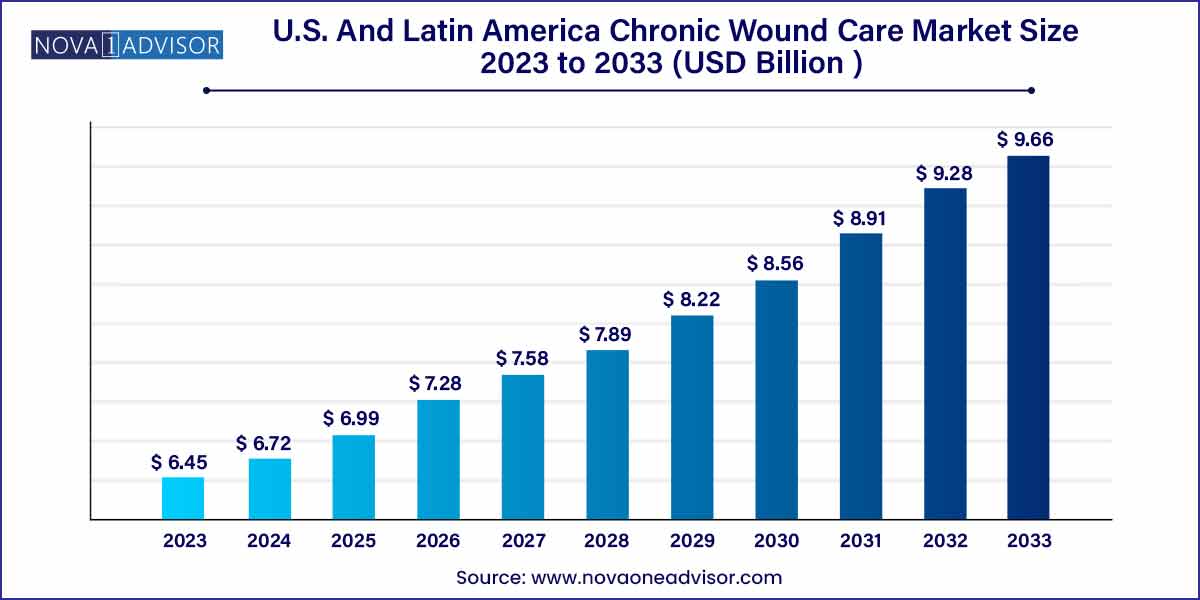

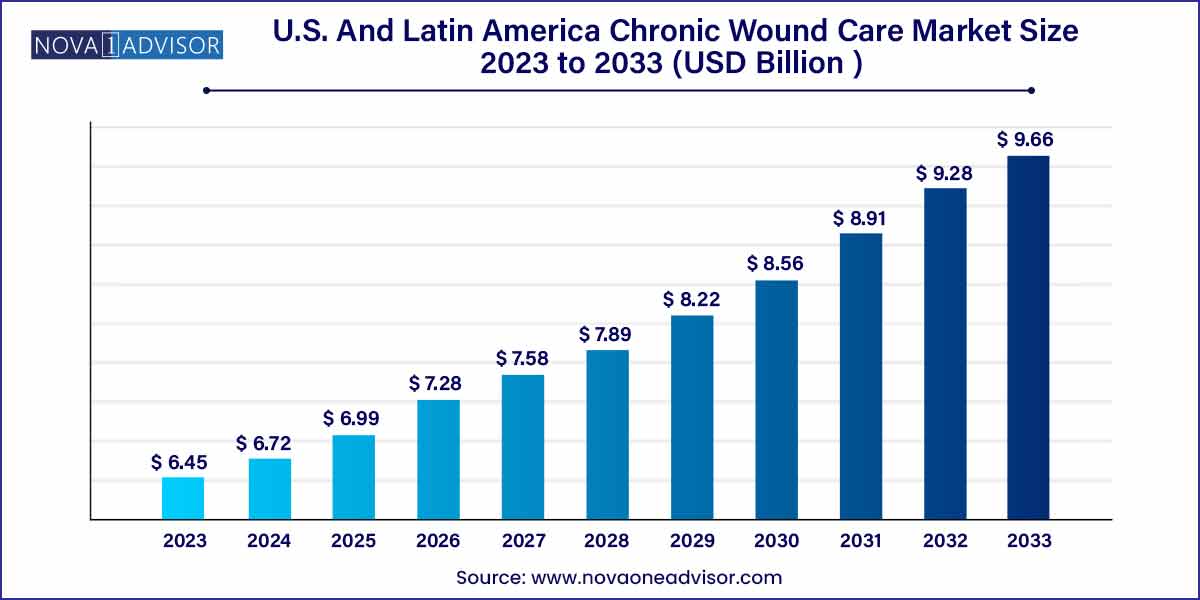

The U.S. and Latin America chronic wound care market size was estimated at USD 6.45 billion in 2023 and is projected to hit around USD 9.66 billion by 2033, growing at a CAGR of 4.12% during the forecast period from 2024 to 2033.

Key Takeaways:

