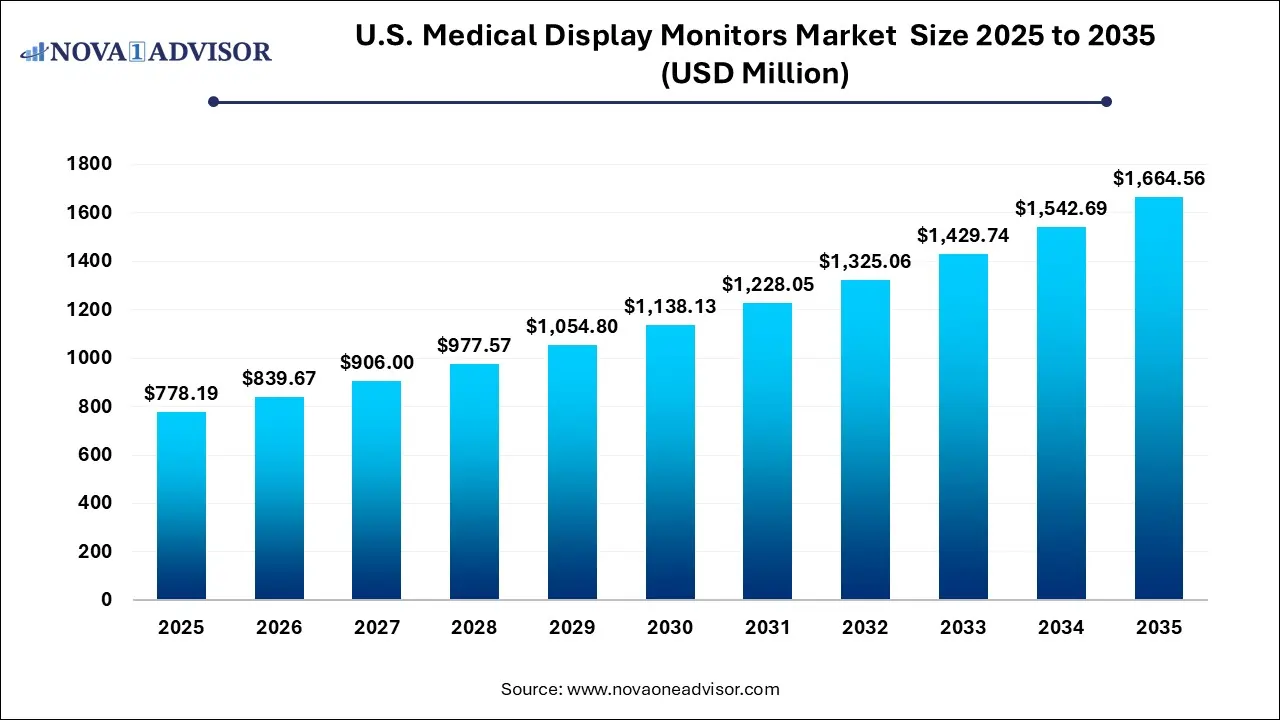

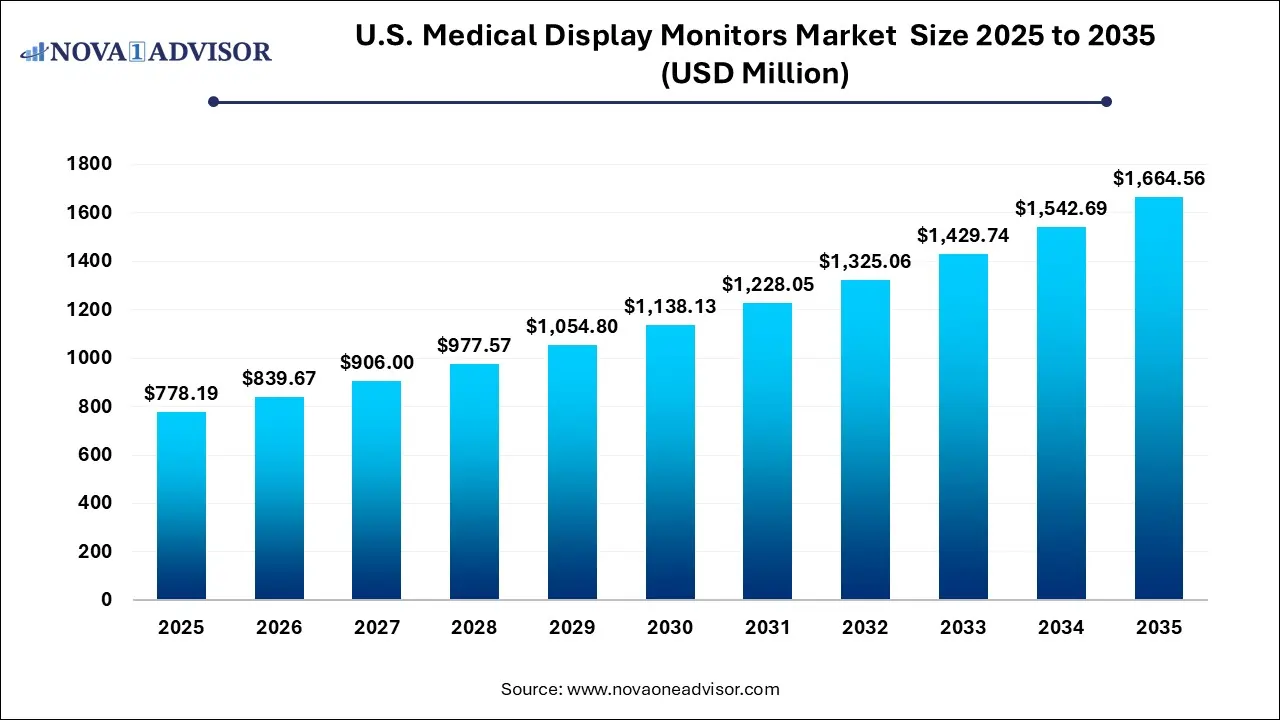

U.S. Medical Display Monitors Market Size and Growth 2026 to 2035

The U.S. medical display monitors market size was exhibited at USD 778.19 million in 2025 and is projected to hit around USD 1,664.56 million by 2035, growing at a CAGR of 7.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The greyscale segment dominated the market and accounted for the largest revenue share of 78.0% in 2025.

- The LED segment dominated the market and accounted for the largest revenue share of 49.0% in 2025.

- The general radiology segment dominated the U.S. medical display monitors market and accounted for the largest revenue share of 30.0% in 2025.

- The 16:9 segment dominated the market and accounted for the largest revenue share in 2025 owing to its advantages of showcasing distortion-free and high-definition images.

Market Overview

The U.S. medical display monitors market represents a critical intersection of healthcare and imaging technology. These specialized monitors are designed to provide high-resolution visualization for medical professionals during diagnostic, surgical, and treatment procedures. Unlike commercial-grade screens, medical-grade display monitors are calibrated for color and greyscale accuracy, brightness uniformity, DICOM compliance, and long-lasting performance under intense operational conditions.

