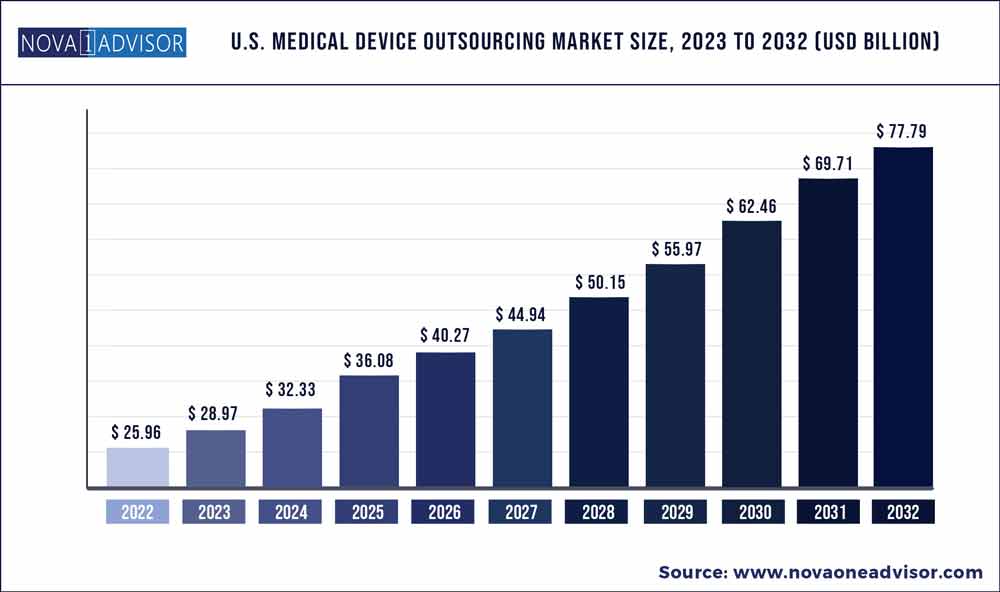

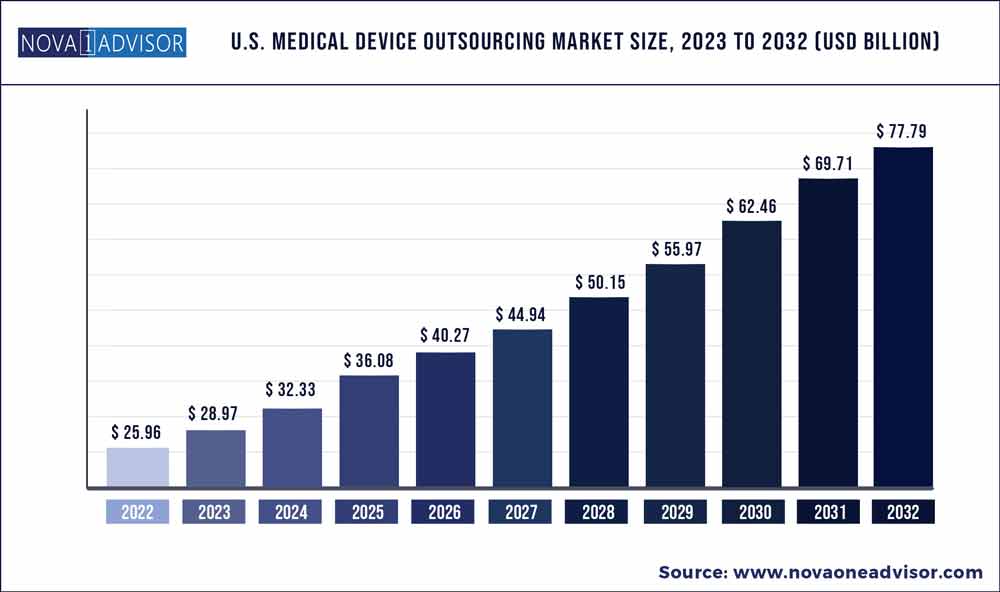

The U.S. medical device outsourcing market size was estimated at USD 25.96 billion in 2022 and is expected to surpass around USD 77.79 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 11.6% during the forecast period 2023 to 2032.

