U.S. Large And Small-scale Bioprocessing Market Size and Research

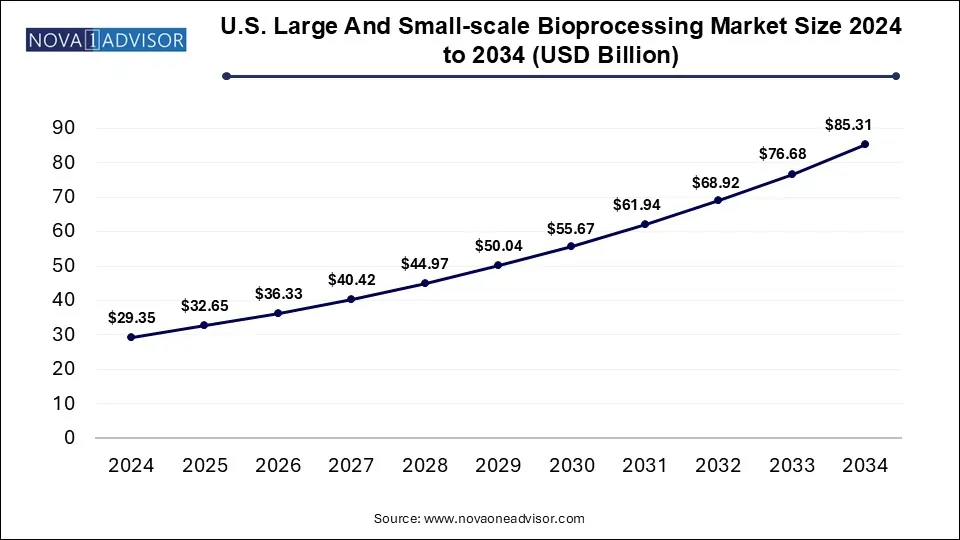

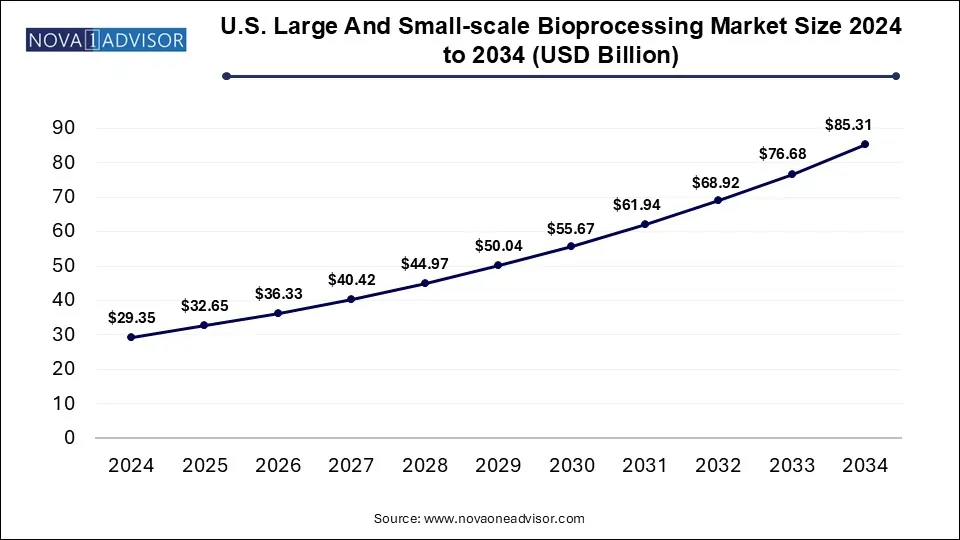

The U.S. large and small-scale bioprocessing market size is calculated at USD 29.35 billion in 2024, grows to USD 32.65 billion in 2025, and is projected to reach around USD 85.31 billion by 2034, growing at a CAGR of 11.26% during the forecast period 2025 to 2034. The market growth can be linked to rising demand for biopharmaceuticals, adoption of advanced bioprocessing technologies, focus on personalized medicine and emerging biotech startups.

