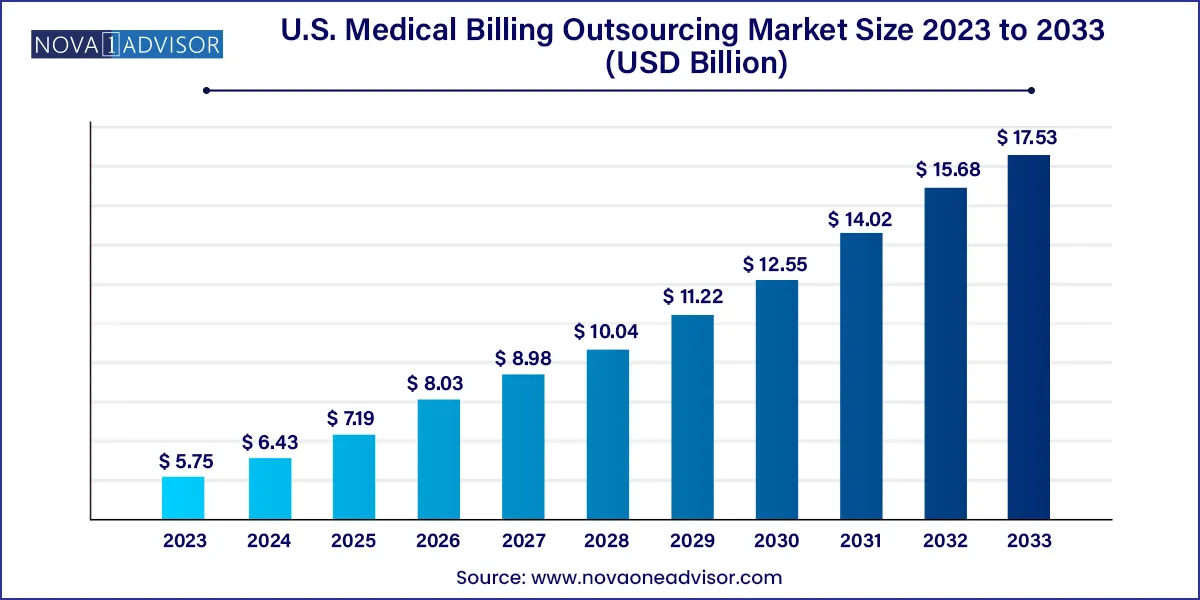

The U.S. medical billing outsourcing market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 17.53 billion by 2033, growing at a CAGR of 11.79% during the forecast period 2024 to 2033.

Key Takeaways:

