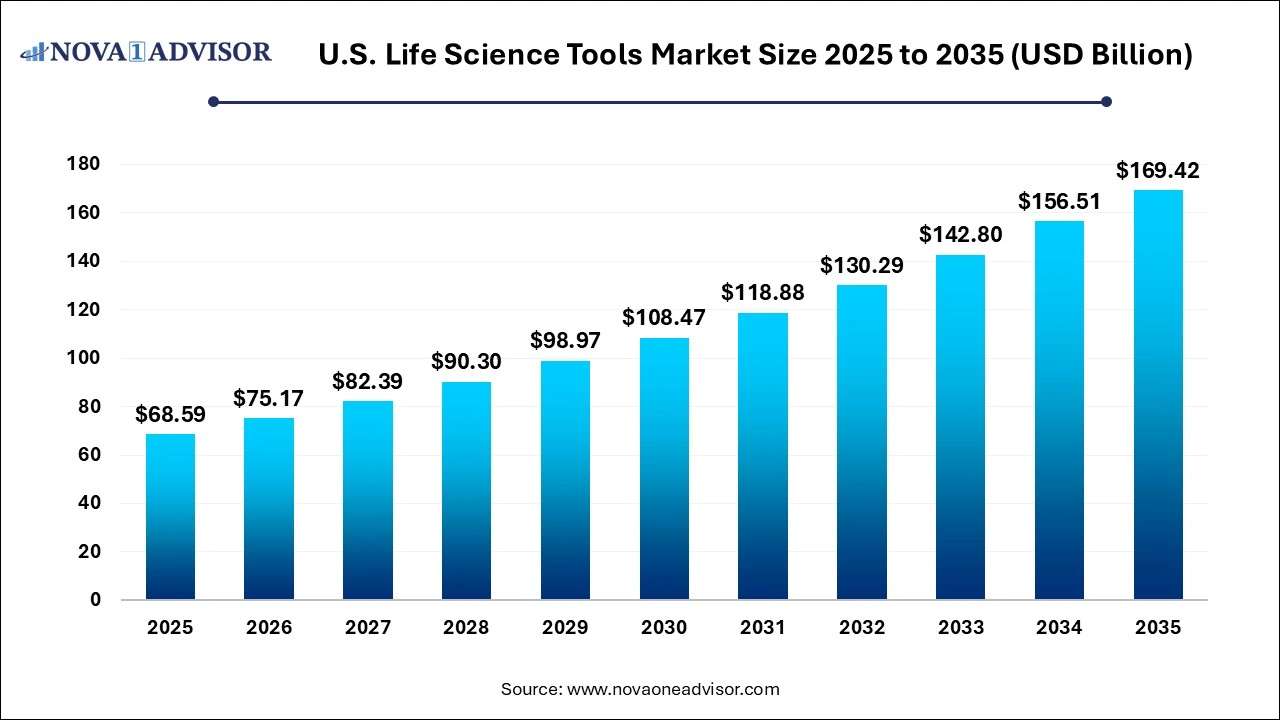

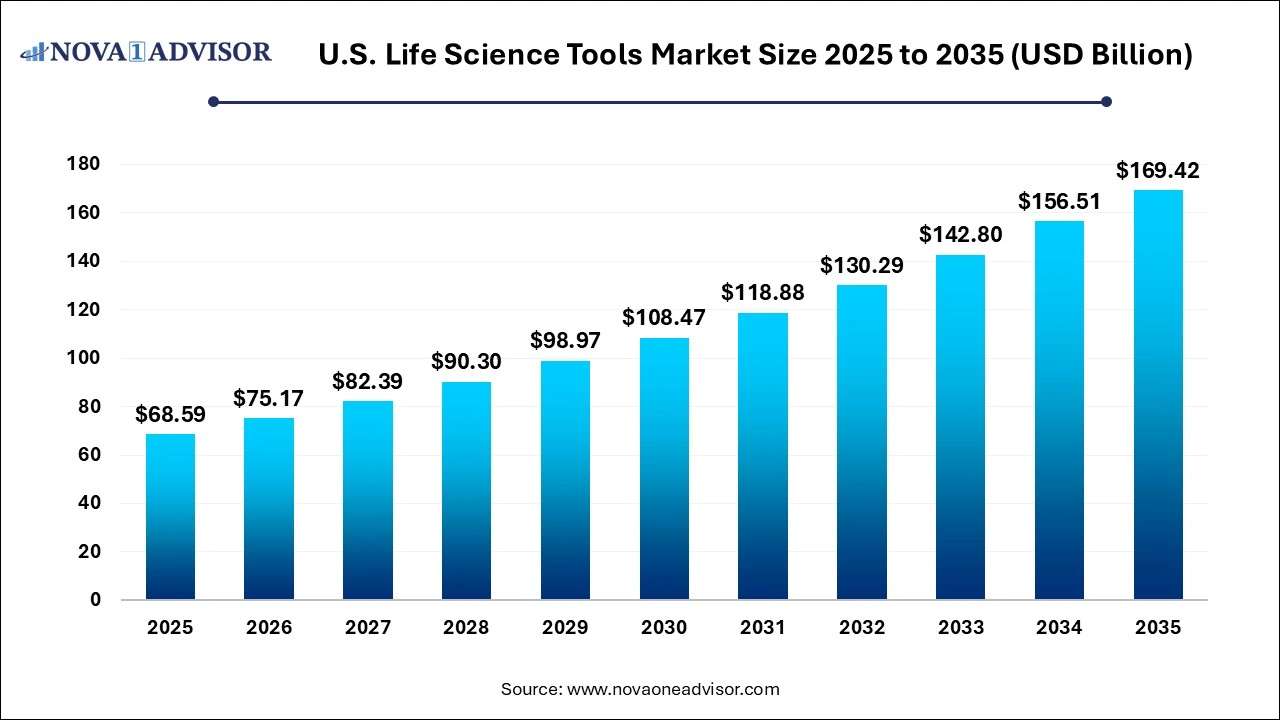

The U.S. life science tools market size is expected to be worth around 169.42 billion by 2035, increasing from USD 68.59 billion in 2025, representing a healthy CAGR of 9.46% from 2026 to 2035. U.S. life science tools are significant for conducting diagnostics, experiments, and novel drug development in different medical and scientific sectors. Life sciences research and development bring cutting-edge novel treatments and therapy in the form of biopharmaceuticals like human tissue products and monoclonal antibodies, regenerative medicine such as cardiac cell transplantation and stem cell therapy, and also modified medicine, which drives the growth of the U.S. life science tools market.

Key Takeaways:

- The genomic technology segment contributed the highest market share in 2025.

- The cell biology technology segment is estimated to be the fastest-growing segment during the forecast period.

- The Next Generation Sequencing (NGS) technology segment captured the biggest market share in 2025.

- The cell culture systems and 3D cell culture segment are expected to grow at a significant CAGR from 2026 to 2035.

- The biopharmaceutical companies segment contributed the highest market share in 2025.

- The government and academic institutions segment is estimated to be the fastest-growing segment during the forecast period.

The U.S. Life Science Tools Market is one of the most critical pillars underpinning scientific advancement and innovation across biotechnology, pharmaceutical research, clinical diagnostics, and healthcare. These tools form the technological and instrumental backbone of biological investigation, enabling researchers and clinicians to decode complex biological processes, discover new drugs, monitor disease progression, and engineer next-generation therapeutics.

Life science tools encompass a broad array of products—from high-end instruments such as mass spectrometers, flow cytometers, and PCR machines to consumables like reagents, antibodies, and culture media. These tools serve as essential components in workflows ranging from genomic sequencing and proteomics to cellular imaging and molecular diagnostics. As science becomes increasingly interdisciplinary, life science tools are bridging gaps between biology, data science, and engineering, fostering a new era of precision and predictive science.

