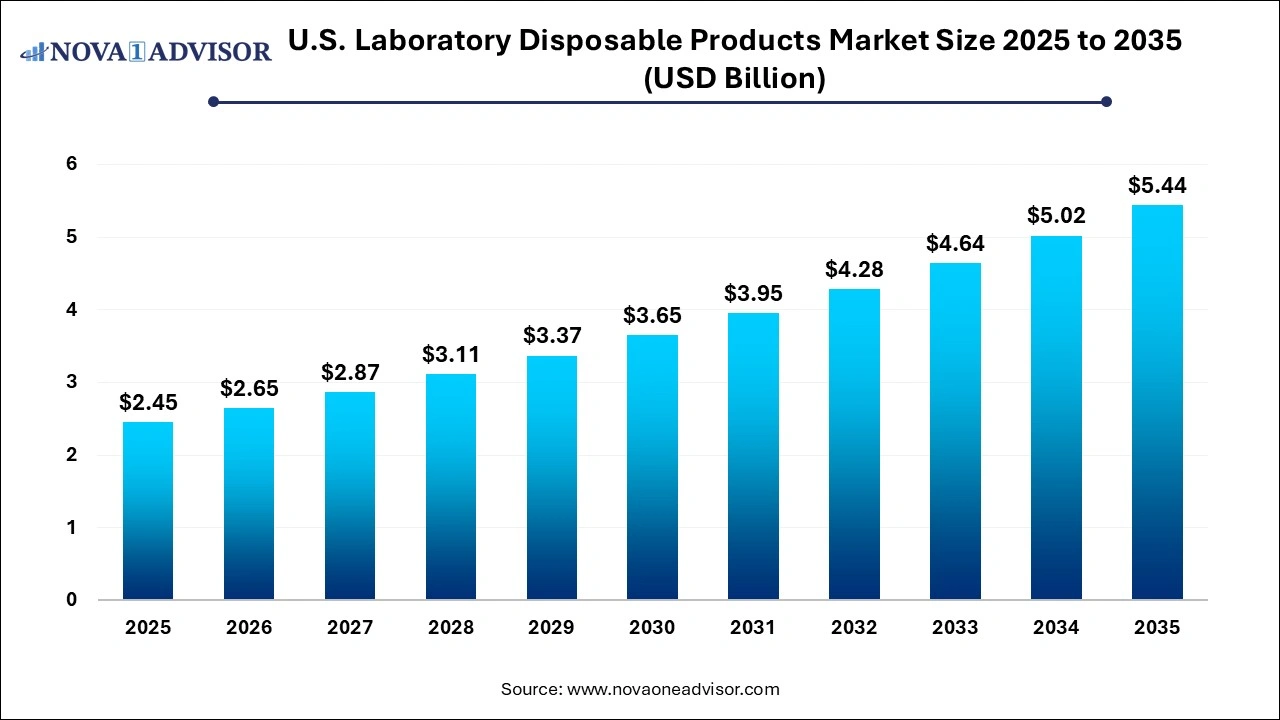

The U.S. laboratory disposable products market size was exhibited at USD 2.45 billion in 2025 and is projected to hit around USD 5.44 billion by 2035, growing at a CAGR of 8.3% during the forecast period 2026 to 2035.

U.S. Laboratory Disposable Products Market Key Takeaways:

- The specimen containers segment dominated the market in 2025 with a share of 40.3%.

- The tissue collectors segment is expected to grow at a CAGR of 9.3% over the forecast period.

- The plastics segment accounted for a revenue share of 54.0% in 2025.

- The glass segment is expected to grow at a CAGR of 8.3% over the forecast period.

- The Contract Research Organizations (CROs) segment dominated the market in 2025.

- The hospital segment is expected to grow at a CAGR of 8.7% from 2026 to 2035.

Market Overview

The U.S. laboratory disposable products market is an integral component of the broader life sciences and diagnostics ecosystem. These products serve as essential, single-use items that support sample collection, containment, storage, transport, and analytical processing in clinical, academic, pharmaceutical, and diagnostic laboratories. Laboratory disposables play a critical role in ensuring hygiene, preventing cross-contamination, and maintaining sample integrity, especially in high-throughput environments.

With rising demand for reliable and scalable laboratory workflows, disposable items such as specimen containers, vials, swabs, and optical-grade slides are seeing strong adoption. The increasing incidence of infectious diseases, expanding diagnostic testing volumes, and the growing footprint of CROs (Contract Research Organizations) are fueling demand across the country. Moreover, the COVID-19 pandemic amplified awareness of infection control practices, reinforcing the role of single-use consumables in both research and clinical labs.