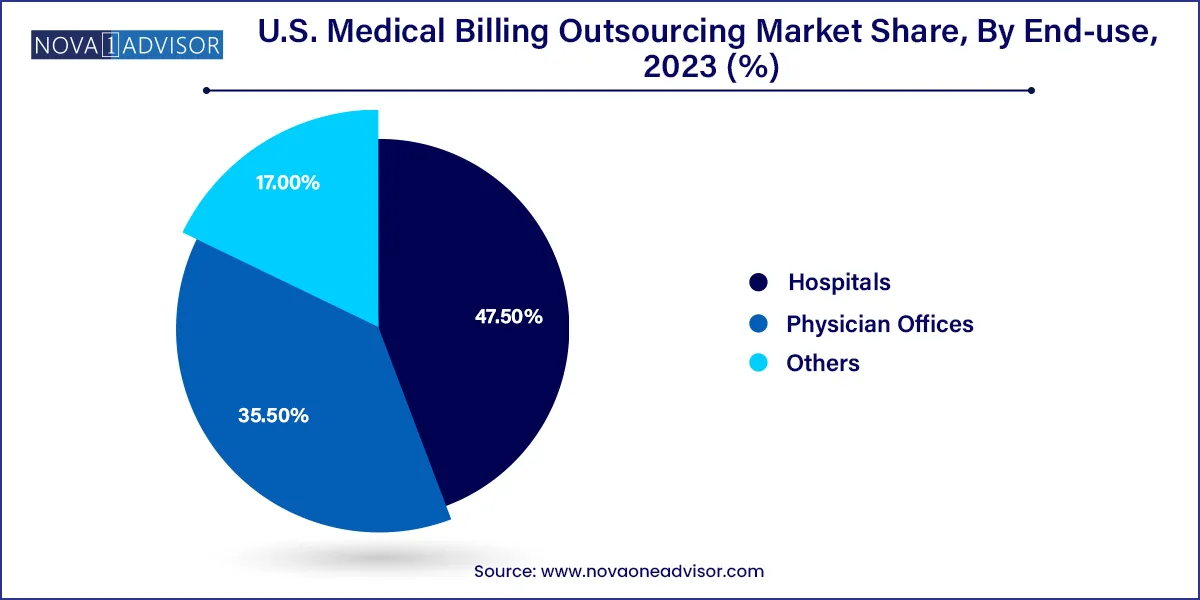

- Based on end-use, the hospital segment accounted for the largest revenue share of 47.50% in 2023.

- Physician offices segment is projected to witness substantial growth during the forecast period.

- The outsourced segment held the largest revenue share of over 57% in 2023 and is expected to register the fastest growth over the forecast period.

- The front-end services segment dominated the market with a revenue share of over 38% in 2023.

Market Overview

The U.S. Medical Billing Outsourcing Market is a crucial segment of the healthcare revenue cycle management (RCM) ecosystem. It refers to the practice of healthcare providers outsourcing administrative processes related to patient billing, coding, claims management, and reimbursement handling to third-party specialized agencies. These services ensure that providers receive timely and accurate payments from insurance companies, government payers, and patients.

In the U.S., the billing process is exceptionally complex due to a fragmented payer environment comprising Medicare, Medicaid, commercial insurance, and private payers, all with distinct requirements. In such a scenario, outsourcing medical billing helps mitigate administrative burdens, reduce errors, accelerate cash flow, and ensure compliance with frequently changing federal and state healthcare regulations.

Over the past decade, as healthcare delivery has evolved towards value-based care models, the need for optimized revenue cycle operations has grown exponentially. Smaller practices, solo physicians, and even mid-size hospitals are now turning to external vendors to handle front-end (patient registration, eligibility verification), middle-end (coding, charge entry), and back-end (claims submission, denial management) functions.

The U.S. is uniquely positioned for this outsourcing growth due to several factors: high operational costs, stringent regulatory compliance requirements (e.g., HIPAA), frequent coding changes (such as ICD-10/11), and increasing emphasis on financial sustainability in healthcare delivery. Amid physician burnout and administrative overheads, outsourcing has emerged as a strategic necessity rather than a mere cost-cutting measure.

Major Trends in the Market

-

AI and Automation Integration in Billing Services

Companies are incorporating robotic process automation (RPA), machine learning, and predictive analytics to streamline claims processing and reduce human error.

-

Rising Demand from Independent Physician Offices

Solo practices and small clinics are outsourcing to focus on patient care while avoiding complex administrative burdens.

-

Shift Toward Cloud-Based RCM Platforms

Vendors are offering scalable, secure, cloud-based billing systems to support real-time claim tracking, remote access, and data security.

-

Growing Popularity of End-to-End Revenue Cycle Management

Clients increasingly seek full-service offerings, including credentialing, compliance audits, coding, and payment reconciliation.

-

Emphasis on Compliance and Data Security

Outsourcing firms are strengthening their HIPAA-compliant infrastructure and investing in cybersecurity to manage sensitive patient and financial data.

-

Adoption of Performance-Based Pricing Models

Outsourcing contracts are shifting toward pay-per-performance models, aligning vendor incentives with client revenue goals.

-

Increased Demand Post-COVID-19 for Billing Flexibility

The pandemic exposed gaps in in-house billing capacity and accelerated the migration to third-party services.

