U.S. Livestock Monitoring Market Size and Growth 2025 to 2034

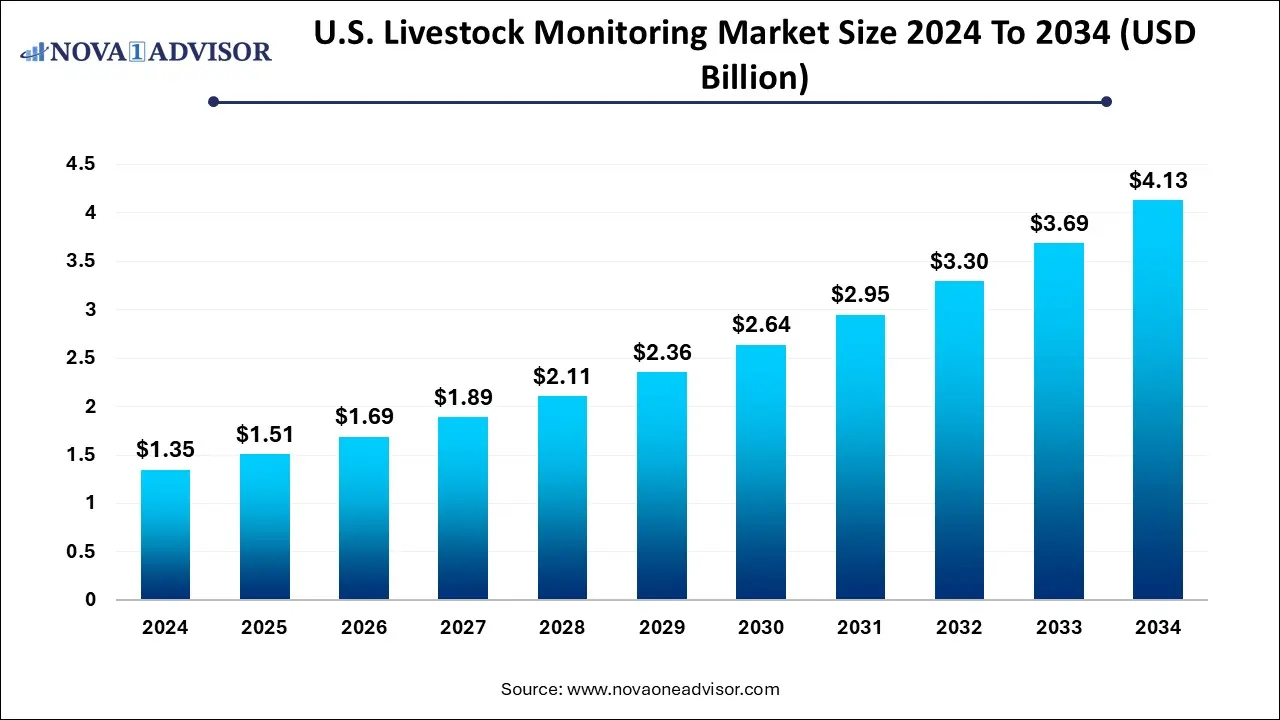

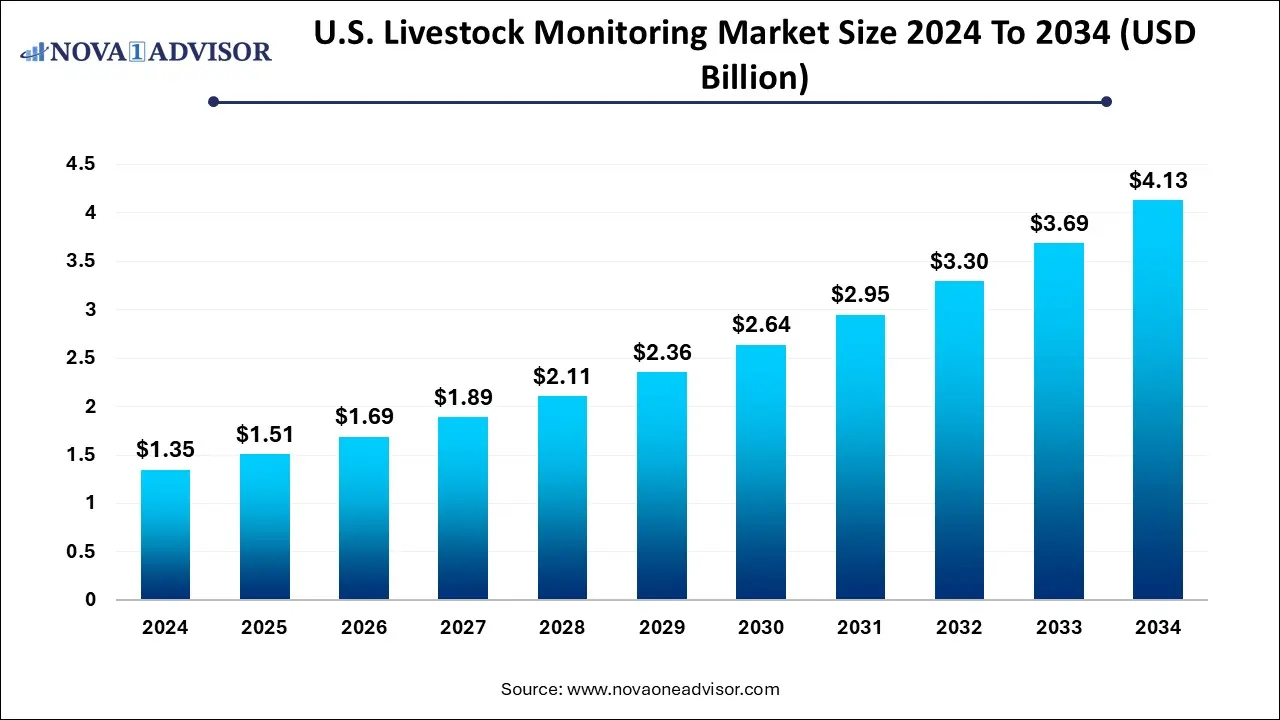

The U.S. livestock monitoring market size is estimated at USD 1.35 billion in 2024 and is anticipated to reach around USD 4.13 billion by 2034, expanding at a CAGR of 11.83% from 2024 to 2034.

U.S. Livestock Monitoring Market Key Takeaways

- By component, the hardware segment led the market in 2024.

- By component, the software segment is expected to grow at the fastest rate during the forecast period.

- By animal type, the bovine segment dominated the market in 2024.

- By animal type, the poultry segment is observed to grow at the fastest rate during the forecast period.

- By end user, the dairy segment led the market with the largest share in 2024.

- By end user, the meat segment is expected to grow at the fastest rate during the forecast period.

Market Summary

The livestock monitoring market in the U.S. is growing at a significant rate, driven by the increasing focus on animal health and welfare, technological advancements in health management systems, the emergence of predictive farming practices, innovative strategies, robust government initiatives and sustainability goals.

The livestock monitoring market’s growth and development is currently driven by advancements in technology and increasing awareness regarding animal welfare. The integration of Internet of Things (IoT) devices, artificial intelligence and data analytics is further influencing how livestock can be effectively managed. Farmers and ranchers are increasingly adopting these new technologies to enhance productivity, monitor health and optimize feeding practices. This shift is seen not only improving operational efficiency but is also contributing to sustainable farming practices.

What is Livestock Monitoring?

Livestock management, which is also known as precision livestock farming is a way to analyze and check the wellbeing of livestock, most often cattle. Keeping track of farm animals and other livestock is a necessary concept due to the expanding scale of the livestock business. The integration of advanced technology provides farmers with data-driven insights into their animals' health, behavior, and performance. This allows for improved breeding practices, optimized feeding and early disease detection. It also builds consumer confidence in the quality and safety of meat and dairy products.

What are the Key Trends in the Market?

- The growing global emphasis on animal health and welfare has prompted consumers and regulatory bodies to push for better living conditions and proactive health management, driving market growth.