The U.S., as a hub of biotechnology, pharmaceutical innovation, and academic research, generates significant demand for high-quality, sterile, and regulatory-compliant disposable lab supplies. Leading manufacturers are innovating with advanced materials, tamper-evident closures, and smart labeling features that improve traceability and workflow automation. The shift toward sustainability is also pushing suppliers to offer eco-friendly plastics and recyclable solutions.

Major Trends in the Market

-

Surging Demand for Sample Collection and Transport Devices Post-COVID

-

Material Innovation: Biodegradable and Recyclable Plastic Alternatives Emerging

-

Automation-Compatible Designs for High-Throughput Laboratories

-

Smart Labeling and Barcoding for Sample Tracking

-

Increased Customization of Swabs and Containers for Specific Sample Types

-

Rising Demand from Biobanks and Genomics Research Labs

-

Collaborations Between Diagnostics Companies and Disposable Manufacturers

-

Growth in Private Testing Labs and Home Collection Kits

Report Scope of U.S. Laboratory Disposable Products Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.65 Billion |

| Market Size by 2035 |

USD 5.44 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.3% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Material, End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Cardinal Health; Thomas Scientific; Medicus Health; Therapak, an Avantor company.; Dynarex Corporation.; Thermo Fisher Scientific Inc.; MCKESSON CORPORATION; Medline Industries, Inc.; BD; Agilent Technologies, Inc. |

Market Driver: Expanding Diagnostic Testing and Research Activity

A key driver for the U.S. laboratory disposable products market is the rapid expansion of diagnostic and life sciences testing activities. The United States conducts some of the world’s highest volumes of laboratory tests, ranging from routine blood and urine analysis to advanced genetic screening and molecular diagnostics. This growth is propelled by an aging population, increasing disease surveillance programs, and public health initiatives requiring mass testing (e.g., influenza, COVID-19, STIs, and cancer screening).

Each diagnostic test typically involves the use of multiple disposable items such as swabs for collection, vials for transport, and containers for sample storage making demand closely correlated with testing volumes. Additionally, academic institutions, CROs, and pharmaceutical companies running clinical trials also rely on laboratory disposables for data collection, assay development, and biospecimen storage. The need for sterile, tamper-proof, and error-free consumables is only expected to rise with the ongoing digitalization and automation of laboratory environments.

Market Restraint: Environmental Waste and Regulatory Scrutiny

Despite its indispensable role in laboratory operations, the disposable nature of these products creates substantial environmental and regulatory challenges. Laboratories generate a significant volume of plastic and biohazardous waste, much of which cannot be recycled due to contamination or material composition. This contributes to landfill burden and environmental degradation, especially as testing volumes surge.

Additionally, increased scrutiny from regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and state-level public health departments is prompting laboratories to justify their waste disposal processes. These regulations create operational complexity and compliance costs. Laboratories are under pressure to balance safety with sustainability, while manufacturers face growing demands to innovate with biodegradable or reusable alternatives without compromising sterility or cost-efficiency.

Market Opportunity: Development of Sustainable and Automation-Friendly Products

A significant opportunity in the U.S. laboratory disposable market lies in the development of sustainable, automation-compatible products that cater to the evolving needs of smart laboratories. With environmental concerns on the rise, laboratories are actively seeking products made from biodegradable plastics, recycled materials, or reusable formats that meet safety and regulatory standards.

Simultaneously, modern labs are automating their workflows—from sample accessioning to diagnostic reporting—necessitating disposable products that are compatible with robotic arms, conveyor systems, and imaging technologies. Manufacturers that can integrate features like anti-fog coatings, ergonomic shapes, laser-etchable surfaces, and machine-readable barcodes are well positioned to capture this demand. Partnerships with digital health and automation platforms are likely to shape the next wave of innovation in the lab disposables space.

U.S. Laboratory Disposable Products Market By Product Insights

Specimen containers dominate the U.S. laboratory disposable products market due to their critical role in routine and advanced diagnostics. These containers are used for collecting urine, feces, sputum, and other samples in clinical settings and are indispensable across hospital and outpatient diagnostics. Available in sterile and non-sterile formats, these containers must comply with FDA and CLIA standards for leak-proofing, labeling, and tamper-evident features. Their dominance is underpinned by high-volume usage and relatively low cost per unit, making them essential consumables in every clinical workflow.