Report Scope of The U.S. Medical Billing Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.43 Billion |

| Market Size by 2033 |

USD 17.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.79% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Service, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

R1RCM Inc.; Veradigm LLC (Allscripts Healthcare, LLC); Oracle (Cerner Corporation); eClinicalWorks; Kareo, Inc.; McKesson Corporation; Quest Diagnostics Incorporated; Promantra Inc.; AdvancedMD, Inc. |

Market Driver – Cost Efficiency and Operational Optimization

The most significant driver for the U.S. medical billing outsourcing market is the pursuit of cost efficiency coupled with operational optimization. Maintaining an in-house billing team requires investments in training, salaries, compliance certification, software upgrades, and error management all of which increase the overhead burden for healthcare providers. For small to mid-sized organizations, this often means sacrificing profitability or clinical capacity.

Outsourcing allows providers to tap into expertise at scale, access trained coding professionals, and stay updated on regulatory changes without internal resource strain. Billing vendors use dedicated teams and advanced technologies to ensure quicker claim submission, lower denial rates, and better follow-up on delayed or rejected claims. This improves overall cash flow, reduces days in accounts receivable, and enhances patient satisfaction through transparent, accurate billing.

For example, a multi-specialty practice in Chicago that outsourced its RCM functions to a leading vendor reported a 25% reduction in claim rejections and a 17% improvement in net collections within a year. Such outcomes are increasingly drawing hospitals and clinics towards outsourcing to remain financially viable while focusing on core healthcare delivery.

Market Restraint – Data Security and Patient Privacy Concerns

Despite its advantages, medical billing outsourcing also presents a key challenge: data security and patient privacy risks. Medical billing involves the exchange of highly sensitive data, including personal identifiers, insurance details, clinical records, and financial transactions. Any breach in data handling can lead to HIPAA violations, legal penalties, and reputational damage.

While top-tier outsourcing firms maintain robust cybersecurity protocols and compliance certifications, smaller or offshore vendors may lag in implementing advanced firewalls, encryption, intrusion detection systems, and real-time monitoring. Moreover, outsourcing introduces third-party access points to the provider’s digital infrastructure, increasing the attack surface for cybercriminals.

In recent years, healthcare has become the number one industry targeted by ransomware attacks in the U.S., and medical billing platforms are among the most vulnerable endpoints. This has made providers cautious, especially in choosing offshore or mid-tier vendors. Data security concerns, therefore, remain a major restraint for full-scale outsourcing adoption, especially in highly regulated specialties like oncology and mental health services.

Market Opportunity – Technological Integration in Billing Operations

One of the most promising opportunities in the U.S. medical billing outsourcing market is the integration of emerging technologies, particularly AI, machine learning, blockchain, and predictive analytics. Traditional billing processes have long suffered from human errors in coding, delayed submissions, and poor denial management. Now, the use of intelligent automation is poised to change the game.

AI-powered billing engines can identify incomplete or incorrect data in real time before submission, reducing denials. Machine learning algorithms can predict denial patterns based on payer behavior, enabling preemptive interventions. Blockchain, though still in early adoption, offers a secure, immutable ledger for billing transactions and patient history, enhancing trust and transparency.

Leading vendors are already piloting smart dashboards, which give providers insights into collection trends, payer performance, and patient balances—all in real time. These innovations not only increase billing accuracy and reduce cycle times but also enable strategic decision-making for healthcare administrators. As digital adoption deepens in the post-COVID era, outsourcing firms that offer tech-integrated, value-added services stand to gain significantly.

U.S. Medical Billing Outsourcing Market By End-use Insights

Hospitals are the largest end-users of medical billing outsourcing in the U.S., accounting for the majority share in terms of revenue. Given the sheer complexity of hospital billing which includes a mix of inpatient, outpatient, emergency, and specialty services outsourcing becomes a necessity. Hospitals must process thousands of claims daily across different departments and payer types. External vendors offer streamlined services and leverage bulk processing tools that minimize revenue leakage. In the wake of shrinking margins and rising staffing shortages, hospitals increasingly outsource full-cycle RCM to maintain financial health.