- Technological advancements have enabled the development of more advanced livestock monitoring solutions that provide real-time, actionable insights, fueling market expansion.

- Growing emphasis on improving farm efficiency is projected to provide several market opportunities in the coming years.

- Moreover, there is a growing emphasis on animal welfare and health. Livestock monitoring systems help farmers detect diseases early, monitor animal behavior, and ensure better living conditions, aligning with animal welfare regulations and consumer expectations.

- Innovations in IoT, AI, and data analytics have made livestock monitoring more efficient. Technologies such as RFID tags, GPS tracking, and wearable sensors allow farmers to monitor the health, location, and productivity of their livestock in real-time.

What is the Impact of Ai in this field?

AI technologies are revolutionizing livestock monitoring by enabling real-time health tracking, behavior analysis, and predictive disease management, ultimately enhancing animal welfare and farm productivity.

These advancements enable precise, continuous health monitoring and predictive insights, helping producers optimize herd management and proactively mitigate disease risks. Even in remote livestock regions, real-time data collecting has become feasible owing to advances in connectivity options, which encourage early intervention and lower losses. The advancement driven by technology places livestock monitoring in the U.S. at the forefront of highly efficient, welfare-focused, and sustainable farming practices.

Another factor pushing predictive practices forward is regulatory pressure and market demand. Consumers increasingly expect transparency around animal welfare, traceability, and food safety. Producers who show minimized disease outbreaks, fewer antibiotic interventions, and more precise resource use gain a competitive advantage. Predictive monitoring tools enable reporting and assurance.

Report Scope of U.S. Livestock Monitoring Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.51 Billion |

| Market Size by 2034 |

USD 4.13 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.83% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Component, By Animal, By End Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

DeLaval, Affimilk Ltd., BouMatic, Merck & Co., Inc. (Allflex), Zoetis, Lely, Moocall, GEA Group Aktiengesellschaft, Fullwood JOZ, Dairymaster |

Market Dynamics

Driver

Increasing Focus on Animal Health and Sustainability

A significant driver of the livestock monitoring market development is the growing global emphasis on animal health and welfare. Consumers and regulatory bodies are increasingly concerned about the well-being of livestock, pushing for better living conditions and proactive health management. Livestock monitoring technologies play a crucial role in achieving these standards by enabling continuous observation of animals, facilitating early detection of diseases, injuries, or distress. Healthy and well-cared-for animals are more productive.

Sustainability is becoming a central theme in the Livestock Monitoring Market, as stakeholders recognize the environmental impact of livestock farming. There is a growing emphasis on practices that reduce carbon footprints and promote resource efficiency. Monitoring technologies that track feed efficiency, waste management, and overall environmental impact are gaining traction. As consumers and regulators alike push for more sustainable practices, the demand for innovative monitoring solutions is likely to grow, further propelling the Livestock Monitoring Market.

Restraint

High Capital Investment

In addition, high capital investment combined with a fragmented agriculture industry, an inability to determine hygienic conditions, and a lack of a favorable reimbursement scenario in developing and underdeveloped economies will pose additional challenges for the market. Furthermore, the lack of strong network infrastructure in remote communities, as well as a lack of standardization for data processing and data aggregation, will stymie market growth.

Opportunity

Technological Advancements

The Livestock Monitoring Market is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of livestock management. Innovations such as IoT devices, wearable sensors, and advanced data analytics are becoming increasingly prevalent. These technologies enable farmers to monitor animal health, behavior, and location in real-time, leading to improved decision-making. As farmers seek to optimize their operations, the integration of these advanced technologies is likely to drive growth in the Livestock Monitoring Market.

U.S. livestock producers have been increasingly embracing predictive farming, leveraging sensor technologies, data analytics, and automation to anticipate issues rather than react. Real-time monitoring through environmental sensing and wearable sensors is the foundation of predictive farming. Vital indicators, behavioral changes, feed intake, reproductive cycles, and movement patterns are all monitored via devices. These sensors capture data all the time, which is then used by computers to predict any health problems, make the best use of feed and resources, and plan maintenance or remedies before losses happen. The referenced analysis highlight that such capabilities like predicting illness, optimizing breeding windows, minimizing stress allow farmers to reduce waste, improve animal welfare, and increase yield.