The U.S. continues to dominate the global life science tools landscape owing to its strong network of academic institutions, biopharmaceutical companies, federal funding bodies (like NIH and NSF), and innovation-driven start-ups. Furthermore, the post-pandemic emphasis on pandemic preparedness, personalized medicine, and data-centric health technologies has intensified demand for advanced life science tools. Whether it’s developing mRNA vaccines, monitoring cancer biomarkers, or understanding neurological pathways, these tools have become indispensable to modern science.

Moreover, the U.S. market benefits from a mature regulatory framework, rapid adoption of AI and cloud-based platforms in research labs, and ongoing public-private collaborations. All of these factors create a fertile environment for sustained growth and innovation within the life science tools industry.

-

AI and Automation Integration: Robotic liquid handlers, AI-driven image analysis, and machine learning for drug discovery are enhancing research productivity and reproducibility.

-

Single-Cell Analysis Expansion: Tools enabling single-cell RNA sequencing, proteomics, and spatial transcriptomics are gaining traction for their precision in heterogenous cell populations.

-

Miniaturization and Portability: Devices like portable PCR machines and handheld spectrometers are making research more accessible and scalable, even in field settings.

-

Rise of Lab-on-a-Chip and Microfluidics: These technologies are streamlining workflows in genomics, proteomics, and diagnostics by reducing reagent consumption and turnaround time.

-

Cloud-Connected and Digital Lab Infrastructure: Remote access, real-time data sharing, and cloud computation are redefining laboratory operations across academia and industry.

-

Customization in Kits and Reagents: Tailored solutions for specific workflows or applications are becoming popular, especially in gene editing, CRISPR-based research, and rare disease diagnostics.

-

Increased Demand from Biopharma R&D and CDMOs: The surge in biologics, gene therapies, and cell therapies is accelerating demand for advanced analytical tools and bioprocessing technologies.

| Report Attribute |

Details |

| Market Size in 2026 |

USD 75.17 Billion |

| Market Size by 2035 |

USD 169.42 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.46% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, product, end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Agilent Technologies, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc.; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi, Ltd.; Bruker Corporation; Oxford Instruments plc; Zeiss International |

Market Driver: Acceleration of Biopharmaceutical R&D in the U.S.

A major growth driver for the U.S. life science tools market is the surging demand from biopharmaceutical R&D, which relies heavily on cutting-edge technologies for drug discovery, preclinical validation, and quality control. The U.S. hosts many of the world’s leading biopharmaceutical firms—including Pfizer, Merck, Amgen, and Moderna—who are investing billions annually into developing biologics, cell and gene therapies, and RNA-based therapeutics.

These pipelines demand precision instrumentation such as next-generation sequencing (NGS), high-resolution mass spectrometry, and automated high-throughput screening platforms. For instance, the rapid development of mRNA vaccines for COVID-19 required intensive use of cell culture systems, NGS platforms, and protein purification tools—cementing the value of life science technologies in achieving translational outcomes.

Federal support, in the form of NIH and BARDA funding, as well as tax incentives for R&D, further boosts tool adoption. Biopharma's pivot toward personalized therapeutics and biomarkers is also increasing reliance on multiplexed assays, single-cell tools, and CRISPR-based genome editing kits.

Market Restraint: High Capital and Maintenance Costs

Despite its robust trajectory, the U.S. life science tools market is constrained by high capital investment and operating costs. Many advanced instruments—such as flow cytometers, cryo-electron microscopes, or NMR systems—cost hundreds of thousands to millions of dollars, limiting access for smaller academic labs or start-ups. In addition to the purchase cost, labs must consider installation, calibration, maintenance, software updates, and operator training.