Physician offices are the fastest-growing end-user segment, especially among solo practitioners and small group practices. These providers often lack dedicated billing staff and rely on part-time or shared administrative resources. With the growing complexity of CPT and ICD coding systems, many are now turning to affordable cloud-based outsourcing services that handle everything from claim submission to follow-up. Moreover, the COVID-19 pandemic pushed several independent practices to reconsider their internal operations, leading to increased outsourcing adoption. Affordable pricing, better compliance, and simplified workflow management are driving this segment’s expansion.

U.S. Medical Billing Outsourcing Market By Component Insights

Outsourced medical billing services dominate the market, as providers increasingly shift away from in-house management to specialized third-party vendors. The rising complexity of coding guidelines, reimbursement models, and insurance verification processes has made outsourcing a practical and efficient solution. Third-party vendors offer scalable solutions tailored to the size and needs of the provider whether it’s a single physician clinic or a multi-hospital system. This flexibility, along with access to trained personnel and the latest billing software, makes outsourced billing preferable for many healthcare organizations.

In-house billing is declining but remains relevant, especially among large academic health systems and integrated delivery networks (IDNs) that have the scale and budget to support internal RCM teams. These institutions often use advanced in-house software and employ certified medical coders and billers. However, many are still outsourcing parts of their revenue cycle such as denial management or credentialing—through a hybrid model. Despite its benefits in terms of control, in-house billing suffers from higher costs, staffing challenges, and frequent training needs due to regulation updates.

U.S. Medical Billing Outsourcing Market By Service Insights

Back-end services dominate the outsourced billing services market, encompassing crucial tasks such as claims submission, denial management, payment posting, collections, and reconciliation. These are the most labor-intensive and time-consuming processes, making them ideal for outsourcing. Efficient back-end services ensure that providers are paid faster and that claims are not lost or delayed in the system. High-volume institutions such as hospitals and surgery centers benefit significantly from back-end outsourcing due to the scale of their operations.

Front-end and middle-end services are the fastest-growing, particularly with the increasing adoption of comprehensive end-to-end RCM outsourcing. Front-end services such as insurance eligibility verification, patient registration, and prior authorization are critical in preventing claim denials at later stages. Meanwhile, middle-end services including coding, charge entry, and documentation review are benefiting from AI-powered tools that automate error detection and improve accuracy. As more providers recognize the benefits of early-cycle interventions in improving cash flow, front- and middle-end service outsourcing is expected to grow rapidly.

Country-Level Analysis – United States Focus

The U.S. medical billing outsourcing market is unique in its complexity and size, driven by a multi-payer reimbursement system, shifting regulatory landscape, and immense technological investment. Key industry dynamics include:

-

Widespread private insurance usage, which varies from state to state and necessitates billing customization.

-

Federal mandates, including HIPAA, MACRA, and the No Surprises Act, which require expert handling by billing partners.

-

Widespread use of Medicare Advantage and Medicaid Managed Care, which adds layers of payer-specific rules.

Major cities like Los Angeles, Houston, New York, and Miami serve as hubs for billing vendors due to the high concentration of healthcare providers. However, smaller cities and rural practices are increasingly accessing outsourced solutions via cloud-based platforms. Across the country, the need for efficient, secure, and scalable medical billing is becoming uniform, making the U.S. a highly fertile ground for outsourcing firms offering standardized but customizable solutions.

Some of the prominent players in the U.S. medical billing outsourcing market include:

- R1RCM Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- Oracle (Cerner Corporation)

- eClinicalWorks

- Kareo, Inc.

- McKesson Corporation

- Quest Diagnostics

- Promantra Inc.

- AdvancedMD, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical billing outsourcing market.

Component

Service

- Front-end services

- Middle-end services

- Back-end services

End-use

- Hospitals

- Physician Offices

- Others