U.S. Large And Small-scale Bioprocessing Market Key Takeaways

- By scale, the industrial scale segment dominated the market with the largest share in 2024.

- By scale, the small-scale segment is expected to show the fastest growth over the forecast period.

- By workflow, the downstream processing segment held the largest market share in 2024.

- By workflow, the fermentation segment is expected to register significant growth during the forecast period.

- By product, the bioreactors/ fermenters segment captured the largest market share in 2024.

- By product, the cell culture products segment is expected to show the fastest growth during the forecast period.

- By application, the biopharmaceuticals segment generated the highest market revenue in 2024.

- By application, the speciality industrial chemicals segment is expected to grow at a significant rate over the forecast period.

- By use-type, the multi-use segment accounted for the highest market share in 2024.

- By use-type, the single-use segment is expected to grow significantly during the predicted timeframe.

- By mode, the in-house segment dominated the market with the biggest revenue share in 2024.

- By mode, the outsourced segment is expected to grow at the fastest CAGR during the forecast period.

How is the U.S. Large and Small-scale Bioprocessing Market Expanding?

Large and small-scale bioprocessing are crucial for industrial-scale and R&D-scale production of biological products, respectively. The U.S. large and small-scale bioprocessing market is experiencing significant growth driven by factors such as rising prevalence of chronic diseases creating need for biopharmaceuticals, increased adoption of precision medicine, and focus on developing eco-friendly bioprocessing solutions. Innovations in bioprocessing technologies such as single-use systems and automation, supportive U.S. government initiatives for strengthening biotechnology research and development as well as rising investments by companies are expanding the market potential.

What Are the Key Trends in the U.S. Large and Small-scale Bioprocessing Market?

- In June 2025, at the Biotechnology Innovation Organization (BIO) International Convention, Ecolab Life Sciences launched its new Purolite AP+50 affinity chromatography resin which has a 50-micron bead size offering dynamic binding capacity of the AP resin platform and can optimize operations during the antibody manufacturing process.

- In May 2025, Made Scinetific, a leading cell therapy CDMO, announced a 12,000 sq. ft. expansion of its Princeton, New Jersey facility for meeting the rising demand from late-phase and commercial clients and to support the expected rise in approved advanced therapies. The expansion will add U.S. FDA and EU Annex 1 Compliant GMP Capacity along with high-throughput manufacturing design and advanced automation by Q3 2026.

Artificial intelligence (AI) and machine learning are enhancing the efficiency and precision of large and small-scale bioprocessing in the U.S. In large-scale bioprocessing, AI algorithms can be deployed for optimizing bioreactor performance, process intensification and automation, real-time monitoring and control of bioprocesses, data analysis and interpretation as well as for accelerating drug discovery and development processes in large-scale bioprocessing. Cloud computing platforms enable data aggregation and offer centralized control, whereas edge computing facilitates real-time decision-making. In small-scale bioprocessing, AI algorithms are being used in various applications, such as to optimize control over cell culture conditions in microfluidic bioreactors, for workforce training with AI-powered digital training platforms, as well as automating data management to ensure compliance with evolving regulatory requirement and mitigating documentation errors.

Report Scope of U.S. Large And Small-scale Bioprocessing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 32.65 Billion |

| Market Size by 2034 |

USD 85.31 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.26% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Scale, Workflow, Product, Application, Mode, Use-type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Avantor, Inc., Bio-Synthesis, Inc., Corning Inc., Danaher (Cytiva), Distek, Inc., Entegris, Eppendorf AG, F. Hoffmann-La Roche Ltd, Getinge AB, Lonza, Meissner Filtration Products, Inc., Merck KGaA (MilliporeSigma),Thermo Fisher Scientific, Inc., PBS Biotech, Inc., Repligen Corporation, Saint-Gobain, Sartorius AG |