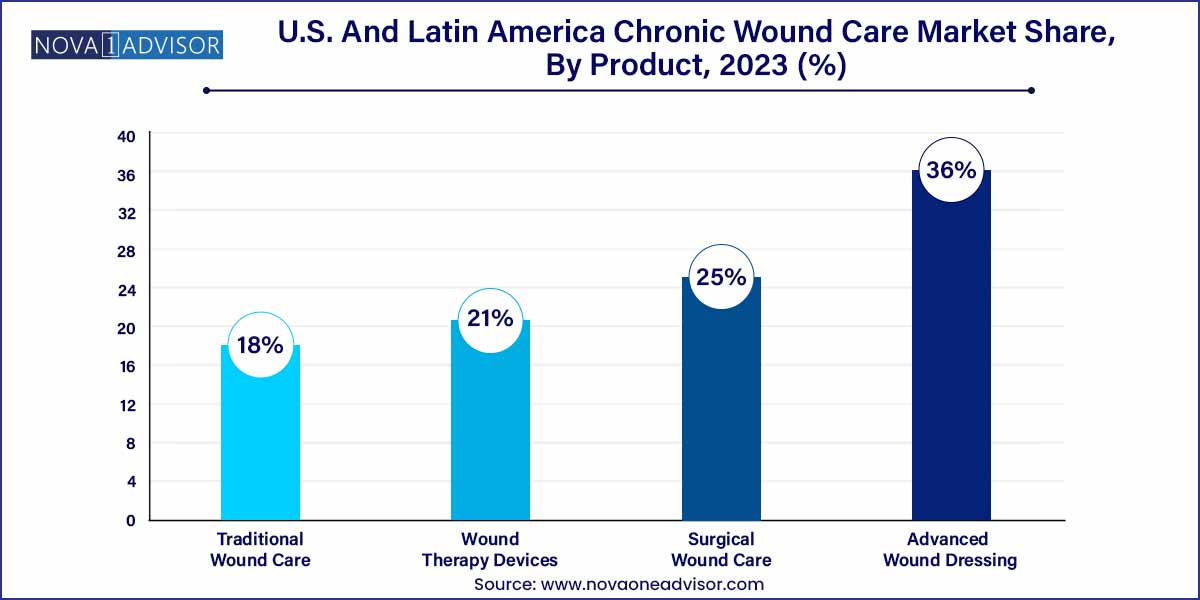

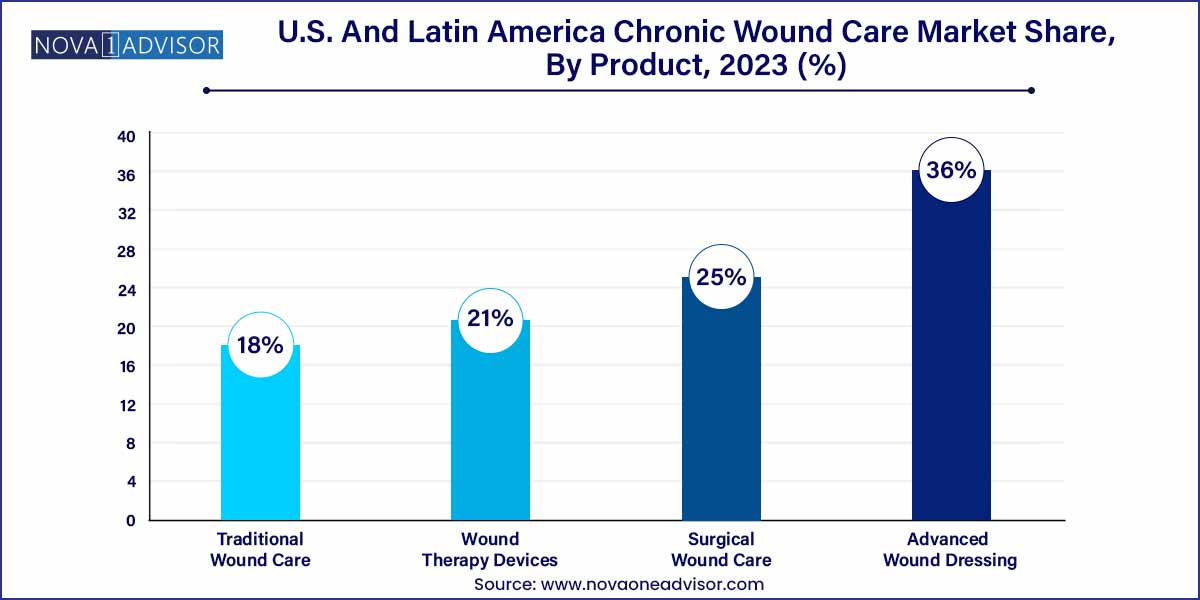

- The U.S. & Latin America chronic wound care market with the highest market share of around 36% in 2023. Also, it is expected to grow at the highest compound annual growth rate (CAGR) of 4.39% from 2024 to 2033.

- The diabetic foot ulcers segment dominated the U.S. & Latin America chronic wound care market with the largest market revenue share in 2023.

- The pressure ulcers segment is expected to grow at the highest compound annual growth rate (CAGR) from 2024 to 2033.

- The hospitals end-use led the market in 2023.

- The home healthcare segment is expected to grow at the highest compound annual growth rate (CAGR) from 2024 to 2033.

Market Overview

The chronic wound care market in the U.S. and Latin America is undergoing significant transformation driven by rising chronic disease prevalence, a rapidly aging population, growing healthcare expenditure, and increasing awareness of advanced treatment options. Chronic wounds defined as wounds that do not heal within a predictable time frame—include diabetic foot ulcers, pressure ulcers, and venous leg ulcers, all of which have become key public health concerns.

In the United States, the burden of chronic wounds affects nearly 7 million individuals annually, with diabetic foot ulcers alone accounting for a significant share of hospital admissions and amputations. The U.S. boasts a robust infrastructure for wound care innovation and implementation, backed by reimbursement frameworks like Medicare and partnerships between hospitals, research institutes, and device manufacturers.

