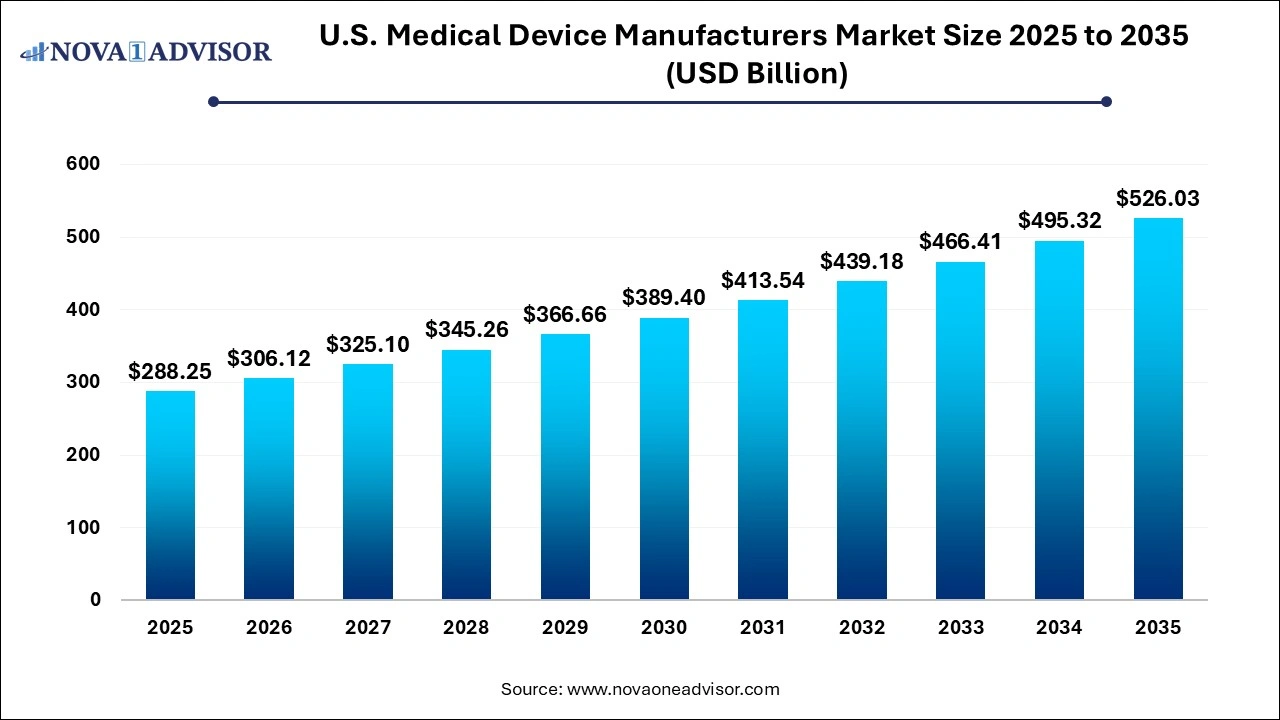

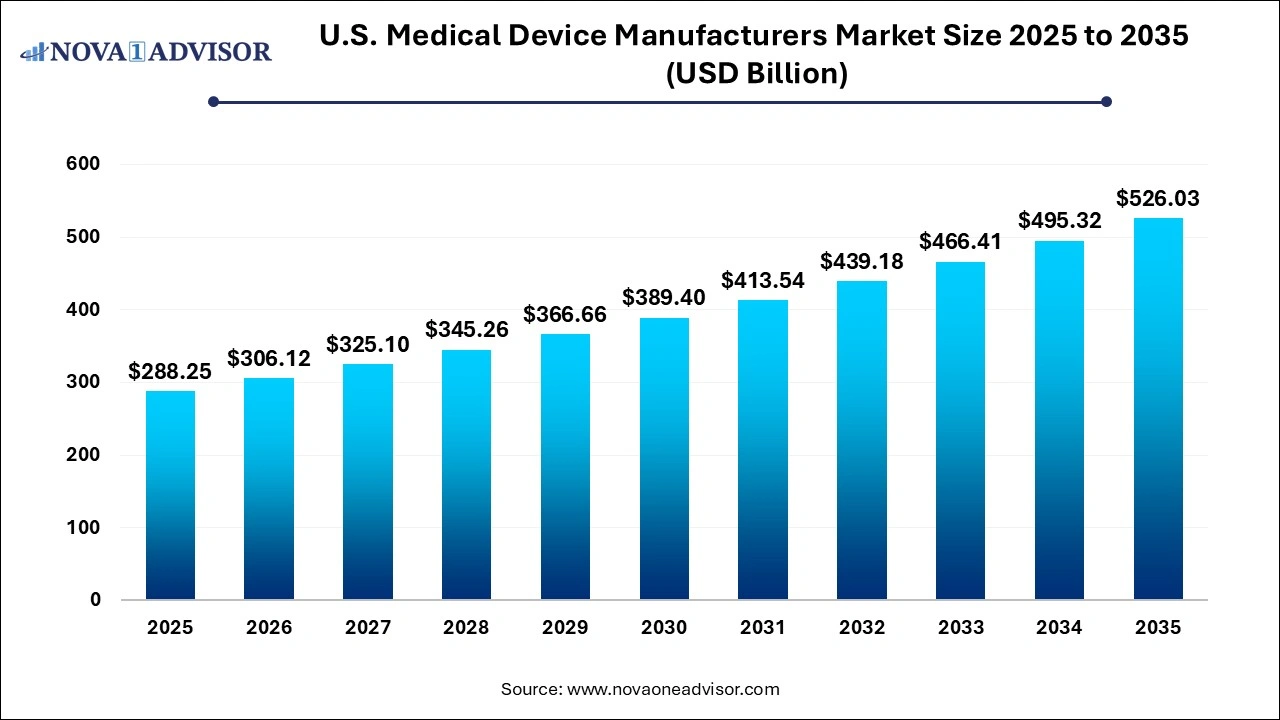

U.S. Medical Device Manufacturers Market Size and Trends 2026 to 2035

The U.S. Medical Device Manufacturers Market size was exhibited at USD 288.25 billion in 2025 and is projected to hit around USD 26.03 billion by 2035, growing at a CAGR of 6.2% during the forecast period 2026 to 2035.

U.S. Medical Device Manufacturers Market Overview

The U.S. medical device manufacturers market represents one of the most advanced and innovative segments in the global healthcare ecosystem. It serves as a critical driver of medical innovation, combining advanced engineering, cutting-edge biocompatible materials, artificial intelligence, and robotics to improve patient outcomes and healthcare delivery across various clinical domains. The sector encompasses a wide array of products ranging from surgical instruments and diagnostic imaging systems to implantable devices, wearable health monitors, and robotic-assisted surgical systems.

With the U.S. being home to some of the largest and most established medtech companies in the world, the nation’s medical devices manufacturing industry is distinguished by a high concentration of R&D activity, a favorable regulatory environment led by the U.S. Food and Drug Administration (FDA), and robust public and private investment flows. The market is driven by the rising demand for minimally invasive procedures, the aging population, and a growing prevalence of chronic diseases such as cardiovascular disorders, orthopedic injuries, diabetes, and neurological conditions.

Moreover, U.S. manufacturers benefit from a sophisticated domestic healthcare infrastructure, widespread insurance coverage, and a culture of early adoption of high-tech solutions by hospitals and surgical centers. The integration of smart devices, real-time diagnostics, and advanced imaging with electronic health records (EHRs) is transforming the nature of care and elevating the demand for smarter, safer, and more personalized devices.

Despite global supply chain disruptions witnessed during the COVID-19 pandemic, the U.S. medical device manufacturing industry has demonstrated remarkable resilience and agility, further investing in automation, nearshoring, and digital quality control systems. These shifts have set the stage for long-term growth and innovation leadership on a global scale.

Major Trends in the U.S. Medical Device Manufacturers Market

-

Surge in Minimally Invasive and Robotic-Assisted Devices: Growing demand for procedures that offer quicker recovery, less scarring, and reduced hospital stays.