The market's growth in the U.S. is underpinned by several factors, including the rise in diagnostic imaging procedures, increased demand for minimally invasive surgeries, and growing digitalization in hospital infrastructure. Institutions ranging from large urban hospitals to outpatient diagnostic centers are equipping themselves with advanced visualization tools to improve diagnosis accuracy, surgical precision, and overall clinical workflow. Moreover, the growing adoption of Picture Archiving and Communication Systems (PACS) and electronic health records (EHRs) has made high-quality display monitors indispensable.

Leading manufacturers are investing in technology enhancements such as OLED panels for sharper contrasts, AI-based calibration for consistent image quality, and ergonomic designs tailored for clinical environments. Furthermore, the demand for remote consultations and teleradiology surged during the COVID-19 pandemic, catalyzing interest in portable and mobile display units. These trends are likely to continue, further reshaping the competitive dynamics of the U.S. medical display monitors market.

Major Trends in the Market

-

Increasing demand for hybrid color-greyscale monitors optimized for multimodal imaging.

-

Rapid shift from CCFL to energy-efficient LED and OLED display technologies.

-

Rise in surgical and diagnostic applications requiring ultra-high definition (4K and 8K) monitors.

-

Integration of DICOM calibration and automatic luminance correction features.

-

Growing interest in mobile and wall-mounted displays for space-constrained environments.

-

Adoption of widescreen aspect ratios (21:09) for panoramic surgical visualization.

-

Expansion of AI-integrated display monitors to assist in real-time anomaly detection.

-

Increased adoption of multi-display setups for radiology workstations.

