U.S. Long Term Care Market Size and Trends

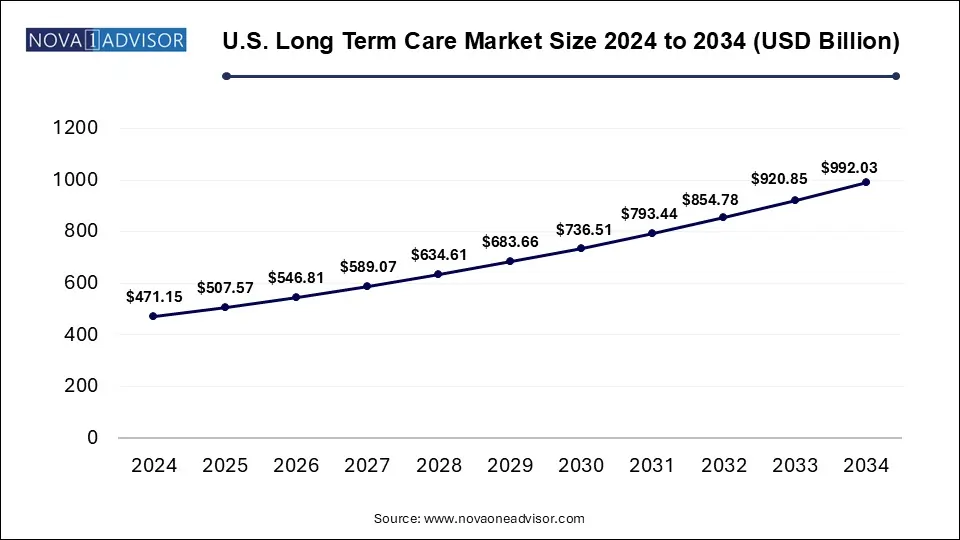

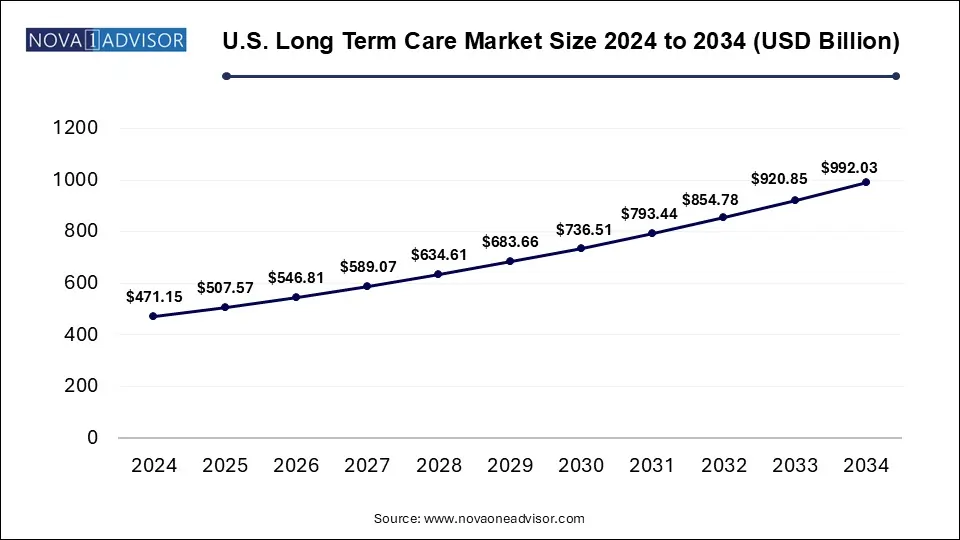

The U.S. long term care market size was exhibited at USD 471.15 billion in 2024 and is projected to hit around USD 992.03 billion by 2034, growing at a CAGR of 7.73% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the nursing care segment accounted for the highest share of revenue, contributing 35.48% to the market.

- The public payer segment emerged as the leading revenue contributor in 2024, representing 66.06% of the total market share.

Market Overview

The U.S. Long Term Care (LTC) market plays a critical role in the healthcare continuum, addressing the needs of individuals with chronic illnesses, disabilities, or conditions requiring extended care over months or years. As of 2025, the market continues to experience notable expansion due to an aging population, growing incidences of age-related disorders such as Alzheimer’s and Parkinson’s, and increasing life expectancy. Long term care encompasses a range of services including medical and non-medical assistance, ranging from home health care and assisted living to hospice and skilled nursing care.

According to data from the U.S. Census Bureau, by 2030, over 73 million Americans will be aged 65 and above nearly 20% of the total population. This demographic shift underpins the growing demand for long-term care services. With a considerable portion of care being delivered in home-based or community-oriented settings, the market is also witnessing a paradigm shift from traditional institutional care toward patient-centric models supported by technology and personalized services.

