U.S. Ligation Devices Market Size and Research

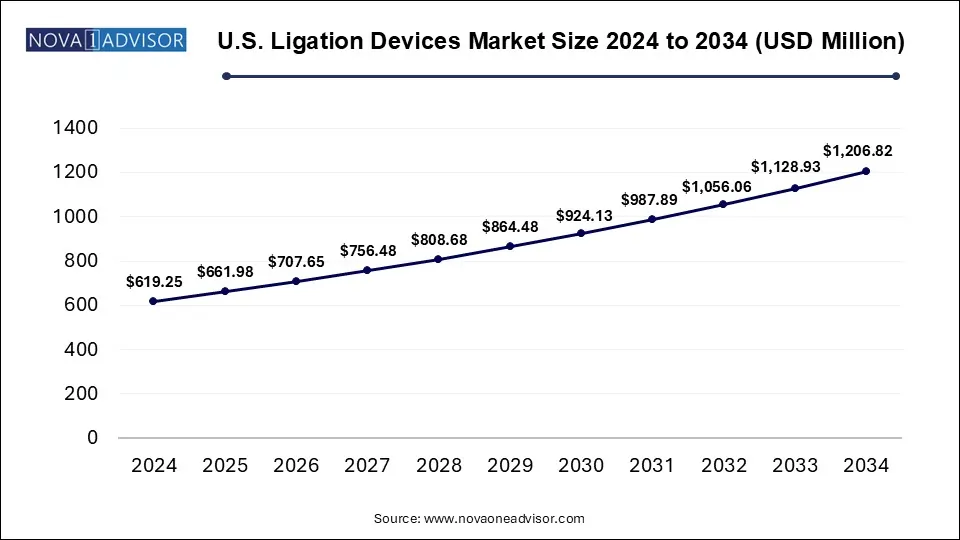

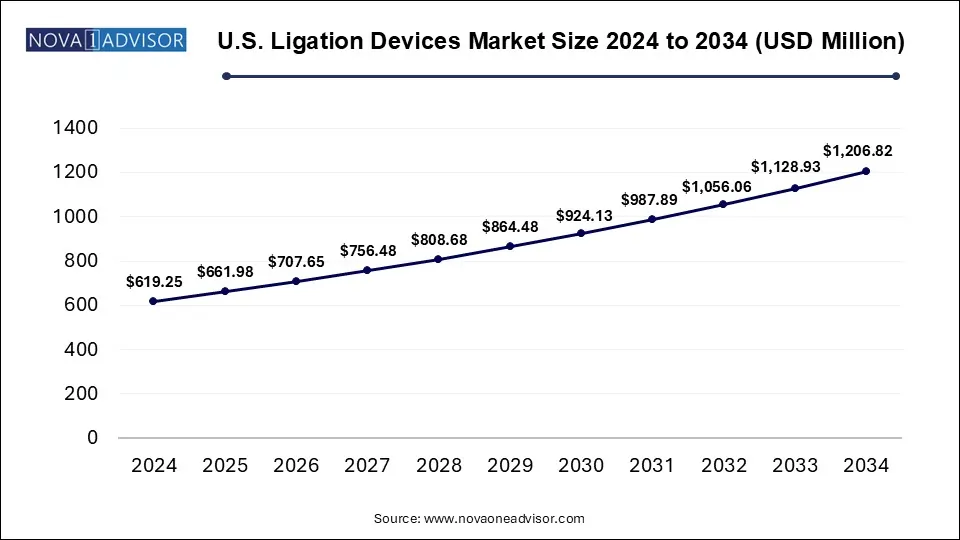

The U.S. Ligation Devices Market size was exhibited at USD 619.25 million in 2024 and is projected to hit around USD 1,206.82 million by 2034, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

Key Takeaways:

- Accessories held the highest revenue share in 2024, contributing 68% to the overall market.

- In 2024, the gastrointestinal and abdominal segment led the market, securing a 30.0% revenue share.

- Minimally invasive surgeries (MIS) dominated the market landscape in 2024, capturing an 89% share.

- Hospitals represented the largest portion of the market in 2024, with a 68% share of total revenue.

Market Overview

The U.S. ligation devices market has evolved into a vital component of surgical practice, with applications spanning from general surgeries to highly specialized procedures. These devices, which include clip appliers, clips, and other accessories, are critical for sealing blood vessels or ducts during surgical interventions, minimizing bleeding and improving surgical efficiency. The surge in demand for minimally invasive surgeries (MIS), increasing rates of chronic illnesses requiring surgical management, and technological advancements in device design have all played pivotal roles in shaping the trajectory of this market.

The market’s growth is underpinned by a robust surgical infrastructure in the United States, a high frequency of elective and emergency surgical procedures, and continued investment in advanced surgical tools. For example, procedures such as laparoscopic cholecystectomy or bariatric surgery frequently employ ligation devices to ensure precision and minimize intraoperative blood loss. Furthermore, ligation devices are a mainstay in gynecological surgeries such as hysterectomies and oophorectomies, where secure closure of vessels is crucial.