In contrast, Latin America, particularly countries such as Brazil, Mexico, and Colombia, is emerging as a growing market. Rapid urbanization, increasing incidence of diabetes, and limited access to early wound care interventions contribute to a rising need for structured wound care programs. While healthcare systems vary, both public and private providers are seeking more cost-effective and efficient solutions to tackle wound-related complications and hospital readmissions.

The market encompasses a diverse array of products ranging from advanced dressings and wound therapy devices to traditional gauze-based care and surgical interventions with demand patterns shaped by geography, patient profiles, and healthcare infrastructure maturity.

Major Trends in the Market

-

Adoption of Advanced Wound Dressings Over Traditional Solutions

-

Rise in Home-based Wound Care and Mobile Healthcare Services

-

Expansion of Negative Pressure Wound Therapy (NPWT) in Hospitals

-

Increased Use of AI and Telehealth in Wound Assessment

-

Focus on Infection Control and Antimicrobial Dressings

-

Strategic Collaborations Between Hospitals and Technology Companies

-

Government Campaigns for Diabetic Ulcer Prevention in Latin America

-

Personalized Wound Management Using Sensor-enabled Devices

U.S. And Latin America Chronic Wound Care Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.72 Billion |

| Market Size by 2033 |

USD 9.66 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.12% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, Application, End-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Smith & Nephew PLC; Mölnlycke Health Care AB; ConvaTec Group PLC; Baxter International; Coloplast Corp.; Medtronic; 3M; Derma Sciences (Integra LifeSciences); Medline Industries, Inc.; Ethicon (Johnson & Johnson); B. Braun SE; Cardinal Health, Inc.; Organogenesis Inc; MIMEDX Group, Inc. |