In financial terms, the U.S. long term care market is valued in the hundreds of billions and is poised for robust growth. The interplay of public health policy reforms, private insurance innovation, and increased consumer awareness is reshaping the competitive landscape. As stakeholders invest in care quality, workforce training, and digital infrastructure, the market is transitioning into a more integrated and resilient segment of the broader healthcare ecosystem.

Major Trends in the Market

-

Shift Toward Home-Based and Community-Based Services: Patients increasingly prefer to receive care in home-like environments, prompting service providers to develop flexible and technology-enabled home care solutions.

-

Adoption of Telehealth and Remote Monitoring: The COVID-19 pandemic accelerated digital health integration, with LTC providers investing in telehealth to monitor patients, reduce hospital readmissions, and improve outcomes.

-

Workforce Shortage Challenges: Chronic staffing issues especially with registered nurses (RNs), certified nursing assistants (CNAs), and geriatric caregivers are driving the need for automation, training incentives, and workforce development programs.

-

Rise in Memory Care Services: With increasing cases of dementia and Alzheimer’s disease, dedicated memory care units are being developed within assisted living and nursing facilities.

-

Growth of Value-Based Care Models: Payers are incentivizing outcomes over volume, pushing LTC providers to demonstrate efficacy, reduce unnecessary utilization, and improve patient satisfaction.

-

Private Equity Investment Surge: Investors are recognizing long-term care as a stable revenue opportunity, with many private equity firms acquiring or funding regional home health chains and assisted living networks.

-

Consumer Demand for Aging-in-Place Solutions: Smart home technologies and personal emergency response systems (PERS) are gaining traction among aging individuals who wish to remain independent while being safe.

Report Scope of U.S. Long Term Care Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 507.57 Billion |

| Market Size by 2034 |

USD 992.03 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.73% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service, Payer |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Brookdale Senior Living, Inc.; Sunrise Senior Living, LLC; Kindred Healthcare; Amedisys, Inc.; Genesis Healthcare, Inc.; Capital Senior Living Corporation; Diversicare Healthcare Services, Inc.; Home Instead, Inc.; Senior Care Centerz; Atria’s Senior Living |

Key Market Driver: Aging Demographics and Chronic Disease Burden

One of the most impactful drivers of the U.S. long term care market is the rapidly aging population. The Baby Boomer generation (those born between 1946 and 1964) is now entering the age bracket most likely to require long-term care services. This cohort not only represents a substantial demographic share but is also more likely to live longer due to medical advancements, further increasing the duration and intensity of care required.

Compounding the demographic trend is the prevalence of chronic illnesses. According to the Centers for Disease Control and Prevention (CDC), approximately 85% of older adults have at least one chronic health condition, and 60% have two or more. Conditions such as cardiovascular disease, arthritis, and diabetes often necessitate sustained care, sometimes involving skilled nursing, rehabilitation, or palliative support. The convergence of these factors exerts upward pressure on both demand and cost, prompting stakeholders to expand capacity and explore new care models to meet these evolving needs.

Key Market Restraint: High Cost of Long-Term Care Services

Despite increasing demand, the cost of long-term care services remains a significant barrier. Nursing home care can exceed $100,000 annually for a private room, while assisted living costs can range between $4,000 and $7,000 per month depending on location and service level. Home health services, though often more affordable, also require a cumulative financial commitment over time.

These costs are often not fully covered by Medicare, leaving individuals reliant on Medicaid, private insurance, or out-of-pocket payments. For middle-income seniors who do not qualify for Medicaid and do not have long-term care insurance, access to quality care becomes difficult. Additionally, inflationary pressures and labor shortages have pushed up operational costs for service providers, who often pass these increases onto consumers.

The affordability crisis in long-term care underscores the need for systemic policy reform, new financial instruments (e.g., hybrid life-LTC insurance), and scalable, cost-effective service delivery models.

Key Market Opportunity: Technological Integration to Enhance Care Efficiency

Technology presents a significant opportunity to enhance the efficiency, quality, and personalization of long-term care. From AI-powered patient monitoring systems to wearable devices and electronic health records (EHR), digital innovations are enabling real-time decision-making and better care coordination.

For instance, remote patient monitoring tools can track vitals and detect falls, allowing quicker intervention and reducing hospitalizations. Platforms like Honor and CarePredict integrate caregiver scheduling, analytics, and alerts into a single dashboard, streamlining operations and improving family communication.

Moreover, virtual reality (VR) is being introduced in memory care for cognitive stimulation, while robotic process automation (RPA) is helping administrators manage billing and documentation. As interoperability standards improve, LTC providers that embrace technology will likely gain a competitive edge by delivering higher-quality outcomes at lower costs.