U.S. Medical Display Monitors Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 839.67 million |

| Market Size by 2035 |

USD 1,664.56 million |

| Growth Rate From 2026 to 2035 |

CAGR of 7.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, Aspect ratio, Technology, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

HP Development CompanyL.P; Quest International Stryker; Double Black Imaging; Steris; UTI Technology; NDS Surgical Imaging (A Novanta Company); Canvys; Advantech Co. Ltd.; Barco; Eizo Corporation |

Market Driver: Rise in Imaging and Minimally Invasive Procedures

One of the primary drivers for the U.S. medical display monitors market is the surging volume of diagnostic imaging and minimally invasive surgical procedures. With the aging population and rising prevalence of chronic conditions like cardiovascular diseases, cancer, and neurological disorders, imaging modalities such as MRI, CT, and mammography have seen significant upticks. These modalities demand high-precision display systems to interpret subtle differences in grayscale and tissue density.

Simultaneously, the increasing adoption of minimally invasive and image-guided surgeries in U.S. hospitals and ambulatory surgical centers has created a need for real-time, high-definition visualization. Surgeons rely on advanced monitors to make split-second decisions, making display clarity and accuracy non-negotiable. For example, institutions like the Mayo Clinic have adopted 4K surgical displays with integrated touch functionality and smart sensor adjustments, improving surgical efficiency and safety.

Market Restraint: High Cost and Maintenance Complexity

A notable restraint affecting the U.S. market is the high initial cost and ongoing maintenance complexity of medical-grade display monitors. These systems are built for stringent clinical environments and must conform to regulatory standards like FDA Class I and DICOM compliance. As a result, the price of a single high-resolution diagnostic or surgical display monitor can range from $4,000 to over $10,000, depending on features and use-case.

Smaller hospitals and clinics, especially in rural areas, may struggle with the capital investment needed to upgrade from commercial monitors. Additionally, regular calibration, firmware updates, and compatibility with legacy systems can increase operational costs. Technical support, particularly for multi-display installations in radiology departments, requires trained personnel and dedicated IT resources—posing barriers for budget-constrained healthcare providers.

Market Opportunity: Teleradiology and Remote Consultations

An emerging opportunity within the U.S. medical display monitors market lies in the growing demand for teleradiology and remote clinical consultations. The COVID-19 pandemic acted as a catalyst in reshaping healthcare delivery models, normalizing remote diagnostics. Radiologists and specialists are increasingly working from home, necessitating high-fidelity, DICOM-compliant monitors that replicate in-hospital diagnostics.

Companies are seizing this opportunity by designing portable, lightweight displays that offer wireless connectivity, ergonomic support, and software-assisted calibration. For instance, several startups are now marketing plug-and-play medical displays that can seamlessly integrate with PACS over secure cloud environments. This trend not only expands access to care in underserved regions but also creates a new market for high-performance yet compact and cost-effective medical monitors.

Segmental Analysis

By Type

Color medical display monitors dominate the market, accounting for a majority of units sold in the U.S. These monitors are favored for their versatility and are capable of displaying both greyscale and full-color imaging modalities, making them ideal for general radiology, surgical, and pathology applications. Modern color monitors also feature high brightness levels, contrast ratios, and automatic DICOM calibration, which ensures accurate grayscale representation even in color imaging modes. Facilities like Cleveland Clinic and Johns Hopkins have adopted color monitors for their ability to streamline workflows across departments with varied imaging needs.

In contrast, Greyscale monitors are growing steadily, especially in mammography and radiology-focused departments. These monitors offer superior contrast resolution and luminance uniformity tailored specifically for high-detail imaging tasks. For example, mammograms require nuanced grayscale differentiation, which greyscale monitors achieve with better signal-to-noise ratios. While not as versatile as color monitors, their niche utility in specific diagnostic tasks secures their relevance in specialized imaging centers.

By Aspect Ratio

16:09 aspect ratio monitors are the most commonly used, especially in general radiology and surgical applications. These widescreen monitors offer a balanced field of view suitable for dual imaging displays or side-by-side comparisons. Their popularity stems from compatibility with existing video systems and their availability in full HD, 4K, and even 8K resolutions. Radiologists prefer the 16:09 format for reviewing multi-slice CT scans or cross-comparisons in PACS environments.

Meanwhile, 21:09 ultra-wide monitors are the fastest-growing segment due to their increasing use in surgical suites and digital pathology. These displays offer panoramic views, allowing multiple imaging modalities, real-time surgical feeds, and data overlays on a single screen. For example, during complex neurosurgical procedures, 21:09 monitors can display endoscopic visuals, navigation data, and vital signs concurrently. Their enhanced horizontal field of view also supports multitasking, increasing clinician efficiency and reducing the need for multiple monitors.

