U.S. Medical Device Contract Manufacturing Market Size and Trends 2026 to 2035

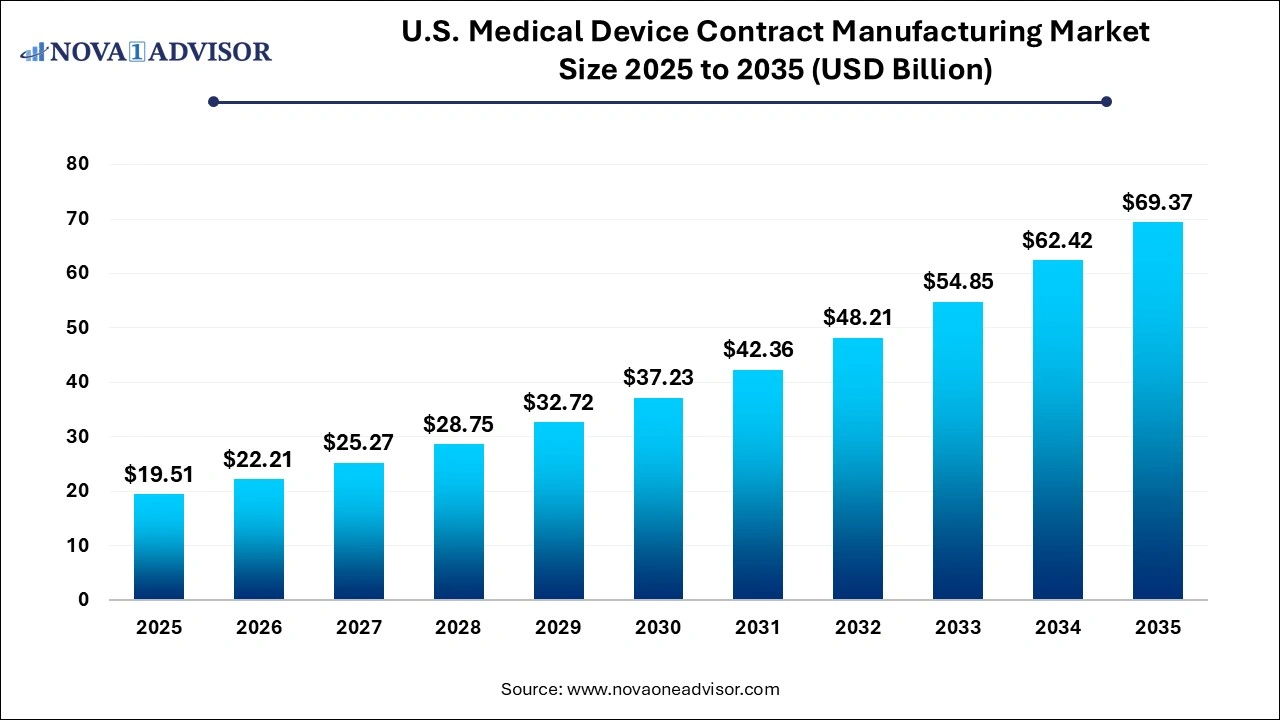

The U.S. medical device contract manufacturing market size is reached at USD 19.51 billion in 2025, grows to USD 22.21 billion in 2026, and is projected to reach around USD 69.37 billion by 2035, growing at a CAGR of 13.52% from 2026 to 2035. The U.S. medical device contract manufacturing market growth is driven by the increasing demand for medical device technologies, rising trend of outsourcing production and innovative service offerings launched by contract manufacturers.

U.S. Medical Device Contract Manufacturing Market Key Takeaways

- By product, the class II segment dominated the market with the largest share in 2025.

- By product, the class I segment is expected to show the fastest growth over the forecast period.

- By services, the accessory manufacturing segment held the largest market share in 2025.

- By services, the device manufacturing segment is expected to register fastest growth during the forecast period.

- By therapeutic area, the cardiovascular devices segment captured the largest market share in 2025.

- By therapeutic area, the surgical instrument segment is expected to show the fastest growth during the forecast period.