Market Driver: High Prevalence of Diabetes and Obesity

The primary driver for the chronic wound care market is the rising prevalence of diabetes and obesity, which are both major risk factors for chronic wounds. In the U.S., over 11% of the population has diabetes, with diabetic foot ulcers occurring in up to 25% of these patients during their lifetime. Similarly, in Latin America, rising lifestyle diseases are significantly contributing to increased chronic wound cases.

Chronic wounds are particularly difficult to manage in diabetic patients due to poor circulation, neuropathy, and a compromised immune response. In this context, chronic wound care products such as antimicrobial foam dressings, enzymatic debriders, and NPWT systems are increasingly being adopted to improve outcomes and reduce the risk of amputations and sepsis.

Market Restraint: High Cost of Advanced Wound Care Products

A notable restraint in the market is the high cost associated with advanced wound care products and technologies, especially in resource-limited settings across Latin America. Products like negative pressure wound therapy systems, bioengineered skin substitutes, and silver-infused dressings are often priced beyond the reach of smaller hospitals or uninsured patients.

While the U.S. market benefits from reimbursement coverage through Medicare, Medicaid, and private insurers, the lack of standardized reimbursement or limited public healthcare funding in Latin America hampers widespread adoption. Additionally, many chronic wound patients require long-term treatment, making affordability a persistent challenge for healthcare providers and patients alike.

Market Opportunity: Integration of Digital Health in Wound Management

One of the most promising opportunities lies in the integration of digital technologies such as telemedicine, AI, and remote monitoring into chronic wound care. With the rise of mobile wound assessment apps, image analytics platforms, and wearable sensors, clinicians can now track wound healing remotely, reduce unnecessary visits, and intervene early in case of infection or complications.

In the U.S., several hospital systems have already incorporated AI-powered wound assessment tools into their electronic health records (EHRs), enabling better documentation and clinical decision-making. In Latin America, digital tools offer a way to bridge geographic and economic barriers, especially in rural and underserved communities where access to specialists is limited.

Segments Insights

By Product Insights

Advanced Wound Dressings Dominated the Market

Advanced wound dressings dominate the chronic wound care product segment in both the U.S. and Latin America due to their effectiveness in maintaining a moist wound environment, controlling infection, and accelerating healing. Foam dressings, hydrocolloids, alginates, and hydrogels are particularly popular for diabetic foot ulcers and pressure injuries. These dressings are frequently used in hospitals, long-term care facilities, and increasingly in home healthcare.

The use of antimicrobial dressings especially those infused with silver or iodine has also grown due to rising concerns about wound infections. Foam dressings with extended wear times and exudate control are in demand across outpatient and surgical wound care settings.

Wound Therapy Devices are the Fastest-Growing Segment

Wound therapy devices, particularly negative pressure wound therapy (NPWT) systems, are the fastest-growing segment. These devices create a controlled vacuum environment around the wound, promoting blood flow, reducing exudate, and drawing together wound edges. In the U.S., portable and single-use NPWT systems have revolutionized post-operative and chronic wound management, enabling earlier discharge and better patient compliance.

Latin America is witnessing a gradual uptake of NPWT, especially in urban tertiary care centers and private hospitals. Market growth is being aided by increasing clinician awareness, pilot programs in national health services, and cost-effective innovations by local suppliers.

By Application

Diabetic Foot Ulcers Dominate the Application Segment

Diabetic foot ulcers (DFUs) dominate the application segment, driven by high prevalence rates of diabetes and associated complications. In the U.S., DFUs are among the leading causes of non-traumatic lower-limb amputations, underscoring the importance of early and aggressive wound care intervention. Advanced dressings, debridement therapies, and NPWT are commonly used for deep, infected ulcers.