The pandemic also brought renewed focus to hospital preparedness, which included upgrading surgical suites with disposable instruments to reduce cross-contamination risks. As healthcare providers continue to prioritize patient safety, the adoption of single-use ligation products is growing particularly in ambulatory surgical centers (ASCs) and outpatient facilities.

Major Trends in the Market

-

Rise in Minimally Invasive and Robotic Surgeries: Surgeons increasingly favor MIS approaches, particularly laparoscopic and robot-assisted procedures, which require advanced ligation tools.

-

Increased Adoption of Disposable Appliers: Infection control protocols are pushing demand for disposable clip appliers in hospitals and ASCs.

-

Device Integration and Multi-functionality: New ligation devices are being designed with integrated clipping, cutting, and sealing features.

-

Growing Use in Bariatric and Urological Procedures: Rising obesity and urological disorders are expanding surgical volumes, thereby boosting ligation device consumption.

-

Surge in ASCs and Daycare Surgeries: The trend toward outpatient procedures increases the need for compact, efficient, and disposable surgical tools.

-

Eco-friendly Innovations: Manufacturers are exploring recyclable or biodegradable clip materials in response to hospital sustainability initiatives.

Report Scope of U.S. Ligation Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 661.98 Million |

| Market Size by 2034 |

USD 1,206.82 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 6.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Procedure, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Medtronic plc; Johnson & Johnson (Ethicon Inc.); Teleflex Inc.; B. Braun Melsungen AG; Olympus Corporation; Boston Scientific Corporation; ConMed Corporation; Applied Medical Resources Corp.; Wexler Surgical; Medical Disposables Corp. |

Market Driver

Growing Preference for Minimally Invasive Surgery (MIS)

The most powerful driver of the U.S. ligation devices market is the accelerating shift toward minimally invasive surgical procedures. Laparoscopic and robotic-assisted techniques now dominate in fields such as gastrointestinal, gynecological, and urological surgery, due to their reduced recovery time, lower infection rates, and less postoperative pain. These procedures require precise vessel control within confined anatomical spaces making high-quality ligation tools indispensable. Ligation devices provide surgeons the ability to occlude vessels securely without excessive thermal spread or bleeding, which is especially critical in delicate robotic procedures. As more hospitals and ASCs invest in MIS platforms, the associated demand for compatible and efficient ligation systems continues to rise.

Market Restraint

Cost Concerns and Limited Reusability in Budget-Constrained Settings

While technological improvements enhance surgical precision, they often come with increased costs. Disposable appliers and high-performance clip systems can be prohibitively expensive for smaller healthcare facilities and outpatient clinics. The upfront expense of robotic-compatible instruments or advanced reusable clip systems may strain procurement budgets, especially in non-urban hospitals with limited funding. Additionally, reusable devices require stringent sterilization protocols and incur maintenance costs, which may limit their adoption where support infrastructure is insufficient. These factors can hinder broad-scale adoption, despite clinical efficacy.

Market Opportunity

Technological Innovation in Smart and Multi-functional Devices

There is a significant opportunity in the development of ligation devices that incorporate sensors, advanced ergonomic design, or multi-functionality such as clipping, cauterizing, and tissue dissection in one tool. For instance, a device that automatically alerts surgeons about incomplete closure or misplacement could greatly enhance surgical safety. As operating rooms across the U.S. move toward digital and AI-supported workflows, the integration of ligation tools with robotic arms or real-time surgical analytics platforms can drive next-level precision. Companies that successfully combine clinical reliability with ease of use, reduced procedure time, and digital integration are poised to capture emerging demand.

Segmental Analysis

By Product Outlook

The accessories segment captured the highest revenue share in 2024, accounting for 68% of the total market.

Accessories such as clips and clip removers form the operational core of ligation procedures. Their widespread application across multiple surgical specialties including gastrointestinal, gynecological, and vascular surgeries makes them essential and high-volume consumables. Titanium and polymer clips dominate due to their biocompatibility, strength, and secure closure. Hospitals and surgical centers routinely stock a broad range of clip sizes and types to cater to varying procedural needs. Additionally, growing awareness of clip safety, along with enhancements in locking mechanisms, has further propelled demand.

Among accessories, clips have dominated due to their critical function in vessel sealing. Meanwhile, clip removers are gaining traction as hospitals prioritize postoperative retrieval or adjustments. Surgeons also value high-precision clip removers in complex revision surgeries. As innovations improve both the efficacy and ease of use of these accessories, particularly for MIS applications, their market adoption is anticipated to accelerate even further over the next decade.

By Appliers

Disposable appliers held the largest market share in 2024, driven by infection control standards and ease of use.