-

Integration of AI and Machine Learning: AI-driven diagnostics, imaging, and predictive maintenance of devices are revolutionizing performance and care precision.

-

Growth in Wearable and Remote Monitoring Devices: Rising consumerization of healthcare is driving demand for home-use and wearable monitoring solutions.

-

3D Printing for Custom Implants and Prototypes: Personalization of orthopedic, dental, and cardiovascular devices is being accelerated by 3D manufacturing technologies.

-

Biodegradable and Smart Implant Materials: Innovations in material science are enabling the next generation of resorbable and sensor-embedded implants.

-

Regulatory Acceleration via FDA Breakthrough Designation: Manufacturers are leveraging fast-track pathways for high-need areas such as oncology and neurology.

-

Digital Twins and Virtual Prototyping in R&D: Simulation models and digital twin technology are cutting down product development timelines and costs.

-

Nearshoring and Localized Manufacturing: Companies are investing in domestic production facilities to mitigate supply chain disruptions and geopolitical risk.

Report Scope of U.S. Medical Device Manufacturers Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 288.25 Billion |

| Market Size by 2035 |

USD 526.03 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

3M Healthcare; Abbott; Baxter International, Inc.; B. Braun SE; GE HealthCare; Johnson & Johnson Services, Inc.; Boston Scientific Corporation; Danaher; Intuitive Surgical; Cardinal Health; Stryker; Edwards Lifesciences Corporation; Eli Lily and Company. |

Market Driver: Increasing Demand for Advanced and Personalized Healthcare Technologies

The most significant driver of the U.S. medical device manufacturers market is the escalating demand for advanced and personalized healthcare solutions. As the U.S. population ages and chronic conditions such as heart disease, diabetes, cancer, and neurological disorders become more prevalent, there is a growing need for sophisticated diagnostic and therapeutic tools that can improve outcomes while reducing cost and invasiveness.

Patients and providers alike are demanding devices that are more accurate, durable, and adaptable to individual needs. Technologies such as implantable cardiac monitors, AI-powered imaging systems, wearable insulin pump, and robotic orthopedic tools are increasingly being adopted in mainstream clinical practice. Personalized devices—such as patient-specific implants and smart sensors—are improving surgical precision and long-term recovery.

Moreover, the rise in value-based care and reimbursement models that emphasize outcomes over volume are pushing providers to adopt devices that not only function efficiently but also demonstrate real-world clinical effectiveness. This shift is creating robust opportunities for U.S. manufacturers to develop smarter, more integrated device solutions that address both provider and patient priorities.

Market Restraint: Regulatory Complexity and Cost of Compliance

One of the key restraints for U.S. medical device manufacturers is the increasing complexity and cost of regulatory compliance, particularly for companies introducing new and innovative technologies. Although the FDA’s 510(k) and PMA pathways are well-structured, the process of gaining approval for Class II and Class III devices remains resource-intensive, time-consuming, and expensive.

Complying with Good Manufacturing Practices (GMP), maintaining quality assurance programs, conducting clinical trials, and managing post-market surveillance all require substantial investment in infrastructure, talent, and documentation systems. Smaller companies and startups often struggle to keep up with evolving regulatory expectations, particularly around data security, interoperability, and real-world evidence generation.

In addition, global harmonization initiatives such as the Medical Device Regulation (MDR) in the European Union place additional pressure on U.S. manufacturers that export devices overseas. Balancing innovation speed with regulatory rigor continues to be a major operational challenge in this highly scrutinized and safety-focused industry.

Market Opportunity: Integration of AI and IoT in Medical Devices

A significant opportunity lies in the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into the design and performance of medical devices. Smart devices capable of collecting, analyzing, and transmitting patient data in real time are becoming essential components in modern healthcare.

For example, AI-enabled imaging tools can enhance diagnostic precision in radiology and pathology by detecting anomalies with higher accuracy than the human eye. In cardiology, wearable ECG monitors use predictive analytics to detect arrhythmias before they become life-threatening. In surgery, robotic systems equipped with AI can optimize tool trajectory and improve outcomes.