Market Dynamics

Drivers

Rising Demand for Biologics and Biosimilars

Increasing prevalence of chronic diseases such as cancer, diabetes and autoimmune disorders as well as rare genetic disorders, especially in the aging populations is creating the need for effective and targeted therapies, many of which comprise of biologics. Pharmaceutical companies are heavily investing in R&D of novel biologics such as transformative cell and gene therapies, monoclonal antibodies and vaccines for expanding product pipelines, further creating demand for strong bioprocessing capabilities at all scales. Small-scale bioprocessing is gaining traction due to shift towards personalized medicine for tailoring treatments based on individual genetic profiles. Additionally, expiring patents of numerous blockbuster biologic drugs is paving the way for biosimilars entry in the market.

Restraints

Financial Hurdles in U.S. Bioprocessing

Setting up bioprocessing facilities involves specialized infrastructure such as highly specialized cleanroom environments, advanced HVAC and robust quality control along with advanced equipment which can lead to high upfront capital investments, especially in large-scale bioprocessing. Demanding regulatory guidelines for validation and qualification of equipment, facilities and processes set by the U.S. FDA can add to the initial capital expenditure. Furthermore, high operational costs associated with raw materials and consumables, skilled personnel, energy and utilities, quality control and assurance, R&D activities for new biologics as well as maintenance and calibration of specialized equipment to ensure regu8latory compliance can potentially restrain the market growth.

Opportunities

Continuous Advancements in Bioprocessing Technologies

Innovations in bioprocessing technologies are enhancing the efficiency, reducing costs and enabling the production of complex and novel biopharmaceuticals. Continuous bioprocessing is enabling higher throughput and faster production cycles for large-scale facilities, whereas small-scale operations are becoming cost-effective with maximized output in limited space and resources. Development of compact, modular and portable biomanufacturing systems is facilitating set up of satellite facilities for large companies as well as supporting decentralized manufacturing models for small-scale production of advanced therapies.

Segmental Insights

What Made Industrial Scale the Dominant Segment in the Market in 2024?

By scale, the industrial scale (over 50,000 liters) segment accounted for the largest market share in 2024. Increasing and continuous demand for blockbuster biologics such as monoclonal antibodies (mAbs) and vaccines, as well as the rise in biosimilars, is creating the need for comprehensive and robust manufacturing processes which use large-scale bioreactors for high-volume of these established products, offering significant economies of scale, leading to low cost per dose. Stainless steel bioreactor technology is widely used in bioprocessing industries due to its proven scalability and robustness for long-term and high-volume production of successful drugs. Furthermore, rising investments by large pharmaceutical companies and major Contract Development and Manufacturing Organizations (CDMOs) in large-scale stainless steel biomanufacturing facilities across the U.S. are expanding the market potential.

By scale, the small-scale (less than 50,000 liter) segment is expected to register the fastest growth during the forecast period. Expansion of advanced therapies such as cell and gene therapies (CGTs) which target small patient populations or individual patients through autologous cell therapies requires small-scale bioprocessing for developing these niche and personalized products. Small-scale systems are being integrated with automated technologies, AI and digital tools which offer greater control, precision and flexibility into complex bioprocesses with rapid development cycles, further driving their adoption for accelerating R&D and clinical trial timelines. Emerging biotech startups, increased academic research activities, cost-effectiveness of small-scale production facilities, and shift towards decentralized manufacturing and point-of-care (POC) biomanufacturing, especially for personalized therapies are the factors driving the market growth.

How Downstream Processing Segment Dominated the Market in 2024?

By workflow, the downstream processing segment dominated the market with the biggest share in 2024. Continuous advancements in downstream processing such as innovations in chromatography resins, development of automated chromatography systems, improved filtration technologies such as microfiltration and tangential flow filtration (TFF), adoption of single-use downstream components, shift towards continuous downstream processing, and integration of process analytical technologies (PAT) offering real-time monitoring and control are driving the market growth of this segment. Additionally, rising complexity of new biologics, demand for high-quality products, stringent regulatory requirements, increasing investments for optimizing downstream processes, and focus on intellectual property protection for process-intensive products by companies are the factors fuelling the market expansion.