With rising regulatory and infection control mandates, particularly post-COVID-19, the use of disposable clip appliers has surged in hospitals and outpatient surgery centers. These devices reduce the risk of cross-contamination, eliminate the need for sterilization, and offer greater surgical readiness. Their utility is especially high in ASCs and in emergency surgeries where rapid device availability is vital. Disposable appliers are also increasingly engineered for precision placement and ergonomic control, meeting the preferences of new-generation surgeons.

Reusable appliers, on the other hand, are projected to grow steadily, particularly in high-volume hospital settings. Despite the need for sterilization, they provide cost efficiency over long-term use. Premium versions now feature replaceable cartridges and modular heads, which add versatility while minimizing recurring expenses. As sustainability in healthcare gains focus, reusable models with durable, autoclavable materials are also likely to see renewed interest.

By Application Outlook

The gastrointestinal and abdominal segment was the top contributor in 2024, accounting for 30% of market revenue.

Surgical procedures involving the gastrointestinal tract—such as appendectomies, hernia repairs, and colectomies frequently require vessel ligation and tissue sealing. As obesity and colorectal cancer rates rise in the U.S., GI procedures are growing in frequency. Ligation devices play a key role in laparoscopic GI surgeries by ensuring minimal blood loss and improving surgical outcomes. As hospitals expand their advanced endoscopy and laparoscopic units, this segment remains central to device consumption.

The gynecological segment is expected to grow at a rapid pace, driven by increasing procedures like hysterectomies, myomectomies, and ovarian cystectomies. Female reproductive surgeries frequently involve ligation of uterine arteries or adnexal vessels, where precision is critical. With robotic and laparoscopic gynecological surgeries gaining preference, the need for compatible, compact, and ergonomic ligation systems is accelerating.

By Procedure Outlook

Minimally invasive surgeries (MIS) dominated the market with an 89% share in 2024.

The shift toward MIS procedures especially laparoscopic and robotic-assisted techniques has redefined the utility and design of ligation devices. These surgeries demand tools that are compact, flexible, and precise. For instance, laparoscopic cholecystectomy and robotic prostatectomy rely heavily on efficient vessel ligation within limited anatomical spaces. Surgeons require tools that enhance visibility, tactile feedback, and sealing strength all of which modern ligation devices are now engineered to deliver.

Within MIS, robotic-assisted procedures are the fastest-growing sub-segment, due to increased robotic system adoption across U.S. hospitals. These systems need specialized ligation instruments compatible with robotic arms, often equipped with enhanced articulation and control. As more institutions adopt surgical robots like the da Vinci system, the demand for high-tech ligation instruments with seamless robotic integration is poised to surge.

By End Use Outlook

Hospitals led the market in 2024, accounting for 68% of total revenue.

As primary providers of both emergency and elective surgical care, hospitals are the largest consumers of ligation devices. They manage a diverse range of surgeries and require a comprehensive inventory of both reusable and disposable ligation tools. High surgical throughput, advanced MIS capabilities, and access to robotic systems position hospitals as the central hub for ligation device deployment. Institutional purchasing contracts and bulk procurement practices also make hospitals a lucrative target market for manufacturers.

Ambulatory Surgical Centers (ASCs) are anticipated to be the fastest-growing end-use segment, supported by the rise of outpatient and day surgeries. Procedures once limited to hospitals are now routinely performed in ASCs, which prioritize disposable, easy-to-use instruments that reduce turnaround times. Their lower cost structure and increasing reimbursement support for MIS are boosting device consumption. As more procedures shift to outpatient settings, device manufacturers are developing compact, intuitive tools tailored for ASC workflows.

Country-Level Analysis: United States

The United States represents a highly mature and innovation-driven market for ligation devices. With an extensive network of hospitals, surgical centers, and outpatient clinics, the country supports a diverse range of surgical specialties. Moreover, high surgical awareness, robust reimbursement systems, and aggressive adoption of minimally invasive and robotic surgeries ensure consistent demand for ligation instruments.

States such as California, Texas, and New York lead in surgical volumes, while institutions like Mayo Clinic, Cleveland Clinic, and Johns Hopkins are at the forefront of MIS innovation. Academic hospitals and private centers continue to test advanced ligation systems, often setting new clinical benchmarks. Furthermore, the country’s aging population and rising chronic disease burden underscore long-term procedural growth, particularly in urology, bariatrics, and GI.

Some of The Prominent Players in The U.S. Ligation Devices Market Include:

- Medtronic plc

- Johnson & Johnson (Ethicon Inc.)

- Teleflex Inc.

- B. Braun Melsungen AG

- Olympus Corporation

- Boston Scientific Corporation

- ConMed Corporation

- Applied Medical Resources Corp.

- Wexler Surgical

- Medical Disposables Corp.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Ligation Devices Market.

By Product

By Application

- Gastrointestinal and abdominal

- Gynecological

- Cardiothoracic

- Urological

- Bariatric

- Vascular

- Other

By Procedure

- Minimally Invasive Surgery

-

- Laparoscopic

- Robotic Assisted

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Others