Manufacturers who embed digital intelligence into their products are not only enhancing clinical outcomes but also creating new revenue models through software-as-a-service (SaaS), subscription-based remote monitoring, and cloud analytics platforms. These digital add-ons open up the possibility of predictive maintenance, adaptive therapy, and patient-specific treatment planning—delivering long-term value for both clinicians and patients.

Segmental Insights

By Application Insights

The others segment led the market and accounted for 36.0% of the revenue in 2025. driven by the high incidence of joint-related conditions such as osteoarthritis, sports injuries, and age-related degenerative diseases. Hip and knee replacements, spinal implants, and trauma fixation devices form the core of this segment. With an aging population and rising obesity rates, demand for joint reconstruction procedures continues to climb. Additionally, innovation in biomaterials, patient-specific implants, and 3D printing has enhanced the safety and durability of orthopedic devices.

This segment also benefits from the growing use of robotic-assisted surgery and navigation systems that improve implant alignment and reduce revision rates. U.S. manufacturers such as Stryker and Zimmer Biomet are investing heavily in product personalization, cloud-based analytics, and robotic integration, keeping the segment at the forefront of technological evolution.

Neurology devices are projected to witness the fastest growth through 2035, primarily due to the rising burden of neurological conditions such as Parkinson’s disease, epilepsy, stroke, and Alzheimer’s. The demand for neurostimulators, implantable electrodes, seizure detection systems, and neuro-monitoring devices has surged alongside advancements in functional neurosurgery and brain-computer interface technologies.

Companies are also innovating in minimally invasive neuromodulation techniques and developing closed-loop systems capable of real-time therapeutic adjustment. With FDA support for breakthrough devices in neurodegenerative diseases and mental health, U.S. manufacturers are accelerating development timelines and expanding patient access to novel neurological devices.

Country-Level Insights

As the world's largest and most advanced medical device market, the United States remains unmatched in terms of innovation, investment, and infrastructure. It is home to over 6,500 medical device companies, most of which are small-to-medium enterprises, supported by academic institutions, venture capital, and robust supply chains.

Key characteristics of the U.S. medical device landscape include:

-

FDA Regulatory Leadership: The FDA’s Center for Devices and Radiological Health (CDRH) provides clear pathways for device approval, including premarket approval (PMA), 510(k) clearance, and De Novo classification, encouraging both established and emerging manufacturers to innovate responsibly.

-

Academic-Industry Partnerships: Leading research institutions such as the Mayo Clinic, Johns Hopkins, and MIT collaborate with manufacturers on translational research, design validation, and clinical trials.

-

Government Support and Funding: Federal initiatives such as BARDA, ARPA-H, and SBIR grants fuel early-stage medtech innovation and commercialization.

-

Export Orientation: The U.S. is a major exporter of medical devices, with high demand from Europe, Asia, and Latin America, making domestic production critical to global supply chains.

Some of the prominent players in the U.S. Medical Device Manufacturers Market include:

U.S. Medical Device Manufacturers Market Recent Developments

-

In March 2025, Stryker unveiled a new robotic platform for spinal surgery, enabling real-time 3D imaging and AI-guided navigation, enhancing surgical precision and reducing operative time.

-

In February 2025, Medtronic received FDA approval for its next-generation insulin pump with advanced AI-driven glucose prediction capabilities, targeting Type 1 diabetes patients.

-

In January 2025, Boston Scientific announced the expansion of its Minneapolis manufacturing facility to boost the production of neuromodulation and cardiac rhythm management devices.

-

In December 2024, Abbott launched a new continuous glucose monitoring (CGM) system with integrated wearable patch and mobile app compatibility in U.S. retail pharmacies.

-

In November 2024, GE HealthCare and Mayo Clinic formed a strategic alliance to co-develop imaging AI algorithms for earlier detection of cardiovascular disease, with plans to commercialize by 2026.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Device Manufacturers Market

By Application

- Orthopedic Devices

- Cardiovascular Devices

- Neurology Devices

- Drug Delivery Devices

- Ophthalmic Devices

- Nephrology & Urology Devices

- Others