Segmental Analysis

Service Outlook

Nursing Care Dominated the Market in 2024 Due to High Acuity Needs and Institutional Capacity.

Nursing care remains the backbone of the U.S. long-term care ecosystem, accounting for the largest share in revenue. This segment includes skilled nursing facilities (SNFs) that provide 24/7 medical supervision, post-acute care, and complex chronic care management. It caters to patients recovering from surgeries, strokes, or managing severe comorbidities. Regulatory oversight and structured reimbursement pathways via Medicaid and Medicare also contribute to the segment’s scale and consistency. Notable players such as Genesis HealthCare and Life Care Centers of America continue to invest in facility expansion and staff training to maintain clinical quality and compliance.

Home Health Care is the Fastest Growing Segment as Consumers Demand Personalized In-Home Services.

The home health care segment is projected to experience the highest growth during the forecast period. Consumers increasingly seek alternatives to institutional care that provide autonomy and familiarity. Services include wound care, medication management, physical therapy, and assistance with daily living activities. Technological advancements like remote monitoring and mobile health apps are enhancing the scope and reliability of in-home care. Companies such as LHC Group and Amedisys have expanded their geographical footprint and capabilities, signaling strong investor and patient confidence in this delivery model.

Payer Outlook

Public Payers (Primarily Medicaid) Dominate the U.S. Long Term Care Funding Landscape.

Public funding, especially through Medicaid, is the dominant payer in the long term care market. Medicaid accounts for more than half of total LTC expenditures in the U.S., particularly for lower-income individuals and those requiring institutional care. The dual-eligible population (covered by both Medicare and Medicaid) is a key target group, often representing the highest-need cases. States administer Medicaid waivers to support home and community-based services (HCBS), which are expanding under programs like Money Follows the Person. The federal government’s continued support has helped stabilize public funding despite budgetary pressures.

Out-of-Pocket Payments are the Fastest Growing Due to Inadequate Insurance Coverage.

Out-of-pocket expenses are growing as more individuals exhaust their Medicare limits or lack long-term care insurance. The rise in consumer-directed care, combined with gaps in public funding and private insurance uptake, has placed greater financial responsibility on individuals and families. The trend is especially notable in the assisted living and home care segments, where services are typically not covered by Medicare and only partially covered by Medicaid in select states. This shift is pushing middle-income consumers to explore new financing solutions, including reverse mortgages, annuities, and health savings accounts (HSAs).

Country-Level Analysis: United States

The U.S. long term care market reflects significant regional variation in cost, regulation, and service availability. States like California, New York, and Florida lead in the number of licensed LTC facilities, driven by large senior populations. However, rural areas across the Midwest and South are experiencing critical access shortages, compounded by healthcare workforce deficits and limited funding.

Medicaid expansion under the Affordable Care Act (ACA) has facilitated access to LTC services in certain states, but disparities persist in waiver utilization and HCBS infrastructure. The U.S. Department of Health and Human Services (HHS) continues to incentivize states to rebalance their systems from institutional to community-based care. On the legislative front, the U.S. Congress has debated various proposals, including tax credits for family caregivers and incentives for LTC insurance adoption, but comprehensive reforms remain pending.

Some of The Prominent Players in The U.S. long term care market Include:

- Brookdale Senior Living, Inc

- Sunrise Senior Living, LLC

- Kindred Healthcare

- Amedisys, Inc

- Genesis Healthcare, Inc

- Capital Senior Living Corporation

- Diversicare Healthcare Services, Inc

- Home Instead, Inc.

- Senior Care Centerz

- Atria’s Senior Living

Recent Developments

-

Amedisys and Optum Merger Talks (April 2025): Amedisys, a leading home health and hospice provider, advanced its merger discussions with Optum, a division of UnitedHealth Group. The deal is expected to enhance Optum's value-based care capabilities by integrating Amedisys’ in-home clinical services into its broader care ecosystem.

-

Brookdale Senior Living Launches Memory Care Training Program (March 2025): In response to the growing demand for dementia care, Brookdale launched a comprehensive training initiative for its staff to improve patient engagement and safety across its memory care communities.

-

LHC Group Expands into Rural Markets (February 2025): To address LTC disparities, LHC Group announced its acquisition of five smaller home health agencies in underserved rural regions, aiming to bridge care gaps and increase patient volume.

-

Genesis HealthCare Deploys AI-Powered EHR (January 2025): Genesis integrated an artificial intelligence-driven electronic health record system designed to optimize care plans and flag patient deterioration risks in real-time.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. long term care market.

By Service

- Home health care

- Hospices

- Nursing care

- Assisted living facilities

- Others

By Payer

- Public

- Private

- Out-of-Pocket