Key Takeaways:

- The contract manufacturing services segment dominated the market in 2022 and accounted for the largest share of 55.7% of the overall revenue.

- The quality assurance segment is expected to grow at the fastest CAGR of 13.8% during the forecast period.

- The cardiology segment accounted for the maximum share of 22.8% in 2022 and is likely to remain dominant throughout the forecast period.

- General and plastic surgery devices outsourcing is anticipated to exhibit the fastest CAGR of 13.11% across the forecast.

- Class II type medical devices accounted for the largest revenue share of 68.6% in 2022 and the segment is expected to register the fastest CAGR of over 11.1% over the forecast period.

- Class I medical devices is expected to grow at a CAGR of 10.11% during the forecast period.

U.S. Medical Device Outsourcing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 28.97 Billion

|

|

Market Size by 2032

|

USD 77.79 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 11.6%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Services, Application, Class

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Report Coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Key Companies Profiled

|

Integer Holdings Corporation; Avail Medsystems, Inc.; Active Implants.; Omnica Corp.; Teleflex Incorporated; Cantel Medical Corp. (STERIS plc); SGS SA; Laboratory Corporation of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; WuXi AppTec; IQVIA Inc.; Charles River Laboratories; ICON plc.; PAREXEL International Corporation; Medpace ; Premier Research; North American Science Associates, LLC ; Sterigenics U.S., LLC (GTCR, LLC)

|

This market is growing as a result of increased offshore trends, a rise in demand for high-tech medical devices, and stringent regulation for medical devices in the U.S.

The medical device industry has always been highly competitive, and categories such as coronary stents, orthopedic devices, and wound care are moving toward maturity. As high-impact scientific innovation in the above categories is difficult to achieve and is a time-consuming process, smaller companies are gaining market share by offering low prices and introducing innovative business models. Due to the convergence of mounting challenges and changing market dynamics, medical device manufacturers are likely to opt for outsourcing business models to reduce costs, manage business risks, and improve service delivery. This factor is expected to propel market growth over the forecast period.

The government authorities have escalated funds for the research and development of essential devices, thus driving the market. The majority of clinical research globally devices are conducted in the U.S. alone according to Clinical Trials .gov. In case of the medical device also significant studies are conducted in the U.S.

For instance, as of February 2023, over 25033, research for medical devices was registered in the Clinical Trials .gov. Medical device companies are conducting research in the country owing to the availability of skilled labor and advanced infrastructure, as well as the presence of a significant number of CROs offering quality services. All these factors are expected to support the market in the post-Pandemic period.

Service Insights

The contract manufacturing services segment dominated the market in 2022 and accounted for the largest share of 55.7% of the overall revenue. Based on services, the market is categorized into quality assurance, Regulatory Consulting Services, product design & development services, product testing & sterilization services, product implementation, product upgrade, product maintenance, and contract manufacturing services.

Players in the U.S. medical device market are striving to reduce costs as profit margins are shrinking. To curtail fixed costs, companies are expected to outsource medical device manufacturing activities. In addition, there are a significant number of medical device contract manufacturing organizations in the U.S. that offer quality services. These factors are expected to support the segment’s growth.

The quality assurance segment is expected to grow at the fastest CAGR of 13.8% during the forecast period. Medical devices are required to comply with various standards, such as Health Insurance Portability and Accountability Act (HIPAA), the Centers for Medicare and Medicaid Services (CMS), the American Society for Testing and Materials (ASTM), and others.

Medical device outsourcing service providers conduct ISO 13485 audits. This is expected to improve the confidence of medical device companies in outsourcing service providers. Hence, the segment market is expected to grow during the forecast period owing to various advantages of quality management systems services, including better quality & consistency of medical products as well as increased confidence in the ability to consistently achieve & maintain compliance with regulatory requirements.

Application Insights

The cardiology segment accounted for the maximum share of 22.8% in 2022 and is likely to remain dominant throughout the forecast period. Based on application the market is segmented into Cardiology, Orthopedic, IVD, Diagnostic imaging, Ophthalmic, General and plastic surgery, Drug delivery, Dental, Endoscopy, Diabetes care, and others. The U.S. CDC states that one person dies every 34 seconds in the U.S. from cardiac disorders.