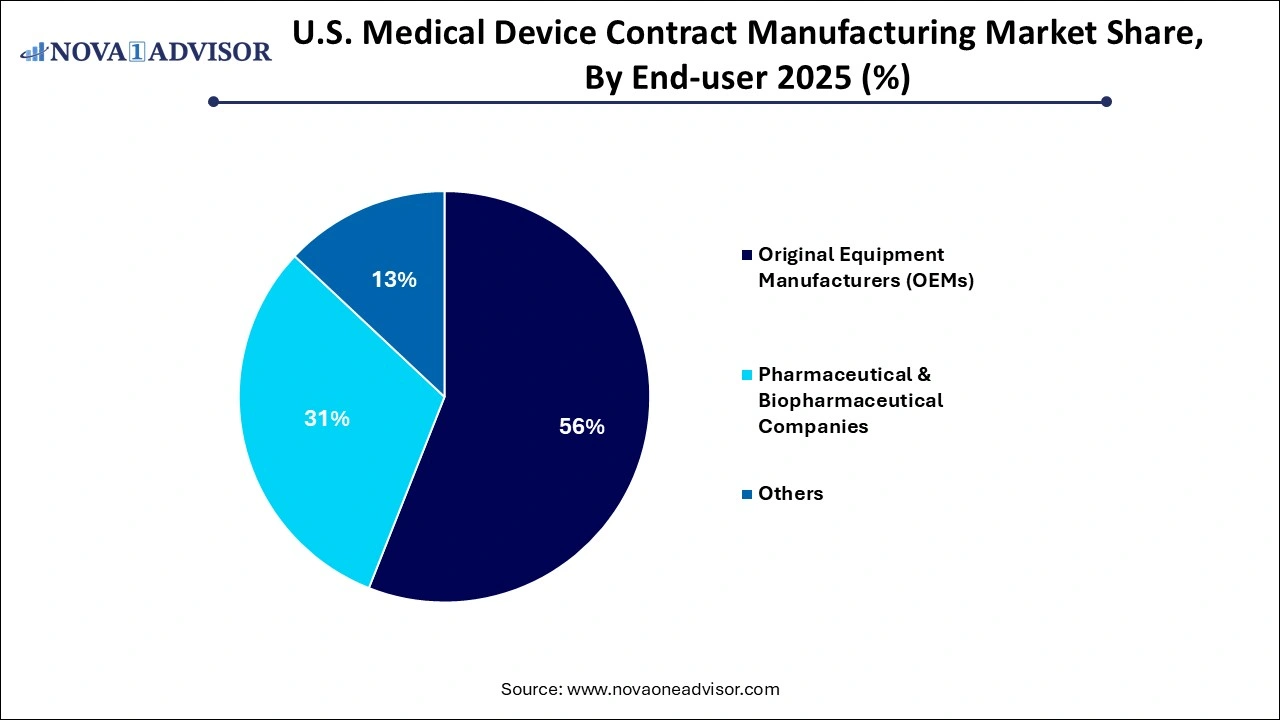

- By end use, the original equipment manufacturers segment generated the highest market revenue in 2025.

- By end use, the pharmaceutical and biopharmaceutical companies’ segment is expected register the fastest CAGR over the forecast period.

What Drives the Growth of the U.S. Medical Device Contract Manufacturing Market?

Medical device contract manufacturing refers to outsourcing production outsourcing of medical devices or components to specialized contract manufacturing service providers. Several advantages offered by medical device contract manufacturers such as access to specialized expertise, cost savings, enhanced regulatory compliance, and accelerated product development and commercialization of medical devices are driving their adoption throughout the U.S. Continuous advancements in medical device manufacturing technologies, increased outsourcing trend, rising complexity of medical devices, need for addressing unmet needs and stringent regulations are driving the growth of the U.S. medical device contract manufacturing market.

What are the Key Trends in the U.S. Medical Device Contract Manufacturing Market in 2025?

- In May 2025, Boyd Biomedical disclosed a new divisional structure, Design by Boyd, Build by Boyd, and Launch by Boyd for its company with the launch of new facility in Waltham, Massachusetts. The new division will provide with medical device design and development services for biomedical innovators seeking commercialization of novel biomedical devices.

- In April 2025, Confluent Medical Technologies, a leading contract manufacturer in medical device and materials science specializing in polymer and metal components, launched the strongest polymide tubing in the industry, Ultra Polymide which offers twice strength of traditional polymide, further enabling design flexibility and improved performance for medical device manufacturers.