Consumables and reagents also pose recurring costs, especially in high-throughput workflows. Moreover, labs must comply with stringent safety, calibration, and regulatory requirements, which add complexity and expense. The lack of skilled technicians and the need for specialized training to operate these tools also impact overall productivity and return on investment. This cost barrier can inhibit broader tool democratization, especially in underfunded institutions or emerging biotech ventures.

Market Opportunity: Expansion in Personalized Medicine and Molecular Diagnostics

The growing focus on personalized medicine and molecular diagnostics offers a transformative opportunity for the U.S. life science tools market. As healthcare moves toward tailored treatment strategies, there is increasing reliance on tools that provide detailed insights into patient-specific genetic, proteomic, and metabolic profiles.

NGS platforms, PCR/qPCR systems, digital droplet PCR (ddPCR), and high-throughput multiplex assays are central to this trend. Clinical genomics laboratories, such as those run by Invitae and GeneDx, use these tools to analyze inherited disorders, cancer mutations, and pharmacogenomic markers. Furthermore, the integration of sequencing and AI is enabling early cancer detection from liquid biopsies, reshaping diagnostic paradigms.

This opportunity extends into population health genomics initiatives and longitudinal studies like the NIH's “All of Us” program, which utilizes a suite of life science tools to gather real-world, diverse genetic data. These trends not only drive tool innovation but also expand their usage in point-of-care diagnostics, wearable biosensors, and home testing kits.

Segmental Analysis

By Technology Analysis

Genomic Technology dominated the U.S. life science tools market by technology. Driven by advances in NGS, CRISPR-Cas9, and transcriptomic profiling, genomic tools are at the forefront of modern research. U.S. institutions and biotech firms heavily rely on genomics for drug development, disease risk profiling, and biomarker discovery. For example, companies like Illumina and Pacific Biosciences are central players, supplying high-throughput platforms to academia and industry alike. Genomics tools also power large population health studies and pharmacogenomic applications.

Cell Biology Technology is the fastest-growing segment, propelled by rising interest in stem cell research, cell therapies, organoids, and 3D cell culture systems. The use of cell biology tools in immunotherapy, regenerative medicine, and personalized in vitro models is expanding. Companies like Thermo Fisher and STEMCELL Technologies offer robust platforms for live-cell imaging, differentiation, and manipulation. This trend is expected to grow as researchers focus more on physiologically relevant models that bridge the gap between in vitro and in vivo studies.

By Product Analysis

Next Generation Sequencing (NGS) products dominated the market. NGS has revolutionized genomic research, offering high-resolution insights at a lower cost and with greater scalability. Instruments and reagents used in NGS workflows—from library prep to variant calling—are widely used in oncology, rare disease diagnostics, and evolutionary studies. Illumina’s dominance in this space, along with the growth of startups offering long-read sequencing (e.g., Oxford Nanopore), demonstrates NGS’s centrality in life sciences.

Cell Culture Systems and 3D Cell Culture are the fastest-growing segments across products. The demand for more accurate disease models and bioproduction systems is pushing investment into scaffold-based 3D culture, bioreactors, and extracellular matrix technologies. Consumables, including media, sera, and flasks, see recurring demand, while advanced cell imaging and automated handling systems are expanding rapidly in labs exploring stem cell therapies and organ-on-chip models.

By End-use Analysis

Biopharmaceutical companies are the dominant end-users in the U.S. market. These organizations account for a substantial portion of tool consumption, using them for target discovery, lead optimization, drug screening, and clinical validation. Tools used in GMP-grade bioproduction and quality control, such as chromatography and mass spectrometry, are also crucial to regulatory compliance.

Government and academic institutions are the fastest-growing users, due to large-scale research funding, public health initiatives, and university-led translational science projects. The NIH, NSF, CDC, and other public entities allocate billions in funding annually to labs working on cancer, neuroscience, infectious diseases, and aging. In addition, the pandemic reinforced the role of government-backed institutions in molecular surveillance and viral research using PCR, sequencing, and antibody assays.

