U.S. Medical Coding Market Size, Growth Trends 2026 to 2035

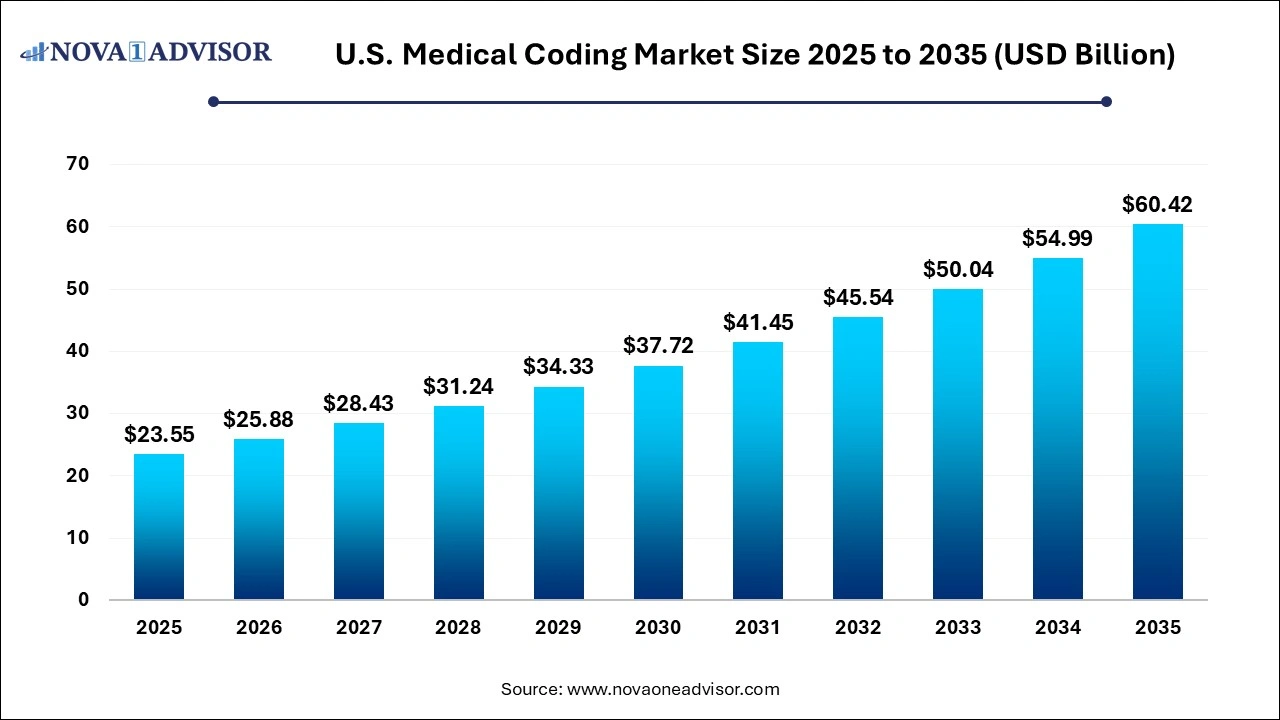

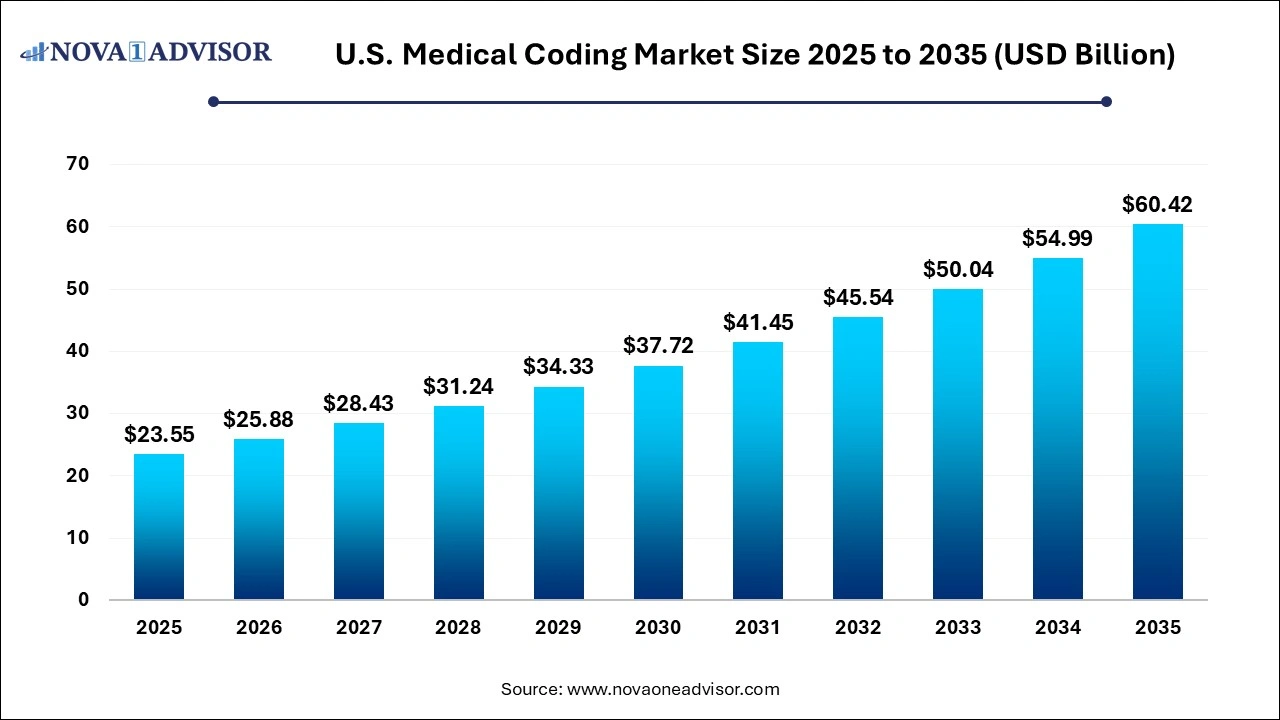

The U.S. medical coding market size was exhibited at USD 98.98 billion in 2025 and is projected to hit around USD 60.42 billion by 2035, growing at a CAGR of 9.88% during the forecast period 2026 to 2035.

Key Takeaways:

- ICD held the highest revenue share of 69.4% in the market in 2025 owing to the growing use of ICD codes by coders.

- CPT is estimated to be the fastest-growing segment during the forecast period.

- The others segment accounted for over 49.6% of the market revenue share in 2025.

- However, the cardiology segment is expected to witness lucrative growth over the forecast period.

- The outsourced segment accounted for the highest revenue share of 69.4% in 2025 and is estimated to be the fastest-growing segment during the forecast period.

- The in-house segment is estimated to have a steady growth during the forecast period.

U.S. Medical Coding Market Overview

The U.S. medical coding market stands as a foundational pillar of the healthcare revenue cycle, ensuring that clinical services, diagnoses, and procedures are accurately translated into universally understood alphanumeric codes. These codes are essential not only for billing and insurance reimbursement but also for maintaining compliance with federal regulations, conducting public health research, and analyzing clinical outcomes. With the ever-growing complexity of healthcare services and payer requirements, the role of medical coding has transitioned from a back-office task to a strategic function that influences financial performance and operational efficiency.

Medical coding in the U.S. is governed by standardized classification systems like ICD (International Classification of Diseases), CPT (Current Procedural Terminology), and HCPCS (Healthcare Common Procedure Coding System). Coders are responsible for ensuring that documentation provided by healthcare professionals is interpreted correctly and coded in a manner that meets regulatory standards and payer expectations. These functions are increasingly supported by technological solutions such as computer-assisted coding (CAC), AI-driven coding analytics, and EHR (Electronic Health Record) integrations.