Artificial intelligence (AI) integration in U.S. medical device contract manufacturing is enhancing workflows, leading to the development of more efficient and superior personalized medical devices. Input parameters such as material properties and dimensions can be analyzed with AI algorithms for generating several optimized design alternatives, further enabling rapid prototyping and accelerating design phase. AI-powered digital twins are enabling virtual prototyping for simulation and analysis of product performances in virtual environments. Image recognition and data analysis software integrated with AI can potentially enhance quality control processes in manufacturing.

Report Scope of U.S. Medical Device Contract Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 22.21 Billion |

| Market Size by 2035 |

USD 69.37 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.79% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Services, Therapeutic Area, End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Celestica HealthTech, Flex Ltd.'s U.S, Forefront Medical Technology, Integer Holdings Corporation, Jabil Inc., Nortech Systems, Phillips-Medisize (a Molex company), Sanmina Corporation, Sonic Healthcare, Terumo Corporation., TE Connectivity, Viant Medical, WuXi AppTec, Inc. |

Market Dynamics

Drivers

Medical Device Complexity

Incorporation of advanced technologies such as AI, Internet of Things (IoT), miniaturization, sophisticated sensors and robotics in medical devices is increasing their manufacturing complexity, further creating the demand for advanced manufacturing infrastructure with cutting-edge equipment, specialized expertise and cleanroom facilities. Several original equipment manufacturers (OEMs) lack the necessary infrastructure and specialized capabilities for manufacturing medical devices which drives the adoption of contract manufacturing services offering affordable and efficient services with regulatory assurance.

Restraints

Demanding Regulatory Environment

Stringent regulations imposed by the U.S. Food and Drug Administration (FDA) for approval processes of medical devices can potentially launch of innovative products, further limiting patient access to treatments. High costs associated with regulatory compliance such as testing, quality control systems and documentation processes can lead to rise in operational expenses, decreased profitability and competitive disadvantages, especially for small contract manufacturers.

Opportunities

Rising Outsourcing Trend

Original equipment manufacturers (OEMs) of medical devices are actively seeking outsourcing services for different stages of product development and manufacturing. Accelerated time-to-market with reduced in-house manufacturing costs and access to specialized expertise are creating a continuous demand for contract manufacturers offering comprehensive solutions. Furthermore, Contract Manufacturing Organizations (CMOs) are expanding their services and offering end-to-end solutions such as from product design and engineering to post-market support which fuels the market expansion.

Segmental Insights

What Drives Class II Segment’s Dominance in the Market in 2025?

By product, the class II segment held the largest market share in 2025. Class II medical devices such as diagnostic imaging systems, infusion pump, powered wheelchairs, and glucose monitoring devices among many others are considered moderate to high risk and mostly require a 510 (k) premarket notification to the Food and Drug Administration (FDA). Contract manufacturers offer expertise and services for designing, development and production of complex medical devices for companies while ensuring regulatory compliance with FDA’s 21 CFR Part 820 (Quality System Regulation) guidelines. Rising chronic disease burden, increasing demand for wearable and home healthcare devices, and adoption of advanced manufacturing technologies such as automation and 3D printing are driving the market growth.

By product, the class I segment is expected to register the fastest growth over the forecast period. Class I medical devices are classified under low-risk category which include bandages, surgical masks, tongue depressors, stethoscopes among others requiring simple designs and manufacturing processes. Several original equipment manufacturers (OEMs) outsource production of Class I devices for overhead costs, streamline operations and ensure regulatory compliance, further allowing them to focus on core competencies such as R&D and marketing. Furthermore, increased use of Class I medical devices, well-established supply chain networks, and development of specialized manufacturing processes enhancing production capacity are the factors driving the market growth.

How Accessory Manufacturing Segment Dominated the Market in 2025?

By services, the accessory manufacturing segment captured the largest market share in 2025. Rising demand for medical devices across U.S. is creating the need for components such as connectors, sensors and tubing which require specialized manufacturing capabilities lacked by OEMs, further driving the adoption of contract manufacturing services. Increased emphasis on infection control as well as expansion of home healthcare sector is fuelling the sales of consumables and single-use disposable products such as catheters, diagnostic strips, needles and syringes. Furthermore, rising focus on personalized medicine, growing use of wearable medical devices, and need for affordable solutions are creating opportunities for market growth of this segment.

By services, the device manufacturing segment is expected to show the fastest growth during the forecast period. Contract manufacturers are integrating advanced technologies such as additive manufacturing (3D printing) for development of complex and tailored medical devices, deploying AI and machine learning methodologies for quality control and predictive maintenance as well as implementing automation and robotics for enhancing production efficiency and mitigating human error. Rising complexity of medical devices, stringent regulatory guidelines, emphasis on innovative product development, and strategic alliances among medical device companies and contract manufacturers are boosting the market expansion.