Country-Level Analysis

The United States leads the global life science tools market in both innovation and consumption. Home to leading manufacturers, research universities, and biopharma headquarters, the U.S. fosters a thriving ecosystem where tool developers and users collaborate closely. The country’s robust funding channels—through agencies like NIH, BARDA, and DARPA—encourage tool adoption in early-stage and applied research.

Prominent cities like Boston, San Diego, and San Francisco serve as biotech hubs where cutting-edge technologies in genomics, proteomics, and microscopy are tested and commercialized. Additionally, the FDA’s support for biomarker-based diagnostics and digital lab tools accelerates clinical integration. Moreover, public-private partnerships like ARPA-H and the Cancer Moonshot are expected to further propel life science tool deployment in coming years.

The country also leads in automation, digital lab infrastructure, and cloud-based data processing—making U.S. laboratories among the most advanced in the world. With educational institutions acting as talent pipelines and venture capital fueling start-up innovation, the U.S. is positioned to maintain its dominance in the life sciences landscape.

-

March 2025: Thermo Fisher Scientific launched a new automated cell culture system designed for CAR-T cell expansion, aiming to reduce manual labor and improve consistency in cell therapy workflows.

-

February 2025: Illumina announced the release of its NovaSeq X platform in U.S. clinical labs, offering increased speed and reduced sequencing cost for oncology diagnostics and population genomics.

-

January 2025: Agilent Technologies acquired a U.S.-based AI bioinformatics start-up to enhance its NGS data analysis capabilities across clinical genomics and pathogen surveillance platforms.

-

December 2024: Bio-Rad Laboratories introduced a next-generation droplet digital PCR (ddPCR) system optimized for rare mutation detection in liquid biopsies, targeting the early cancer detection market.

-

November 2024: Waters Corporation unveiled a new high-resolution mass spectrometer capable of detecting low-abundance biomarkers in single-cell proteomics studies, launched at a Boston-based proteogenomics summit.

The U.S. life science tools market is intensely competitive, with numerous players offering innovative products. These companies are constantly broadening their product portfolios and introducing new platforms through rigorous R&D to maintain their market position. In addition, strategic actions by leading firms, such as collaborations, mergers, acquisitions, and product launches, are driving market growth and heightening competition. For example, Agilent Technologies, Inc. formed a partnership with Biosciences, Inc. in February 2022 to integrate the AVITI System with SureSelect target enrichment panels, enhancing customer access to genomic tools. This initiative is anticipated to open new growth avenues for the company.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Life Science Tools market.

By Technology

- Genomic Technology

- Proteomics Technology

- Cell Biology Technology

- Other Analytical & Sample Preparation Technology

- Lab Supplies & Technologies

By Product

- Cell Culture Systems & 3D Cell Culture

- Instruments

- Consumables

- Cell & Tissue Culture Services

- Liquid Chromatography

- Instruments

- Consumables

- Services

- Mass Spectrometry

- Instruments

- Consumables

- Services

- Flow Cytometry

- Instruments

- Consumables

- Services

- Cloning & Genome Engineering

- Kits, Reagents, and Consumables

- Services

- Microscopy & Electron Microscopy

- Instruments

- Consumables

- Services

- Next Generation Sequencing

- Instruments

- Consumables

- Services

- PCR & qPCR

- Instruments

- Consumables

- Services

- Nucleic Acid Preparation

- Instruments

- Consumables

- Services

- Nucleic Acid Microarray

- Instruments

- Consumables

- Services

- Sanger Sequencing

- Instruments

- Consumables

- Services

- Transfection Devices & Gene Delivery Technologies

- Equipment

- Reagents

- NMR

- Instruments

- Consumables

- Services

- Other Separation Technologies

- Instruments

- Consumables

- Services

- Other Products & Services

- Antibodies

- General Supplies

- Others

- Instruments

- Consumables

- Services

By End-use

- Government & Academic

- Biopharmaceutical Company

- Healthcare

- Industrial Applications

- Others