Segmental Analysis

By Component Insights

Which component dominated the market in 2024?

The hardware segment dominated the market with the largest share in 2024, the use is expected to increase agricultural productivity and lessen farmers' difficulties, which will increase output. Hardware technology is safe for both the environment and animals, which appeals to many farmers who raise cattle. Sensors, GPS, and other devices are further divided into sub-segments within the hardware sector.

Over the projected period, the software segment is anticipated to develop at the quickest pace of 18.2%. The software element is made up of a collection of bundled software programmes that can be used to monitor livestock. These programmes' user interfaces, features, and functions are linked. Software is being used by several businesses to make collecting livestock data easier.

By Animal Insights

Which animal segment led the market as of this year?

Bovine segment held the largest revenue share of 46.35% in 2024 and is expected to grow at the fastest rate over the forecast period. This is mainly due to the high economic value and scale of dairy and beef operations. Large herd sizes in commercial farms necessitate continuous health, reproduction, and nutrition monitoring to maintain productivity and profitability. Since bovines are particularly susceptible to metabolic diseases, mastitis, and reproductive problems, early identification of diseases and predictive monitoring are extremely important. Technology adoption in cattle is additionally driven by regulatory compliance, which includes requirements for digital tracking and traceability.

Due to the widespread consumption of chicken products around the world, the poultry segment is anticipated to experience the highest growth rate over the projection period. Additionally, it is anticipated that an increasing population would increase demand for poultry products. The daily high consumption of poultry products is a significant driver of this market's expansion. The demand for animal health and monitoring has increased due to the strong demand for poultry products and the growing consumer awareness of high-quality products.

By End User Insights

Which end user held the largest market share in 2024?

The dairy segment dominated the U.S. livestock monitoring market estimates and forecasts, generating the largest revenue share due to dairy farms' high economic value and operational intensity. Monitoring milk yield, cow health, reproduction, and nutrition is critical for maximizing productivity and maintaining herd welfare. Dairy operations increasingly rely on IoT-enabled sensors, automated milking systems, and predictive analytics to optimize efficiency and reduce losses. Adoption of technology is further impacted by consumer demand for superior dairy products, traceability, and regulatory compliance. All of these aspects combine to make the dairy industry the market leader for livestock monitoring.

The meat segment is emerging as the fastest-growing category in the livestock monitoring market. This is primarily because of the need for efficient herd management and the growing demand for meat products like beef and pork. In order to monitor animal health, growth rates, and feed efficiency, producers are increasingly utilizing wearable devices, IoT-enabled sensors, and predictive analytics. The profitability is directly influenced by real-time insights that assist in preventing disease outbreaks, lower mortality, and improving slaughter preparedness. Further driving the adoption of technology in meat-focused operations are consumer expectations regarding welfare and traceability, as well as regulatory compliance.

Some of The Prominent Players in The U.S. Livestock Monitoring Market:

- DeLaval

- Affimilk Ltd.

- BouMatic

- Merck & Co., Inc. (Allflex)

- Zoetis

- Lely

- Moocall

- GEA Group Aktiengesellschaft

- Fullwood JOZ

- Dairymaster

Recent Developments

- April 2024 – Merck Animal Health introduced its SENSEHUB® Dairy Youngstock system, providing 24/7 monitoring for calves from birth through the first 12 months using ear-tag sensors and behavior analytics.

- October 2024 – Merck Animal Health launched SENSEHUB® Cow Calf, a remote monitoring solution targeted at cow/calf producers using AI/ear-tag sensors to detect estrus and reproductive issues in beef operations.

- July 2025 – Allflex (U.S.) unveiled a new line of wearable monitoring devices for livestock, aimed at improving realâ€time behavior and health tracking in large-scale operations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. livestock monitoring market.

By Component

- Services

- Integration & Deployment

- Maintenance & Support

- Others

By Animal

- Bovine

- Poultry

- Swine

- Others

By End Use