Several factors contribute to the growth of the U.S. medical coding market, including rising healthcare expenditure, increasing patient volumes, the need for accurate reimbursement, and the growing demand for outsourced coding services. Moreover, the shift toward value-based care and population health management adds further complexity to the coding process, necessitating specialized expertise and continuous education.

Post-pandemic, hospitals, physician groups, and payers have intensified their focus on cost-efficiency and compliance, leading to a surge in demand for certified coders and end-to-end coding solutions. As coding errors can result in claim denials, delayed payments, and legal penalties, providers are investing more heavily in both human and tech-driven coding services. This dynamic ecosystem presents immense opportunities for innovation, specialization, and service model transformation.

Major Trends in the U.S. Medical Coding Market

-

Surge in Outsourced Coding Services: Providers are increasingly outsourcing medical coding to third-party specialists to manage staffing shortages, cost pressure, and scalability challenges.

-

Rise of AI and Automation: Computer-assisted coding (CAC) and artificial intelligence (AI) tools are transforming the speed, accuracy, and consistency of coding operations.

-

Increased Complexity Due to ICD-11 Transition Planning: While the U.S. is currently on ICD-10, stakeholders are beginning to prepare for the future ICD-11 transition, which will increase coder training needs and system overhauls.

-

Growth in Specialty-Specific Coding Demand: Complex specialties such as oncology, cardiology, and emergency services are seeing increased need for certified coders due to evolving procedures and coding nuances.

-

Emphasis on Coding Compliance and Audit Preparedness: With the rise in payer audits and federal scrutiny, healthcare organizations are investing in compliance programs to reduce error rates and avoid reimbursement risks.

-

Remote and Offshore Coding Models Expansion: The proliferation of remote work has enabled a surge in offshore and hybrid coding models, driven by labor cost advantages and improved connectivity.

-

Increased Integration with RCM and EHR Platforms: Coding services are being bundled into broader revenue cycle management (RCM) and EHR ecosystems to create seamless clinical-to-financial workflows.

Report Scope of The U.S. Medical Coding Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 85.63 Billion |

| Market Size by 2035 |

USD 60.42 Billion |

| Growth Rate From 2025 to 2035 |

CAGR of 9.88% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Classification System, Component, Medical Specialty |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

StarTek; Oracle; Maxim Healthcare Services; Parexel International Corporation; Aviacode Inc.; Verisk Analytics, Inc.; Medical Record Associates, LLC. |

Market Driver: Rising Healthcare Expenditure and Claim Volumes

One of the most compelling drivers of the U.S. medical coding market is the growing healthcare expenditure and the corresponding rise in medical claims processing. The Centers for Medicare & Medicaid Services (CMS) reported that national healthcare spending reached approximately $4.5 trillion in 2023, representing a substantial portion of the U.S. GDP. This ballooning cost is driven by chronic disease prevalence, increased access to healthcare, and a growing aging population.

Every patient interaction—from routine checkups to surgical interventions generates documentation that must be meticulously coded. As patient volumes increase, the demand for accurate, compliant coding grows in tandem. Furthermore, with value-based reimbursement models gaining traction, providers are now incentivized not only to bill correctly but also to ensure that coded data reflects the quality and outcomes of care. This intensifies the demand for experienced coders and advanced coding platforms that minimize claim denials and maximize revenue integrity.

Market Restraint: Skilled Workforce Shortages and Training Gaps

Despite high demand, the U.S. faces a critical shortage of skilled and certified medical coders, which remains a key restraint on market growth. Medical coding requires a deep understanding of anatomy, clinical terminology, payer rules, and constantly evolving codebooks. Becoming proficient often involves certification through organizations like the AAPC or AHIMA, which requires significant training and examination.

However, many healthcare institutions struggle to recruit and retain coders, particularly those with specialty-specific experience. Additionally, ongoing education is essential due to frequent updates in coding guidelines, payer rules, and regulatory compliance mandates. Smaller clinics and rural hospitals are particularly impacted by these shortages, often relying on overworked internal staff or inconsistent outsourced solutions. Without sufficient talent, healthcare providers face coding delays, compliance risks, and revenue loss.