By workflow, the fermentation segment is expected to show significant growth during the predicted timeframe. The rising consumer demand for eco-friendly, sustainable and ethically produced products is driving the use of precision fermentation for production of materials derived from animals or agriculture by utilizing microbes, leading to reduced greenhouse emissions, water consumption and land use. Fermentation technology is widely used for manufacturing bio-based chemicals and enzymes required for industrial applications as well as bioplastics. Microbial fermentation is a primary method used for manufacturing broad range of biopharmaceutical such as antibiotics, recombinant proteins, insulin and certain vaccines such as Hepatitis B vaccine as well as new therapeutic modalities like mRNA-based therapies.

Why Did the Bioreactors/ Fermenters Segment Dominate in 2024?

By product, the bioreactors/ fermenters segment held the biggest market share in 2024. The increasing demand for biopharmaceuticals, adoption of cell-based and microbial expression systems, need for flexible manufacturing systems and ongoing R&D in bioprocessing technologies are driving the market growth. Advancements in bioreactors and fermenters such as deployment of Bioprocessing 4.0 solutions with integration of AI and machine learning (ML) for real-time bioprocess monitoring and control as well as automated systems are increasing the efficiency, reducing costs, improving scalability and reproducibility with faster development times across various applications in various fields, including biopharmaceuticals, biofuels and tissue engineering.

By product, the cell culture products segment is expected to register the fastest CAGR over the forecast period. The strong evolving U.S. biotech ecosystems driven by significant investments in R&D, adoption of advanced bioprocessing technologies, focus on regenerative medicine, and presence of well-established academic and research institutes are contributing to the market growth. Rising trend towards use of chemically defined and serum-free media for development of cell cultured products is reducing contamination risks and improving the reproducibility, leading to improved regulatory compliance.

What Drives Biopharmaceuticals Segment’s Dominance in the Market in 2024?

By application, the biopharmaceuticals segment generated the highest market revenue share in 2024. Large and small-scale bioprocessing facilities are crucial for development and production biologics and advanced therapies required to address the rising chronic disease burden. Pharmaceutical and biotech companies as well as venture capitalists are actively investing in R&D for innovative biopharmaceuticals, leading to expansion of product pipelines requiring bioprocessing. Supportive programs such as “breakthrough therapy designation” by the U.S. FDA are expediting the review and approval process of novel therapies, further encouraging biopharmaceutical development.

By application, the speciality industrial chemicals segment is expected to grow at a significant rate over the forecast period. Specialty industrial chemicals refer to high-value, low-volume products tailored for specific applications across biological processes. The segment’s growth is driven by the increasing demand for bio-based and sustainable solutions, advancements in industrial biotechnology and synthetic biology such as strain engineering and biocatalysis of enzymes, supportive government initiatives and strict regulations. Companies are actively seeking bioprocessing expertise beyond biopharmaceuticals for producing biopolymers, bio-based solvents and surfactants, speciality food ingredients, advanced biofuels and biochemicals, bio-pesticides, bio-fertilizers as well as fine chemicals used in cosmetics and personal care.

How Multi-Use Segment Accounted for the Highest Market Share in 2024?

By use-type, the multi-use segment accounted for the largest market revenue share in 2024. Multi-use stainless steel bioreactors and downstream equipment are widely used for production of high-volume and established biologic products such as insulin, antibodies and vaccines, further providing a cost-effective approach in the long run. The durability, robustness and effectiveness for intensified and continuous processes at larger scales offered by multi-use systems are driving their adoption for bioprocessing workflows.