In Latin America, DFUs are an emerging public health crisis. Public hospitals in Mexico and Brazil are adopting targeted DFU management programs, supported by non-governmental organizations and educational campaigns. Early-stage products like antimicrobial hydrogels and foam dressings are increasingly used to avoid infections and amputations.

Pressure Ulcers are the Fastest-Growing Segment

Pressure ulcers, particularly in elderly and immobile patients, are the fastest-growing application segment. With the aging population in the U.S. and the rise of long-term care facilities, the incidence of pressure injuries is increasing. These wounds are complex and slow to heal, requiring multilayer foam dressings, offloading devices, and frequent monitoring.

In Latin America, public hospitals are integrating pressure ulcer prevention protocols into geriatric and palliative care departments. As awareness of preventive strategies grows, so does the demand for pressure-relieving products and specialized wound care teams.

By End-use

Hospitals are the Largest End-users

Hospitals remain the largest end-users of chronic wound care products, especially for acute and complex wounds. Tertiary hospitals and surgical centers in the U.S. routinely use NPWT systems, surgical debridement tools, and advanced dressings in managing severe chronic wounds. Institutional protocols, presence of wound care specialists, and reimbursement support bolster hospital-based usage.

Latin American hospitals are increasingly investing in wound care infrastructure, particularly in major urban areas. Despite budget limitations, the expansion of wound care clinics within hospitals and government procurement of dressing kits has created steady demand.

Home Healthcare is the Fastest-Growing End-use

Home healthcare is rapidly growing, driven by a shift toward outpatient care, shorter hospital stays, and patient preference for comfort. In the U.S., many chronic wound patients—especially those with diabetic ulcers and pressure injuries—are managed at home using portable NPWT, antimicrobial dressings, and telehealth follow-ups.

In Latin America, the concept of community-based wound care is gaining traction, especially in Brazil and Colombia, where public-private partnerships are delivering kits and teleconsultation support for chronic patients in rural regions.

Country-Level Analysis

United States

The U.S. is the leading market, driven by robust reimbursement systems, high disease burden, and cutting-edge wound care technology. Public health programs like Medicare's coverage for NPWT and pressure ulcer management have encouraged hospitals and home care providers to adopt advanced solutions. Major cities host dedicated wound healing centers, and the country’s DSO and home care network is actively investing in mobile wound services and data-integrated treatment platforms.

Brazil

Brazil is the largest Latin American market, with rising chronic disease cases and increased investments in public healthcare. National health programs are supporting early wound diagnosis and prevention, particularly in diabetes management. Private hospitals are adopting NPWT systems and advanced dressings, and medical device companies are collaborating with hospitals for localized wound care protocols.

Mexico

In Mexico, the chronic wound burden is high due to lifestyle diseases and limited access to preventive care. However, the presence of private specialty clinics and the expansion of insurance coverage for outpatient wound care is encouraging the adoption of advanced solutions. Training programs for nurses and GPs on wound staging and dressing selection are improving clinical outcomes.

Recent Developments

-

April 2025 – 3M Health Care announced the U.S. launch of a next-gen single-use NPWT system with extended battery life and Bluetooth integration for home monitoring.

-

March 2025 – Smith+Nephew expanded its Latin American operations by opening a regional wound care training center in São Paulo, Brazil.

-

February 2025 – ConvaTec signed a strategic agreement with a Mexican private hospital chain to supply antimicrobial dressings and wound assessment software across 10 facilities.

-

January 2025 – Mölnlycke Health Care introduced a dual-layer foam dressing in the U.S. aimed at improving pressure injury prevention in immobile hospital patients.

-

December 2024 – DermaRite Industries partnered with a telemedicine company in Texas to pilot a remote wound care program for diabetic patients in rural areas.

Key U.S. And Latin America Chronic Wound Care Companies:

- Smith & Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Baxter International

- DeRoyal Industries, Inc.

- Coloplast Corp.

- 3M

- Integra LifeSciences

- Medline Industries, Inc.

- Johnson & Johnson

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Organogenesis Inc

- MIMEDX Group, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. And Latin America Chronic Wound Care market.

By Product

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

By Application

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

By Regional

- North America

- Latin America

- Brazil

- Mexico

- Colombia

- Panama