U.S. Medical Coding Market By Classification System Insights

ICD held the highest revenue share of 69.4% in the market in 2025 owing to the growing use of ICD codes by coders. ICD 11 which was effective from 1st January 2023 is accurate and flexible. It allows health information to be utilized for multiple applications such as enhancement in patient outcomes; quality analysis; safety; integrated care; strategic planning; population health reporting; and delivery of health care services. The ICD 11 codes are easy to use. It allows the embedding of the coding tool into local digital records and information technology systems. This results in an increase in user compliance, as well as lowered cost & time for training. Multiple ICD codes and multiple revisions to suit the rapidly evolving health industry is driving the segment growth.

CPT is estimated to be the fastest-growing segment during the forecast period. CPT codes are a part of HCPCS codes. They are used for describing tests, surgery, and other procedures. They are used for medical billing. The government tracks the CPT codes for assessing disease prevalence and health spending. HCPS codes are used by Medicaid, Medicare, and third-party insurers. Usage of HCPCS codes is mandatory under the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. This in turn is driving its adoption.

Market Opportunity: Integration of AI-Driven Coding and Analytics

An exciting opportunity within the U.S. medical coding landscape lies in the integration of artificial intelligence (AI), natural language processing (NLP), and advanced analytics into coding workflows. AI can process vast amounts of unstructured clinical data to identify relevant information for accurate coding. When coupled with NLP, these tools can interpret clinical notes, identify diagnoses and procedures, and recommend appropriate codes with remarkable speed.

Tech-enabled platforms like 3M CodeFinder and Optum360 are revolutionizing coding accuracy and productivity. These tools not only reduce turnaround times but also help identify under-coded or over-coded cases, providing real-time insights that improve both compliance and revenue. As EHR adoption becomes universal, the ability to embed AI-powered coding within digital workflows presents a scalable solution to workforce shortages and growing documentation demands. Startups and established tech players are racing to develop platforms that integrate seamlessly with provider systems—positioning technology as a transformative force in the future of medical coding.

U.S. Medical Coding Market By Medical Specialty Insights

Radiology coding dominates the specialty segment due to the sheer volume and diversity of imaging procedures performed daily across the country. From CT scans to MRIs and ultrasounds, each modality requires detailed interpretation and specific CPT and ICD codes. Coders working in radiology must be adept at understanding complex procedures and anatomy across all body systems. The use of teleradiology and PACS (Picture Archiving and Communication Systems) has further increased the workload, making radiology a consistent demand center for skilled coders.

On the other hand, oncology coding is emerging as the fastest-growing segment, propelled by the rise in cancer incidence, evolving treatment protocols, and reimbursement complexities. Oncology coding involves tracking chemotherapy administration, radiation therapy, surgical oncology, and targeted biologic treatments—each with its own coding intricacies. The emergence of precision medicine and personalized cancer therapies adds an extra layer of coding complexity, requiring specialized knowledge and updated training. As cancer care becomes more outpatient-based and multidisciplinary, oncology coding services are expanding to meet both payer and provider needs.

U.S. Medical Coding Market By Component Insights

The outsourced coding segment currently dominates the U.S. market, driven by the need for cost-efficiency, scalability, and access to specialized expertise. Healthcare providers are partnering with third-party firms and BPO companies to manage their coding workloads, especially for high-volume specialties like emergency medicine and radiology. Outsourcing allows organizations to reduce in-house staffing needs, lower overhead, and improve turnaround times. Many firms offer full-cycle coding solutions that include coding audits, quality assurance, and denial management.

Offshore medical coding services are growing at the fastest rate, particularly from countries like India and the Philippines. These services offer certified coders at significantly lower costs, supported by strong training infrastructure and round-the-clock operations. Advances in secure remote access, HIPAA-compliant cloud platforms, and AI-enabled coding systems are helping mitigate traditional concerns over data security and accuracy. As economic pressures mount, offshore partnerships are becoming increasingly attractive to large hospital systems and revenue cycle management companies.