By use-type, the single-use segment is expected to grow at the fastest rate over the forecast period. Single-use components such as bioreactors, bags, filters, tubing, connectors are pre-sterilized and can be disposed after each use, further eliminating the need for complex and resource-intensive cleaning-in-place (CIP) and sterilization-in-place (SIP) procedures. This potentially reduces the risk of microbial contamination and cross-contamination between batches or different products. Additionally, faster turnaround times, increased flexibility, low capital expenditure and reduced operational costs, simplified validation processes enhancing regulatory compliance and accelerated time-to-market are the factors expected to fuel the market growth of this segment.

What Made In-House Segment Dominant in the Market in 2024?

By mode, the in-house segment captured the largest market share in 2024. Companies across the U.S. are widely adopting in-house bioprocessing to maintain complete control over their manufacturing processing while ensuring adherence to stringent quality standards and regulations imposed by the U.S. FDA to ensure product integrity and safety. In-house production offers intellectual property protection for manufacturing processes, especially for several advanced therapies. Furthermore, in-house capabilities enable the conduction of in-depth process development and optimization, quick generation of material for preclinical and clinical trials as well as allows quick solutions over issues, leading to minimized delays and accelerated development and time-to-market.

By mode, the outsourced segment is expected to register the fastest growth over the forecast period. High costs associated with building and maintenance of state-of-the-art bioprocessing facilities is driving the trend towards outsourcing production, especially for emerging biotech companies and startups with limited funding in the U.S. Outsourcing allows companies to focus on core competencies such as clinical trials, R&D, and commercialization strategies.

- For instance, in May 2025, BioWell officially presumed operations of Texas BioTechnology's pilot plant which includes 13,000L of fermentation capacity and also provides advanced laboratory space, bioprocessing capabilities, and CDMO services.

Country-Level Analysis

The U.S. is a dominant force in the pharmaceutical and biotechnology sectors which ultimately drives the demand for large and small-scale bioprocessing capabilities. Mass production of established biologics, increased emphasis on biosimilar development and manufacturing, focus process intensification with adoption of continuous bioprocessing and perfusion technologies are boosting the market growth. Strategic acquisitions by large pharmaceutical companies and CDMOs of existing large-scale manufacturing facilities for strengthening their geographical presence and expanding their commercial production are creating opportunities for market growth. Focus on strategic independence is driving investments in strong and advanced domestic large-scale manufacturing facilities within the U.S.

Some of the Prominent Players in the U.S. Large and Small-scale Bioprocessing Market

- Avantor, Inc.

- Bio-Synthesis, Inc.

- Corning Inc.

- Danaher (Cytiva)

- Distek, Inc.

- Entegris

- Eppendorf AG

- F. Hoffmann-La Roche Ltd

- Getinge AB

- Lonza

- Meissner Filtration Products, Inc.

- Merck KGaA (MilliporeSigma)

- Thermo Fisher Scientific, Inc.

- PBS Biotech, Inc.

- Repligen Corporation

- Saint-Gobain

- Sartorius AG

U.S. Large and Small-scale Bioprocessing Market Recent Developments

- In May 2025, Waters Corporation launched the BioResolve Protein A Affinity Columns with MaxPeak Premier Technology, offering precise titer measurements. The new columns will accelerate method optimization in downstream development for biologics, advance access to results in upstream bioprocessing, and will provide a new level of agility in the discovery, optimization and manufacturing of antibody-based drug products.

- In May 2025, DuPont expanded its bioprocessing portfolio with the launch of its agarose-based chromatography resin, DuPont AmberChrom TQ1 chromatography resin which supports purification of oligonucleotides and peptides across a wide-range of biopharma applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Large And Small-scale Bioprocessing Market.

By Scale

- Industrial Scale (Over 50,000 Liter)

- Small Scale (Less Than 50,000 Liter)

By Workflow

- Downstream Processing

- Fermentation

- Upstream Processing

By Product

- Bags & Containers

- Bioreactors/Fermenters

- Bioreactors Accessories

- Cell Culture Products

- Filtration Assemblies

- Others

By Application

- Biopharmaceuticals

- Environmental Aids

- Speciality Industrial Chemicals

By Use-Type

By Mode