This is due to the high prevalence of conditions such as angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease in the country. The high prevalence of CVDs in the U.S. is increasing the demand for cardiovascular devices and thus promoting the segment’s growth.

General and plastic surgery devices outsourcing is anticipated to exhibit the fastest CAGR of 13.11% across the forecast. This market is anticipated to expand as a result of the abundance of reputable outsourcing companies in the United States that adhere to legal and regulatory regulations, as well as the growing demand for cosmetic procedures.

The demand for cosmetic operations in the United States has surged as a result of the huge rise in awareness and consciousness about physical appearance in recent years. The need for these surgical equipment is witnessing a rise due to the need for specific molding and machining procedures for items like fixation devices, extremities splints, and epilators. The sector market is supported by all of the aforementioned factors.

Class Insights

Class II type medical devices accounted for the largest revenue share of 68.6% in 2022 and the segment is expected to register the fastest CAGR of over 11.1% over the forecast period. Based on the class type, the market is segmented into Class I, Class II & Class III. The high cost of this type of medical device is one of the key reasons for the largest share of the segment.

Moreover, these devices have a higher risk as they are required to be in continuous contact with patients. Due to the complexity of these devices, medical device companies prefer to outsource the development and manufacturing of these devices to an expert. These factors are enhancing the growth of the segment market.

Class I medical devices is expected to grow at a CAGR of 10.11% during the forecast period. Class I medical devices are low- to moderate-risk for patients. These devices are noninvasive. Class I devices include stethoscopes, bandages, bedpans, tongue depressors, latex gloves, surgical masks, irrigating dental syringes, and others. These devices are used daily and are required more frequently. The high demand for these devices is improving the demand for the outsourcing of Class I medical devices.

Key Companies & Market Share Insights

The companies are constantly involved in providing a wide range of services and equipment, which can be an effective cost-curbing tool for the recipient organization. Participants are also involved in mergers, acquisitions, and expansions to increase their market share. For instance, Celestica Inc. in January 2022, declared that its AbelConn Electronics factory in Maple Grove, Minnesota, officially gained the ISO 13485:2016 certification for manufacturing medical devices. The certification broadened Celestica's international design and manufacturing capabilities, enabling it to offer support quality and legal compliance for its international healthcare clients. Some prominent players in the U.S. medical device outsourcing market include:

- Integer Holdings Corporation

- Avail Medsystems, Inc.

- Active Implants.

- Omnica Corporation

- Teleflex Incorporated

- Cantel Medical Corp. (STERIS plc)

- SGS SA

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- Pace Analytical Services, Inc.

- Intertek Group plc

- WuXi AppTec

- IQVIA Inc.

- Charles River Laboratories

- ICON plc.

- PAREXEL International Corporation

- Medpace

- Premier Research

- North American Science Associates, LLC

- Sterigenics U.S., LLC (GTCR, LLC)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Device Outsourcing market.

By Service

- Quality Assurance

- Regulatory Consulting Services

- Clinical Trials Applications And Product Registrations

- Regulatory Writing And Publishing

- Legal Representation

- Other

- Product Design And Development Services

- Designing & Engineering

- Machining

- Molding

- Packaging

- Product Testing & Sterilization Services

- Product Implementation Services

- Product Upgrade Services

- Product Maintenance Services

- Contract Manufacturing

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

By Application

- Cardiology

- Class I

- Class II

- Class III

- Diagnostic imaging

- Class I

- Class II

- Class III

- Orthopedic

- Class I

- Class II

- Class III

- IVD

- Class I

- Class II

- Class III

- Ophthalmic

- Class I

- Class II

- Class III

- General And Plastic Surgery

- Class I

- Class II

- Class III

- Drug Delivery

- Class I

- Class II

- Class III

- Dental

- Class I

- Class II

- Class III

- Endoscopy

- Class I

- Class II

- Class III

- Diabetes Care

- Class I

- Class II

- Class III

- Others

- Class I

- Class II

- Class III

By Class

- Class I

- Class II

- Class III