Offshore medical coding services are growing at the fastest rate, particularly from countries like India and the Philippines. These services offer certified coders at significantly lower costs, supported by strong training infrastructure and round-the-clock operations. Advances in secure remote access, HIPAA-compliant cloud platforms, and AI-enabled coding systems are helping mitigate traditional concerns over data security and accuracy. As economic pressures mount, offshore partnerships are becoming increasingly attractive to large hospital systems and revenue cycle management companies.

Country-Level Analysis: United States

Within the U.S., the medical coding ecosystem is shaped by payer policies, federal regulations, and the digital transformation of healthcare. The implementation of the Affordable Care Act (ACA), HIPAA, and the HITECH Act has pushed providers to adopt standardized coding systems, integrate digital workflows, and maintain audit readiness. Medicare and Medicaid remain central to shaping reimbursement policies, particularly for CPT and HCPCS codes, with frequent updates issued by CMS.

The U.S. Department of Health and Human Services (HHS), in collaboration with AHA and AMA, continues to issue coding guidance and compliance alerts, especially in light of telehealth expansion and COVID-19-related services. Professional organizations like the AAPC and AHIMA have introduced updated certifications and continuing education programs to meet evolving coding demands.

With the growing burden of chronic disease and increased regulatory oversight, hospitals and physician groups are investing in coding audits, quality assurance, and analytics. Large health systems such as Kaiser Permanente, HCA Healthcare, and Mayo Clinic are adopting integrated RCM platforms that blend coding, billing, and analytics into a seamless ecosystem. Furthermore, technology vendors and coding service providers are consolidating to offer end-to-end coding and documentation solutions—making the U.S. a hotspot for innovation and investment in medical coding.

Some of the prominent players in the U.S. medical coding market include:

Recent Developments

-

April 2024 – Omega Healthcare Acquires Vasta Global to Expand U.S. Coding Operations: Omega Healthcare, a major provider of healthcare outsourcing services, acquired Vasta Global to enhance its medical coding and RCM service offerings in the U.S. market.

-

March 2024 – Aviacode Launches AI-Based Coding Audit Tool: Aviacode introduced a new tool using AI and NLP to automate medical coding audits and identify compliance gaps in real time, aiming to reduce denial rates and increase coding accuracy.

-

February 2024 – The AAPC Expands Coding Certification Programs: The AAPC announced new specialty certifications in oncology and cardiology coding to address the growing demand for subspecialty-trained coders.

-

January 2024 – 3M Health Information Systems Enhances CAC Platform: 3M launched updates to its CodeFinder tool, integrating advanced NLP to better support outpatient and emergency medicine coding environments.

-

December 2023 – Change Healthcare Adds AI Layer to Coding Workflow Platform: Change Healthcare integrated machine learning capabilities into its coding suite to support predictive error checking and enhanced coder productivity.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global U.S. medical coding market.

Classification System

Component

- In-house

- Outsourced

- Onshore

- Offshore

Medical Specialty

- Oncology

- Cardiology

- Anesthesia

- Radiology

- Pathology

- Pain Management

- Emergency Services

- Others

Offshore medical coding services are growing at the fastest rate, particularly from countries like India and the Philippines. These services offer certified coders at significantly lower costs, supported by strong training infrastructure and round-the-clock operations. Advances in secure remote access, HIPAA-compliant cloud platforms, and AI-enabled coding systems are helping mitigate traditional concerns over data security and accuracy. As economic pressures mount, offshore partnerships are becoming increasingly attractive to large hospital systems and revenue cycle management companies.

Offshore medical coding services are growing at the fastest rate, particularly from countries like India and the Philippines. These services offer certified coders at significantly lower costs, supported by strong training infrastructure and round-the-clock operations. Advances in secure remote access, HIPAA-compliant cloud platforms, and AI-enabled coding systems are helping mitigate traditional concerns over data security and accuracy. As economic pressures mount, offshore partnerships are becoming increasingly attractive to large hospital systems and revenue cycle management companies.