By Technology

LED-based monitors continue to dominate the U.S. medical display market due to their affordability, energy efficiency, and reliability. Most diagnostic and surgical monitors use LED backlighting, offering high brightness, color consistency, and long service life. Companies like Barco and Eizo have developed advanced LED display panels that maintain DICOM compliance and offer consistent luminance across the screen. LED monitors are also less susceptible to burn-in and easier to maintain, making them the first choice for high-volume healthcare environments.

On the other hand, OLED technology is witnessing rapid adoption, especially in high-end surgical visualization and telepathology. OLED displays offer true black levels, faster response times, and superior contrast ratios. These attributes are crucial for tasks requiring absolute color accuracy and depth perception—such as laparoscopic and robotic surgeries. Hospitals that have invested in robotic surgical systems are increasingly adopting OLED monitors to support high-precision, real-time visualization. However, their higher cost and limited availability still restrict mass adoption.

By Application

General radiology is the dominant application segment, accounting for a significant share of medical display monitor installations. Radiologists rely on these monitors for reviewing CT, MRI, and X-ray images. The need for high-resolution, color-accurate, and DICOM-calibrated screens makes them indispensable in hospital radiology departments. According to a 2024 American College of Radiology survey, 82% of radiologists consider display quality a key factor in diagnostic accuracy—making these monitors critical to patient outcomes.

Meanwhile, surgery is the fastest-growing application, fueled by the rise in minimally invasive and robot-assisted procedures. Surgeons need real-time imaging with high fidelity and zero latency, especially when operating through small incisions. Modern surgical displays offer features like anti-glare coatings, waterproof casings, and touchscreen capabilities for intraoperative adjustments. Institutions performing complex surgeries—like cardiovascular or oncology procedures—are integrating these monitors into hybrid operating rooms, supporting both pre-operative imaging and intra-operative navigation.

Country-Level Analysis: United States

The U.S. represents one of the most advanced and lucrative markets for medical display monitors globally. With over 6,000 hospitals, tens of thousands of imaging centers, and one of the highest rates of medical imaging per capita, the demand for quality visualization tools remains strong. Government initiatives, such as the HITECH Act, and mandates for digital record-keeping have accelerated the shift toward digital imaging, further bolstering the monitor market.

Major metropolitan areas like New York, Los Angeles, and Chicago serve as hubs for tertiary care hospitals and research institutions with high-end diagnostic and surgical capabilities. These institutions drive demand for the latest display technologies, including OLED and AI-integrated monitors. Meanwhile, the rise of outpatient clinics and teleradiology services across suburban and rural America is creating demand for cost-effective yet high-performance mobile and compact monitors. Additionally, favorable reimbursement policies and aggressive adoption of AI tools in diagnostics contribute to an ecosystem where medical display monitors are not just a luxury but a necessity.

Some of the prominent players in the U.S. Medical Display Monitors Market include:

- HP Development Company, L.P

- Quest International

- Stryker

- Double Black Imaging

- Steris

- UTI Technology

- NDS Surgical Imaging, A Novanta Company

- Canvys

- Advantech Co. Ltd.

- Barco

- Eizo Corporation

Recent Developments

-

April 2025: Barco unveiled its next-generation “Eonis Surgical Display” series at the HIMSS conference in Las Vegas, featuring OLED technology with AI-driven auto-calibration for precision surgeries.

-

February 2025: Eizo Inc. partnered with a leading U.S. radiology group to pilot its new RadiForce RX370 monitor for high-speed MRI diagnostics, focusing on reduced eye strain and ergonomic performance.

-

December 2024: Sony Medical Systems launched a 55-inch 4K 3D surgical monitor designed for robotic-assisted surgeries, citing increased demand from hospitals integrating with da Vinci Surgical Systems.

-

October 2024: LG Electronics expanded its healthcare solutions division, introducing a range of DICOM-compliant OLED displays tailored for U.S. teleradiology services and portable diagnostic setups.

-

August 2024: Siemens Healthineers announced an R&D investment of $30 million into advanced display visualization systems in collaboration with academic medical centers across the U.S.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Display Monitors market.

By Type

By Aspect ratio

By Technology

By Application

- General Radiology

- Mammography

- Surgery

- Dentistry

- Digital Pathology

- Others