Collection and transport swabs are the fastest-growing segment, especially after the COVID-19 pandemic highlighted their significance. Nasopharyngeal, oropharyngeal, and other swab formats are now used for viral testing, genetic diagnostics, microbiological sampling, and forensic analysis. Manufacturers have invested in flocked and foam tip technologies to improve sample yield and compatibility with molecular assays. Demand is surging not just in hospitals, but also in at-home collection kits and decentralized clinical trials. Companies offering differentiated swab formats—like DNA-free swabs or transport-ready packages—are gaining traction in research and commercial testing labs.

U.S. Laboratory Disposable Products Market By Materials Insights

Plastic remains the dominant material used in laboratory disposables due to its versatility, low cost, sterility, and mass manufacturability. Polypropylene, polystyrene, and polyethylene-based products form the backbone of specimen containers, vials, and swabs. These materials are preferred for their chemical resistance, autoclavability, and lightweight nature. The dominance of plastics is further sustained by continuous R&D into sustainable polymers, making them more compliant with regulatory expectations and sustainability goals.

Glass, while traditionally used, is gaining momentum in specialized and high-precision applications such as optical microscopy, certain histopathological procedures, and drug stability testing. Laboratories handling sensitive samples—such as trace metals or volatile compounds—prefer glass due to its inertness and transparency. In academic research and pharmaceutical labs, optical-grade glass slides, tubes, and tissue collectors are used where clarity, precision, and non-reactivity are paramount. This segment, although smaller in volume, commands higher value and is supported by innovation in tempered and coated glass technologies.

U.S. Laboratory Disposable Products Market By End use Insights

Hospitals represent the largest share of end users in the U.S. lab disposables market. Hospital laboratories perform a wide range of diagnostics—from infectious disease testing and pre-operative analysis to chronic condition monitoring—generating high daily volumes of sample collection and processing. Hospitals adhere to strict infection control protocols, making the use of sterile, single-use laboratory disposables non-negotiable. Furthermore, hospital consolidation is creating centralized labs with higher throughput, reinforcing demand for bulk, automation-compatible disposable supplies.

CROs (Contract Research Organizations) are the fastest-growing segment, as they play a pivotal role in clinical trials, biomarker discovery, and pharmaceutical testing. As outsourcing becomes more prevalent among biotech and pharma firms, CROs are handling increasing volumes of samples that require standardized, traceable, and regulatory-compliant disposables. From specimen vials and biohazard bags to slide-mounted samples, CROs depend on disposable products that ensure reproducibility and eliminate cross-sample contamination. Their need for customization, batch tracking, and scalability makes them a key growth driver in this market.

Country-Level Analysis – United States

The United States is at the forefront of laboratory disposable product utilization, supported by one of the world’s most advanced healthcare, diagnostics, and biotechnology ecosystems. The country houses a vast number of public and private diagnostic labs, including LabCorp, Quest Diagnostics, and numerous academic centers, all of which demand standardized and high-quality disposable tools.

Additionally, government bodies such as the NIH, CDC, and FDA play a major role in funding, regulating, and standardizing laboratory practices. The increased frequency of infectious disease outbreaks, lifestyle disease screening, and wellness diagnostics is reinforcing sample collection and processing infrastructure across all states. Investments in lab automation, POC testing, and precision medicine are also expanding the scope and sophistication of laboratory consumable use.

Furthermore, post-pandemic reforms and initiatives like the expansion of CLIA-waived testing and over-the-counter diagnostics are boosting at-home collection kits, most of which are powered by laboratory disposable tools. This diversification into consumer health is expected to broaden the market's horizons beyond traditional clinical settings.

Some of the prominent players in the U.S. laboratory disposable products market include:

U.S. Laboratory Disposable Products Market Recent Developments

-

February 2025: Thermo Fisher Scientific launched a new line of biodegradable specimen containers aimed at reducing lab plastic waste by up to 40%, targeting academic institutions and hospital labs.

-

January 2025: Puritan Medical Products announced expansion of its U.S. manufacturing facility to meet rising demand for molecular-grade swabs used in respiratory and genetic testing.

-

November 2024: Corning Inc. introduced its next-generation optical-grade glass slides with anti-fog coatings and enhanced barcode integration for high-resolution imaging applications.

-

October 2024: BD (Becton, Dickinson and Company) unveiled a partnership with a major CRO to supply customized lab kits including collection tubes and transport vials for decentralized clinical trials.

-

August 2024: Globe Scientific launched a redesigned line of polypropylene vials compatible with high-speed centrifugation and robotic sorting systems for automation-enabled labs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. laboratory disposable products market

By Product

- Specimen Containers

- Transport Vials

- Collection and Transport Swabs

- Tissue Collectors

- Optical Grade

By Material

By End Use

- Hospitals

- Ambulatory Surgical Centers

- CROs

- Others