Why Did the Cardiovascular Devices Segment Dominate in 2025?

By therapeutic area, the cardiovascular devices segment generated the highest revenue in the market in 2025. Rising prevalence of cardiovascular diseases such as arrhythmias, coronary heart disease, hypertension and heart failure are leading to high cases of morbidity and mortality in the U.S., further creating a demand for cardiovascular devices like pacemakers and stents for efficient diagnosis and treatment management. Advanced sensors and progress in remote monitoring capabilities integrated with Internet of Medical Things (IoMT) technology in cardiovascular devices is facilitating real-time data collection and analysis. Rising shift towards development of minimally invasive cardiac procedures for placement of specialized devices sand instruments is driving the adoption of cardiovascular devices. Development of novel technologies such as Pulsed-Field Ablation (PFA) devices used in cardiac ablation for treating atrial fibrillation are expanding the market.

By therapeutic area, the surgical instrument segment is expected to expand rapidly during the predicted timeframe. Increasing surgical procedures for treatment of chronic conditions, trauma cases and emergency departments is creating a need for wide range of surgical instruments, including disposable and reusable. Advancements in surgical instruments technology such as development of minimally invasive surgical (MIS) instruments for procedures like laparoscopy and endoscopy as well as deployment of smart and robotic-assisted instruments integrated with AI and IoT are boosting the market growth of this segment.

What Drives Dominance of Original Equipment Manufacturers Segment in 2025?

By end use, the original equipment manufacturers segment accounted for the largest market share in 2025. Original equipment manufacturers (OEMs) of innovative medical devices are prioritizing their core activities which includes product designing, R&D, creation of intellectual property, clinical trials and marketing. Outsourcing product manufacturing through contract manufacturers allows OEMs to focus on core competencies and maintain a competitive edge in the constantly evolving market. Integration of Industry 4.0 technologies as well as specialized manufacturing process services such as casting, machining and rapid prototyping required for complex medical devices offered by contract manufacturers are leading to improved efficiency and product quality.

By end use, the pharmaceutical and biopharmaceutical companies’ segment is anticipated to show the fastest growth over the forecast period. Several pharmaceutical and biopharmaceutical companies lack the in-house infrastructure and expertise necessary for manufacturing of specialized and complex medical devices which creates the need for outsourcing manufacturing processes for reducing capital expenditure and accelerate product development timelines. Rising trend of personalized medicine and focus on patient-centric approach drives the adoption of contract manufacturing services offering expertise, improved scalability and flexibility for designing and production of tailored medical device solutions.

Country-Level Analysis

U.S. is considered as a major hub for medical device contract manufacturing, owing to the presence of advanced healthcare framework, robust research infrastructure, key market players and well-established supply chain networks. Accelerated development and approvals of innovative medical devices through FDA programs such as Breakthrough Devices Program and Medical Device Development Tools (MDDT) program are creating demand for specialized contract manufacturing services. Funding and grants form government agencies such as the National Institutes of Health (NIH) and Biomedical Advanced Research and Development Authority (BARDA) for supporting medical device R&D are fuelling the market growth.

Some of the Prominent Players in the U.S. Medical Device Contract Manufacturing Market

- Celestica HealthTech

- Flex Ltd.'s U.S

- Forefront Medical Technology

- Integer Holdings Corporation

- Jabil Inc.

- Nortech Systems

- Phillips-Medisize (a Molex company)

- Sanmina Corporation

- Sonic Healthcare

- Terumo Corporation

- TE Connectivity

- Viant Medical

- WuXi AppTec, Inc.

Recent Developments

- In June 2025, Medical Manufacturing Technologies (MMT), distributor of automated and systematic medical device manufacturing solutions, completed the acquisition of Comco, a supplier of micro-precision sandblasting services.

- In October 2024, Biomerics, a leading contract manufacturer of vertically integrated medical devices in the interventional device market, through their new Metal Injection Molding (MIM) Center of Excellence launched its vertically integrated metal injection molding services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Device Contract Manufacturing Market.

By Product

- Class I

- Class II

- Class III

By Services

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labeling

- Others

By Therapeutic Area

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

By End Use

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others